Collection of bankruptcy estate and its distribution. Is subsidiary liability advisable?

Has a debtor bankrupted his own company?

The company’s funds are not enough to pay creditors, while the amount of its director’s private real estate is measured in millions?

The situation is standard. More than 50% of creditors, as a result of completed bankruptcy cases, do not receive a single ruble.

The insufficiency of the debtor company's property to repay the debt is one of the main threats to the creditor. Debtors withdraw valuable property. An “interested” arbitration manager – a key figure in the bankruptcy procedure – turns a blind eye to illegal actions and even passively helps the debtor, without taking the necessary measures to replenish the bankruptcy estate. A pool of creditors loyal to the debtor receives all available funds.

- How can a creditor protect its interests in conditions of “total collusion”?

- How to ensure the full formation and fair distribution of the bankruptcy estate?

The anti-crisis arbitration manager and general director, Sergei Storozhenko, spoke clearly about the complex issues.

Competitive weight. What is it formed from?

Creditors receive their money at the final stage of bankruptcy - during bankruptcy proceedings, from the so-called “bankruptcy estate” - a financial reserve that was formed from the debtor’s existing assets during bankruptcy.

The larger the bankruptcy estate, the higher the likelihood that creditors will receive their funds in full.

The bankruptcy estate is collected by the arbitration manager through all open and hard-to-reach channels, namely, it is formed from the debtor’s property owned by the organization at the expense of:

- Collection of accounts receivable

Debtor's receivables are financial assets due to an enterprise from individuals and legal entities and contained in unfulfilled contracts and monetary obligations. Debt collection from counterparties is carried out both pre-trial (through negotiations or filing claims) and in court.

- Reclaiming property from someone else's illegal possession

Property owned by the debtor is not always actually in his hands. Sometimes an organization voluntarily transfers part of its assets for use to counterparties - on the basis of written or oral agreements. In other cases, property is lost due to invalid transactions or as a result of forceful pressure and fraudulent actions of third parties. Such property is subject to return and is included in the bankruptcy estate, and the legal basis for return in each specific case will depend on how the assets were removed from the debtor's possession. In addition, the debtor has the right to demand the return of income received by the illegal holder from the use of other people's assets.

- Challenging previously concluded transactions

Bankruptcy provides an opportunity to challenge and cancel the debtor’s illegal transactions. As a result, all funds and lost property are returned to the debtor and are subject to inclusion in the bankruptcy estate for settlements with creditors. In this case, the burden of proving the absence of grounds to challenge the transaction falls entirely on the defendant.

Almost any transaction can be challenged: purchase and sale, loan, pledge, offsets, and even direct write-off by credit institutions of the amount of debt from accounts. The court recognizes the transaction as invalid or void if it has signs of interest; caused significant property damage to the debtor company or counterparty; was committed with an underestimated value of assets and on other legally established grounds.

How to distribute proceeds to the bankruptcy estate, taking into account the requirements of the secured creditor

Home / Articles / How to distribute proceeds to the bankruptcy estate, taking into account the requirements of the secured creditor

Published: 07/17/2019

The Supreme Court considered a case in which the dispute was about the sequence of satisfying the claims of third-priority creditors (determination No. 310-ES18-17700 (2) dated July 11, 2019).

The courts have established

A bank with the status of a secured bankruptcy creditor went to court to declare the actions of the arbitration manager illegal. The fact is that when about 40 million rubles were received into the bankruptcy estate - from rent and other transactions not related to the sale of the collateral - the manager distributed them among the creditors, bypassing the attention of the secured creditor. The largest part, 30 million rubles, was paid to the company, the rest of the funds went to other unsecured creditors.

In general, the bank presented claims against the debtor for 635 million rubles, and the totality of claims of third-priority creditors was equal to 887 million rubles.

The lower courts refused to satisfy the bank's claims, considering that bankruptcy legislation does not provide for the obligation to satisfy the claims of third-priority creditors only after settlements with secured creditors. The courts also indicated that the debtor has not only property pledged to the bank, but also other assets, and therefore the bank can satisfy its claims from their sale.

The Supreme Court expressed a different opinion. Firstly, it was stated that the actions of the arbitration manager must be assessed from the standpoint of good faith.

Secondly, if the pledged property is cheaper than the claims of the secured creditor, then the remaining claims are satisfied according to the general rules along with unsecured creditors.

The bank indicated that out of 690 million rubles of claims, 391 million rubles were secured by collateral. Therefore, even before the sale of collateral assets, the insolvency administrator must know that the collateral creditor will have to give money from the total bankruptcy estate.

Thirdly, the Supreme Court decided the question in what sequence the 40 million rubles received in the bankruptcy estate should have been paid. It was stated that it was correct to distribute these funds after the sale of the collateral assets, since it would be possible to calculate the share of payments outstanding by the collateral assets for the collateral creditor. And until the sale of collateral, these funds should have been reserved.

In this regard, the acts of the lower courts were canceled, and the actions of the manager were declared illegal.

Back to articles

Similar articles:

If there is no agreement on legal assistance with a foreign state, the foreign defendant will have to be summoned through the Russian Ministry of Foreign Affairs

To ensure a fair trial, it is necessary to ensure that all participants in the process are informed about the day and place of court hearings. This rule also applies to informing foreign participants in the process.

More details

Subsidiary liability for debts

The current legislation of the Russian Federation establishes the obligation of a debtor, an individual or legal entity, to independently answer for his debts. The creditor is guaranteed protection of his right to receive the amount

More details

Methods for submitting a request to convene an extraordinary general meeting of shareholders

The competent and correct execution of the requirement to convene an extraordinary general meeting of shareholders (in the text - EGM) determines whether it will be convened for holding or whether such holding will be refused...

More details

"Who is last?" Distribution of the bankruptcy estate

After the bankruptcy estate is formed, the assets are sold and the funds are distributed according to the claims of creditors in the order of priority established by law. First - for current payments, then - payments to persons who suffered harm to health, wages to employees, and only then are the claims of the rest, register creditors, satisfied. Secured creditors have priority.

The claims of creditors that remain unsatisfied due to the insufficiency of the legal entity’s property are considered extinguished after the completion of the bankruptcy procedure and liquidation of the debtor.

That is, creditors who are “last” in line will receive nothing with a 99% probability.

BUT: IF THE COLLECTED COMPETITION ESTATE IS NOT SUFFICIENT TO REPAY THE DEBT TO CREDITORS, THEN PERSONAL FUNDS AND PROPERTY OF THE MANAGEMENT, OWNERS AND OTHER PERSONS CONTROLLING THE DEBTOR CAN BE USED TO REPAY THE DEBT - BY THEIR SUBSIDIARY FROM RESPONSIBILITY.

What is excluded from the bankruptcy estate

Not all property of legal entities and individual entrepreneurs can be included in the bankruptcy estate. There are objects that are excluded from it. Let's look at their list:

- An apartment or a share in it, if this is the person’s only home.

- Household items.

- A plot of land.

- Personal belongings of the individual entrepreneur. For example, clothes, shoes. However, there are exceptions. In particular, these are luxury items and jewelry.

- Fuel.

- Nutrition.

- Equipment and tools needed to perform professional activities. However, the exception is objects costing more than 100 minimum wages.

- Seeds.

- Items needed for medical care (for example, a wheelchair).

- Livestock that is not used in business activities.

- Prizes and memorial signs.

This list is not final. The arbitration court may supplement it depending on the individual case. Excluded is property the sale of which does not have a significant impact on satisfying the claims of creditors. This is property whose value does not exceed 10,000 rubles, as well as illiquid objects worth no more than 100 minimum wages.

Bankruptcy in persons. Vicarious liability for the perpetrators

Controlling persons, that is, persons empowered to give instructions binding on the organization or otherwise determine its actions, can pay with personal property for the debts of the company.

So, the following may be held vicariously liable:

- Supervisor. This person may be called “CEO”, simply “director”, “president”, etc. The main criterion for recognition as a manager is the right to act on behalf of the company without a power of attorney.

- Owners of enterprise property. In the event that their actions or orders led the company to insolvency.

- Participants of a business company (shareholders). If they are to blame for the bankruptcy of the enterprise.

- Other individuals who are not legally associated with the company, but in fact manage it during the two-year period preceding the initiation of bankruptcy proceedings.

Bringing those responsible for bankruptcy to subsidiary liability is often the last opportunity for a creditor to collect debts from an “empty” debtor. But in practice, forcing the perpetrators to part with personal property is a difficult task that requires a special level of professionalism. And the very possibility of bringing to responsibility requires an analysis of its feasibility.

How is the bankruptcy estate formed?

In the bankruptcy procedure, one of the most important stages is the formation of a contract. masses. As already mentioned, this is in charge of the arb. manager, and this procedure goes through in stages:

- The property is described/inventoried. To do this, the debtor is forced to bring reports and accounts. documentation. Ownership papers are also required. The manager must receive them no later than three days after submitting the request.

- An attempt to recover receivables and assets that were illegally transferred to third parties. For example, the manager has to look for where the debtor’s property is, since the debtor is trying to hide it by reselling it to another person.

- Select the collateral property from the total mass. Collateral items are described separately to satisfy the request of the lender in whose collateral the property is located.

- KM correction. To do this, property of government agencies, personal belongings, etc. are removed from this category.

- Transaction analysis. This applies to transactions that the bankrupt carried out before the financial period. troubles. If a violation is found or transactions are of a dubious nature, they may be challenged. This threatens transactions with shell companies, etc. Then the assets are returned to KM.

- KM assessment. This is carried out only after all property has been collected. New rules have recently been introduced. Now there is no need to hire an outside specialist. The manager himself can carry out the assessment, having the financial statements at hand.

- Organization of trades. The modern trading format is virtual and open. Everyone can participate in them, provided that they have an electronic signature.

If someone has doubts about the fairness of the assessment, they can challenge the results. But it is not profitable for the manager to underestimate the price of assets. His earnings depend on their size.

Is subsidiary liability advisable?

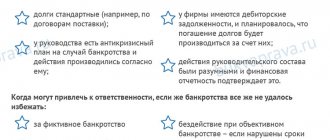

Vicarious liability may arise in cases where the controlling persons:

- Did not file or filed a bankruptcy petition late;

- They brought the company to bankruptcy through their actions and orders;

- Accounting documents were not transferred, distorted or lost;

- Caused significant property damage to creditors.

It is advisable to bring the bankrupt’s managers and owners to subsidiary liability, firstly, if these persons have a sufficient amount of property. Secondly, in the presence of a well-developed, reliable evidence base and a number of special conditions.

Terms of liability

It is possible to bring the debtor's representatives to subsidiary liability only if simultaneously present. This:

- Significant damage caused to creditors or the debtor's own company. That is, undeniable facts of the existence of losses that can be expressed in monetary terms. For example, loss or damage to property, non-receipt of income due to the fault of a specific person.

- Committing illegal acts aimed at causing damage. This could be any action or inaction that led to the loss. For example, concluding illegal transactions, selling assets, etc.

- A clear cause-and-effect relationship between the unlawful acts and the damage caused. Evidence of the existence of such a connection can be the data of accounting documents and the results of financial analysis, but in practice it is extremely difficult to prove a cause-and-effect relationship and very rarely is it possible for an unprepared plaintiff.

- The presence of guilt. We can talk about guilt if there is undeniable evidence of the defendant's intent.

Legal methods for assessing the feasibility of bringing representatives of the debtor company to subsidiary, or personal property, liability are different in each specific case of bankruptcy. Therefore, the result of the trial depends entirely on the legally competent actions of the creditor and his representatives.