Home / Bankruptcy / Bankruptcy of legal entities

Back

Published: 07/14/2019

Reading time: 7 min

0

581

Declaring a legal entity bankrupt entails certain civil consequences. From the point of view of the subject’s position, in a bankruptcy case one can highlight the consequences for the owners and management of the company, as well as for ordinary employees.

- The main consequences of bankruptcy of a legal entity

- Consequences for founders and directors

- Consequences of the procedure for company employees

Almost every bankruptcy is not without consequences.

The process of bankruptcy of a legal entity is always lengthy and labor-intensive. Most often, the founders of commercial companies turn to the arbitration court with a request to declare the company bankrupt in cases where all measures to financially rescue the enterprise are exhausted.

Also, its business partners, as well as tax authorities, can file a claim to declare an organization bankrupt in cases where the debt to them has reached a certain level and no other means of collecting it are envisaged.

However, at the same time as “honest” bankruptcy, there are situations when the owners and management of a company intentionally bankrupt it, pursuing not entirely legal goals. At the same time, all bankruptcy stories, regardless of their reasons, are not without consequences.

Bankruptcy of a legal entity consequences for the founder

The most significant consequence of bankruptcy for the owners of an enterprise is the sale of property and the closure of a legal entity. After the procedure is initiated, they become outside observers and cannot make transactions or make management decisions. After a legal entity is excluded from the Unified State Register of Legal Entities, its former founders can open a new business. There are no restrictions for them.

However, the bankruptcy of a legal entity can result in another side for the founders - there is a risk of being brought to subsidiary liability. This is possible in case of their inaction. If the participants of the enterprise do not submit an application to the Arbitration Court on time to declare the enterprise bankrupt, then they are liable with personal property.

If, as a result of their inaction or illegal actions, the company finds itself in a deep debt hole, major damage is caused to the business, creditors, and the state, and the founders are brought to criminal liability.

Important! Both directors and founders must understand that they risk being held liable, including the liquidation of the company. Bankruptcy procedures can last more than 2 years, and all this time it is necessary to “keep your hands on the pulse” and not ignore the help of lawyers.

Legal and financial consequences of bankruptcy for an LLC. Debt write-off

After the bankruptcy procedure is completed, the LLC is liquidated, data about it is removed from the Unified State Register of Legal Entities, and all title documents are archived. At the same time, something happens for the sake of which, in fact, bankruptcy is most often started, namely: writing off existing debts.

Thus, creditors and lenders suffer losses, deprived of any opportunity to get their money back.

In this case, the founders of the company lose only the authorized capital - this, by the way, is the meaning of the phrase “limited liability” . No one can force them to pay their debts in full, not even the courts.

Articles on the topic (click to view)

- Do you know what a trademark is and what its meaning is? Definition of concept and types, characteristics and examples

- What to do if your credit history is damaged: how to “rehabilitate” the borrower

- Classification of industrial goods

- What financial guarantee is required for a visa to Italy?

- Fedresurs bankruptcy of individuals

- How does a simplified bankruptcy procedure for a legal entity occur: procedure

- The procedure for dismissing employees in the event of bankruptcy of an enterprise, required compensation and payments

The director of an LLC, as a hired employee, does not bear any financial liability for debts at all. Moreover, by law, after closing the LLC, he is obliged to receive wages, coupled with compensation for unspent vacation and severance pay.

For your information! If there is even the slightest opportunity to agree with the debtor on the return of debts peacefully, even in installments and in small installments, you must definitely take advantage of it. In this case, there is a real chance to get at least something back.

Attention! If the court or law enforcement agencies establish that the bankruptcy of the enterprise was deliberate, then the founders of the LLC will have to compensate for the losses of creditors from personal funds and property, although only after the court verdict comes into force. By the way, if the fact of illegal bankruptcy is established, it is possible to collect debts from the director of the enterprise, since he, as an official, is liable with personal property if an economic crime committed by him is discovered and proven.

What is bankruptcy of legal entities?

If a company is unable to pay its existing accounts for a long time, it becomes necessary to officially declare bankruptcy or insolvency of a legal entity. This means that managers do not see development paths and prospects in the market. As a result, employees face wage arrears, which is accompanied by non-payment of creditor claims.

The consequences and process of declaring bankruptcy of a legal entity are regulated by Federal Law No. 127, as amended in 2015. In the course of the instructions set out in this document, at each stage of the procedure, various measures are proposed aimed at saving an unpromising enterprise.

The company is brought to this state as a result of ineffective management, inept administration, and a combination of unfavorable economic factors. Firms that have certain characteristics are considered bankrupt:

- there is a significant delay in payment of severance pay and wages to employees;

- debts to a particular counterparty have not been paid for more than 3 months;

- inclusive of payments to the budget and taxes, the total amount of debt to all creditors is from 300 rubles.

In addition to the main debt to creditors and wages, the overall debt structure includes various claims from clients, court payments, and penalties.

Important! Religious, political and budgetary institutions are not subject to bankruptcy.

Restrictions on the rights of founders after bankruptcy of an LLC

According to the law, if an enterprise is declared insolvent, this does not affect the rights of its founders in any way. In other words, the former owners of the company have every right to continue to engage in commercial activities, but within the framework of other organizations. They can also create new companies and register as individual entrepreneurs.

Expert opinion

Musikhin Viktor Stanislavovich

Lawyer with 10 years of experience. Specialization: civil law. Member of the Bar Association.

Important! If facts of major offenses are revealed, the management team of a bankrupt enterprise, that is, its chief accountant and director, may be deprived of the right to work in any area for up to several years through a judicial procedure.

Criminal liability

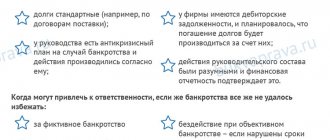

In some cases, bankruptcy proceedings can lead to very sad consequences, namely, criminal liability for the founders and management of the company. But this is only possible when law enforcement agencies prove in court the fact of committing an economic crime and deliberate intent to do so.

The following interested parties can contact law enforcement officers with a statement of fictitious bankruptcy:

- bankruptcy trustees appointed by the arbitration court;

- creditors and lenders;

- external managers;

- observers;

- other persons and organizations having an interest in the case.

Criminal prosecution

Sometimes the procedure of declaring bankruptcy for a company results in serious consequences. For example, the founders and management of the company are held criminally liable.

A situation arises when law enforcement agencies present evidence during a court hearing that the procedure for declaring bankruptcy was initiated by the company for illegal purposes. Thus, criminal liability occurs when an economic crime committed by a company is proven in court.

The following persons have the right to submit an application to law enforcement agencies that a company has initiated bankruptcy proceedings on illegal grounds:

- bankruptcy trustees who were appointed by the arbitration court;

- creditors and lenders;

- external managers;

- observers;

- other citizens or companies who have a personal interest in the matter.

Consequences of enterprise insolvency for the debtor

Declaring an enterprise insolvent has legal consequences for the debtor himself. There is no way to avoid them.

But with the right approach, they can be managed profitably. The bankruptcy procedure does not always involve the liquidation of a legal entity. First of all, measures are taken to restore the solvency of the organization.

There are several stages of bankruptcy:

If the arbitration court declares a legal entity bankrupt, the following consequences occur:

- The director and other management bodies are removed from the management of the company, and an arbitration manager is appointed in their place. He is engaged in the sale of the remaining assets of the debtor and the repayment of his debts to creditors.

- Penalties, fines, interest on loans, and amounts of penalties cease to be accrued on the bankrupt's overdue debts.

- Proceedings on writs of execution to collect funds from the debtor are closed.

- If the debtor's property has been seized, as a result of the bankruptcy of the legal entity, all restrictions are lifted.

- Information about the bankrupt’s property status ceases to be a trade secret and is freely available.

- The amount of tax debt is written off.

- Data about the organization are excluded from the Unified State Register of Legal Entities.

At the same time, the founders and managers of a bankrupt enterprise are subsequently not deprived of the right to engage in commercial activities in the future. By declaring their organization bankrupt, they are essentially freed from an unprofitable business and gain the prospect of opening a new, profitable business.

Bankruptcy of a legal entity

All legal consequences are indicated in Art. 134 of the Bankruptcy Law. There are situations where a debtor deliberately initiates insolvency proceedings. This is done in order to avoid liability for obligations to creditors.

Important!

Fictitious bankruptcy is a violation of the law. The legal consequences in this case may be unfavorable for the debtor (up to and including the initiation of a criminal case).

Property sold illegally and dislodged assets are returned to the company. Conducted transactions lose legal force. All agreements that caused bankruptcy are canceled.

The violator is subject to various types of liability:

- The founders and managers of the organization, as well as persons who are liable to creditors with their own funds and assets, are brought to subsidiary liability;

- Administrative liability occurs if the manager intentionally commits actions that caused the financial insolvency of the company. This includes making unprofitable transactions and artificial accumulation of debt (salaries are not paid, taxes are not deducted, etc.);

- Criminal liability arises in case of major damage. Consequences of bankruptcy persons in the field of criminal law are punished for illegal actions in the event of insolvency, for targeted bankruptcy.

Bankruptcy of legal entities for the director of an enterprise

When a decision to declare a legal entity bankrupt is made, the question arises: what responsibility does the director of the enterprise bear? The manager is an employee of the debtor and is not liable with his personal property for his debts.

If the director carried out his activities within the framework of the law and in the interests of the legal entity, there will be no financial consequences for him if the enterprise is declared insolvent. In this case, the liquidation of the organization as a result of bankruptcy threatens the manager only with the loss of his job. Another situation may arise when the director, as a result of his actions or inaction, is guilty of causing bankruptcy of a legal entity.

The director bears subsidiary liability in the following cases:

- as a result of his activities, property damage was caused to creditors;

- maintaining, drawing up and storing accounting and other reporting documents was carried out in violation of Russian legislation;

- lack of application or untimely application to the judicial authorities with an application to declare the debtor insolvent.

Vicarious liability implies that the director will be obliged to cover debts to creditors from his personal property. In addition to subsidiary liability, the head of the enterprise may be held administratively liable.

The director is subject to fines and other administrative measures if it is established that he initiated fictitious bankruptcy or hid the property of the enterprise. If it is established that a manager is involved in the deliberate bankruptcy of a legal entity, he may be held criminally liable.

The director is liable as a result of the insolvency of a legal entity only by a court decision. To find a manager guilty of bankruptcy, it is necessary to apply to the judicial authorities and provide evidence. Directors can submit an application to hold them accountable:

After bankruptcy proceedings are completed, the manager cannot be held accountable.

Consequences of bankruptcy of legal entities

Having examined what awaits the director of an organization in the event of bankruptcy in one case or another, let’s move on to considering the consequences for other interested parties.

For the founder

If the bankruptcy of the enterprise was carried out with the connivance of the founders, and their guilt is proven, they risk being held accountable. The degree of responsibility depends on what actions were performed by the founders.

It is worth noting: negative consequences can only await those founders who are found guilty of bankruptcy of the enterprise. In other cases, they can only expect the loss of their authorized capital. In the future, they will be able to freely engage in entrepreneurial activities.

For employees

When liquidating a bankrupt enterprise, the bankruptcy trustee, who is the person to whom management functions are transferred, dismisses employees. Dismissal must be carried out in accordance with current legislation:

- employees are notified of dismissal within a month after the start of bankruptcy proceedings (Article 129 of Federal Law No. 127);

- for employees, wages are maintained for two months after dismissal (Article 180 of the Labor Code);

Employees can count on payments for unused vacation, and the bankruptcy trustee is obliged to notify the employment service of the mass dismissal of employees.

For the lender

During bankruptcy proceedings in the case of insolvency of a legal entity, its property is sold off. The proceeds are distributed among creditors.

Find out what is the order of satisfaction of creditors' claims in bankruptcy. See signs of bankruptcy of a legal entity in 2021 here.

What should shareholders do in the event of bankruptcy of the developer during shared-equity construction? Advice from lawyers in the article.

It is very important for debt holders to get into the register of creditors as quickly as possible in order to satisfy their claims first.

As practice shows, often the proceeds from the sale of property are not enough to satisfy creditors' claims in full. In this case, the interests of the creditors suffer, but there may be no reason to attract employees of the enterprise with subsidiary liability.

For founders

If a company is declared insolvent, its founders will not be able to avoid the consequences, but with the right approach, the owners can benefit from this process. The insolvency procedure of a legal entity does not always end with its liquidation.

This process is divided into several stages, some of which are aimed at restoring the company's solvency through reorganization or other measures. During the trial, the entire management team and owners of the bankrupt partially lose their powers and ability to manage the company.

The right to manage the enterprise passes to the creditors, who make all important decisions at meetings of creditors organized by the manager. Once an organization is declared insolvent, its assets are subject to valuation and sale at public auction in order to obtain funds to pay outstanding debts.

If the company is liquidated, the former founders are not deprived of the right to conduct business in the future. In some situations, the insolvency of a company and the closure of an unprofitable business frees its owners from troubles, giving them the opportunity to start a new business.

For employees

If, in the process of declaring a legal entity bankrupt, it is not possible to restore its solvency, the enterprise is liquidated and all employees are dismissed. The interests of workers in this situation are protected by the manager, who must monitor the participants’ compliance with the norms of the Labor Code of the Russian Federation.

If an employee believes that his rights have been violated, he can file a lawsuit. The Law “On Insolvency” specifies specific deadlines for notifying the workforce about the bankruptcy of an enterprise and about their reduction.

Each employee must read the notice and sign it. When an employee is laid off due to the insolvency of an LLC, he is accrued the following amounts:

- salary;

- vacation compensation;

- allowance.

Employees of a bankrupt company must receive all payments and settlement documents on the day of dismissal along with documents.

Now about the bad

Bankruptcy of legal entities and the consequences sometimes bring negative results for all participants in the process, namely:

- forced dismissal of the workforce;

- loss by lenders of part of their investments;

- the likelihood of non-payment of obligations to the state;

- risk of loss of property of company owners.

In an unfortunate scenario, bankruptcy can have a detrimental effect on everyone involved. Therefore, owners and managers of enterprises should not allow their outstanding liabilities to grow. You should be more attentive and rational in planning and managing the finances of a legal entity, and if bankruptcy of a company with debts is inevitable, you should comply with the deadlines, rules and regulations established by law.

Why should a company be prepared for bankruptcy in advance?

The arbitration manager who deals with the bankruptcy of a company has a lot of powers. He analyzes the company's transactions, searches for and inventories its property, and interacts with creditors. Who, of course, want to recover the company’s property to the maximum.

Expert opinion

Musikhin Viktor Stanislavovich

Lawyer with 10 years of experience. Specialization: civil law. Member of the Bar Association.

Vicarious liability is also a very serious matter. The personal property of its director and founders can be recovered for the company’s debts. If there are sufficient reasons, of course. Selling property to friends, wives and children will not save you.

However, the law can be interpreted in different ways. The director may believe that there are no reasons to hold him vicariously liable, but the court may decide otherwise.

All this suggests that it is necessary to prepare for the procedure in advance in order to avoid the negative consequences of bankruptcy of a legal entity. The lawyer must put the company’s documents in order in advance so that neither the arbitration manager nor the arbitration court has unnecessary questions.

The goal is to make the bankruptcy price of an LLC or a company with another organizational and legal form as low as possible. We can do this because our company deals only with banknotes.

In 91% of cases, our clients achieve their goals in bankruptcy proceedings. This happens thanks to the experience of the company’s lawyers. We have been providing bankruptcy services for more than 8 years.

Contact us. We will make bankruptcy of your company safe.

Declaring a legal entity bankrupt entails certain civil consequences. From the point of view of the subject’s position, in a bankruptcy case one can highlight the consequences for the owners and management of the company, as well as for ordinary employees.