What is a loan agreement?

Art. 807 of the Civil Code of the Russian Federation defines an agreement. There are two parties involved in the transaction: the lender and the borrower. The first transfers money to the second party for temporary possession. The borrower accepts them on the terms specified in the contract. In particular, he assumes the obligation to return the funds.

The loan can be interest-bearing and without accrual of interest on the amount of the principal debt.

The essential terms of the agreement are its subject matter, as well as the borrower’s obligation to repay the money with or without interest. The peculiarity of these conditions is that without their inclusion in the text of the agreement, it is void at the time of its conclusion. Consequently, he is qualified under Art. 166 of the Civil Code of the Russian Federation.

Previously, the loan agreement was real. Now, with the entry into force of N212-FZ of 2021, the loan agreement may be consensual, but this provision applies exclusively to legal entities.

Art. 808 of the Civil Code of the Russian Federation establishes the requirements for a loan agreement: it is always concluded in writing if one of the two participants is a legal entity. In addition, a similar form is observed in relation to agreements, the subject of which exceeds 10,000 rubles.

Foreign currency loan agreement

As you already understand, the subject of a cash loan agreement is money. As a general rule - Russian rubles. However, paragraph 2 of Art. 807, as well as paragraph 2 of Art. 140 and paragraph 3 of Art. 317 of the Civil Code of the Russian Federation indicate the possibility of using foreign currency as a loan object, subject to compliance with the procedure specified by law. According to the provisions of this Law, a foreign currency loan agreement can be concluded:

- if one of the parties to the agreement is a non-resident of the Russian Federation (Article 6, 10 of the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control”);

- between credit institutions (banks) that, on the basis of a license from the Bank of Russia, are entitled to carry out currency transactions (Part 2 of Article 9 of Federal Law No. 173-FZ dated December 10, 2003 “On Currency Regulation and Currency Control”, Directive of the Bank of Russia dated April 28. 2004 No. 1425-U “On the procedure for carrying out foreign exchange transactions on transactions between authorized banks”);

- between banks licensed by the Bank of Russia to carry out foreign exchange transactions and residents of the Russian Federation (Part 3 of Article 9 of the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control”).

Parties who are residents of the Russian Federation, as a general rule, do not have the right to enter into a loan agreement, the object of which is foreign currency.

This prohibition follows from Art. 9 of the Federal Law of December 10, 2003 No. 173-FZ “On Currency Regulation and Currency Control”. If persons who are residents of the Russian Federation have entered into a foreign currency loan agreement in violation of the requirements established by the currency legislation of the Russian Federation, then they will be held administratively liable under Art. 15.25 Code of Administrative Offenses of the Russian Federation. In this case, they will be required to pay an administrative fine in the amount of 75 to 100% of the amount of the illegal currency transaction (Resolution of the Federal Antimonopoly Service of the Volga Region dated May 24, 2006 in case No. A49-13188/2005-95OP/2). An agreement that does not comply with current legislation is declared invalid by the court on the basis of Art. 168 Civil Code of the Russian Federation. Persons who are residents of the Russian Federation enter into a cash loan agreement in rubles, indicating the loan amount in the equivalent of an amount in foreign currency.

What is debt collection under a loan agreement?

If the borrower does not receive money within the period agreed upon in the agreement, a delay occurs. In this situation, under the terms of the agreement, the creditor has the right to demand satisfaction of financial claims. The borrower must transfer the money within 30 days from the date of receipt of the claim from the lender. This complies with the mandatory out-of-court procedure for the consideration of a controversial legal relationship.

Borrower debt arises for various reasons. There may be extenuating circumstances, such as loss of a job. Also malicious actions on the part of the borrower and unwillingness to repay the debt. For a bank or another creditor, the qualification of the actions of the second party is not so important. The main thing for them is that the money be returned back, with interest for using it + payment of a penalty.

The likelihood of a refund increases if:

- the borrower has left a pledge, which the bank has the right to realize in case of debt;

- use not only a property, but also a physical method of securing a loan;

- thoroughly study the potential client and the history of previously issued loans.

The collection procedure is different, it all depends on the amount of debt and other conditions of the loan issued:

Option 1: The Bank operates through the Security Service. If the process does not bring results, then the debt is transferred to collectors by assignment.

Option 2: The bank transfers the claim to the debtor. If he ignores it or refuses to satisfy the demands of the credit institution, he goes to court.

Option 3: debt collectors are in charge of repaying the debt under rental agreements, since they bought it from the bank. If work with the debtor is ineffective, the agency goes to court.

How to win a court case under a loan agreement?

Winning a lawsuit in favor of the borrower is possible if the borrower can prove the fact of repayment of funds. Likewise, the lender can win in court if he proves the fact of transferring money or property on loan. If a dispute arose between two individuals, then to prove the transfer of an amount less than 10 minimum wages, the testimony of two witnesses is sufficient. If the amount is greater than the specified amount, then the court has the right to refuse to satisfy the lender’s interests, since he was obliged to draw up an agreement or take a receipt (written evidence of the formation of the loan).

The loan agreement can also be challenged due to lack of funds - thus, the borrower can prove that valuables or funds were never transferred by the lender in full.

It is important to consider that even a written agreement can be challenged by the borrower with the help of witnesses if the loan agreement was concluded under threat, under difficult circumstances, through deception or violence. You must contact the appropriate authority within the limitation period of such an agreement (3 years).

In what cases is the collection procedure carried out?

Collection begins the report from the moment when the citizen incurred a debt on the loan. In this case, the borrower may pay part of the loan, or not pay in full.

In this situation, from the day of delay, specialists from a bank or other financial organization contact the debtor and inform him that he has a loan debt. This happens by notifying him and his immediate family. The bank finds out the reason for non-payment, and also informs that the borrower’s credit history is deteriorating under N218-FZ, and financial sanctions are imposed under Art. 395, 811 Civil Code of the Russian Federation.

Legal regulation

The borrower's obligation to repay the debt is specified in Article 810. Civil Code. The person who received the money is obliged to return it in a timely manner, within the terms established by the agreement. If the terms are not specified in the contract for any reason, then the return is carried out within a month after the request of the lender. The debt is considered repaid as soon as the money is transferred to the lender personally or arrives in his bank account.

The law allows for early repayment of debt if it is interest-free. Money borrowed with interest can be returned ahead of schedule by notifying the recipient a month before the planned return.

According to Art. 811 of the Civil Code of the Russian Federation, if the debt is not paid on time, interest is charged on its amount for each day of delay. In addition, in accordance with Art. 395, the lender has the right to demand compensation for losses incurred as a result of late repayment of debt obligations if their amount exceeds the amount of accrued interest.

Process Features

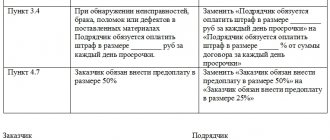

Collection of amounts under a loan agreement or credit agreement has its own particularities. In particular, a claim procedure is provided for this category of cases. It consists of the creditor attempting to peacefully negotiate with the debtor to return the money. And only after the debtor does not respond to the claim or expresses disagreement with it, the court comes into play.

REFERENCE: in most cases, if the formation of debt arose for good reasons, then banks offer the borrower a loan restructuring. That is, they meet their client halfway. Interest may be suspended on a mortgage if a person loses their job. In each case, the bank works individually with the person.

As judicial practice in this category of cases shows, most disputes are resolved in favor of the creditor. In some cases, the court may not agree with the amount of the penalty.

Pre-trial debt repayment

For this category of cases, debt repayment is provided out of court. This means that the parties should try to reach an agreement among themselves. If the negotiations do not lead to results, the bank files a claim. This letter is addressed to the debtor.

It does not have a strictly unified form, but business customs indicate the inclusion of mandatory details in this document. In particular, it must indicate the following information:

- Lender and borrower: addresses, contacts, bank name, surname and initials of the borrower, registration address, etc.

- Requirements put forward by the bank.

- Calculation of debt under an existing loan agreement.

- The period within which it must be repaid.

- Links to legal acts that a person violates.

- The further actions that the bank takes in the event of no response to the claim must be indicated.

- Seal of the sending organization.

There is no provision in the law that would oblige a citizen to respond to this letter. If no response is received within 30 days, the bank has the right to go to court.

REFERENCE: the letter is sent so that the bank has evidence that it tried to resolve the situation peacefully. For example, documents from the post office stating that he sent a letter by registered mail with notification of delivery.

The procedure for collecting debt through court

The creditor files a claim. The document is submitted to the court at the location of the defendant.

The court of general jurisdiction hears cases in which citizens are participants.

AS RF – disputes between organizations. In a specific case - if the loan was issued for running a business.

The court of general jurisdiction, in turn, considers disputes up to 50,000 - a magistrate, more than this amount - a court at the district level.

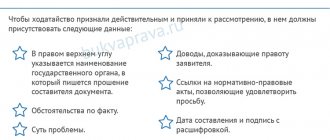

Filing a claim with a court

The form and content of the claim are clearly described in Art. 131 Code of Civil Procedure, as well as 125 Art. APK.

The text of the procedural document must contain the following information:

- name of the court;

- information about the parties: plaintiff and defendant;

- amount of claims;

- references to clauses of laws that were violated;

- description of the loan situation;

- request for collection with calculation of debt, interest.

REFERENCE: a list of documents must be attached to the claim. Among them is a claim that was drawn up as a pre-trial settlement. If it is not there, then the claim must be accompanied by evidence that the plaintiff tried to resolve the dispute without court intervention.

In addition to the claim, the following documents are submitted with the claim:

- a copy of the application (2 copies are sent to the defendant);

- loan agreement;

- debt schedule;

- state duty receipt.

The fee is paid in advance, before the court hearing. The amount is calculated on the basis of general claims in accordance with tax legislation. In this case, Art. 333.19 Tax Code of the Russian Federation. The minimum duty is 400 rubles. If the plaintiff appeals to the RF Arbitration Court, then Art. 333.21 Tax Code of the Russian Federation.

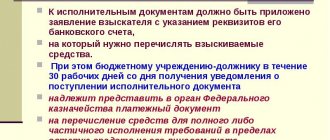

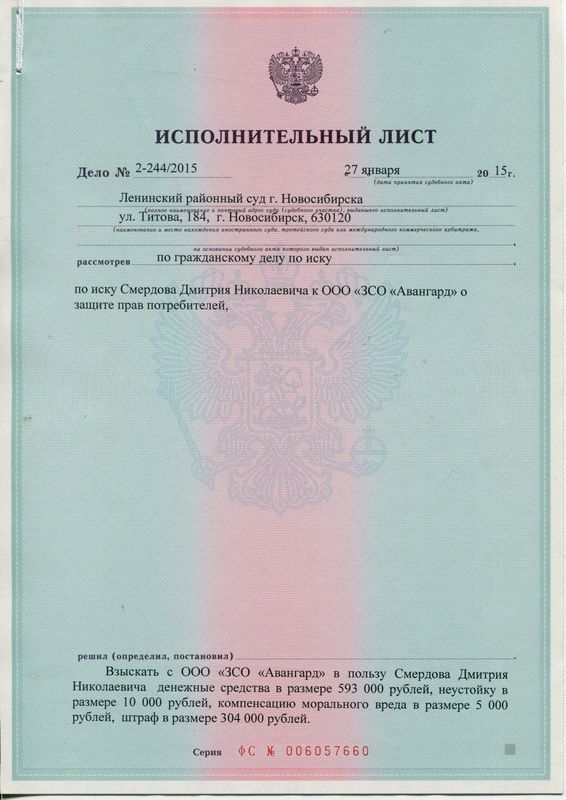

Obtaining a writ of execution

After receiving the writ of execution (sheet), the creditor has two methods of collection:

- Return the money yourself. At the same time, have the relevant documents on hand.

- Visit the Bailiff Service.

If the creditor decides to turn to the official authority, the bailiffs open enforcement proceedings 3 days from the date of the relevant decision. Copies of the resolution are sent to two addresses: the creditor and his debtor.

The latter is given a period of 5 days to repay the debt voluntarily. If the debtor completely ignores a difficult situation, forced collection occurs.

The creditor should contact the FSSP at the place of registration of the debtor or at the legal address of the organization.

Presentation of a writ of execution at the bank

The creditor has the right to independently present a writ of execution to the bank where the debtor has accounts (Article 8, N229 - Federal Law, 2007). This is done to save time: The Bailiff Service is heavily loaded. Information about which credit institution the debtor organization has accounts with comes through the following chain:

- Art. 69, Part 8 N229-FZ, information about accounts that belong to the organization can be provided to a participant in the process. He presents the writ of execution for execution.

- You must request account information from the tax authority. He is obliged to provide data within 7 days of receiving the request. Notification of the availability of accounts is carried out on the basis of a writ of execution, a copy of which is sent to the Federal Tax Service.

The creditor can collect money under a writ of execution through a banking institution, or go to the accounting department of the enterprise or company where the debtor works. But collection from the bank will be carried out in full, since there is a writ of execution. It is logical that only if there are enough funds in the organization’s account to repay the debt.

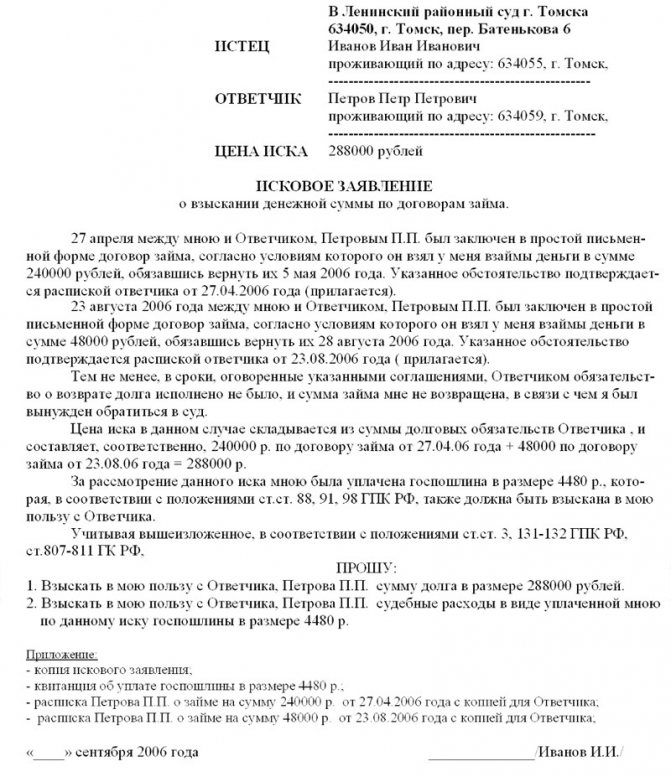

Sample statement of claim for debt collection under a loan agreement

The sample shows that the claim is filed in writing, signed by the plaintiff.

Debt collection by receipt in court

The creditor is obliged to first contact the debtor with a claim for debt collection. After the expiration of the thirty-day period, unless another period is provided for in the agreement, the creditor may file a statement of claim.

In order to save money, the creditor has the opportunity to petition the court to grant a deferral of payment of the state duty. Ultimately, judicial collection of debts in the form of a fee will be from the debtor.

A well-chosen strategy for litigation in a collection case, as well as carefully selected evidence, will allow you to obtain a decision in the shortest possible time, the subject of which is the collection of a debt on a receipt. Accounts receivable must be given significant attention, since it allows not only to obtain working capital for the business, but also to use it as a means of payment.

You may be interested in more detailed information about the legal dispute if the parties did not allocate VAT in the agreement

Interim measures

The creditor must actively use the methods provided by law to secure property interests. At the stage of initiating a court case, it is necessary to petition the court to take interim measures in the form of seizure of funds, property or a prohibition to perform certain actions.

Courts rarely take interim measures, which necessitates the search for objective evidence, as well as the formation of convincing arguments that will allow the court to grant such a request. If this happens, then the creditor needs to monitor the execution of the court’s ruling on taking interim measures for the return of debt obligations, since any delay can lead to dishonest actions on the part of the debtor.

Useful tips for the defendant

If there is a debt, it is in the borrower's interests not to take the matter to court. Collection under an unfulfilled loan agreement threatens him with even greater expenses. It is necessary to negotiate with the bank.

REFERENCE: in practice, if you read specialized forums on the Internet, many borrowers wait until the statute of limitations expires on their cases. According to Art. 196 of the Civil Code of the Russian Federation, it is equal to 3 years. If the bank does not file a lawsuit during this time, then the financial claims are dropped. But this method is risky.

A credit institution, if there are good reasons and the client’s good faith, which is visible from a positive credit history, can meet halfway and offer loan payment options. If a citizen or organization becomes a defendant in court, you need to try to pay off the debt.

Debt collection in parts // Error of the RF Armed Forces raises new questions about legal costs

The definition of the Supreme Court of the Russian Federation, which we will consider below, at first glance is devoted exclusively to the individualization of the claim. However, upon closer examination, it will become clear why, precisely in connection with the obligation of the losing party to compensate for legal costs, it can cause a lot of harm.

I. Position of the court

We are talking about the Determination of the Judicial Collegium for Civil Cases of the Armed Forces of the Russian Federation No. 5-KP9-219 in case No. 2-21/2018 dated December 17, 2019. In it, the court stated as follows:

civil legislation does not impose on the creditor the obligation to collect the entire amount of the debt from the debtor at once and does not contain a prohibition on filing various claims in court to collect the amount of the debt in parts, limiting this possibility to the statute of limitations […].

Thus, the Supreme Court answered the question popular among law school students: “can we recover a million for a ruble?”: “Yes, you can.”

This answer is wrong, and undeniably wrong. The concept of individualization of a claim, enshrined in the current Civil Procedure Code and Arbitration Procedure Code, does not allow for the collection of debt in parts. As follows from Art. 39 Code of Civil Procedure and Art. 49 of the APC, the legislator does not include the amount of claims in the subject of the claim. The amount of claims can be changed, regardless of the subject and basis of the claim, as many times as desired, and the court does not take it into account when making procedural decisions based on the identity of disputes (for example, determinations to refuse to accept a statement of claim or to return it). If the size of the claims individualized the claim, the rules on increasing and decreasing the size of claims would simply lose their meaning.

And the doctrinally position of the RF Armed Forces does not stand up to any criticism. Also E.V. Vaskovsky noted that it is necessary to distinguish the subject of the claim from the material object, recognizing the correctness of the Senate’s position on this issue: “A claim brought for any right in a smaller amount against the one in which this right belongs by law must, after the decision on this decision , be considered resolved and, by virtue of this decision, the same right cannot be the subject of a new claim.”

In this regard, it is quite obvious that two claims for the collection of “different parts” of the same debt will be identical. As a result of their consideration, the values for the protection of which the institution of individualization of the claim was actually created will be undermined. Essentially the same dispute will be considered in court several times. The court's efforts will be multiplied unnecessarily, and the defendant will remain extremely vulnerable to the plaintiff throughout the entire period of limitation. After all, it is clear that having lost the first lawsuit, he most likely will not be able to win any of the subsequent ones.

Perhaps the defendant will not even go to court, but will patiently wait for the next decision made against him at home. But no one forbids the plaintiff to send his own lawyer to each trial. He will win the case anyway, so the legal costs will fall on the defendant... And thinking about this, we will soon come to the conclusion that the most undesirable consequences of the RF Armed Forces allowing “partial” claims lie precisely in the area of legal costs.

II. Legal expenses Let's start with a well-known circumstance: the rules for calculating state fees do not at all imply that for consideration of one claim in the amount of 2 million rubles. we will pay the same amount as for considering two claims of 1 million rubles each. every. Making one claim for 2 million, we will have to pay 18,200 rubles, and filing two claims for a million - 26,400 rubles. If you divide the debt into more parts, the difference becomes quite dramatic. So, when collecting a two-million-dollar debt in ten installments, the state duty to SOYU will already be 52,000 rubles. By the way, the situation is similar with fees for filing claims in arbitration courts.

Who should pay the difference in the amount of the state duty resulting from the plaintiff’s choice to collect the debt in parts? It is clear that the provisions of the chapter of procedural codes on legal costs will not help us answer this question. And we have no complaints about the codes, since this issue would not arise at all if they were applied correctly.

Let's return to legal costs and the plaintiff who sends his own lawyer to each of the proceedings. It is clear that if disputes are multiplied, the total legal costs will increase, albeit not proportionally, but quite noticeably in order to wonder how fair this is in relation to the defendant. On the one hand, we can say: “if you, the defendant, did not pay off the entire debt voluntarily after the first lost case, it is your own fault that you will have to pay for all subsequent processes.” On the other hand, the defendant may argue that he did not have strong arguments against the first claim, but he does have them against the second, and it was precisely because of the plaintiff’s choice to bring several claims that he could not immediately present them in court.

Intuitively, I would like to call on Art. 99 of the Code of Civil Procedure, which provides for the payment of compensation by a party abusing its rights, for example, by filing an unfounded claim in bad faith. However, the fact of the matter is that “partial claims,” if we support the logic of the RF Armed Forces, are quite reasonable and are limited only by the statute of limitations. With such legitimization, one can hardly talk about any bad faith on the part of the plaintiff.

Of course, there is no reasonable solution here from the point of view of the chapter on legal costs. The solution is found in the rules on the individualization of a claim and can be simplified as follows: one dispute - one claim - one decision.

To summarize, it must be said that this is only one of many errors by the Supreme Court in the application of procedural law, although it can have particularly unpleasant consequences. To be fair, we note that even earlier the same mistake was made by the now disbanded Supreme Arbitration Court of the Russian Federation in the case of the Krasnoufimsk Garment Factory (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 27, 2004 No. 2353/04 in case No. A60-14530/03-C4). Unfortunately, the error of the Supreme Arbitration Court was replicated by arbitration courts. In this case, the custom of courts of general jurisdiction not to listen to the positions expressed by the RF Supreme Court in its rulings will only benefit practice.

***

We are waiting for your suggestions for publication in the “Case of the Month” section through a special form on the website. Materials can also be sent to the editor by email: egorkin[at]igzakon.ru.

Useful tips for the plaintiff

According to judicial practice, debt collection under loan agreements is in favor of the creditor in most cases. The winning party receives a writ of execution.

If the creditor can wait, then it is worth taking the document to the Bailiff Service.

They have many tools at their disposal to collect debt. For example, bailiffs can seize the debtor’s property, impose a ban on his travel outside the Russian Federation, limit his rights in driving a vehicle, etc. All these measures are aimed at ensuring that the person or legal entity makes active efforts to pay the debt. Order a free legal consultation