How to write a document correctly

The response to the claim is created in free form, subject to certain rules for writing such documents. That is, the appeal must be written in an official business style. It should not contain rude expressions, insults or everyday language. Corrections and errors are not allowed in the response to the complaint. Before sending it, you should carefully analyze the document for any inaccuracies.

The written answer must be reasoned, complete and concise. All arguments must be accompanied by correct references to relevant regulations, departmental instructions, rules and other acts that may come as a surprise to the author of the complaint.

The response must certainly contain all the required details that give the document legal force.

If the response is created by a legal entity, then it must be written on official letterhead.

Sample responses to complaints.

The structure of the response to the claim is as follows:

- in the upper right part you should indicate the addressee: the name of the organization or the full name of the citizen presenting his demands for debt payment. This part also contains the details of the legal entity, address, information about the sender and his contacts,

- the descriptive part of the response contains the defendant’s arguments: why issuing the debt is unfair, for example, there is an indication that payment has already been made under the agreement. He can also admit the existence of a debt and ask for an installment plan or deferment due to unforeseen circumstances (for example, loss of a job, etc.). In the latter situation, a person indicates an obligation to “close” the debt before a specified date or proposes a schedule for transferring funds. In addition, the debtor can indicate his own calculation of the debt or penalty,

- At the bottom there is a signature and its decoding, as well as the date of compilation.

The answer is sent by registered letter with a list of attachments or delivered directly to the addressee against signature. If the latter case is used, the document must be drawn up in two copies. When sending a response by an organization, it should be certified in advance with the company’s seal and the date and number of outgoing correspondence must be affixed.

Documents that confirm the accuracy of the information provided are attached to the response to the claim.

This may be a copy of the passport, a copy of the agreement, copies of payment documents certifying the fact of payment, reconciliation acts, etc.

Watch the video. How to write an official letter to a bank:

How to write a response to a claim for debt payment?

Since the complaint is of an official nature, the response to it will also be legally significant. First of all, you need to study the situation, that is, the contract, all your actions to implement it, and the actions of the counterparty. You should also collect all documents confirming these actions.

It is necessary to carefully analyze the claim itself for errors, inaccuracies, and inconsistencies with reality. The discovery of such facts does not mean that the letter can be ignored. This should not be done under any circumstances. Simply, any distortions regarding the agreement under which you are recognized as a debtor are grounds for making a decision.

As a result of such preparatory work, a person usually comes to the following solutions:

- fully agree with the claim, promising to fulfill their obligations within the appointed time frame;

- completely deny the presented demands and accusations;

- partially agree with the facts presented in the document;

- fully or partially agree with the claim, but put forward your own proposals for a way out of the situation.

In addition to developing such verdicts, it is also necessary to develop arguments. Non-payment of debt may occur for the following reasons.

- Force majeure. These are circumstances that do not depend on the will of the parties, but prevent the fulfillment of the terms of the contract. If it can be proven that contractual obligations were not fulfilled due to force majeure, then the claim is invalid. In this case, the counterparty just needs to be informed of the current situation, assuring them of their readiness to follow the letter of the agreement in the future.

- Circumstances beyond your control, but not related to force majeure. In this case, there is a reason to persuade the counterparty to postpone the fulfillment of contractual obligations to another time.

- Lack of legal justification for the requirements. The claim may contain incorrect references to standards, errors may have been made in the description of clauses of the contract, persons involved in the case, amounts of debt collected, etc.

In the first case, the person accused of failure to fulfill his obligations is not such. In the second, there is a compelling reason to agree to defer the execution of the contract. The reasons set out in the third paragraph are the basis for recognizing the claims as inadequate.

After this, you can begin to draft a response to the complaint. The main objective of this action is to convince the counterparty not to go to court. To do this, all arguments must be given in as much detail as possible.

The letter must be drafted precisely as a response, that is, in accordance with the points of the complaint. However, it is worth considering references to regulations that support your position, and not the opinion of the counterparty.

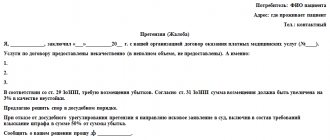

Response letter form

There is no specially approved form of such a document. However, there is generally accepted ethics in business correspondence and the logic of drawing up legal documents.

The response to the claim must consist of three blocks - “header”, content, conclusion and signature with date. The document must be formatted in such a way that the recipient immediately understands which letter the response was sent to.

To do this, in the “header” in the “to whom” section the name of the organization that sent the claim must be displayed exactly. The “from whom” section should contain the real data of the responding person, and not those provided by the counterparty. This will highlight inconsistencies in information, if any. The identification meaning should be included in the title. The wording “response to the claim” must be supplemented with a reference to the outgoing number of the letter, if any, and the date of its preparation.

A statement of the decision on the claim can be located before or after the narrative part. It all depends on the nature of the decision made and the desire to emphasize the argument.

The narrative part depends to an even greater extent on the correspondence of the facts presented in the claim to the true state of affairs. If the responding person acknowledges his debt and is ready to pay it within the specified period, then there is nothing to write in the narrative part. Then the response simply turns into a notice. A similar situation arises if you agree with the claim, but present a request for a deferred payment.

In case of complete or partial disagreement with the facts stated in the claim, the content should consist of references to the letter, contract and regulations. It is on these links that the argumentation for defending your point of view should be built.

Required items

If you want the counterparty to understand you, then the response to the claim must be formed according to all the rules of business correspondence, first of all, the “header” and the stating part. Everything else depends on the position of the person who accepted or rejected the claim.

The recipient of the response must clearly understand that this document is a response specifically to his claim regarding failure to fulfill contractual obligations. The formulation of the position of the respondent must also be unambiguous. Otherwise, this letter cannot acquire the status of a legally significant document.

Deadlines

If a person has acknowledged his debt in full in accordance with the claim, then the most desirable response to the creditor will be to repay the debt within the specified period, and preferably ahead of schedule. If you disagree with the claim or if it is impossible to make the payment within the appointed time, the response must be sent within the time limits specified by law. Otherwise, the creditor will have no choice but to file a lawsuit.

There are the following standards that determine the period for the debtor to respond to a claim.

- Articles 452 and 810 of the Civil Code. The first of them is devoted to the procedure for changing and terminating the contract. The emergence of circumstances beyond the control of the parties dictates the need to amend the terms of the contract. This can only happen by mutual consent. Failure to receive a response to a complaint within the agreed or thirty day period may be considered a refusal to make changes. The same period is stipulated in Article 810, which is devoted to the borrower’s obligations to repay the debt. Only in this case we are talking about the timing of the debtor’s response to the creditor’s demand for debt repayment.

- Article 22 of the Federal Law “On the protection of consumer rights. It determines the response time of the manufacturer of goods to a consumer complaint. This must happen within the minimum period determined by the agreement of the counterparties. This period should not exceed 45 days.

- Federal Law No. 40 (on compulsory motor liability insurance) determines the time frame for consideration of claims by insurance organizations within 20 days from the date of their receipt. Old-style policies are still subject to a review period of 30 days.

These are the basic standards. However, there are special laws regulating the interactions of counterparties in some specific sectors of trade, services and production.

Do I need to answer?

In situations where the debt is not paid for an extended period, debtors may receive a collection claim created in accordance with current legislation. It should not be ignored, because otherwise a lawsuit may be filed in court. Sending an appeal demanding payment of debt is a pre-trial method of resolving a dispute.

The creditor will wait for a response to the sent claim and further fulfillment of its obligations. If all his demands are not met, a statement of claim and the start of a legal battle may follow. To avoid such a course of events, it is better to resolve the conflict peacefully.

Claims are of the following nature:

- must be presented,

- subject to presentation under an existing contract,

- subject to the expression of will of either party.

Note! A claim in civil proceedings does not act as a mandatory element, unlike arbitration proceedings. Therefore, submitting a claim is the creditor’s step towards resolving the conflict situation before the court hearing. You need to respond to such a message in any case.

The purposes for which the creditor sends a claim are:

- encourage the debtor to repay the debt, preferably pre-trial,

- obtain the right to appeal to a judicial authority,

- intimidate the debtor.

Depending on the purpose sought by the complainant, the type of response will depend. It can be created according to a specific template.

For example, a claim from a customer under a contract agreement most often focuses on eliminating operational deficiencies. The parties have the right to indicate in the contract that the response is mandatory, but responsibility, as a rule, is not prescribed. Therefore, the requirement must be fulfilled immediately.

Attention! Our qualified lawyers will assist you free of charge and around the clock on any issues. Find out more here.

Who can make a claim for payment?

Claims for payment of debt may be made by:

- credit institutions for loans,

- utility organizations,

- mobile operators if there is a debt for services provided,

- microfinance firms in case of a loan,

- pawnshops,

- institutions involved in public transport.

Debt obligations can appear not only between organizations, but also between citizens.

In certain cases, the response to a claim is an acknowledgment of the debt. This kind of response takes the form of a letter of guarantee for payment when one of the parties does not fulfill its financial obligations.

A letter of guarantee allows you to perform the following tasks: informs the counterparty, the creditor about problems with funds, acts as a basis for revising the debt payment schedule, and is a confirmation of future repayment.

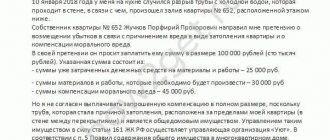

How to file a claim for compensation for moral damages?

Response Content Forms

The addressee of the claim has several options for how to respond to the document received:

- satisfy in full. In such a situation, the text must indicate that the complaint sent by the creditor has been accepted, the monetary demands indicated in it are legal and will be executed at the specified time and in the required amount,

- satisfy in part. The claim is recognized only in part, and a letter is sent to the creditor setting out other conditions,

- refuse completely. This is done in situations where the creditor's demands for the return of funds are unfounded due to certain clauses of the agreement or provisions of the law. The response should include specific references to regulations, results of examinations and other documents. At the end, the author of the complaint should be invited to contact the court.

When drawing up a response, the main task is to express an opinion regarding the claim expressed by the opposite party and present it with your decision.

Response to a claim for lack of debt

This answer is usually the longest and most complex because it contains an analysis of the contract, regulations and actions of both parties. For greater clarity and accessibility, its content should be structured as much as possible in accordance with the points of the claim.

The principle of structuring based on the base document creates significant differences between the response and the claim itself. However, this does not mean that the letter should not contain references to the agreement and regulations. We are talking only about the order in which information is posted.

The success of defending your interests depends on the literacy of argumentation and clarity of information arrangement. The counterparty must immediately understand the prospects for its further actions. If you do not agree with his claims, then the task is to persuade the counterparty to dialogue, and not to retaliatory aggression. Both the form and content of the document should serve this purpose.

In what cases are claims rejected?

The addressee of the complaint has several options on how to respond to it. In what cases does the debtor have the right to reject the demands put forward?

Note! There are four reasons :

- absence of the debtor’s fault in the circumstances leading to the failure to fulfill obligations. Such situations are described in the “Force Majeure” clauses of the agreements,

- failure to fulfill an obligation occurred due to a situation that, although not force majeure, cannot be controlled,

- the addressee is incorrectly specified,

- the demands made by the creditor are unlawful or were not recorded in the agreement.

In certain situations, despite a correctly written response to a claim, it is not possible to avoid litigation. But the very fact that the answer was provided within the required time frame will be another plus for the debtor. Otherwise, he would have to pay all legal costs even if the outcome was positive.

Response to a claim for debt payment: sample

The general scheme for drawing up such a response to a claim does not have much specificity. There can be two options in the content of the letter - full and partial consent.

In the first case, after the heading “response to the claim”, phrases may be placed stating that when considering the information received about the debt under the contract (identification data), the counterparty came to the following conclusion (decision on full or partial consent). The delay in payments was caused by circumstances that for our organization are of a force majeure nature.

After agreeing with the total amount of debt and the terms of its repayment, a phrase about disagreement, for example, with the amount of the penalty, can be given. In this case, you should provide your own calculations as a counterargument.

With full agreement, you can only apologize, explain the reasons for the delay in payments, and inform about the date of repayment of the debt.

and familiarize yourself with a sample response to a claim for debt payment.

Writing deadline

According to current legislation, a response to a claim for repayment of debt obligations must follow within the established time frame, which is adopted in accordance with the following principles:

- as a rule, complainants use Article 452 of the Civil Code and set the minimum time for drawing up a response to a pre-trial complaint regarding a debt obligation - this is thirty days from the time of its filing,

- in exceptional cases, when creating a response to a claim requires a long time due to various circumstances, the applicant has the right to fix his own individual time period in the text of the document itself, for example, forty-five or sixty days,

- when the term in the claim is not fixed, but only the date of its preparation, then it is recognized as minimal by law, that is, equal to one month. If the sender does not even indicate the date of writing the document, it is considered void and has no legal force,

- if an employee calls on the head of the organization to pay arrears of wages, the response time to such an appeal can be reduced to seven days. The same applies to those situations where one of the parents forces the ex-spouse to pay his child support obligations.

The period during which the applicant waits for a response must be justified and fully justified by the number of actions for drawing up a counter document.

Later, if the judge decides that the plaintiff gave too little time to the debtor to respond, he will have the right to reject the claim due to a violation of the pre-trial dispute resolution mechanism.

Claim against the manufacturer for a defective product.

What to pay attention to

If you ignore a written request to repay the debt, wait for a subpoena.

Keep in mind that debt collection for housing and utilities is now carried out on the basis of a court order, which is issued by a single judge, without calling the parties. Therefore, a letter of claim for payment of debt, a sample of which we examined, is sent to the debtor immediately before filing a claim in court. And if you haven’t answered it and haven’t paid off the debt, then the next document you receive will be a court order that has the force of a writ of execution

This is important to know: Where to complain about the work of the post office

Features of preparing a letter to the management organization

Often claims demanding repayment of debt are sent to management companies.

In such situations you should:

- determine the period of debt,

- compare tariffs, meter readings, payment receipts,

- find out why the complaint was submitted at this particular moment.

If the management organization does not want to provide more detailed information regarding the existing debt, a reference should be made to Government Resolution No. 731 of September 23, 2010, which specifies its obligation to provide such information.

Watch the video. How to respond to a letter of complaint: