How to file a complaint against an insurance company with the Central Bank

The Central Bank of the Russian Federation is the regulator in the country's insurance market. In addition to the development of new bills, sanctions are applied to insurance organizations that violate laws or neglect insurance conditions, including those specified in the agreement. Therefore, if insurers violate any of the rules in the contract, which are enshrined in law, you can write a complaint to the Central Bank against the insurance company. The Bank of Russia online reception office has a corresponding application form. This claim will be considered for no more than 30 days.

- The insurer refuses to enter into an MTPL agreement. This action is considered unlawful unless there are compelling reasons for it. In such a case, the citizen has the right to appeal the decision of the insurance company to the Central Bank of the Russian Federation.

- Sale of insurance policies with imposed additional services. For example, a compulsory motor liability insurance agreement is often accompanied by Casco insurance, which is not required to be purchased. This violation can also be appealed by the client.

- Missed deadlines for consideration of claims for damages. The insurance company is given twenty days to make a decision on the client’s application. If a decision is not made within this period, the policyholder has the opportunity to write a complaint to the Central Bank against the insurance company.

- Refusal to accept a complaint about insurance payments, which is motivated by an incomplete package of papers. The list of this documentation, which is required to accept a claim for each insured event, is specified in the MTPL insurance rules. So, if the insurance organization does not accept the application, but all the papers were provided, the Central Bank will also take responsibility for these violations.

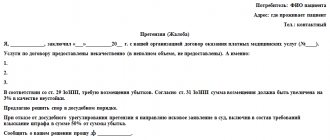

Sample complaint to the Central Bank on how to restore rights violated by an insurance company in 2021

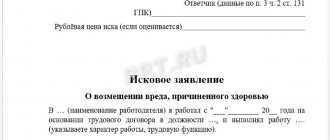

If other violations occurred, you should complain to the court. For example, if the owner of the MTPL policy considers the accrued amount of due payments to be incorrectly calculated. In this case, a statement of claim is drawn up according to the established form, which can be taken on the website.

- The company does not want to enter into an MTPL agreement. If the actions of the insurance company are not justified, then they violate the rights of clients.

- When selling policies, insurance companies impose additional services on clients. For example, when offering to conclude a compulsory motor liability insurance contract, the client may be forced to include additional insurance, which is not at all mandatory. Moreover, some insurance companies simply refuse to provide services if the client does not purchase additional options. Here, of course, legal awareness of citizens is needed so that when applying for a compulsory motor liability insurance policy, they know what exactly is the violation of rights.

- The deadlines for considering an application for damages are being violated. The law establishes a period for consideration of applications. If the company exceeds it for unknown reasons, the client has the right to file a complaint against it.

- The insurance company refuses to make the required payments to the client due to an insufficient package of documents. The documents required from clients are listed in the established rules of OSAGO. Therefore, before complaining about the actions of the insurance company, you should carefully study these rules and see whether all documents have been submitted. If everything is normal, you can safely complain to the Central Bank of the Russian Federation.

Algorithm for filing a complaint with the Central Bank

In order to send a complaint to the Central Bank of the Russian Federation, it is necessary to compose it correctly and attach all the necessary documents.

Rules for filing a complaint

The Central Bank does not have a mandatory form for filing a complaint, but, like any document, it must be submitted in writing indicating the required data:

- name, address and details of the organization to which the complaint is sent;

- passport and contact details of the applicant;

- name, address and details of the insurance company against which the complaint is being made;

- if you have an MTPL insurance policy, then indicate its number and the date of conclusion of the contract;

- describe in detail the situation that occurred in connection with which the complaint is being filed;

- if possible, indicate the specific law under which the violation occurred and the consequences of the situation, if any;

- register previously taken actions and appeals;

- outline your requirements: most often this is an inspection of individual insurance operators or the insurance organization as a whole, bringing the perpetrators to justice, compensation for damage caused, restoration of the Bonus-Malus coefficient, etc.

- indicate additional information that may influence the positive decision of the Central Bank, for example, testimony of witnesses.

When filing a complaint with the Central Bank, you must have the following documents with you: the applicant’s passport, compulsory motor liability insurance policy, documents confirming the violation of rights (for example, a written refusal from the insurer), previously sent statements, if any, and additional arguments, for example, photos, audio or video recordings.

How to file a complaint

There are three ways to send a complaint against an insurance organization to the Central Bank of the Russian Federation:

- By personal contact to the territorial branch of the Central Bank of the Russian Federation.

- By registered mail to the main or territorial branch of the Central Bank of the Russian Federation.

- On the official website of the Central Bank of the Russian Federation through a special submission form or by email to the address of the Central Bank.

Complaint against an insurance company

- Refusal to pay insurance compensation on far-fetched grounds.

- Delaying payment deadlines.

- Unreasonable reduction of the amount paid.

- Refusal to conclude an agreement (they say the forms have run out, the computers don’t work, “we don’t serve your region,” etc., etc.).

- Imposing additional services.

- Requesting from the client additional documents that are not actually required in this case.

- Arbitrary increase in tariffs.

- The insurance company imposes services on its clients that they did not order.

- The company refuses to enter into an agreement under a flimsy pretext or even without explanation at all.

- There is a violation of the deadlines within which compensation must be paid.

- The KBM is not applied or is applied incorrectly.

- The amount of compensation is underestimated or payment is refused under false pretexts.

- They do not accept or issue documents related to insurance or an insured event.

- The client does not agree with the quality or timing of the repairs required under CASCO.

We recommend reading: How to See Who is Registered in an Apartment

How to file a complaint to the Central Bank

- The complaint must contain violations that relate only to the activities of the financial sector.

- The citizen must provide convincing evidence of his innocence and the fact of violations.

- The content and facts stated in the complaint must be clear and concise.

- Correct document formatting. This includes the presence and correctness of all necessary details, as well as compliance with the structure of the complaint.

- A clear and reasoned statement of violations. Without this condition, there is a high chance that the complaint will not be considered at all.

- Availability of complete information about the sender and bank. This includes the client’s first and last name, his address and telephone number, as well as the name of the bank and its basic details.

- Making several copies of a document. One copy is sent to the central office of the Central Bank of the Russian Federation, the second to the regional representative office, and the third can be addressed to the offending bank itself.

Central Bank complaint against insurance company

Filling out a complaint and submitting it to any government agency is clearly a necessary measure. Russians often try to resolve a dispute with the insurance company on their own, but this does not always work out. In order to quickly and efficiently achieve what they want and defend their rights, citizens file a complaint against the insurance company with the Central Bank, FSSN, RSA and the court.

There are frequent cases of citizens turning to banking organizations for the return of funds transferred by mistake to other persons. It is possible to return the money if the recipient voluntarily returns it to the account, or you will have to go to court and file a civil lawsuit for unjust enrichment and recovery of incorrectly transferred money. We will tell you whether bank employees have the authority to collect funds from the cards and accounts of erroneously gifted citizens, and we will determine what to do in the event of an irreparable transfer. Also in this article we will look at what the reality is - how the courts react to claims for the return of funds.

Complain about the actions of another bank

Before contacting the Central Bank, you need to understand in what cases you can file complaints against the actions of banks. Reasons for contacting the Central Bank of the Russian Federation may be:

- Illegal refusals to provide credit.

- Unreasonably high interest rates on loans.

- Unlawful actions in the process of registering collateral.

- Incorrect accrual of penalties, fines and penalties.

- Writing off funds from the client's account without his permission, except in cases provided for by law (Article 854 of the Civil Code of the Russian Federation).

- The bank's refusal to return the insurance premium or part thereof during the “cooling off period”.

- Transfer of confidential information of a bank client to third parties in violation of the law (Law N152-FZ of 2006 “On Personal Data”).

Methods for filing complaints

- Mail or Fax . Complaints must be sent via mail using a registered letter, with an inventory of the contents and a return receipt. The date of receipt of the letter is considered the date of acceptance of claims. Verification of fax receipt is carried out by telephone.

- Public reception . You must make an appointment in advance before visiting. A visit to the territorial branches of the Central Bank is allowed if it is impossible to visit the reception office in Moscow.

- Internet reception . The most convenient way to contact the Central Bank. To file a complaint, you must click on the “Internet Reception” button on the main page of the Central Bank website. Next, select the “Submit a complaint” menu item, determine the topic of the complaint, fill out all fields of the electronic form, describe the problem in detail and reflect other required information.

How to file a complaint

The claim is drawn up in free form, but using an official business style and in compliance with a number of basic requirements characteristic of official documentation. The application for the bank's actions must reflect:

- Full name of the structure to which the complaint is being sent.

- Personal data of the applicant, with contact information.

- The essence of the complaint, with a detailed description of the circumstances that gave rise to the appeal, as well as links to articles of the law that were violated by the financial institution.

- Applicant's requirements.

- List of attachments to the application.

Along with the claim, information confirming violations in the bank’s operations must be provided. These can be documents in paper or electronic form, audio, video files and photographs, as well as written testimony.

How to properly complain about a bank to the Central Bank of Russia

As can be seen from the list, the Central Bank has very limited influence on banks in terms of restoring the violated rights of clients, and a complaint can hurt the bank’s own interests, without giving any benefit to the client himself. Therefore, when drawing up an appeal, the client must take into account exactly what consequences may occur.

The tasks of the Central Bank in the financial life of Russia are not limited to maintaining the state treasury, printing money and storing the country's gold and foreign exchange reserves. Along with these absolutely important functions, the Central Bank also plays the role of regulator of the activities of banking and other financial and credit institutions.

How to write a complaint against an insurance company to the Central Bank of the Russian Federation

For example, if the policyholder does not agree with the amount of insurance compensation paid, both for compulsory insurance under OSAGO and for voluntary insurance under CASCO, there is no point in filing a complaint with the Central Bank of the Russian Federation. This is due to the fact that the Bank of Russia does not have the right to oblige insurance organizations to make insurance payments. The Central Bank cannot determine the proportionality of the payment made to the policyholder, since among its powers there is no such function as assessing the correctness of expert opinions on the amount of damage.

- refusal or evasion of the insurer from concluding a contract under the Law “On Compulsory Insurance...” dated April 25, 2002 No. 40-FZ;

- imposing additional services on the policyholder wishing to obtain a compulsory motor liability insurance policy;

- the absence of an insurer's branch near the insured, which can resolve issues of insurance payments in the event of an insured event under compulsory motor liability insurance;

- payment of an underestimated insurance amount or refusal to pay it at all;

- failure to comply with the deadlines for consideration of the policyholder's applications, as well as the deadlines established for payments;

- failure by the insurer to accept applications for compensation of losses and other requests, including refusal to issue documents in the event of an insured event;

- inflated insurance premiums, poor-quality repairs and other situations arising between the insurer and the policyholder under CASCO.

We recommend reading: Do you need permission to build a garage on your own site?

Complaint against KBM under compulsory motor insurance to the Central Bank

On May 18 of this year, my MTPL policy issued by Rosgosstrakh LLC expired, and from that day I cannot issue a new policy, because all insurance companies offer to purchase a policy at an unreasonably inflated price, citing the fact that now I do not have a discount for accident-free behavior, and by default I am assigned class 3 with KBM = 1. When I independently check my KBM on the RSA website, I get the same result - class 3 and KBM=1.

In this case, you need to file a complaint with the Central Bank (Bank of Russia). It is the Central Bank that has the authority to control the correctness of calculation of insurance premiums under MTPL contracts. You can submit a complaint to the Central Bank of the Russian Federation through the online reception. In the complaint, you will need to describe the circumstances - when, with which insurance company, with which KBM you took out policies, how many accidents occurred during the insurance period. You will also need to mention that your claim to the insurance company was left unanswered. To your complaint to the Central Bank, attach scans of documents proving the need to correct the CBM, as well as your previously submitted application to the insurance company and its response (if any).

We recommend reading: How to make a technical passport for an apartment

Complaint to the Central Bank against the insurer: will there be an effect?

- Forcing to eliminate the cause of the client's dissatisfaction, for example, to accept an application for insurance payment or sell a compulsory motor liability insurance policy taking into account the correct bonus-malus ratio.

- Imposing a fine on a financial organization.

- Dismissal of those employees who were found guilty of violating the rights of the policyholder.

- Organizing an additional inspection to identify other types of violations.

- Suspension or revocation of a license. This is the most serious measure - the insurer will not be able to conduct business until the license is returned to it. Downtime, of course, leads to losses.

If the Central Bank believes that the insurer is really wrong, it issues an order. The insurance company will not ignore the order, because this promises it serious problems with the law. “Recalcitrant” insurers can be punished with a fine and even, in the worst case scenario, loss of their license.

Consideration of a complaint against KBM by the Central Bank

How to confirm the fact of the insurer’s evasion from concluding a contract? Anna Chalmanova To record the committed offense, citizens have the right to photograph, audio and video record the process of concluding an agreement. Witness testimony can also serve as evidence of an insurance company employee’s refusal to issue a compulsory motor liability insurance policy. Insurers are avoiding concluding a compulsory motor liability insurance agreement, offering to write an application for insurance, which will be reviewed by them within a month. At the same time, they are aware that my MTPL policy expires in a week. Is this behavior of the insurer legal? Olga Ershova No, it’s illegal. Today, the legislation does not really stipulate the period during which the insurer is obliged to conclude a compulsory motor liability insurance agreement.

Disobedient insurers can be punished with a fine and even, in the worst case, loss of their license. According to statistics, in 2015 the Central Bank issued 417 orders to insurers, which speaks of this organization as an active regulator of the insurance market. In what cases should you complain to the Central Bank? In what cases should you complain to the Central Bank? There are 5 most common grounds for a complaint to the Central Bank:

We recommend reading: Procedure for discharge and registration

Complaint to the Central Bank against an insurance company, sample KBM

Each insurance company selling MTPL policies must be guided by the general insurance tariffs that have recently been established by the Bank of Russia (Instruction of the Bank of Russia dated September 19, 2014 N 3384-U). In particular, the final cost of compulsory motor liability insurance will also be affected by the bonus-malus ratio (BMR), that is, the “break-even” of your previous compulsory motor liability insurance policies. Based on the availability of payments under your MTPL contracts in previous years, as well as their quantity, the cost of the next insurance policy will be cheaper or more expensive for you. There is an automated compulsory insurance information system (AIS), from which insurance companies take data to calculate the cost of your policy.

Please be aware that this is illegal. Law of the Russian Federation dated 02/07/1992 N 2300-1 (as amended on 07/13/2015) “On the protection of consumer rights” 2. It is prohibited to condition the purchase of some goods (work, services) on the mandatory purchase of other goods (work, services). Losses caused to the consumer as a result of violation of his right to free choice of goods (work, services) are reimbursed by the seller (performer) in full. How to refuse an imposed service If you were forced to purchase a policy in a place with another policy imposed on you, then you have the right to terminate the voluntary insurance contract: According to the instructions of the Bank of Russia dated November 20, 2015.

Possible penalties for the insurance company

If, as a result of consideration of the complaint, violations on the part of the insurance organization are confirmed, the Central Bank has the right to apply certain sanctions against it:

- issue an order to the insurance company to eliminate violations of insurance legislation, which must be completed no later than the specified period;

- if an administrative or criminal offense is detected in the actions of an insurance organization, bring it to administrative responsibility or, accordingly, transfer documents to law enforcement agencies;

- in case of failure to comply with the order properly, as well as in case of evasion of the order, limit or suspend the validity of the license to carry out insurance operations (Article 32.6 clause 4 of the Law of the Russian Federation dated November 27, 1992 No. 4015-1 (as amended on August 3, 2018) “On the organization insurance business in the Russian Federation");

- revoke the license if the consequences of the insurance business are not eliminated , which is grounds for terminating the work of the insurance company (Article 32.8 of the Federal Law of the Russian Federation No. 4015-1).

Didn't find the answer to your question? Call hotline 8. It's free.

Article source: https://zakonguru.com/zpp/uslugi/zhaloba-osago-cb.html

Complaint to the Central Bank against an insurance company, sample KBM

Samples of court documents on insurance topics are designed to counter the most common violations of the law on compulsory motor liability insurance by insurance companies. Complaint to RSA. Sample for filing a complaint against an insurance company with the Russian Union of Insurers. Suitable for all types of violations of the law on compulsory motor liability insurance by insurance companies. Complaint to the Central Bank against an insurance company. The sample is used to file a complaint with the Central Bank of the Russian Federation in case of underestimation of payment and violation of payment deadlines under compulsory motor liability insurance.

Clients of insurance companies often complain that their payments are underestimated or delayed, they are refused to sell policies, they do not want to acknowledge an insured event, etc. In such cases, it is sometimes not possible to solve the problem only at the level of communication with representatives of the Insurer, and the question arises of where to complain about the CASCO insurance company. Today there are several bodies that exercise control over the activities of insurance organizations: the Russian Union of Auto Insurers (RUA).

Complaint against MFO

Services of microfinance organizations must be performed according to standard schemes, taking into account the norms of the legislation of the Russian Federation: laws No. 353 “On consumer lending”, 2014, No. 151 “On MFOs” 2010 and other regulations. As a rule, such companies specialize in providing short-term loans to individuals at interest. Quite often, controversial situations arise between the subjects of the relationship. There are many reasons why citizens file complaints with the Central Fund of the Russian Federation regarding the activities of microfinance organizations. Main complaints:

- Preventing early repayment of debt.

- An increase in the interest rate on loans without the consent of the borrowers and sufficient grounds for this.

- Incompetent work of company employees or support services.

- Refusal to provide documents confirming full payment of debt.

- Illegal transfer of personal data of clients to third parties.

- Formation of non-existent debts.

- Connection to paid services without the knowledge of borrowers.

- Threats from representatives of the MFO security service, calls at night and disturbing the peace of clients.

Ways to file a complaint

The methods for filing claims are similar to those against banks. Before sending a complaint, it is advisable to consult with representatives of the Central Bank about the appropriateness of the appeal by calling the hotline number.