Regulatory regulation of the concepts of deed of gift and agreement on donation of things

Legal relations arising between the parties when concluding a gift agreement for an apartment or other real estate (movable) property are regulated by Chapter 32 of the Russian Civil Code.

According to the provisions of Article 572 of the Code, a gift is a transaction that provides for the unilateral obligation of a person (donor) to transfer free of charge to another person (done) some type of property.

According to the legislation, a donor is considered a person who, on his personal initiative, has an obligation to give his property to another person (citizen, organization or state) without presenting counterclaims. The donee is considered to be the person who receives the object of the donation into ownership along with all real rights to it.

A gift agreement can be concluded for a car or any other thing owned by the donor. Along with the property, the donor also transfers all property-type rights to it. In addition, when concluding a transaction, it may be possible to provide for the transfer of all property obligations related to the subject of the gift (for example, repayment of a loan for property, etc.).

An essential condition of a gift agreement is that the donor has no counterclaims, and the donee has no counterobligations arising from the content of the agreement.

What is more profitable to register: a deed of gift or an inheritance?

When concluding an agreement, the question arises of registering the transfer of ownership rights. This stage should not be skipped or carried out at the wrong time. However, the interested party does not always understand which transaction is more profitable to register in a financial and legal sense.

The difference between a deed of gift and an inheritance is huge. The meaning of the transaction differs in that inheritance is possible only after the death of the owner, and donation involves the transfer of the right to the thing immediately after registration of the contract. The transfer of inheritance by will or by law is not registered in any way until the death of the owner.

A deed of gift is always beneficial for the donee, especially if he is a close relative of the donor. In this case, there are no tax expenses, the transaction is reliable, and it is difficult to challenge it.

This is important to know: How to refuse a deed of gift for an apartment

When registering property rights, you will have to pay a state fee in both cases. However, the donation is registered immediately, and for inheritance the death of the testator is required.

Main features of a property donation agreement

According to the provisions of Article 574 of the Russian Civil Code, the form of a donation agreement for a house or other real estate (movable) property can be either written or oral. Also, the legal act stipulates several conditions under which the contract must be concluded exclusively in writing.

Concluding a gift agreement in writing is mandatory in the following cases:

- The donor's party to the transaction is an enterprise, organization or institution, and the value of the subject of the agreement is more than three million rubles.

- The contract states that the donor is obliged to fulfill the terms of the transaction in the future (for example, upon the occurrence of a certain event).

- The subject of the transaction is an immovable property object, contracts with which must be registered with a state body (Cadastral Chamber, etc.).

A deed of gift in the generally accepted understanding is a gift in writing. Thus, in the minds of citizens, these two concepts are correlated in the form of form and content. This is fundamentally incorrect, since the term “deed of gift” is not fixed in any regulatory legal act of Russian legislation.

Consequently, the deed of gift and the agreement on donation of property are related as private and general due to the fact that the agreement can be concluded orally or in writing, and the deed of gift is considered a written document. This is the only difference between a deed of gift and a gift agreement.

Deed of gift and deed of gift - what is the difference

There are many concepts and situations in jurisprudence that can mislead the average person. Today we will look at one of the most common examples, namely, how a deed of gift differs from a gift agreement and in what cases it is appropriate to use each of these terms when transferring real estate, using the example of an apartment and a house.

So, the similar terms “donation agreement” and “deed of gift” are identical not only from the point of view of vocabulary . Both of them mean a notarized agreement that serves as the legal basis for the transfer or “donation” of certain property with all obligations and rights passing from one party to the agreement.

At the same time, the concept of deed of gift, used in colloquial everyday speech, is not acceptable in legal practice, in which the use of the term deed of gift seems more appropriate. First of all, this fact is due to the fact that for each lawyer the transaction in question acts as an agreement that is concluded between two parties. Simply put, what is important for a specialist is not the principle of the transaction, but its documentary evidence.

Expert opinion

Oleg Ustinov

Practicing lawyer, author of the website “Legal Ambulance”, one of the co-founders of the “Our Future” foundation.

The main essence of the gift agreement is the mutual desire of the parties giving and receiving the gift to complete a transaction by transferring a certain object free of charge.

The object of the transaction can be both material goods (house, apartment, things, shares) and intangible goods (for example, obligations or intellectual property). Mutual desire, in turn, means the fact that the donor, of his own free will, wants to transfer certain property into the ownership of another person (the donee), and the donee has no objections to this and is ready to accept the gift on appropriate terms.

The main feature of this agreement, and at the same time its main difference from similar methods of alienation of property (will, purchase and sale agreement, etc.), is the gratuitous nature of the transaction. Thus, according to current legislation, the donor cannot demand any money, material benefits or performance of actions for the object of the transaction.

Among other features of the deed of gift, it is worth highlighting:

- Donation on behalf of minor citizens is prohibited! At the same time, this condition applies only to large gifts and real estate, and gifts of insignificant value do not fall under this requirement.

- In 2021, both tangible and intangible benefits can still be the objects of a gift agreement. It is worth noting that this feature of the transaction also includes the transfer of claims to a third party, as well as gratuitous release from certain types of obligations.

- A donation can be the gratuitous transfer of an object not only in the present time, but also in the future.

ARTICLE RECOMMENDED FOR YOU:

How to draw up a debt gift agreement?

An important fact of the transaction is that, in fact, the gift agreement can be canceled even after it is signed by both parties and registered with the authorized bodies. This becomes possible in the following cases:

- After the conclusion of the gift agreement, the health or financial situation of the donating party has sharply deteriorated, and fulfillment of the terms of the transaction will cause a further deterioration in the quality of life of the donor, further aggravating the current situation.

- The recipient party committed actions that caused damage to the donor party or his relatives and close people.

- In the event of the death of the donor, his heirs may, in some cases, file a lawsuit to terminate the concluded transaction.

- If the request of the donee poses a threat to the safety of the object of the transaction. This condition, as a rule, comes into effect if the gift is very dear to the donor, although it does not represent significant material value.

Today, the most popular, first of all, are real estate donation agreements:

- apartments;

- land plots;

- houses;

- dachas, etc.

In all of the above cases, the deed of gift must be drawn up exclusively in writing. In this case, certification of the gift agreement by a notary is desirable, but still remains at the discretion of the parties. In turn, experienced lawyers of the Legal Ambulance website recommend certifying the deed of gift in order to avoid conflict situations in the future.

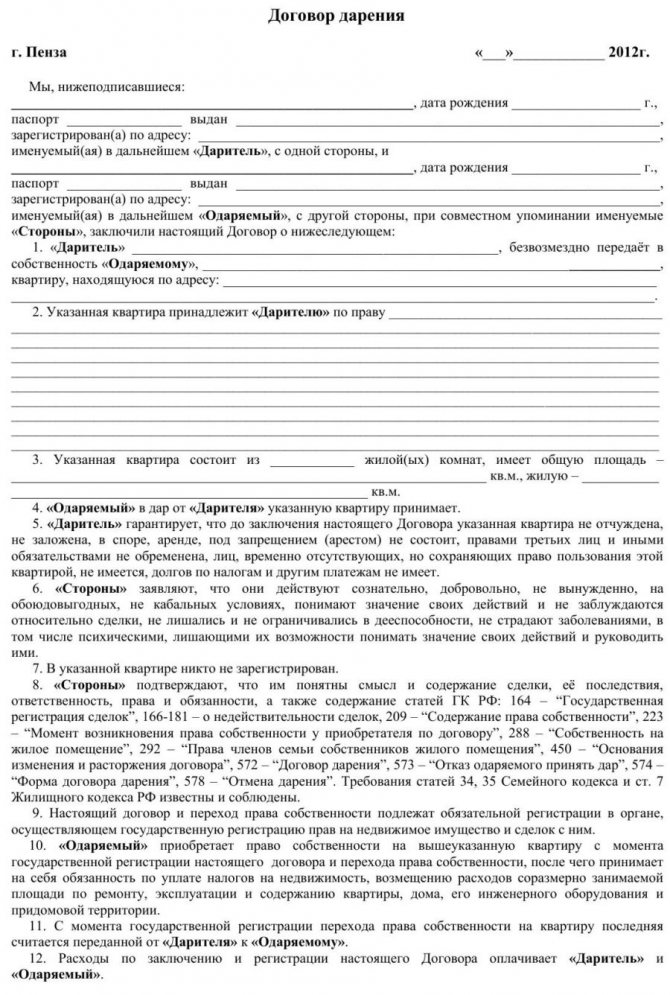

In addition, the gift agreement may be terminated due to incorrect drafting of the document, a sample of which you can download below. Therefore, the contents of the real estate paper must indicate:

- complete important information (passport data) about the donor and the recipient;

- place and date of drawing up the donation agreement;

- the most complete characteristics of information about the property being donated;

- confirmation that the donor has legal rights to the property.

The contents of the deed of gift should not contain any conditions for concluding a transaction!

Also, it should be noted that receiving an object as a gift, in accordance with the legislation in force in the Russian Federation, entails the mandatory payment by the recipient of the established income tax for individuals, the amount of which in 2021 is 13% of the total assessed value of the transaction object.

Lawyer's Note

The tax is not paid only if close relatives act as parties to the gift agreement.

In addition, registration of a deed of gift is mandatory for Russians in cases where the object will subsequently be registered with the traffic police, Rosreestr or other similar institutions. In other cases, the law does not require drawing up a deed of gift. The above category also includes valuable gifts, for example:

- luxuries;

- jewelry and art objects;

- antiques, etc.

ARTICLE RECOMMENDED FOR YOU:

Donation agreement to a budgetary institution in 2021 - current sample, errors, rules

As you can see, although there is a difference between a deed of gift and a gift agreement, it relates only to the lexical sphere, denoting the same process of transferring property free of charge from the donor to the recipient. In this case the term:

- gift deed – used in legal official documents;

- deed of gift - in colloquial speech.

If you still have questions after reading the article, do not hesitate to ask them in the form below. All our consultations are free!

Previous

Gift deed of gift after the death of the donor

Next

Deed of giftWhen can you sell an apartment after donation?

How to cancel a deed of gift (donation agreement)?

A contract can be declared invalid in the following cases:

- The conditions under which a thing is sold are specified. The agreement should not contain counter obligations and demands from the donor to the recipient and vice versa. Also, there should be no financial costs for the recipient in connection with receiving the gift.

- Conditions should not be imposed under which the property passes to a new owner. For example, when transferring ownership of an apartment, the donor prescribes lifelong residence or maintenance in the donated apartment, depositing a certain amount into the account, etc. The agreement in such cases will be declared invalid.

- There is a so-called mixed contract, which may contain elements of other contracts. To recognize such a document, it is important to draw it up so that the conditions do not look like pressure or an order.

Whatever type of contract you choose, it is worth remembering that a donation is a gratuitous transfer of legal property to another owner. You should carefully consider this serious step so that you do not later regret or defend the annulment in court.

Despite the simplicity of registration of gift transactions, when going to court such cases are considered the most complex and protracted.

Didn't find the answer to your question? Find out how to solve exactly your problem - call right now: +7 (Moscow) +7 (812) 309-53-42 (St. Petersburg) It's fast and free!

What is the difference between a deed of gift and a gift agreement?

Donation agreement, in accordance with Art. 574 of the Civil Code of the Russian Federation, can be committed both orally and in writing. At the same time, the legislator has established a number of conditions, under which the execution of a written transaction is mandatory.

This is important to know: A plot of land for which state ownership is not demarcated

Thus, compliance with the written form is mandatory if any of the following conditions are met:

- The donor in the transaction is an organization, and the subject of the transaction costs more than 3 thousand rubles.

- The transaction involves the fulfillment of the donor’s obligation in the future (for example, upon the occurrence of any events).

- The subject of the agreement is real estate, transactions with which are subject to mandatory registration with government agencies.

In the generally accepted sense, a deed of gift means only a written form of donation, that is, a deed of gift and a gift agreement are correlated in the minds of people as content and form. However, it is incorrect to talk about the correctness of such a ratio, since the concept of gift, as already mentioned, is not contained in the legislation.

Thus, the concepts of “donation agreement” and “deed of gift” are correlated as general and particular, since the agreement can be both oral and written, and the deed of gift can be exclusively written. This is the difference between a gift agreement and a deed of gift.