Who can initiate?

The agreement for providing a targeted loan for the purchase of real estate, both in the text itself and in the clauses of the governing legislation, contains provisions that under certain conditions its termination is possible.

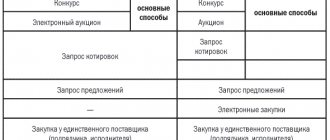

Thus, according to Article 450 of the Civil Code of the Russian Federation, termination of an agreement between a borrower and a banking organization is possible in two ways. The first method includes termination by agreement of the parties, in which they come to a mutual agreement and neither the financial institution nor the borrower will interfere with the intentions of the other party. In the second case, termination will occur in court, when the party interested in termination files a claim.

Like any agreement concluded when a financial relationship arises, a mortgage can be terminated at the initiative of its direct participants - the citizen who received funds from the bank for the purchase of real estate and the financial organization itself that allocated the funds to him. When intending to terminate an agreement, it is necessary to pay attention to the possibility of resolving a conflict or situation without such a drastic method, perhaps by some changing the terms of the agreement.

How to terminate a mortgage agreement with a bank?

Is it possible to terminate a mortgage agreement at the initiative of the borrower? Unlike consumer lending, termination of mortgage agreements not only occurs in practice, but also occurs quite often. This is due both to the peculiarities of mortgages (targeted and collateralized lending) and to the reasons that often arise for the bank to declare the need to terminate the contract.

The most common ways to terminate a mortgage agreement are:

- at the initiative of the bank, the reason for which is significant violations by the borrower of the terms of the mortgage;

- by agreement of the parties, when the bank and the borrower find a solution that is satisfactory for all parties.

Unfortunately, termination of a mortgage agreement at the initiative and unilateral decision of the borrower is practically impossible, although from the point of view of the law it is permissible.

Here the same difficulties arise as when borrowers try to terminate consumer lending agreements - it is extremely difficult to find a basis and it is practically impossible, with the exception of isolated cases, to prove the existence of such a basis.

In most cases, the initiator of termination of the mortgage agreement is the bank. The reason may be any serious violation of obligations by the borrower, but, as a rule, banks refer to:

- For inappropriate use of borrowed funds - for any needs and purposes that are not stipulated by the terms of the agreement. Despite the fact that today it is extremely difficult for borrowers to secretly dispose of the received financing, some manage, including using various kinds of “gray” schemes, to direct funds for completely different purposes than indicated in the loan agreement.

- For deception, provision by the client of false information, forged documents when applying for a mortgage. The identified facts themselves rarely lead to termination of the contract, but if they caused or contributed to the borrower’s violation of obligations, the bank will definitely take advantage of the situation and either invite the borrower to terminate the contract by agreement, or file a corresponding claim in court.

- Violation of the terms of the pledge, which resulted in its loss, damage, or serious decrease in value. Security that has lost its original appearance or has significantly lost value due to the fault of the borrower-mortgagor can no longer be considered objectively reliable. It is possible that before terminating the agreement, the bank will require other security to change the terms of the mortgage, but it is quite likely, especially if there are problems with repaying the loan, that it will immediately announce termination.

- For violation of the terms of collateral insurance. In this case, the situation is approximately the same as when the collateral loses its original characteristics. But first, most likely, the borrower will receive a request to eliminate violations.

If the borrower simply does not pay the mortgage, then there is usually no talk of terminating the contract immediately. But if the bank considers it necessary to go to court with a demand for debt collection, then at the same time a demand for termination of the mortgage agreement will be filed.

Our lawyers know the answer to your question

If you want to find out how to solve your particular problem, then ask our duty lawyer online. It's fast, convenient and free!

or by phone:

- Moscow and region: 7-499-350-97-04

- St. Petersburg and region: 7-812-309-87-91

- Federal ext. 149

The borrower has this right. Termination of the contract is possible either by agreement of the parties or in court. Another thing is that it is almost impossible to realize this right.

The only more or less “working” basis is a significant change in circumstances, as a result of which the borrower cannot fulfill its obligations.

But it will be necessary to prove that the borrower could not have anticipated such a change in circumstances at the time of registration of the mortgage, nor could he have taken measures to prevent such circumstances or, if they occurred, to eliminate them.

Considering that a mortgage is traditionally accompanied by life and health insurance of the borrower, as well as collateral insurance, or at least such offers come from the bank, it is impossible to prove the impossibility of assuming a significant change in circumstances.

The financial problems of the borrower, which led to the inability to repay the debt, are not taken into account even in court and even in cases of force majeure. A striking example is the problems of foreign currency mortgage borrowers that arose in 2014-2015 due to a sharp fall in the ruble exchange rate.

All that was offered to such borrowers was to take advantage of restructuring (refinancing) or government assistance through AHML.

This is perhaps the best solution for all parties. But banks will not agree to an agreement if it is not beneficial for them.

Most often it is possible to reach an agreement in the following cases:

- The borrower wants to sell the collateral and pay off the loan proceeds. To reduce its risks and receive money, the bank will most likely offer to sell the collateral on its own or under its full control.

- The borrower wants to cancel the mortgage agreement and transfer the debt and other obligations to another person. In fact, in such a situation we are talking about the sale of collateral and the subsequent transfer of one’s credit obligations. If this option can be agreed upon with the bank, then the mortgage agreement is terminated, and a new one is concluded with another borrower-mortgagor.

We suggest you read: How to correctly write and submit a claim to an insurance company

Other options should not be immediately rejected either. In any case, if there is a need to terminate the contract, you will have to contact the bank. It is possible that through mutual efforts the optimal option will be found.

Mortgage lending is considered one of the most complex types of financial relationships between a bank and a borrower, since it differs from other loan options in large loan amounts and a long repayment period. Citizens of the Russian Federation who enter into mortgage agreements do not always analyze the correctness and appropriateness of their actions.

It is difficult for people to adequately assess their own capabilities in such a long term, because payment terms can reach 30 years or more. And given the high pace of modern life and the volatility of the economy, it happens that proposals that seemed relevant and profitable just yesterday become completely unacceptable today.

In this regard, many Russians are concerned about the question of whether it is possible to terminate a mortgage agreement and how to do it.

|

Legislation of the Russian Federation, in particular Art. 450 of the Civil Code provides for two ways to terminate a contract:

- By agreement of the parties.

- By court decision.

Borrowers most often decide to terminate their mortgage due to deteriorating financial condition and insolvency, as well as a desire to sell the mortgaged property. In such situations, as a rule, creditors meet the debtors halfway and offer optimal options for repaying the existing debt.

Important! It is also possible to terminate a mortgage agreement if one of the parties significantly violated its obligations, which resulted in losses for the other party.

This option is beneficial for both the bank and the borrower, since the former will not have to wait for the court decision to come into force and the debt to be collected by bailiffs, and the latter will not have to incur additional costs. Therefore, if you decide to terminate your mortgage, the first thing you should do is contact the credit institution.

If we are talking about the impossibility of making payments due to a deterioration in the financial situation, the bank may offer restructuring instead of terminating the contract. This procedure involves reducing monthly mortgage payments along with increasing the overall loan term.

If you are not satisfied with any options other than terminating the contract, the bank can put the collateral property up for auction, cover the debt with money from the sale, and give the remaining amount to you.

Important! If there are late payments and penalties, it would be better for you to contact a judicial authority to terminate the mortgage agreement. In this case, it will be possible to petition the court to reduce the penalty on the basis of Art. 333 Civil Code of the Russian Federation.

In some situations, it is possible to terminate a mortgage agreement only by a court decision.

Thus, it is impossible to avoid going to court in the event of dividing the mortgage between spouses during a divorce, in the event of the death or disability of the borrower, in the case of issuing a social mortgage, etc.

In the presence of such circumstances, the bank is unlikely to be able to offer debt repayment options acceptable to the other party.

The Civil Code provides for the termination of a mortgage through the court if:

- one of the parties has materially violated the terms of the contract;

- the parties cannot find a compromise and resolve the issue out of court;

- one of the parties’ circumstances have changed, which has led to the impossibility of fulfilling the terms of the contract;

- There are other situations that require individual resolution.

According to Art. 452 of the Civil Code of the Russian Federation, the borrower can file a claim for termination of the mortgage agreement in court only after receiving from the bank a refusal to terminate the agreement pre-trial, or if within 30 days the financial organization has not responded to the client’s proposal.

Important! Credit relations between the bank and the borrower are subject to the Law of the Russian Federation No. 2300-1 “On the Protection of Consumer Rights”. When filing a claim in court under this law, there is no need to pay a state fee.

If there are late mortgage payments, a credit institution can also initiate legal proceedings. The bank also has the right to demand termination of the mortgage agreement if:

- the borrower improperly handles the collateral real estate (rents it out, remodels it, etc.);

- it became known that the client provided falsified data when concluding the contract;

- The borrower refuses to insure the collateral.

If the court decides to terminate the contract, the client must repay all existing debt to the bank. If the borrower does not have the funds for this, the credit institution resorts to selling the collateral property through auction.

Cases of recognition of a mortgage agreement as not concluded are quite rare, since financial organizations carefully ensure that the content of such agreements complies with all the necessary requirements of Russian legislation.

How is a mortgage terminated according to the law?

The law clearly defines the conditions for recognizing a mortgage agreement as illegal and the conditions for terminating a mortgage at the request of one of the parties to the agreement. In addition, the correct mortgage agreement must describe the conditions under which the borrower can be recognized as having fallen into such living conditions that it is impossible to pay the mortgage to the bank.

Termination of a mortgage can be done through the court. If you obtain a court decision to terminate the mortgage agreement, the agreement may be terminated.

Termination of a mortgage is possible by mutual agreement of the parties: the bank and the borrower.

You can terminate a mortgage if one of the parties: the borrower or the bank, violated the terms of the agreement. The violation must be significant and entail financial losses for the other party. In this case, either the mortgage is terminated (at the initiative of the injured party) or its terms are changed (by agreement of the parties). For example, a mortgage when spouses divorce is divided between them. And one of the divorcing couple is ready to assume obligations under the contract, but demands the redistribution of the mortgage to himself.

Sale or exchange of a mortgaged apartment

The sale or exchange of a mortgaged apartment may be the reason for the termination of the mortgage. This happens when the bank and the borrower agree among themselves to terminate the mortgage and repay the debt and there is a party who is ready to buy or exchange the apartment and bear obligations under the mortgage in the future.

Is a mortgage terminated if a bank goes bankrupt?

Is a mortgage terminated if a bank goes bankrupt? No. If a bank goes bankrupt, the mortgage agreement is not automatically terminated. The borrower must obtain a court decision. Only in this case the termination of the mortgage be legal.

Typically, the bank is the party that wants to terminate the mortgage. This happens when the borrower violated the terms of the agreement: did not pay the installments for a certain period of time. But it happens that borrowers also go to court. For example, if you need to divide the mortgage during a divorce.

Legal advice and assistance from a lawyer in disputes with banks in court are at your service. There is no need to wait to contact us for advice. Just call and make an appointment with a lawyer.

Ask a question, we are online!

Leave a message!

+7-921-904-34-26 Mortgage termination

Main reasons

Among the main reasons that lead to the termination of a mortgage agreement may be factors of non-compliance with its basic conditions or misleading the other party. The most common reason that leads to termination is the termination of repayment of the debt obligation. At the same time, borrowers may even attempt to hide from the banking organization, although in fact such an action cannot produce positive results, because an apartment or house purchased with a mortgage is most often collateral that can be seized to pay off obligations.

In parallel, the borrower may provide the bank with false information regarding the level of official income, place of work, or the value of residential property, which may result in the possibility of non-payment of the obligation. There may also be violations of clauses of the contract, in which the borrower or bank performs actions prohibited by its text.

What are the consequences?

In most cases, the initiator of termination of the contract is the banking organization, which insists on severing the relationship due to the borrower’s failure to fulfill any conditions. In addition to the termination of loan repayment and violation of the terms of use of the received housing, banks indicate as the reasons for the rupture the use of a gray scheme for cashing out loan funds, when there is an agreement between the buyer and seller to fictitiously conclude a purchase and sale agreement in order to receive cash.

If we talk about termination of the contract at the initiative of the borrower, then the main reasons why such an action occurs is the impossibility of further repaying the loan. Although in practice there is another way out of the situation - contacting the bank with a problem, as a result of which the organization can provide the opportunity to relax the terms of the contract, credit holidays, reduce monthly payments while simultaneously extending the mortgage term.

In extreme cases, there may be a transfer of rights to an apartment, when the residential property, together with existing obligations, is transferred (sold) to another person, who will subsequently repay the loan. If it is not possible to reach a compromise and termination of the contract is inevitable, then when an agreement is reached, the document ceases to be valid.

We invite you to read: Complaint against the decision of the State Labor Inspectorate imposing a fine on an official. || Appealing a decision of the City Council on an administrative offense

Refusal of mortgage through court

In practice, cases of borrowers going to court to terminate a mortgage agreement with a bank are rare. To go to court you need good reasons. They are listed in the banking services agreement.

The legal grounds for termination of a mortgage loan agreement at the initiative of the borrower are:

- serious violation by the bank of the terms of the agreement (change in repayment terms);

- unreasonable increase in mortgage rates;

- refinancing a mortgage agreement.

When planning to go to court, you should strictly adhere to the procedure established by law. First of all, you will need to notify the organization in writing of your claims and demands. You can go to court only after refusal or lack of response from the credit institution.

For the court hearing, it is important to prepare all the necessary documents to support your position.

Lawyers note that it is possible to make a decision in favor of the plaintiff in a situation where one of the spouses took out a mortgage without the consent of the second party to the transaction. This makes it possible to invalidate the contract or challenge your half of the debt.

It should be understood that if the court makes a decision in favor of the borrower, the balance of the debt will need to be paid in full.

Termination of a mortgage agreement at the initiative of the lender

- Failure to fulfill loan repayment obligations;

- Use of bank funds for purposes other than their intended purpose;

- Providing false information;

- Carrying out redevelopment without obtaining the consent of the credit institution;

- Causing damage to the collateral;

- Failure to comply with insurance conditions.

The most common reason why a bank will insist on terminating a mortgage agreement is the presence of constant delays, and if the client does not hide and conceal his real financial situation, then an alternative solution is possible - debt restructuring (more on this below). A mortgage, as everyone knows, is a long-term loan and no one, even the most responsible borrower, is insured against job loss, salary reduction, illness, or the appearance of additional mandatory expenses.

Excerpt from Article 159 of the Criminal Code of the Russian Federation Fraud

Misuse of money issued for the purchase of housing is rare, since an ordinary person will hardly be able to bypass all levels of banking control. If a gross violation is noticed (bribery of responsible persons, falsification of documents), then in addition to termination of the contract, the client may also face criminal prosecution.

The most “cunning” people in terms of using money issued to purchase housing are, as a rule, entrepreneurs and business owners. And quite legal. When registering a non-target

loan secured by real estate,

rates are significantly higher than for targeted lending for the purchase of housing. Particularly enterprising citizens “buy” housing from relatives, friends and business partners, re-registering ownership among themselves. And the money transferred to the seller is used for some of their own purposes, for example, replenishing working capital, business development. This turns out to be much cheaper than taking out a loan on regular terms, and there are also fewer delays associated with assessing a business with a non-mortgage loan. Although it is worth noting that some banks will need to analyze the client’s business to obtain a mortgage, but this analysis will be much more superficial than if the loan was issued for the same replenishment of working capital.

Providing false information is simple; it is provided in order to:

- The bank experienced difficulties in finding contact with problem borrowers,

- The loan amount was higher despite insufficient solvency

- The cost of the loan has decreased due to preferential conditions.

Redevelopment can reduce the average market value of the collateral, so all actions must be coordinated with the lender. He has the right to inspect the collateral, and if the housing is damaged (either by significant redevelopment or in other ways), the mortgage agreement can be terminated. Read more about redevelopment of a mortgaged apartment.

Failure to comply with the insurance conditions most often only leads to an increase in the interest rate, but if it comes to property insurance, since this type of insurance is required by law, the lender may demand early repayment of the entire amount of the mortgage loan. Life or title insurance claims (these tend to be more expensive if the property is a standard apartment rather than a house or townhouse) can be disputed.

It is worth noting that in practice this happens quite rarely. The most common reason for terminating a contract with a mortgage borrower is that he or she is seriously in arrears on monthly payments. At the same time, the borrower does not make contact and does not want to discuss his financial problems with the bank.

As a rule, such termination is accompanied by a statement of claim in court. In addition, there are a number of other reasons why a bank may initiate termination of a mortgage agreement:

- if the borrower does not use the loan money for its intended purpose, that is, if the borrowed funds or part of them are not used to purchase housing. Today this is a very unlikely reason, since, as a rule, banks control the entire transaction from start to finish and transfer the money directly to the seller;

- if the borrower deliberately provided the bank with false information about himself, especially with regard to income and place of work. In the vast majority of cases, this condition is written directly into the contract, and if some time after taking out the loan, fraud is discovered, the bank has every right to terminate the contract early and demand repayment of the full amount of the debt and possibly even payment of a certain amount of a fine;

- if the borrower deliberately changes the price of housing without the approval of the bank or causes harm to it, this includes various types of repairs, remodeling, moving plumbing, etc. The ability to carry out periodic inspections of mortgaged housing is prescribed in the Federal Law “On Mortgage”;

- if the borrower has not entered into an annually signed housing insurance contract. For the bank, this means that its risks are not insured and in the event of damage or loss of the collateral, it will not be possible to compensate for the corresponding expenses and insurance payments.

In all of these cases, termination can be carried out by court order or by mutual agreement between the borrower and the lender. Typically, banks try by all means not to bring the matter to court. If a borrower experiences financial difficulties, he is usually offered various options for debt restructuring, credit holidays and other options for easing the credit burden.

Here, the main reason, just as in the previous case, is the borrower’s lack of ability to service the loan. If the client cannot agree with the bank to soften the terms of the loan on terms acceptable to him, then he has no choice but to terminate the agreement. However, it must be remembered that termination of the mortgage agreement entails early repayment of the entire amount of the debt. The borrower may also terminate the contract for one of the following reasons:

- refinancing a mortgage with the same or another bank. As a rule, this move is resorted to if a more profitable mortgage program appears than the one that the borrower is already servicing. Many banks have a separate line of refinancing, since such transactions require a special approach;

- if the borrower wants to sell or exchange the mortgaged property. In such a situation, the client will have to fully repay the loan ahead of schedule or enter into a loan agreement with the bank on other terms in order to pay off the remaining debt;

- if the bank violates its obligations specified in the loan agreement, for example, arbitrarily changes the interest rate upward or unreasonably demands early repayment of the loan. However, even in such a situation, the borrower’s financial obligations will not go away, and the debt to the bank will need to be paid

We invite you to read: Forced resignation: what to do if an employer forces you to resign at your own request or by agreement of the parties

How to terminate a mortgage agreement at the initiative of the borrower?

Transactions to purchase real estate using mortgage lending are very common: it is a relatively simple and affordable option for many people to purchase an apartment on favorable terms.

But we must remember that a mortgage is a rather complex transaction where there are three parties: the seller, the buyer and the bank that provides credit funds to the buyer.

Therefore, when terminating the contract, especially at the initiative of the borrower, a number of difficulties may arise.

In this article we will tell you whether it is possible to terminate a mortgage agreement, how to do it correctly and what is needed for this procedure.

The decision to buy an apartment with a mortgage is not always the right one: you need to remember that this is a financial burden for a long period (10-15 years or more).

And if at the time of concluding the contract the financial situation is quite sufficient to pay the amount due to the bank, then after some time everything may change: loss of a job, illness of a relative or other life situation will make such payments unacceptable.

It is possible to try to soften the terms of the mortgage agreement, but banks rarely make concessions, and terminating the agreement may be a more profitable option.

Another reason for terminating a mortgage agreement is the desire to sell an apartment purchased with a mortgage loan. This cannot be done until the entire amount under the agreement is paid with the interest established by the bank.

You can try to negotiate with a financial institution on early repayment of the loan, but they will not always cooperate: often early repayment of the loan means a reduction in interest, and therefore is unprofitable for the bank.

In this case, you can go to court and terminate the contract by its decision.

Finally, the reason for the borrower’s desire to terminate the mortgage agreement may be problems with the developer: the house was not built on time, commissioning is delayed, and therefore the transfer of apartments to shareholders.

However, you need to understand that your debt obligations are not to the developer, but to the bank, for which the situation that has arisen will most likely not be a valid reason for revising or terminating the contract, and in this case you may also need to go to court.

A mortgage is a special case of an agreement that is subject to Russian law and is regulated by Art. 450 Civil Code of the Russian Federation. According to this document, the contract can be terminated in two ways: by agreement of the parties (if there are no objections between the parties to the contract) or through the court - if it was not possible to achieve consensus. Legal proceedings can be initiated by any of the parties to the contract.

In any case, termination of the contract implies that the parties pay off their obligations to each other in full; in this case, it will be necessary to either pay the entire remaining amount or return the collateral property - the apartment - to the bank. Thus, you can refuse the mortgage, but in this case you cannot do without losses - money or real estate; in addition, you may need to pay a penalty - this depends on the conditions of termination of the contract.

The procedure for terminating a mortgage agreement is quite complex and includes several stages:

How to refuse a mortgage after signing an agreement with the bank

It is a mistake to believe that to terminate a mortgage agreement with a bank it is enough to stop making monthly mortgage payments. Stopping regular payments will result in penalties and interest.

The next step of the credit institution will be to go to court to recover the collateral, which is the property. Typically, an apartment purchased with mortgage funds serves as collateral. In this case, it does not matter to the bank that it may be the borrower’s only home.

This negative development of events can be avoided if you approach the issue of waiving your mortgage competently.

Getting additional income

In a situation where temporary financial difficulties arise, experts in the field of personal lending recommend using the help of family or friends. You can find a part-time job to pay off your monthly mortgage payment. This is the easiest way out.

Changing loan terms

If a difficult financial situation drags on for several months, it is recommended to notify the bank about any problems you have encountered with repaying your mortgage. By providing the credit institution with documentation confirming the situation that has arisen, the borrower can count on a constructive dialogue with bank employees.

It should be understood that the bank, like a responsible borrower, is interested in solving the problem. Going to court to recover collateral is quite difficult. If a mutual agreement is reached, the bank does not lose interest on the mortgage, and the borrower continues to repay the debt on new terms.

Important! You should not ignore text messages and calls from the bank regarding the issue of debt. This will ultimately lead to litigation.

By contacting the bank, the borrower can count on the following options for resolving the issue:

- provision of credit holidays for a period from 6 months to a year;

- recalculation of the full repayment period and the amount of monthly contributions;

- reduction in the interest rate.

Transfer of ownership

The method is also called “civilized rent”. The scheme involves the re-registration of a mortgage agreement and a residential property to a third party. The new participant in the mortgage transaction ultimately receives rights to the property and obligations to repay the mortgage. In this case, the previous borrower has the opportunity to live in the apartment for 5 years as a tenant of the property.

The law prohibits renting out mortgaged property. However, there are specialized organizations that can resolve this issue.

When considering this way of solving the mortgage problem, it is necessary to clearly understand that the rights to the property will ultimately be irretrievably lost.

Selling an apartment

The sale of residential real estate will help solve problems with repaying mortgage obligations. The funds received from the sale must be used to pay off the debt to the bank.

When considering this method of getting rid of a mortgage, it is necessary to clarify with the bank the conditions for the sale of a mortgaged apartment. This is a mandatory condition, since until the debt is fully repaid, it is the banking organization that is the owner of the property.

This scheme is quite complicated, since it is not easy to find a buyer for mortgaged real estate. It should be understood that the sale of a property with such an encumbrance implies a reduction in the cost of the apartment below the market average.

The buyer is deterred by the very fact of purchasing real estate that is the subject of collateral. When deciding on this option, preliminary calculations should be made. The amount received is not always enough to fully repay mortgage obligations.

Refinancing

In 2021, a good way to reduce the financial burden on the borrower is to refinance the existing mortgage with another bank. Against the backdrop of lower lending rates, this method is very popular.

Many banks offer favorable refinancing conditions. Financial institutions provide the borrower with the opportunity to:

- reduce the monthly payment;

- change the full repayment period;

- reduce the amount of the total overpayment on the mortgage.

All these methods can be considered in a situation where it is not possible to repay the mortgage in accordance with the current agreement with the banking organization.

How is a mortgage terminated in court?

- If the terms of the agreement are violated;

- If it is impossible to reach a compromise in resolving the problem under the loan agreement and resolve the conflict without a court decision;

- If there is a significant change in circumstances under which further fulfillment of the terms of the contract is not possible;

- In the event of the death of the borrower himself and the transfer of obligations to the heirs.

If it is necessary to terminate the contract by a court decision, a statement of claim is drawn up, which indicates all the circumstances of the case, as well as the essence of the request - termination of the document, and the reasons for such an action must be indicated, based on the clauses of the agreement itself, legislative acts or conditions that make further fulfillment of obligations impossible .

It is worth noting that the decision will be made solely on the basis of the law and the clauses of the mortgage agreement. So, for example, during one trial, the borrower filed an application to terminate the existing agreement. The reason given was the further impossibility of paying off the loan obligation due to the illness of the debtor’s mother and the loss of an official source of income, since he had to move to another city.

As evidence, sickness certificates, documents confirming being registered with the employment center and the absence of any sources of income were provided. The court, having considered the circumstances of the case, made a decision to terminate the contract. Another example is a case where a borrower goes to court to terminate a loan agreement because the bank has charged a late payment penalty at a higher percentage than he expected.

Bank initiative

Often, a credit institution terminates a loan agreement. To do this, you need to violate the terms of the loan.

When terminating the relationship, the Bank refers to:

CALL A LAWYER

HE WILL SOLVE YOUR QUESTIONS FOR FREE Moscow, region 8 (499) 577-00-25 ext. 130 St. Petersburg, region 8 (812) 425-66-30 ext. 130 Federal number 8 (800) 350-84-13 ext. 130

- misuse of funds . A mortgage is a targeted type of loan that is issued for the purposes specified in the agreement. Some borrowers are clever and can carry out a “gray” transaction to obtain cash. Upon receipt of information of this kind, loan agreements are canceled;

- when cheating . Clients often provide false information regarding employment and income. And this often leads to termination of the contract. The fact of incapacity for work itself cannot affect, but will be considered a violation if payment is refused;

- absence of collateral . If the property was damaged, lost, or actions were taken that resulted in a decrease in value, then the lender also has the right to terminate the concluded agreement. The borrower is already considered unreliable. The bank may require new repayment security;

- in case of refusal to pay for insurance of collateral property . The borrower undertakes to pay for the insurance product annually. It allows you to save the apartment from loss, damage and changes in the original characteristics.

If a citizen does not pay loan obligations, then there is no talk of terminating the loan document. Initially, there are warnings and an appeal to the court to collect the debt. And only then there is a demand for termination of the contract.