Why do banks need lists of debtors?

Trying to reduce their risks and protect their savings from borrowers who delay loan payments, banks and other financial organizations create databases that display information about unscrupulous payers. Special credit history bureaus can help them with this .

Using this database, banks will be able to verify the client’s reliability or refuse to provide a loan. Banks not only have access to the credit histories of their current customers, they can also request a blacklist of bank loan debtors. This list includes the most problematic clients who commit violations with some frequency, refusing to fulfill their obligations to creditors and even deliberately hiding from representatives of the banking industry.

However, among banking specialists there are both supporters and opponents of such a blacklist. Of course, it will be very useful for the bank if it has its own list of problem debtors who are avoiding loan payments. But there is a big problem with compiling these lists.

Who will benefit from information about debtors?

By monitoring such information, organizations reduce financial risks and minimize non-returns. Debtors have the right to correct the situation. Strict conditions on the part of lenders are becoming a necessary measure: more than half of borrowers are behind on payments. Financial institutions are reinsuring themselves, reducing economic risks: pre-trial collection through collection companies or internal banking resources do not give the expected result.

Those wishing to borrow a large amount for mortgage lending should definitely check the blacklists in advance. Lenders update their databases from time to time. MFOs offer borrowers to improve their credit reputation by taking out a small loan, but such offers are unprofitable due to high rates and overpayments. For these reasons, it is better to avoid overdue loans and constantly monitor personal accounts.

Originally posted 2018-03-28 17:07:31.

Who gets blacklisted

Sometimes people are blacklisted as debtors who have temporary delays in payments, but who after a certain period of time successfully settle accounts with the bank that provided the loan. There are cases when clients who have taken out a loan leave the city for a while or move to a new place. And the bank, unable to find such a client, immediately adds him to the list of insolvent persons.

For this reason, data on legal entities is mainly included in blacklists. Banks give preference to private clients, instructing a bureau that specializes in such lists to enter data about debtors and update information about them in a timely manner.

Moreover, any individual or legal entity that has been included in this black list has every right to challenge the fact of their inclusion in the list. If the debtor nevertheless repays the debt to the creditor, he may demand to be removed from the blacklist. However, the specifics of these procedures have not been fully worked out and it is very difficult to prove that you are not a camel and your credit history is clean.

Blacklists of bank debtors are classified information and such a database cannot be freely accessible. Therefore, you should not trust Internet sites offering to download such lists for free. Without a doubt, this is a hoax.

What are the types of debtor databases?

Blacklists (database) can be of two types. The first type of lists is established by a separate bank. He compiles his own list, which includes his clients who took out a money loan and are in no hurry to repay the bank. But there is also a more global list. It already includes debtors whom the bank sued for non-payment and won the case. Such a list can be managed by the bailiff service.

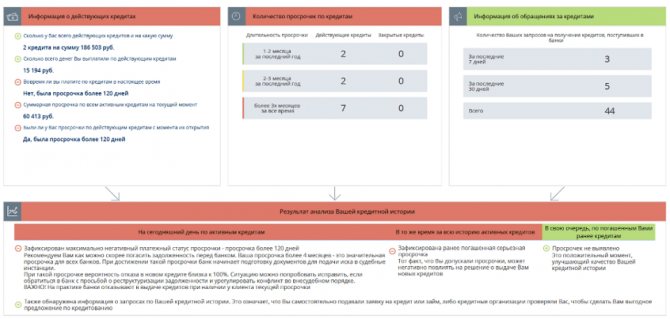

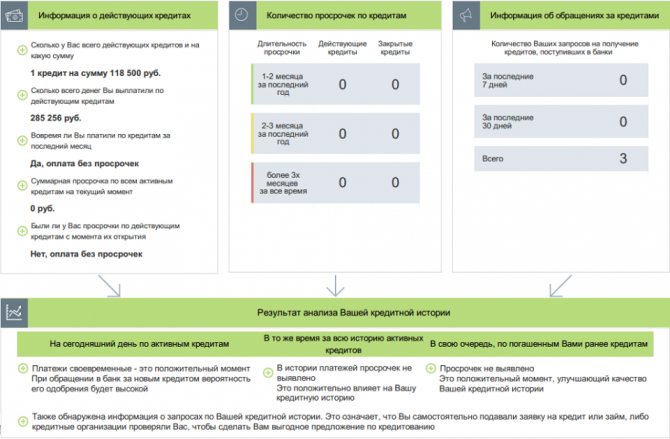

You can receive such a paid service with a detailed report on your credit history instantly by email by filling out this form below, or on the website myrating.rf

Examples of reports:

Example No. 2

In the report you will receive comprehensive information:

- How many loans do you actually have?

- Do you have any delays?

- Find out why banks refuse

- How to fix bad credit history

Which institutions share information?

Getting a loan with a damaged credit history is not easy. Few financial institutions are loyal to malicious defaulters. They are developing special programs for unreliable clients (these are offered by Tinkoff, Renaissance Credit, Citibank), but the rate will be high.

Russian standard

When signing a contract, you need to carefully study the clause regarding delays. At the initial stage, this institution notifies the client about non-payment through mail notifications and calls. After approximately 2 weeks, the case is received by the debt collection department, and the data is entered into the BKI. If the situation moves into a problematic direction, the financial institution can sell the debt to a collection company or file a lawsuit.

To view payments on a Russian Standard loan, you can use the unified database of defaulters provided by the FSSP website. There is no need to go to paid services with hacked lists of debtors, they are created by scammers

Another option is to contact the financial institution with which the financial institution works. To find the location where client data is stored, you should send a request from the website of the Russian Bank to contact the central catalog of credit histories.

You can also send a letter by regular mail or email. A client of a financial institution has the right to receive information not only about the status of loan payments, but also about the financial institutions that sent them to the bureau, individual entrepreneurs, and legal entities that had access to payment reports. A person also has the right to partially or completely challenge what was received by submitting a special application to the BKI.

Alfa Bank

If a person is unable to repay a loan , then one should not aggravate the situation by ignoring the bank’s alerts. If problematic situations arise, you must contact the branch with an application for a deferment or debt restructuring, receiving a new payment schedule with a different interest rate (different financial organizations have different rates). The rate may be higher, but there is a chance to safely pay off the debt, improve the state of your credit file, and remove your name from the blacklist.

If there are delays in payment, the bank sends notifications about the need to make payments. After some time, the banking institution has the right to sell the debt to a collection company or, under special conditions, offer to issue a new loan in order to close the debt in another institution. You can clarify information about payments at Alfa Bank by submitting a request to Equifax Credit Services. This is done in writing or online through a branch of the financial institution. The BKI report contains personal data (full name, series, passport number, telephone number), terms, amounts of loans, overdue payments, and a list of creditor organizations. The service is paid, the cost is 1000 rubles.

Judgment debtors

If a client is included in such a blacklist of debtors, this means that bank employees will under no circumstances provide him with a cash loan.

But since the bank did not file a lawsuit, such a client can move around the country quite freely and even travel abroad. But as soon as the bank sues the client and wins the case, the client not only ends up on the blacklist of credit debtors. He is included in the list of persons who evade compliance with a court decision.

Sometimes situations arise when the payer has paid off his debt, but is still on the blacklist of debtors. This can be explained by the fact that updated information about debtors does not immediately reach the bailiffs, but with some delay. And then the debtor may face problems associated with traveling abroad. Thirty days must pass after repaying the loan debt. After this period, the bailiffs will receive new information about the debtor and close his case.

To avoid proceedings with bailiffs, the bank client needs to pay off the loan debt in a timely manner and pay fines in case of overdue loans. But if it turns out that the client cannot pay for the loan in full, then he will need every effort not to get on the blacklist of credit debtors, which operates in a certain country.

How to Improve Your Credit Score

A loan defaulter has the opportunity to influence the situation in order to improve his reliability rating. Active use of credit products has the same positive impact as simultaneous timely payments. The longer the statute of limitations of a bad history, the less its impact if you start to pay off debts and, for example, sometimes pay for purchases with a credit card.

Closed other loans also have a positive effect, if there are several of them. One current loan means more trust and confidence in a person’s solvency than several outstanding ones, even small ones.

Try not to lead the situation to litigation or other problems. If you have problems paying off your debts, you should first contact the lender directly. Having outlined the situation to the bank’s credit specialist, you can find a solution in the form of a credit holiday or restructuring. This opportunity is available to everyone, but only if the situation has not started and the borrower applies without delaying time.

What else will allow debtors to avoid transferring the case to court or collectors is the monthly payment of at least some amount on an individual’s loan. You need to find out the entire amount of the principal debt along with penalties, interest and commissions in order to control the situation.

Departure of debtors abroad

If a bank client is on the blacklist of debtors, he may not be allowed to go abroad. This restriction also applies to those who are withheld from paying alimony, taxes and utility bills. However, only if there is an appropriate court decision, customs services have the right to block a citizen’s path across the border. If there is such a court decision, then the client is 100% included in the black list of credit debtors. In another case, the debtor will have no reason to worry, and no one will prevent him from leaving the country.

Finding out bank information about clients

Publicity of information does not imply general access to the blacklist. People who have previously interacted with specific lending financial companies will be able to view themselves in these databases. Receiving information is open on a free and paid basis.

You can find out your own loan history in open sources. To determine the reputation of a bank client, identification documents are needed. The exact list of papers is determined by the choice of search location, the same applies to the conditions for clarifying information about the progress of cooperation between the two parties.

The easiest way to identify information is to submit a request to large commercial banks. But they will not help for free. You have the right to obtain free information about the borrower’s reputation. The policy of state banks assumes a one-time annual request. Employees of financial institutions suggest using the Sberbank register: the institution has current lists. Their advantage is remote access.

Collection of information on enforcement proceedings

The FSSP website opens data about debtors against whom a court decision was made to force the collection of debt. The register was formed on the initiative of the executive service. The advantages of using it are that there are no access restrictions; you only need basic details. The portal operates 24 hours a day.

Check debts to bailiffs

The official black list of credit debtors is compiled by bailiffs and can be made available for review at the request of an individual or legal entity or official representatives of these persons. This list is very different from what the bank maintains. Bailiffs pay special attention to the credit history of citizens and companies that have ever borrowed money at interest from third parties.

Most banks do not have a blacklist of debtors. They are just thinking about creating such a database of overdue loans and people who need to repay these loans in the near future. If a potential client is not found on such a list of defaulters, this becomes a good sign for the bank that the borrower is reliable and can be provided with a loan for his needs.

Today, the only free way to check whether you are a debtor is the “Find out about your debts” service on the official website of the Federal Bailiff Service of Russia - https://fssprus.ru/

How the penalty lists are formed

Lending to the population for consumer purposes is carried out by banks on the basis of internal instructions that are consistent with the documents of the Central Bank. When applying for a loan, a person fills out a loan application and consents to the processing of his personal data.

This information is entered into the institution's unified database. After processing it with a special program, the level of the person’s solvency and the amount of the loan that can be issued are determined.

The rules for returning money borrowed from the bank are prescribed in the loan agreement, and the borrower is obliged to fulfill them regardless of the circumstances that occur to him. If payments are not made on time, the credit institution records the delay - special banking programs make it possible to see them when searching. If it is small - up to 5 days, and occurs rarely, this does not affect its status.

Search for debtors on social networks

The modern world is represented by the constant development of progress. Every day people spend a lot of time on the Internet, exchanging various information, especially with regard to social networks. But no one thinks about the fact that often the “Internet interlocutor” may be an employee of a company collecting your credit debt.

This method of searching for debtors and obtaining the necessary information from them has been used for a long time by many collection services. Therefore, if you have already begun to be bothered by this kind of ransomware, then try to be careful in such situations, limit your communication on social networks or carefully work on your profile. To do this, you can make various changes that will “confuse” collectors during identification; this could be a changed age, last name or place of residence.

When communicating on social networks, try as much as possible not to disseminate information regarding your residence or the availability of property. If someone begins to be interested in such questions, then this will be the first sign of concern.

At the moment, most collectors and banks successfully use in their practice the search for “willful” defaulters using such social networks as “My Circle”, “Odnoklassniki”, “VKontakte”. Thus, financial institutions “catch” debtors through social networks. At the same time, a huge number of defaulters, registering on such social networks, do not even suspect that collectors are looking for them.

Basically, representatives of collection organizations register on social networks under the guise of a “beautiful” girl, after which, using various methods, they try to arrange a meeting with the defaulter and ask for his mobile number. The main advantage of such companies is that they feel completely safe. By plunging into the search for your acquaintances, classmates and relatives of the debtor, such a person can easily end up on your list of friends.

Although, at the same time, some collection companies consider this method of searching for defaulters to be ineffective, since during registration many people provide incomplete information about themselves. Another disadvantage is that after the collector finds the debtor’s page, there is no full likelihood of receiving full contact information.

Services for checking debts on social networks

— application of the bank of enforcement proceedings "Odnoklassniki"

—

— application of the bank of enforcement proceedings “VKontakte”