The legislation of the Russian Federation provides for various legal grounds for obtaining ownership of property. Donation is one of the most popular ways. Moreover, such transactions are often not taxed.

If property is received as a gift during the marriage, this often leads to the question of whether it is considered marital property. When resolving it, the parties are guided by the norms of the RF IC. Civil Code of the Russian Federation and a number of federal laws. Let's consider the possible options in more detail.

About donating housing

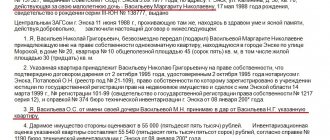

A donation is a gratuitous transaction under which the owner transfers his property into the possession of another party. The gift agreement can be oral or written. The first option is provided for inexpensive property, the price of which does not exceed 3 thousand rubles. If real estate is given as a gift, the agreement must be drawn up in writing and certified by a notary (Article 574 of the Civil Code of the Russian Federation).

Objects received as a gift do not belong to jointly acquired property. They are valued as personal property (Article 36 of the RF IC). It does not matter whether the citizen received the gift while he was married or before the wedding: no distinction is made.

This means that in the event of a divorce, the donated objects are not included in the estate that is divided between the spouses. To resolve the issue, it is very important to have a gift agreement if we are talking about the division of expensive property. For example, about an apartment.

Inheritance disputes regarding recognition of property as personal

Disputes in inheritance cases are quite common. It is also not uncommon for court cases to be considered regarding claims for the exclusion of property from the inheritance mass. Persons interested in this have the right to exclude property. Thus, a spouse can ask the court to exclude an apartment from the inheritance estate if it was acquired during marriage, but at the expense of the funds she received from the sale of personal property.

Accordingly, such property is personal and is not subject to inclusion in the inheritance of the deceased spouse. But in order for property to be recognized as personal, it is necessary to provide the judge with significant evidence.

Such a statement of claim is filed with the district court at the place where the inheritance was opened. The claim must indicate the property to be disputed and evidence supporting the applicant’s arguments.

The judge considers the case with the obligatory summons of the heirs to establish all the circumstances of the case.

READ MORE : make an appointment with an inheritance lawyer to find out all the nuances of the case

Is the gifted property marital property?

If real estate was transferred as a gift under an agreement, it is the personal property of the recipient of this gift and does not belong to jointly acquired property. However, there are two exceptions to this rule that will allow real estate to be recognized as joint:

- In the gift agreement, both spouses are indicated as recipients of the gift. If the document indicates the shares in the ownership allocated to each person, then the size of the property will be in accordance with the indicated shares. If they are not designated, the property will be divided equally between the spouses.

- The property received as a gift was improved using the common funds of the family or with the help of savings that belonged to the spouse who is not the owner of the donated property (Article 37 of the RF IC).

If one of the spouses wants to demand recognition of the donated apartment as common property, he should go to court. When the owner does not mind carrying out the procedure on a voluntary basis, the parties can sign another gift agreement about transferring the share to the spouse or draw up a marriage contract. The terms of this document allow the establishment of any ownership regime for personal property, if this does not contradict the conditions of Russian legislation (Article 42 of the RF IC).

Division of gifted property during divorce

Is gifted property divided in a divorce?

According to the RF IC, only the common property of spouses is subject to division. The law clearly defines what property can be classified as jointly acquired:

- income of spouses from intellectual, labor, and entrepreneurial activities;

- pensions, benefits, other payments that are not targeted or special;

- movable and immovable things;

- securities, deposits, shares, shares in the authorized capital;

- funds deposited with credit institutions.

The RF IC defines movable and immovable property, which is the personal property of each spouse and cannot be divided:

- property belonging to the spouse before registration of marriage;

- personal items (clothes, shoes, etc.);

- property received as a gift or through other gratuitous transactions.

Note!

Such property is not subject to division even if received in a registered marriage.

Thus, gifted property cannot be divided, since it is not joint property.

Division of property received under a gift agreement

If one of the spouses intends to jointly own property transferred as a gift to his marriage partner, it is necessary first to assess whether there is a legal basis for this. If they exist, it is worth contacting your spouse with a request for a voluntary settlement of the issue. If you refuse to transfer part of the property into ownership, you should file a claim in court.

If the judge decides that there are grounds for declaring the property of one of the spouses joint, he will determine options for division. The following factors will be taken into account when making a decision:

- The size of the share that the plaintiff can count on.

- Wishes of all owners.

- Presence of shares of third parties in the property. For example, minor children of the couple, etc.

There are many nuances to the division of property. It’s easier if it can be divided technically. For example, money. When dividing an apartment, one of the following options is used:

- The property is sold and the proceeds are divided. This option is used, as a rule, if the property itself is not needed by either party and/or with equal shares of ownership.

- The judge establishes one owner per apartment. As a rule, this is the person for whom the gift deed is drawn up. He, in turn, undertakes to pay monetary compensation to the second spouse.

- Both parties continue to use the property, being joint owners. The implementation scheme for this option varies somewhat depending on the type of property. For example, shares in kind are allocated in an apartment.

But these options are rare. The bulk of property received as a gift is not subject to division.

If there are children

The presence of minor children is not an important factor in the division of marital property if they are not allocated shares in it. Their presence can only affect the division of residential property, and then only in the presence of accompanying factors.

For example, if minor children remain living with one parent, the latter may receive a larger share when dividing the apartment if he does not have any other housing of his own. But this issue is resolved at the discretion of the judge (Article 39 of the RF IC).

When minor children live in a parent’s apartment, which he received as a gift, after a divorce he will not be able to evict them until they reach adulthood. Even if the children are not registered in this living space. The only option when this is possible is for the parent with whom the children remain after the divorce to have their own home. And the second parent can also live with the children if he is appointed as their official guardian.

The donated apartment is subject to division

Is a donated apartment considered joint property?

Due to the fact that property acquired by donation is not common, the donated apartment is not joint property and is not subject to division.

If, during marriage, the spouse’s parents gave him an apartment in which the spouses subsequently lived, then in the event of a divorce, such real estate will not be understood as joint property and will not be divided.

However, variations are possible if other real estate is subsequently acquired from the sale of the donated property. Such property can be divided, but if the spouse is able to prove that he acquired this property only with funds from the sale of the donated apartment, then the court will refuse to satisfy the claim for the division of the joint property of the spouses.

Note!

It is possible to prove the fact of purchasing an apartment with the personal funds of one of the spouses by presenting to the court documents confirming the sale of the old apartment, the purchase of a new one and payment documents.

This is important to know: Transfer of municipal property to state ownership and vice versa

Such evidence may be purchase and sale agreements in which the date differs by no more than 1 month, as well as payment orders for crediting funds to the spouse’s account and debiting funds. The amounts in the purchase and sale agreements should be the same or slightly less, since in this case there is a risk of determining part of the share for the spouse, since the court may regard the purchase at a price higher than the sale price as a contribution of common funds.

In most cases, when adequate evidence is provided, the courts refuse to satisfy the claim under such circumstances.

In what cases is a donated apartment subject to division?

The law provides for several situations in which donated property is classified as joint property. This means they share in certain shares.

Lack of proof of donation

If expensive property is presented as a gift, a gift agreement must be drawn up to complete the transaction. And it doesn’t matter whether the gift is an apartment or a piece of jewelry. This is especially true if the gift is presented during a marriage.

If a gift deed was drawn up but was simply lost, it can be restored. This option is relevant if the document has been notarized, which, for example, is required when registering a gift for real estate.

In all other cases, if the property was donated after marriage and there is no gift agreement, it will have to be divided in equal shares with the spouse. Therefore, when a husband gives his wife expensive jewelry or another luxury item, it is worth drawing up an agreement. Otherwise, during a divorce, these gifts may also be divided.

Here everyone can familiarize themselves with a sample gift agreement and, if necessary, it.

Increase in the cost of an apartment

Improving property is the main reason why the personal property of each spouse is recognized as common. This norm is enshrined in Art. 37 RF IC. For example, her parents gave a woman a two-room apartment, drawing up a gift agreement in accordance with all the rules. Having been married for 10 years, she and her husband made renovations in the apartment, after which the cost of the apartment increased by one and a half times. In this case, the housing may be recognized as common property.

They won't split it in half. But the woman will be forced to pay monetary compensation to her husband if he decides to share the apartment. The amount of compensation is calculated as follows. First, they will determine the cost difference between the price of the apartment before renovation and after renovation. If common funds were invested in the improvement, this difference will be divided in half. The resulting amount will be the amount of compensation.

In what cases is a donated apartment subject to division?

Wedding gift for both spouses

When getting married, it is customary to present expensive gifts to the bride and groom. This could be real estate or cars. It is very important that the gift agreement in this case indicates both spouses as recipients. Only then will the property be recognized as common.

But if at the wedding the bride and groom were told that the apartment was being given to both of them, and the gift agreement was drawn up for only one, then only one of the spouses will be the owner of such real estate.

Presence of a marriage contract

Art. 40 of the RF IC establishes that spouses can sign a marriage contract to regulate property relations. The terms of this document allow the parties to establish any regime of ownership of personal property. Those. Spouses can record, for example, that housing given to one of them during the marriage will be recognized as common property, and all owners will remain in the apartment during a divorce if they wish.

When donating any expensive property, an agreement should be drawn up. Even if the spouse is the donor, the apartment donated by him should be properly formalized by registering the agreement with a notary. Otherwise, you may be faced with the need to divide personal property during a divorce.