The concept of cohabitation without registration

Previously, this term meant a legalized relationship between a man and a woman without a wedding in a church. Now in the modern world, people have given a new definition to this concept.

A civil marriage is considered a cohabitation of a man and a woman without official registration of marriage , thus a young family has the opportunity to think and make a decision about future marriage.

Today, there are more and more people who do not legalize their relationships. And every young family needs to have all the conditions for development, including housing. Therefore, given such demand, banks decided to create programs for such people that would allow them to purchase the desired apartment.

Is it possible to take out a mortgage in a civil marriage?

The legislation does not provide for the concept of civil marriage. Legally, the couple simply lives together; therefore, such a union does not imply any legal consequences. A similar feature applies to property that will not be considered jointly acquired and will not be divided in the event of termination of the relationship.

Given the popularity of such unions, some banks have introduced a separate clause in the “Marital status” column, where you can indicate being in a civil marriage. Sometimes a financial institution adds up the income of each applicant, thereby increasing the size of the loan. But more often, in the absence of official registration of marriage, salary is considered separately.

To avoid this, applicants can act as co-borrowers and increase the amount of money received.

In the latter case, there are 2 options for executing the contract:

- the agreement is concluded with one borrower, who takes ownership of the purchased property;

- the loan is concluded with both applicants, and the living space is registered as shared ownership.

List of banks

You can take out a mortgage loan while in a civil marriage from the following financial institutions:

- Sberbank;

- Raiffeisenbank;

- DeltaCredit Bank;

- Bank opening;

- Rosselkhozbank;

- Transcapitalbank;

- Absalut Bank;

- Globex Bank;

- Svyazbank;

- Ak Bars Bank;

- Promsvyazbank:

- Bank Uralsib;

- Sovcombank.

This is a list of the most popular lenders, but the list of financial institutions that issue mortgages without a stamp is not limited to this. Based on your individual characteristics, you should study the conditions of the specific bank where you plan to issue a loan and find out exactly whether it is allowed to issue funds without registering a marriage union or not.

Important! Borrowers who are not legally married may increase the likelihood of their application being approved. This can be done by contacting the financial institution where they receive their salary.

Is it available for two?

All mortgage loan programs provide for stable repayment. The main criterion for banks when issuing such loans is a stable place of work and collateral. At the same time, it is much more difficult for a young man or woman to repay a loan alone than for a married couple, even taking into account good wages.

By and large, credit institutions don’t care about the relationship between borrowers. For them, the guarantee of payment of the monthly installment is more important. And such guarantees are the official employment of both partners. Loans of this kind are regulated by Federal Law No. 102 “On Mortgage (Pledge of Real Estate)”.

Depending on the relationship of the couple, banks offer two ways to obtain such a mortgage:

- Taking out a loan for one of the spouses , while the second can act as a guarantor.

This option has its downside, because there is only one owner left, and in the event of separation it will be extremely difficult to find evidence of rights to the apartment. In order to avoid conflict situations, housing can be registered in the name of one of the spouses, but loan payments must be made on separate receipts in equal parts. All receipts must be kept as proof that the home was purchased for two people. This can be provided to the court in case of disputes. - Taking out a loan for two spouses is a more profitable option, because then both will be the owners and bear subsidiary responsibility for preserving all the property. If the relationship breaks down, housing can be divided into equal parts.

Important! When purchasing a home with a mortgage, a couple in a civil marriage needs to clearly discuss all the conditions and agree among themselves, and then discuss their proposals with a bank employee.

Features and nuances, what should you pay attention to?

For people who live without an official marriage, but still want to get a mortgage loan, there are some nuances. After all, this degree of relationship is not always reliable.

In order to ensure that as a result of separation there are no questions about who owns the property, you should resolve this issue among yourself in advance.

If a man and a woman are officially employed and have a stable income, then the best option and guarantee for both will be joint ownership or common equity.

Features of a mortgage:

- The contract must contain a clause that specifies exactly how the apartment is divided, in half or someone has the larger part. As well as the distribution of loan payments. Thus, having checks and receipts, each of the owners can prove their right to own this property.

- In the event of a quarrel or dissolution of the relationship, both borrowers are obliged to repay the loan. If one of the parties shifts its responsibility to the other, then such behavior can be challenged in court.

- Joint homeownership is a joint liability, meaning both parties are responsible for their property.

How is the property of such spouses divided among the acquired real estate?

Very often, various controversial issues arise with such real estate, because once you start a relationship with a person, you begin to trust him. In the event of separation, without having any documents in hand confirming ownership, it is very difficult to prove your right to property. After all, by right, the person in whose name this apartment is registered remains with the housing, as well as the one who pays the monthly loan installments .

Without evidence of such a joint purchase and the facts of investing money, it is impossible to prove your case in court. The division of real estate can occur as follows:

- If the apartment was registered in the name of one of the spouses, and all loan payment receipts are in one name, then in this case he gets the apartment; it is impossible to convince the court otherwise without real evidence.

- If, when applying for a loan, the contract specified division into shares, that is, everyone receives ownership of that part that is proportional to the repayment of the loan. Thus, the apartment can be divided in half or one will own most of the apartment and the other 1/3. At the same time, it is very important that everyone, when repaying a mortgage, makes the payment in their own name. After all, receipts will be one of the evidence in court when dividing housing.

- Housing can be immediately divided in half, in which case the borrowers bear equal responsibility for the mortgage debt and both are home owners.

Legislative subtleties

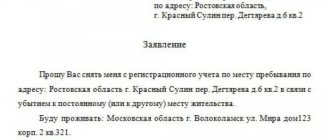

Before you find out whether it is possible to take out a mortgage in a civil marriage, you need to familiarize yourself with the norms of the current Russian legislation.

The fact is that such a concept as “civil marriage” is not spelled out in any regulatory document, so any illegal relationship will be considered a simple cohabitation that does not have any legal consequences.

Because of this, any real estate purchased during a civil marriage and registered in the name of one of the spouses will not be considered jointly acquired. This means that upon separation, everyone receives exactly as much as was written in their name.

So how can you get a mortgage for two people in a civil marriage to avoid conflicts? There are two different options. Let's look at each of them.

Option #1. Applying for a mortgage for one person (most often for the one with the highest income)

In this case, all rights to the purchased property automatically transfer to the person whose name is indicated in the mortgage agreement. As for the second cohabitant, he can act as a guarantor.

However, upon separation, it will be extremely difficult for him to prove his participation in repaying the loan, so this option is suitable only for those couples who completely trust each other.

Option #2. Distribution of a housing loan between two people

Registration of shared ownership for a mortgage in a civil marriage involves the division of loan obligations between two spouses: one of them becomes a borrower, the second a co-borrower (roles are distributed by the bank depending on the level of income).

In addition, partners can divide the housing into two and take out 2 separate loans . In this case, each party becomes the full owner of the property, bears equal responsibility for its safety and makes payments independently of each other.

As for the share of property, it is formed according to the amount of invested funds.

Shared ownership becomes impossible in two cases - when purchasing a one-room apartment and when one of the spouses does not have an official place of work.

It should also be noted that a mortgage for two imposes joint liability on the couple - if the borrower stops fulfilling his obligations, they automatically fall on the shoulders of the co-borrower (without taking into account who the property is registered in).

How to make a purchase?

Almost all banks in the country issue mortgages without an official marriage. Moreover, the conditions for such lending are almost the same as for official spouses. In order to take out such a loan, you need to select a bank and clarify the conditions for applying for a loan and filling out documents.

Subtleties of application preparation

- Provide reliable passport information for each borrower.

- Set the loan amount.

- Calculate your average monthly total income.

- Indicate the period for which the obligation to the bank will be repaid.

Other information and documents may also be required depending on bank regulations.

Can they refuse and why?

Every bank needs customers who can repay their debts without interruption. When applying for a mortgage, bank employees check all the information about the future borrower; monthly income is of particular interest.

If one of the common-law spouses does not have official employment or a stable income, this may be the reason for the bank’s refusal.

Banks are wary of borrowers with a bad credit history. It is very important that each spouse has not had problems with banks in the past. Having a timely repaid loan from this bank, as well as providing documents confirming the solvency of the borrowers, will help increase your chances of getting a mortgage loan.

List of documents required from borrowers

- Passport and a copy of all its pages for each borrower.

- Copies of work records certified by a lawyer and certificates of income from work.

- Documents indicating the presence of marital status and children.

- Documents for housing for which a mortgage loan is issued.

Attention! All documents must be original and contain only true information about the borrowers.

This list of documents is standard in all banks for obtaining such a loan. However, for more reliable information, you should contact a representative of this credit institution , since each bank has its own characteristics and the list may vary and be supplemented.

Procedure

A mortgage loan involves collecting a large number of documents and waiting for a response from the bank. To approach this process correctly, you need to understand the procedure for this type of loan. After borrowers have decided on the choice of bank, taking into account interest rates and the most favorable conditions, it is necessary to:

- Contact the bank with an application for a mortgage loan.

- Collect a package of documents, having previously checked the list with a bank employee.

- After a positive response from the bank, an agreement is concluded, which specifies the future owner and methods of paying the loan installments.

- Make a down payment; in different banks it ranges from 15% to 30% of the total cost of the purchased home.

After completing all these steps, the borrower receives documents confirming ownership. At the same time, he is obliged not to violate his credit obligations specified in the agreement.

What happens to the loan and property if the couple decides to separate?

One of the unpleasant aspects of civil relationships is the risk of separation. Unfortunately, modern statistics are not at all reassuring and this can happen to any couple. During the period of living together, a couple who decides to take out a home on a mortgage must protect themselves from clarifications and proceedings. Will help reduce the risk of losing your home:

- Conclusion of an agreement between common-law spouses, which clearly states who pays what amount of the mortgage loan. Thus, even if the apartment is registered for one person, there is a chance in court to sue for part of the housing in proportion to the amount of contributions (read about how to protect yourself from unnecessary hassle with the help of an agreement when buying an apartment with a mortgage).

- When repaying the loan monthly, you must indicate your own data and full name, which will be displayed on the receipts.

If the property is registered in the name of one spouse, and he is also the payer of the loan, then he will also be the owner of the apartment after separation. In other cases, having evidence of loan payment, you can prove your rights in court

Reference! Cohabitants or common-law spouses are not heirs, the only exception being their mention in the will.

If the borrower is a military personnel

If the apartment was taken out on a mortgage under a program provided for military personnel, its division after the divorce will be carried out according to its own rules. The fact is that while a citizen serves in the ranks of the Armed Forces, the mortgage loan for him is paid by the Ministry of Defense. That is why the spouse will not be able to claim a part of it after a divorce.

But there are a couple of exceptions to this rule. If a citizen retires from the Armed Forces before repaying the loan, then he must pay the remainder of the debt on his own. This means taking money from the family budget. In this case, after the divorce, the second party has the right to demand monetary compensation for the contributed credit balance.

The second exception will be the use of maternity capital to repay the loan. In such situations, the living space is clearly divided in equal shares among all family members.