Vicarious liability - what is it?

This definition refers to the additional liability of third parties who, together with the founder and/or officials, are responsible to creditors and government bodies (for example, the tax service) for unfulfilled obligations established by law or concluded agreements.

Any persons who had the opportunity to conduct transactions on behalf of the organization, give instructions that are binding, or otherwise influence the activities of the enterprise can be held financially liable (Clause 3 of Article 53.1 of the Civil Code of the Russian Federation and Clause 1 of Article 61.10 of the Bankruptcy Law No. 127-FZ). The presence of direct connections is not necessary.

Vicarious liability is established in the amount of the debt that could not be repaid.

Who can attract

Can attract:

- arbitration managers;

- participants in a bankruptcy case.

In the first case, the manager has the right to sue for deliberately bringing the company into insolvency. Other persons can apply for the establishment of a subsidiary only after the completion of the trial and the assignment of bankrupt status to the company, provided that there was no such prosecution within the framework of the case.

When can controlling persons be involved in the investigation?

Subsidiary liability can be imposed on persons controlling the debtor if:

- the impossibility of fulfilling financial obligations in full occurred due to the actions (or inaction) of this person;

- the application for pending insolvency was not sent to arbitration on time (Bankruptcy Law Art. 61.12);

- the legal requirements on the procedure for recognizing the insolvency of an organization were violated (Bankruptcy Law Art. 61.13).

Terms of attraction

Vicarious liability can be established within 3 years from the date the creditor receives the grounds for this. But no more than 3 years should pass after the bankruptcy case was considered and the organization received such status.

Note

Even if an enterprise has been excluded from the register of legal entities, its debts remain valid.

How to avoid subsidiary liability in bankruptcy

There are several conditions under which prosecution is impossible. For example, the manager or owner is not guilty if the liquidation of the legal entity was not carried out due to bankruptcy. Also, judicial proceedings are not applied if there are no culpable acts committed.

Among the preventive measures taken to protect the director from subsidiary liability (risk reduction):

- exclude the sale of assets at a reduced cost;

- avoid concluding unprofitable or unauthorized transactions with “dummy” persons;

- if any financial/accounting or tax documents are lost, restore them as quickly as possible;

- when choosing and collaborating with contractors, exercise extreme caution;

- Keep track of all debts, and if there are any overdue ones, take active measures to repay them.

Important! Compliance with the above points increases the chances of challenging subsidiary liability in court, since it proves the competence and law-abidingness of the manager.

Holding directors and founders accountable

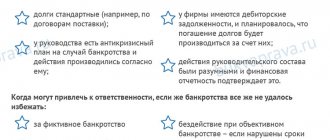

It is possible to establish subsidiary liability for managers and founders only if the following conditions are met:

- it has been proven that it was the actions of the management team that caused the insolvency (at the same time, the persons who forced them to take such actions will be brought in if this is also proven);

- the fact of insolvency (bankruptcy) has been confirmed - there is a court ruling and publication in the media.

This is also important to know:

Arbitration manager in a bankruptcy case: his functions, rights and obligations

Officials in the organization may be:

- CEO;

- Deputy Director;

- head of financial affairs;

- Chief Accountant;

- heads of departments, etc.

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

Each of them can be held vicariously liable provided that their involvement in the resulting insolvency is established.

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Important

What to do if you are held accountable? Your money and your good name are at stake. We recommend turning to professionals; the cost of a mistake is very high. Protection from subsidiary liability is a task for an experienced arbitration lawyer.

The principle of establishing responsibility for a manager or founder

Let's consider the procedure for considering a case in a situation where an organization has incurred a debt in the amount of 1 million rubles.

The algorithm is as follows:

- The manager sends an application to arbitration

- The arbitration decides to establish financial liability for the defendants in the amount of 1 million rubles in favor of the enterprise.

- During the bankruptcy procedure, a temporary manager on behalf of an enterprise assigns claims to creditors by concluding an agreement with each of them on the assignment of the right to claim.

- The creditor sends a petition to arbitration to replace the claimant, after which he receives a writ of execution on the basis of which his funds are recovered from the founders/directors.

- The writ of execution is transferred to the bailiff service, which is involved in the collection procedure.

The following restrictions may be imposed on officials:

- seizure of property, including that acquired after marriage;

- ban on traveling outside the country;

- ban on hunting;

- prohibition on driving a vehicle.

Brought to subsidiary liability: what to do?

If the case has already been sent to the judicial authorities, you should quickly collect documentation for refutation. The following can be used as rebuttal documents:

- an expert opinion confirming the innocence or unproven guilt of the defendant;

- audit assessment provided by a company with a good reputation;

- evidence that at the time of the transaction the conditions complied with the law, for example, prices were lower.

Important! If the fault for the bankruptcy of the enterprise and, as a consequence, the impossibility of paying creditors, lies with the counterparty who turned out to be unreliable, it is necessary to provide information about how the defendant selected him and checked his reliability and solvency. For this you may need; extract from the state register of individuals (registration of a counterparty company), recommendations of partners (written), assessment of reputation at the time of the transaction, etc.

Another way to be released from subsidiary liability is to prove that de facto important decisions were made not by management (director, owner, chief accountant), but by another person to whom powers were transferred. True, the court will not take your word for it, and collecting evidence is quite long and labor-intensive.

Involvement of the chief accountant

After changes are made to the legislation, not only the management of the organization and its owners, but also the chief accountants may be held liable. This is also possible even if the company has been excluded from the register of legal entities.

This is also important to know:

Vicarious liability without bankruptcy procedure: conditions, terms and features

The involvement of a chief accountant is possible if:

- there is evidence that the existing insolvency occurred as a result of the incorrect actions of this employee;

- The organization's assets are insufficient to pay all financial obligations.

This practice is gradually being introduced into the bankruptcy procedure, as can be judged from existing judicial practice.

The most common grounds for holding the chief accountant personally liable are the following:

- distortion of reporting, provision of false documentation;

- violation of deadlines for submitting reports;

- failure to comply with the accounting procedures established by law.

According to the law, only a person whose actions directly affected the organization’s insolvency can be brought into the subsidiary role. This means that if the debt arose in 2021, and the chief accountant has been working only since 2021, then the employee who worked at the enterprise during the specified period is responsible.

Thus, it will not be possible to avoid subsidiary liability if:

- re-register the company with a new manager;

- carry out a transformation in the form of affiliation or merger and perform other actions aimed at changing data about the company.

Involvement of third parties

An individual will be associated with the activities of the company if he had such powers as:

- issuing mandatory instructions;

- influence on the general policy of the enterprise through personal authority or coercion;

- impact directly on the management of the organization.

The main feature of the procedure for this category of persons is the difficulty of establishing a connection with the activities of the bankrupt company. It is necessary to have a solid evidence base in order to apply for the establishment of personal liability of third parties in the course of declaring the insolvency of an organization.

note

Bringing a manager to subsidiary liability does not prevent the founders from filing a claim against him for compensation for damage caused to the enterprise (Clause 9 of Article 10 No. 127-FZ).

Is it possible to avoid responsibility?

Vicarious liability of the former manager is possible only in the event of a bankruptcy procedure. If the company was liquidated without judicial proceedings and assignment of insolvency status, punishment is not possible.

This is also important to know:

Vicarious liability in bankruptcy

According to Art. 419 of the Civil Code, from the moment the organization is dissolved, all its debts are canceled; accordingly, subsidiary liability of the director, founder and other officials is not established.

However, if the insolvency procedure was carried out in accordance with all legal norms, then even after its completion and liquidation of the company, those responsible for financial problems may be held personally liable.

Free legal consultation We will answer your question in 5 minutes!

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Call: 8 800 511-39-66

The only way to guarantee avoidance of subsidiary liability in the event of bankruptcy is to independently and timely apply to arbitration with a petition to initiate the process of recognizing the insolvency of the company. Such a solution does not always suit business owners and managers. But it should be remembered that subsidiary liability allows you to satisfy financial claims, even if the assets of the enterprise are not enough for this (using the personal property of those responsible for bankruptcy).

Let us give an example from judicial practice. According to the decision in case No. B17−16 120/2014, the court refused to allow the bankruptcy trustee to hold the director of the LLC accountable. The argument for filing an application is the reorganization of the company in the form of a separation.

The court rejected the claims on the grounds that there was no connection between the manager and the bankruptcy that occurred.

Vicarious liability: is there life after...

In the article “Second Oil in Bankruptcy Cases,” we talked about some of the features of bringing a business owner to subsidiary liability in the event of bankruptcy of a legal entity. The main conclusion of this article was that the use of the mechanism of subsidiary liability of the head of the debtor company and other persons in a bankruptcy case significantly increases the chances of creditors to receive money from unscrupulous business owners. That is, from those very owners who consider the bankruptcy of their company as a very convenient and, most importantly, safe way for themselves to avoid fulfilling existing obligations.

Today we will look at this problem from the other side. That is, we will ask ourselves the question of what to do for citizens who have already been brought to such liability - after all, in this case we can talk about the recovery of several million (and sometimes several hundred million) rubles. Of course, this is an extremely unpleasant situation for a person, within which numerous restrictions are imposed on him, affecting, among other things, his quality of life. However, life itself does not end there, so we want to talk about some important points from this point of view.

Firstly, the collection of funds under a judicial act on bringing to subsidiary liability after receiving a writ of execution against the claimant (and the claimant, as we indicated earlier, can be either an insolvency administrator; or a person who acquired the right of claim at an auction; or a creditor , who chose the method of disposal in the form of assignment of part of such a claim for debt collection) will be carried out only through the bailiff service, the mechanism of which is quite complex and not particularly effective. That is, the collectors who come to the address with a writ of execution in their hands are not talking about this case.

Secondly , according to the general rule, the period for presenting a writ of execution for execution is three years from the moment the corresponding judicial act acquires legal force (clause 1 of Article 21 of the Federal Law “On Enforcement Proceedings” dated 02.10.2007 No. 229-FZ). In this case, the deadline for submitting the writ of execution for execution is interrupted due to the transfer of the specified document for execution or partial fulfillment of its requirements by the debtor (clause 1 of Article 22 of Law No. 229-FZ). This means that from the specified moment the period (the same three years) provided by law for transferring the writ of execution for execution begins to be calculated anew, and the time that has already passed before the break is not deducted from the new period (clause 2 of this article).

In practice, the writ of execution is sent to the bailiff service, where enforcement proceedings are initiated. Next, the bailiff carries out all the necessary actions for enforcement: searching for the debtor’s property, searching for bank accounts and funds in these accounts. Departure to the debtor’s place of residence is also carried out, and in his respect a decision is issued on a temporary restriction on leaving the Russian Federation, the validity of which is limited to six months (in this case, nothing prevents the bailiff from issuing this ban again). If the debtor lacks property and funds, the bailiff makes a decision to terminate the enforcement proceedings and return the writ of execution to the claimant. As a rule, this happens within 3-6 months, starting from the moment the enforcement proceedings are initiated.

If there is property, enforcement proceedings must be completed only if there has been an auction for it and no one has expressed a desire to purchase it, and the claimant refused to take the property to pay off his debt.

After the end of the enforcement proceedings and the return of the writ of execution, the claimant, as a rule, loses actual interest in the case - the person comes to terms with the fact that he will no longer receive his money. That is why repeated presentation of the writ of execution to the bailiff service is a rare practice.

Thirdly, the rights to claim debt from persons held vicariously liable are often exercised by the arbitration manager through open tenders. Moreover, the multi-million dollar debt is estimated to be tens (and sometimes hundreds) times less than its actual size. If the debt is not purchased the first time, its price is reduced by another 10%, and if even after that a buyer is not found, this debt is sold at public auction. This kind of auction is already more interesting for buyers, since every week (and sometimes every day) the price of the lot decreases - usually in increments of 10% - until it reaches the minimum value. That is, at some point, purchasing debt becomes interesting for the person who was held vicariously liable.

To understand the scale of the fall in prices at public auctions, we can give the following example - in 2021, on the electronic platform "METC", the right to claim receivables collected through subsidiary liability in case A71-1804/2011 in the amount of 1 billion rubles was exercised, at a price of 111 thousand rubles at an initial price of 900 million.

Fourthly, sometimes the shortest way to resolve the issue of subsidiary liability is to buy out the rights of claims of creditors under assignment by third parties. As a rule, they act in the interests of the person held vicariously liable. This option can bring the desired effect some time after the judicial act of collection - in cases where traditional methods of collection through bailiffs do not bring the desired effect, creditors are ready to sell the debt for minimal money, which means that the price may also fall from the nominal value very significant.

Thus, bringing the business owner to subsidiary liability for the company’s debts is only half the battle. It will take a lot of effort to turn the debt that exists on paper into real money.

How to Avoid Responsibility

The question of how to avoid subsidiary liability in bankruptcy is of interest to every director and business owner.

With the introduction of recent adjustments, it is becoming increasingly difficult to avoid it, as the number of reasons for attraction increases. The only option is to avoid actions that could later be classified as deliberate ruin of the company. It means that:

- there is no need to sell assets at a reduced value;

- You cannot enter into obviously unfavorable agreements with persons who have influence on the company;

- you should not make unprofitable deals;

- if financial/accounting documents are lost, take actions to restore them;

- exercise caution and attentiveness when choosing partners;

- Regularly monitor debt repayment deadlines and take measures to eliminate delays (pay or dispute).

This is also important to know:

Bankruptcy of individuals through an arbitration court: conditions, cost, features of the procedure

At the same time, we should not forget that in some cases, a subsidy can lead not only to financial, but also to criminal liability (for example, if the fact of theft is proven).

How to avoid subsidiary liability

Due to changes made to the legislation, it is becoming more and more difficult to prove one’s innocence and avoid subsidiary liability. To reduce the risk of being held liable for this type of liability, managers, founders and other controlling persons must take preventive measures, for example, such as:

- avoid selling the organization’s assets at a reduced price;

- do not enter into deliberately unprofitable transactions with affiliates or fictitious transactions;

- in case of loss of financial and accounting documents, take active measures to restore them;

- exercise due diligence and caution when choosing contractors;

- monitor overdue debt on a regular basis and take timely measures to eliminate it (repay or dispute).

Possible actions if held accountable

It is important to understand that the law provides for a presumption of guilt when it comes to a subsidy. The defendants will have to prove that they have nothing to do with the company's insolvency. To do this, you need to provide materials that reliably confirm:

- innocence of the losses caused;

- the reasonableness and integrity of the decisions made that determined the management and future policies of the organization;

- lack of connection between the actions (inactions) of officials or supervisors or the desire to avoid more serious problems.

The following may be presented as evidence:

- audit reports;

- analyzes of independent experts;

- documentary evidence of completed business transactions, etc.

Also, the manager can prove his non-involvement in bankruptcy by submitting a financial recovery plan approved at the general meeting of founders.

In addition, one should take into account the Resolution of the Supreme Court of the Russian Federation No. 53, according to which it is possible to avoid punishment if the actions of management did not go beyond the limits of standard business risk and did not violate the rights and interests of creditors.

They are held vicariously liable. What to do?

Below we will consider in more detail how to avoid subsidiary liability if you are already subject to it.

To avoid being held accountable, you will have to prove your innocence. The following may serve as evidence:

- there is confirmation of the completion of certain business transactions;

- reports from independent appraisal organizations are presented;

- conclusions on auditors' inspections were recorded;

- actions to improve the current state of the company are described.

All these documents must indicate that you made decisions regarding the company in good faith, thoughtfully and responsibly, did not contribute to its losses, and did not want to cause harm. The documents should not establish a connection between your actions or inactions and the company’s losses.

But it's better to take care of this in advance. When you realize that a company is becoming insolvent, you already know approximately how much it will be able to pay creditors. At this point, try to negotiate with them. In most cases, creditors understand that you will not be able to pay a huge amount and make concessions. With a good relationship, you have the opportunity to pay only part of the company's existing debt.

conclusions

Vicarious liability is one of the key concepts in the bankruptcy procedure of a legal entity. It has become more difficult to avoid such punishment after recent legislative amendments that expanded the list of persons subject to punishment and the grounds on which it is appointed.

To avoid possible punishment, you need to know the features of the subsidy:

- threatens everyone who had the authority to take legal actions on behalf of the company;

- is set at the amount of the outstanding debt;

- may be appointed at the request of an arbitration manager and any persons participating in the procedure for recognizing the insolvency of an organization;

- can be established within 3 years from the moment the grounds for this become known, but no later than 36 months after the completion of the bankruptcy case;

- exclusion from the register of legal entities is not a basis for its cancellation;

- it is possible to attract a subsidiary if two conditions are met: the presence of solid evidence that insolvency occurred as a result of the actions (or inaction) of a specific person and the existence of a fact of bankruptcy - an issued court order and publication in the media;

- may threaten not only the managers and founders, but also the chief accountant if it is proven that bankruptcy occurred through his fault, and the company’s assets are not enough to cover the debts;

- third parties may be involved who do not have a direct connection with the company, but who had the opportunity to influence its policies (provided that this is proven);

- you can avoid a subsidy only by proving non-involvement in the resulting insolvency or that the wrong actions were committed out of a desire to minimize the risk of bankruptcy;

- evidence of innocence can be audit and expert reports and other documentation confirming the legality of actions.

This is also important to know:

Bankruptcy of legal entities

The subsidy has its own characteristics and one should not forget that it can threaten any person connected in one way or another with the organization. To prevent such accusations, you should take care of documentation confirming the legality of the actions and non-involvement in the bankruptcy.

Free consultation

8 800 511-39-66Ask a question