The right to appeal against unlawful actions of employees of debt collection agencies was granted to borrowers by Law No. 230-FZ adopted in 2016. The practice of appealing the actions of debt collectors has changed. A large number of complaints are received by various authorities: the FSSP, Rospotrebnadzor, NAPKA, the police and the prosecutor's office. Not all of them are justified and subject to satisfaction. To be sure that your work in writing a complaint will not be in vain, you need to know how it is submitted. We will talk about this in the article.

What actions of debt collectors are considered illegal?

The concept of illegality stems from the rule that guides lawyers when interpreting the legality of a particular offense: it is permissible to do everything that is not prohibited by law. Following this rule, it is not difficult to establish which actions of collectors are lawful, and which a borrower whose rights have been infringed can safely complain to regulatory authorities. This can be determined by clause 1 of Art. 4 of Law No. 230-FZ, which lists the rights of collectors. There are few of them:

- make calls;

- meet with the debtor in person;

- send SMS or voice notifications;

- send postal correspondence.

What to write in a statement to the police.

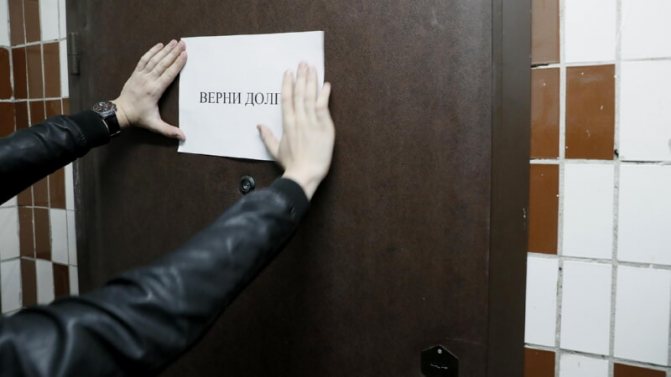

In cases where collectors go too far and instead of working together to find a compromise with the debtor, they begin to threaten over the phone or in person, you will have to go on the offensive.

You should call the local police officer if a representative of a collection agency tries to enter your house or apartment, despite the lack of your consent.

You need to send a statement about extortion from debt collectors to the police station if they threaten violence against you or your loved ones. This must be supported by witness testimony or audio/video recording. Written threats must also be recorded and presented to the police.

Example of a complaint against debt collectors to the police

In what cases should you file a complaint against debt collectors with the prosecutor's office?

Not everyone clearly understands the functions of the prosecutor's office, its powers and the methods by which it influences violators of the law. As a supervisory body, the prosecutor's office is deprived of the power to directly influence the violator, unlike the police, which can quickly stop the unlawful actions of debt collectors. The task of prosecutors is to prevent offenses that have not yet been committed by indicating the inadmissibility of committing any actions.

In order for the complaint to be justified, you must first try to resolve the conflict situation:

- with a bank that, in violation of the terms of the agreement, sold the debt to collectors;

- to Rospotrebnadzor if personal information is disclosed;

- to the police - if collectors damaged property, caused bodily harm or publicly insulted the debtor (third parties);

- FSSP in case of violation of methods or time of interaction.

In most cases, illegal actions stop. Only if the regulatory authority has not responded to your complaint, there is a reason to write a statement to the prosecutor's office. Response measures will apply to both offending collectors and regulatory officials who were negligent in handling the complaint.

What laws govern debt collection?

Expert opinion

Alice

Lawyer, Moscow

Ask a lawyer

All collection activities are focused on collecting problem debt. Creditors resort to them only when the debt is too large in amount and the payer has refused to pay for more than one year. Confiscation of property or collection of funds is carried out in a pre-trial manner. The basis for their actions is a bilateral agreement concluded by the creditor with the collection company. It is called an “assignment agreement” (or in other words, an agency agreement).

Two standard schemes work here:

- Debts are fully repaid.

- Debts are collected and returned to the lender for a certain fee.

In order to properly file a complaint against debt collectors, it is very important to know on what basis this can be done. The following legislative norms are currently in force.

| Link to law | What exactly regulates |

| Code of Civil Procedure of the Russian Federation | The civil litigation process. |

| Act No. 229-FZ of October 2, 2007 | Mechanisms and schemes of work of state executive services. |

| Act No. 230-FZ of January 1, 2021 | Introducing significant restrictions on the actions of collection organizations. |

| Article 14.57 Code of Administrative Offenses of the Russian Federation | Punishment for illegal collection of overdue debt. |

| Article 13.11 Code of Administrative Offenses of the Russian Federation | Responsibility measures for illegal methods in relation to the handling of personal data of individuals and legal entities. |

| Article 20.1 of the Code of Administrative Offenses of the Russian Federation | Punishment for hooligan behavior in public places and personally towards citizens. |

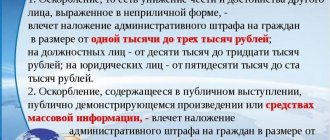

| Article 5.61 Code of Administrative Offenses of the Russian Federation | Being punished for insults. |

| Article 163 of the Criminal Code of the Russian Federation | Describes the penalties for a debt collector after a complaint against the actions of debt collectors has been considered in court and proven. This is called extortion. |

| Article 119 of the Criminal Code of the Republic of Belarus | Penalties for threats to cause harm to life. |

Restrictive conditions for the existence of a collection service, after which they have the right to exist and conduct their work:

- Assets should not be less than 10 million rubles.

- Availability of permanent insurance in the amount of 10 million rubles.

- Registration in the Unified State Register of Legal Entities (or Unified State Register of Legal Entities, depending on the form of ownership).

- Always up-to-date and functioning official website.

Previously, until 2021, collection services in Moscow and other Russian cities pursued a strict policy towards debtors. Their methods were aggressive and brutal actions, condemned by the Criminal Code of the Russian Federation. They constantly referred to Article 382 of the Civil Code of the Russian Federation, which states that it is permissible to transfer other people's debts to intermediary services (a third party) without obtaining the written or oral consent of the debtor. But after the entry into force of the new legal provision No. 230-FZ dated January 1, 2017.

Where to contact

In the Civil and Criminal Procedure Codes that regulate the actions of persons and bodies involved in law enforcement activities, there is the concept of territoriality. It is guided not only by the courts, but also by all government bodies. A complaint against debt collectors should be made to the authority in whose territory the violation was committed.

In relation to a complaint against the actions of debt collectors, it is written to the district prosecutor's office at the place of registration of the debtor. Military or industrial prosecutor's offices may be located on the territory of the administrative district. They perform specific functions and should not be complained about.

The prosecutor's offices have reception areas that accept applications from citizens. You can make an appointment with the prosecutor or assistant and personally state the essence of the claims. However, a personal reception does not exempt you from filing a written complaint through the reception desk and registering it in the incoming correspondence log.

The most common is to send a complaint by registered mail. Do not forget to issue a receipt receipt - it will serve as a guarantee that your complaint has been received by the addressee. From this day the period for response and action will begin.

Going to court

This is the fifth - extreme measure of influence. In this case, the document acquires the status of a statement of claim. The injured party may refer to Art. 151 Civil Code of the Russian Federation. Used in cases of insults and humiliation. You can obtain compensation for moral damages. The court will consider the application received and a decision will be made taking into account the evidence presented.

Ways to file a complaint in court

The claim is sent to the inspection authorities in one of the available ways:

| Personally | If there is an appropriate authority in the city, then you can go to the office yourself and submit a complete set of documents. It is necessary to require that an employee of the institution put an acceptance mark on the copy of the person who applied. |

| By mail | If it is not possible to personally contact the government agency, then the letter is sent by registered mail, with acknowledgment of delivery. Then it will be known that the letter has been delivered to the addressee. |

| Electronically | Citizens can submit a claim online through the official website of a government agency or through State Services. This method of treatment is possible only if this option is provided by the institution. |

How to write a complaint

Writing a complaint requires compliance with some of the requirements for writing official correspondence. Both handwritten and typed complaints are accepted. It is important that its contents make it clear:

- to whom is it addressed;

- who is the complainant;

- where he lives and how to contact him;

- who is the defendant in the complaint;

- where is;

- what are the facts of the offense on the part of the collectors (from the applicant’s point of view);

- what the applicant is asking for;

- confirmation of the identity of the complainant - personal signature;

- indication of the date the complaint was written.

Some information may be unknown to the applicant. For example, the last name or first name of the agency head, the last name or first name of the collector who committed the violation, their contact information (telephone numbers). This is not difficult to establish, so they can be ignored in the complaint.

Care should be taken to describe the nature of the violation. The description will allow you to qualify its severity. Each statement addressed to agency employees should be supported by evidence:

- references to witnesses;

- recordings of conversations on a voice recorder;

- video recordings;

- printouts of phone calls or SMS received from a telecom operator;

- a description of the damage that must be confirmed by appraisers or recorded by police officers;

- if physical harm to health is caused, attach the results of an examination by a doctor (bruises, abrasions).

What is allowed to collectors

Indeed, until recently, collectors, while performing work, misled the borrower, threatening criminal punishment (Article 177 of the Criminal Code), and exerting pressure. But since January 2021, such methods are prohibited by law.

Limited communication

Art. 7 Federal Law-230 regulates the time and frequency of telephone calls and personal meetings. The agency representative has the right to disturb the debtor with calls no more than twice a day and only twice a week.

Time from 08.00 - 22.00, on holidays from 09.00 - 20.00. The collector is required to make audio recordings of conversations with the debtor.

The collection officer has the right to meet with the defaulter only once a week. And 4 months after demands for debt payment arise, the debtor may completely refuse personal communication (Article 8, Clause 6 of the Federal Law).

Responsibilities of the claimant:

- introduce yourself, give your full name;

- name the organization he represents;

- declare the amount of debt;

- leave contact information;

- indicate your current account.

Communication with third parties with the consent of the borrower

According to Art. 4 clause 5 of Federal Law-230, the collector has no right to interact with relatives, colleagues, neighbors of the debtor, call and ask questions. To do this, you must obtain the consent of the interlocutor and written permission from the borrower (which can be revoked at any time).

Letters

An agency employee has the right to send letters to the debtor. The contents of the message are clearly regulated by Art. 7 clause 7 FZ-230:

- debt information;

- information about the documents on the basis of which the claimant makes demands;

- details of the account to which the money should be sent;

- contact details of the organization.

Results from filing a complaint with Rospotrebnadzor

Considering the specifics of the supervisory powers of Rospotrebnadzor, not all unlawful actions of debt collectors can be appealed to this body. It should be remembered that the scope of activity of this body, defined in the Regulations approved by Decree of the Government of the Russian Federation No. 428, is supervision of compliance with consumer rights.

Banks partially fall into this category of violators and are subject to the law “On the Protection of Consumer Rights.” Different rules of law apply to them. However, this does not deprive debtors of the right to appeal against unlawful actions of banks and collectors regarding the disclosure of personal data.

If such a violation is established, the perpetrator may face liability:

- disciplinary;

- civil law;

- administrative;

- criminal

All types of liability, sanctions and fines are contained in the summary table at the link provided.

Additional legal guarantees for control over collection activities

Since the niche of collectors is often of interest specifically to microfinance organizations, Federal Law No. 151 on the rules of their functioning is also a suitable legislative act. Federal Law No. 230 directly introduced some amendments to this legislative act. The changes indirectly change the vector of the relationship between the debtor and the creditor.

The main motives put forward by collectors are an exponential increase in the interest on the loan, and then its repurchase, extracting money using illegal methods and illegal re-crediting. Therefore, the state abolished the maximum interest rate. In addition, in 2021, Federal Law No. 554 was also adopted, which deals with this issue by analogy.

Case resolution practice

Appeal is still the most effective means of influencing not only collectors who violate the law, but also regulatory authorities, especially the FSSP, who do not bother their employees with active work and prefer conservative methods.

There are no special statistics regarding the number of complaints considered against the actions of debt collectors and the prosecutorial response measures taken in the public domain. The number of complaints is indirectly confirmed by the statistics of NAPKA, which received about 30,000 complaints in 2021, and the statistics of the FSSP, the number of complaints to which increased by 1/3.

The situation with the legality of the activities of collection agencies has stabilized. During 2017–2021, there were no reports of gross violations related to crimes committed by debt collectors.

Articles:

How to write a complaint to the FSSP against debt collectors

What time do debt collectors have the right to call?

Laws regulating collection activities

The illegality of the actions of collectors in Russia is explained not by the lack of a legislative framework, but by its ignorance by financial institutions and collectors. Banks are also responsible for unlawful actions of collection agencies, as they enter into cooperation agreements with these legal entities.

Back in 2021, the government apparatus adopted Federal Law No. 230, aimed at protecting the interests of debtors. It is here that the basics of carrying out the activities of collectors within acceptable limits are considered. Unfortunately, in reality it is not always possible to prove the illegality of the actions of collectors on the basis of this standard.

Collectors are often presented as ordinary bandits, whose activities are of an official nature and based on legislative acts. Nevertheless, citizens should be attentive to all articles of this law and, if they do not comply with the rules for the activities of collectors, insist to law enforcement agencies about the need for protection.

To implement the law, not only representatives of law enforcement government agencies must act, but also the debtors themselves, who have come under the adverse influence of the criminal activities of the collector. In this case, it is essential to collect evidence in the form of audio and video recordings, as well as documents on conducting activities contrary to the laws (licensing, presence in the state register, etc.)

How to protect yourself from debt collectors

You can protect yourself from psychological or physical pressure by filing a complaint with law enforcement agencies. It is advisable to make an audio or video recording of the communication as evidence of illegal actions, and obtain testimony from witnesses.

Police officers will take the necessary measures and bring the offender to justice.

Important! The time of “black” collectors is running out. The state is developing a law prohibiting credit institutions from dealing with companies not included in the State Register.

Which companies are included in the FSSP register

In order for an agency to be included in the register, it must comply with the requirements of Art. 13 FZ-230:

- the constituent documents of the main OKVED of the company indicate - collection of overdue debt;

- authorized capital from 10 million rubles;

- It is mandatory to have annual insurance in the amount of 10 million rubles (a guarantee of compensation for possible damage to the debtor);

- An organization must have licensed software and a website.