The biggest nuance is precisely the preparation of the gift agreement. In this article we will look at the basic rules for drawing up such an agreement, as well as the issues that accompany this process.

Find out on our website how to donate an apartment to your son, daughter or grandchildren, what are the main stages and nuances of this transaction and what documents will be required. You can sample a contract for donating an apartment to a minor child.

Agreement for donating a share of an apartment to children

- Title of the document.

- Date and place of drawing up the contract.

- Personal data of the parties to the transaction.

- Rights/responsibilities of the donor/recipient.

- Description of the alienated property.

- Link to the title document.

- Mention of no encumbrances.

- Reference to the need for state registration of the agreement.

- Number of copies of the document.

- Signatures of the parties to the agreement.

When developing a draft agreement, the donor must proceed from the actual circumstances of the case. Key points – information about the parties to the transaction (full name, registration address, passport details). The text of the agreement must clearly indicate the will of the donor. For example, I Sergeev V.V. gave citizen Sergeev N.V. ½ of an apartment belonging to me with a total area of 18 square meters. m. When describing the property, you must indicate the following data:

Contents of the gift agreement

If necessary, the notary will provide a sample agreement and generally verify the correctness of the document. The main points contain the following information:

- information about the place of conclusion of the contract and the date of its signing;

- details of the parties to the transaction;

- information about representatives of the party to the agreement if it is necessary to involve them;

- description of the subject of the transaction;

- the timing of the entry into force of the agreement and the conditions necessary for this (at the request of the donor);

- list of attached documents;

- signatures of the parties to the transaction.

Agreement for the donation of a share of an apartment to minor children - rules for registration

To register the fact of such a transfer of a share in the property, the presence of an official representative of the future young owner will be required. These can be both parents and guardians. They are important to guarantee the ability to pay utility bills and control the technical condition of the gift.

A special feature of such a gift is the legally certified opportunity of the potential recipient of the gift. This will need to be done in writing and must be done before completing the procedure for transferring the gift. The refusal must undergo state registration.

Registration of a gift agreement

You will not have to submit documents to Rosreestr yourself. Registration of the transfer of a share is always carried out through a notary office, which transfers documents to Rosreestr free of charge.

Expert opinion

Borisov Dmitry Pavlovich

Legal consultant with 10 years of experience. Specialization: civil law. Has experience in protecting legal interests.

The standard registration procedure is completed in 3 working days maximum according to approved standards. If electronic document management is used, the time required to create a new record in the database is reduced to a day.

Form of agreement for donating a share of an apartment to a minor child: sample deed of gift for children

However, despite the outwardly positive vision of the situation, very soon unlucky donors who have not prepared for the issues of conducting a transaction will have to face the harsh reality in which a transaction with minors has a lot of pitfalls and nuances.

But the donor has every right to state some of his demands , which are provided for by law. Such requirements include, for example, the wish that the donee enter into ownership upon reaching adulthood, wedding, entering college, and so on.

Draft Agreement of Donation of a Share of an Apartment to a Minor Child

In Russia, citizens can receive residential square meters or any real estate in exchange for the maintenance and care of another citizen. The transaction involves the conclusion of a rental agreement. Let's consider what an annuity agreement is, what rights and obligations the parties to the transaction will have, and outline all the conditions for concluding an agreement.

Russians often end up buying goods of poor quality. Some people go to Rospotrebnadzor or to court, while others leave the issue closed, without even trying to return the funds spent. We will tell you how and by whom the examination is carried out, who can be its initiator, and also indicate what the expert’s conclusion should look like, and how long to wait for the document to be ready.

Agreement for donating a share of an apartment to children

The difference is that one gift agreement does not need to be approved by a notary, while the second is subject to mandatory certification. How to draw up a deed of gift for a child, what to indicate on the form, and in what cases is a notary not needed? You will learn about this and more in our latest material.

- The process of transferring part of the housing is gratuitous (free) in nature (clause 1 of Article 572 of the Civil Code of the Russian Federation).

- The donor (owner) and the recipient (child) must express a personal desire to participate in the transaction.

- The gift agreement is drawn up during the lifetime of the child’s relatives, and if they have already died, the gift is not allowed.

- Entry into ownership is registered with a notary and in Rosreestr.

- Part of the housing jointly owned by the spouses is transferred to the child with the consent of the husband and wife (clause 2 of Article 576 of the Civil Code of the Russian Federation).

- Consent is not required if the apartment is classified as common shared ownership.

- Participants in the transaction can be not only close relatives, but also third parties.

Notary services in document execution

Once all parties to the transaction have reached a certain agreement and drawn up an agreement, they should find a suitable notary and have the documents certified by him. As a rule, when going to meet a notary, you need to have with you the same package of documents that were already listed in this article above.

Certification of a contract by a notary has its own characteristics, among which it is worth noting:

- The notary will verify the legal capacity of all participants in the transaction (except for a minor child, since he is represented either by parents or guardians);

- A child who has not yet reached 14 years of age may not be present at the time of certification of the document;

- A child who is already 14 years old must be with the notary at the time of certification, even if his legal representative is involved in the transaction.

As soon as the notary certifies the documents, he will enter all the information into the unified notary register, and on the act of donation itself he will put a mark and indicate the following information:

- What date was the contract certified?

- What number was assigned to the register entry relating to the contract.

- Information about yourself.

As you can understand, the services of a notary are not free, and you will have to pay to certify the document. The cost of services can vary significantly depending on the region in which the document is certified.

As soon as the notary certifies the gift agreement, the parties to the transaction must carry out state registration of the document.

How to give a share in an apartment to a minor child

- general passports of both parties, including the legal representative;

- birth certificate, if the donee has not reached the age of 14 years;

- documents of title for a share in a residential premises (certificate of title, extract from the Unified State Register of Real Estate, certificate of right to inheritance, etc.);

- cadastral passport (from January 2021, an extract from the Unified State Register of Real Estate is used instead);

- apartment card or extract from the home book (these documents become important if, after the donation, a number of persons retain the right to use the housing);

- consent of the legal representative to accept a share of real estate as a gift.

- an application to the authorized bodies to register the transfer of ownership;

- gift agreement;

- title documents;

- general passports and birth certificates;

- a payment document confirming payment of the state fee for the registration procedure in the amount of 2000 rubles.

Procedure for registering property rights

You must provide the following to the Rosreestr office:

Articles on the topic (click to view)

- Car purchase and sale agreement by proxy: sample 2021

- Property trust management agreement: sample 2021, draft agreement, form

- Donation agreement for a plot of land with a garden house: sample 2021

- Donation agreement for house and land: sample 2021

- Donation agreement for a share in a house: sample 2021, how to draw up

- Agreement for donating a car share to a minor in 2021: sample

- Garage donation agreement: sample 2021

- passports of the parties to the agreement (or other documents that prove identity: birth certificate, ID);

- a form confirming the authority of the representative;

- application for registration;

- receipt of payment of state duty;

- gift agreement;

- a document that confirms ownership of the object;

- consent of the Donor's spouse to conclude the transaction, certified by a notary / certificate stating that he is not currently married;

- confirmation of registration address.

The entire package of documents is checked within 10 days. If shortcomings are discovered or reasons for refusal of registration are identified, the papers are returned indicating these nuances.

If verification is successful, the contract will be stamped accordingly and changes will be made to the database. The donee will receive a registration certificate confirming the transfer of ownership to him.

Below, a sample agreement for donating an apartment to a minor child is available for download.

Other people's children grow up quickly, but their own children are in no way inferior to them in growth. The older generation is starting to wonder if it’s time to give younger family members a share of the apartment? Registration of a deed of gift is a popular and convenient way to re-register property in favor of children.

However, due to a number of changes in the law, the gift agreement for a share in an apartment has undergone some changes. Now it can be concluded:

- in simple written form independently;

- in mandatory notarial form.

The difference is that one gift agreement does not need to be approved by a notary, while the second is subject to mandatory certification. How to draw up a deed of gift for a child, what to indicate on the form, and in what cases is a notary not needed? You will learn about this and more in our latest material.

Sample gift agreement for a minor child

- identification documents of the donor, his spouse (if any), the donee and his representatives;

- a marriage certificate and a notarized application from the donor’s spouse for the alienation of property or a statement from the donor about the absence of a marriage at the time of his acquisition of the property;

- title documents for the transferred property;

- confirmation from the tax service that there is no debt on tax payments (on property);

- assessment report;

- permission from the guardianship and trusteeship authorities (if the interests of minor children who are co-owners of the proposed gift are affected).

Full entry into ownership of the transferred property after receiving a document on state registration may be postponed for a specified period or until the occurrence of a certain circumstance. In this case, the corresponding mark on the encumbrance is placed in the certificate.

We recommend reading: Construction of a linear facility, permit for the construction of a linear facility

Legal Forum

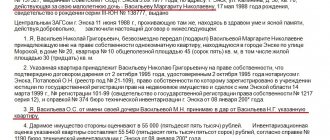

1. I, full name, from the apartment that belongs to me by right of ownership, located at the address: . donated 1/2 SHARE in the ownership of the APARTMENT full name. and full name in equal shares, 1/2 share each. The apartment consists of two rooms with a total usable area of 51.4 (fifty-one point four) square meters, including a living area of 28.9 (twenty-eight point nine) square meters, located on the third floor of a nine-story panel residential building , with cadastral number 000000000000.

gr. Full name, born October 1, 1900, passport 00 00 00000, issued by the Department of Internal Affairs on July 31, 2000, department code 100-000, registered at the address: RT, Solnechny, Zemlyanichny Ave., building 00, apartment 1, acting as the legal representative of her minor children, full name. (birth certificate data), on the other hand,

Agreement for donating a share of an apartment to minor children

- passports or other documents allowing to identify the parties to the transaction;

- marriage certificate, if the donor is married, as well as the consent of the second spouse to the alienation of a share of the apartment, if it is joint property;

- documents indicating that the donor has ownership rights in relation to the subject of the transaction;

- consent from the legal representatives of the minor participant in the transaction;

- documents indicating the absence of encumbrances in relation to the subject of the transaction and its value;

- payment documents for duties and other fees provided for by law.

On behalf of representatives of the first category, parents and other official guardians can participate in transactions. Minors who have reached the age of 14 may become a party to the contract if they have the consent of the mentioned representatives. This simple formality boils down to the fact that the guardian must certify that there are no objections to the transaction on his part by writing “I agree” in the agreement and signing an autograph.

Donation expenses

Even a gift agreement concluded on a gratuitous basis is associated with some costs to pay state-established fees and tax penalties.

Table. Costs when registering a deed of gift

| Expense item | Description |

| Income tax | Members of the same family are exempt from such penalties. If the donor and the donee are not the same, the recipient of the gift will have to pay a 13% tax on the value of the apartment share. |

| State duty | The current amount and payment details should be checked with the registration authority at the place where the transaction was recorded. |

| Notary Services | Information is specified on an individual basis. As a rule, notaries calculate prices for their services in accordance with the value of the subject of the transaction. |

Due to the fact that the donee is a minor and does not have his own income, the costs discussed above are compensated at the parental expense. If desired, the donor can pay for everything himself. The costs of registration and maintenance of the received share are borne by the guardians or parents of the recipient

Among the additional nuances, the following provisions should be noted:

- Until reaching the age of majority, citizens can dispose of the real estate they own under the control of the guardianship authorities;

- Responsibilities for paying utilities and compensating the costs of repairing a share of the apartment fall “on the shoulders” of the official guardian. At the same time, the latter is deprived of the opportunity to present real estate as collateral, sell it, rent it out, etc.;

- If a minor citizen commits illegal actions in relation to the subject of the gift, leading to its damage, destruction, etc., the gift agreement will be canceled and the property will be returned to the previous owner.

On average, the entire procedure is completed within a month, sometimes faster. There are no serious difficulties in the process of transferring ownership rights. You just need to prepare all the necessary documents and adhere to the sequence determined by current legislative standards.

Sample agreement for donating a share of an apartment. Form

Video - Agreement on donating a share of an apartment to minor children

Video - How to draw up a gift agreement

Expert opinion

Borisov Dmitry Pavlovich

Legal consultant with 10 years of experience. Specialization: civil law. Has experience in protecting legal interests.

An agreement implying the gift of a share in an apartment to a minor must be drawn up in accordance with the law and taking into account the nuances relating to transactions in which children are participants . Where to go to get help in drawing up a deed of gift and what formalities will need to be followed so that the child can enter into an inheritance in the future, read below.

Agreement for donating a share of an apartment to children

- Link to title documents, for example: purchase and sale agreement dated June 14, 2007. Here it is also necessary to indicate where and when the owner registered ownership of the residential property, as well as the number and date of issue of the certificate of ownership.

- An indication that the recipient or his legal representative accepts the property being donated.

- Confirmation that the residential premises are not under arrest, there are no encumbrances on the apartment and at the time of gratuitous transfer it is not the subject of a legal dispute.

- An indication of the time at which the beneficiary's ownership accrues if the donor delays taking ownership until some specified event or date.

- Typically, the costs of transferring property as a gift fall on the beneficiary, but if the parties agree on a different payment procedure, then a separate clause in the agreement stipulates the distribution of costs for processing the transaction.

For example, the uncle of a young Nikita issued a deed of gift to him for half of his four-room apartment, but three months later his company went completely bankrupt, and his uncle declared bankruptcy. All other property was sold at auction, the donor was left with nothing, that is, his property situation deteriorated significantly.

Gift by a minor

Can a minor child donate his share in the apartment? By law, he cannot independently manage his property without the help of a guardian. Therefore, in most cases it is impossible to donate or sell your property.

However, in the case of such actions, certain conditions must be met.

For example, a minor must be registered with a parent who also has some property.

If another child is registered in the apartment, it will first be necessary to provide him with an alternative housing option.

Drawing up a gift agreement is a very simple process if you know its sequence and main nuances.

That is why it is worth approaching the study of the issue of donation first theoretically and only then practically, because it will depend on you how you carry out the donation procedure and how much of your free time you will spend on it.

Drawing up a gift agreement for an apartment is today one of the most convenient options for transferring ownership of housing to children or other young relatives and friends.

The execution of such a transaction regulates the fact of the transfer of real estate free of charge. Such a transaction often turns out to be convenient and profitable; the main condition for its success is compliance with the mandatory requirements for the preparation of documentation.

Dear reader! Our articles talk about typical ways to resolve legal issues, but each case is unique.

If you want to find out how to solve your particular problem, please use the online consultant form on the right or call.

All rules for registering such a property transaction are determined in the Civil Code. Articles 572 and 582 of this document take into account the procedure for transferring property as a gratuitous gift to a person who has not yet reached the age of majority.

These articles also take into account:

- relatives close to the donor;

- relatives distant from the donor;

- those who are not related at all;

agreements for donating a share of an apartment to minor children in .doc (Word) format

How to give an apartment or a share in it to a minor child

You can register an agreement by contacting the regional office of Rosreestr, or using the Multifunctional Centers system. If the child is 14 years old, he must be present when registering the deed of gift. To enter data on a change of owner into the state register system, you must provide the following documents:

When it is necessary to draw up a deed of gift for a person under 14 years of age, it is signed by parents or guardians. At the age of 14 to 18 years, a child signs a gift agreement with the permission of a legal representative. At the same time, the latter also puts his signature and a record of his consent to complete the transaction.

What is the status of the apartment?

Before giving a part of an apartment to a minor child, you should know what its status is. In our case, let's talk about shared ownership. What does this legal status of an apartment mean and how is it characterized? The shared form of ownership of real estate means that its owners are several people at once.

As for the characteristic features of the apartment, the following should be said:

- Before proceeding with a transaction with an entire object, it is necessary to notify all its owners, or involve their trustees.

- Before selling part of the apartment, it is necessary not only to notify all owners, but also to give them the opportunity to be the first to buy out the share, since this is their right by law.

- If part of the apartment is sold or donated, the transaction must be certified by a notary.

Now we should talk about the legal status that minor children have.

ATTENTION !!! As you know, until they turn 14 years old, they are classified as citizens with limited legal capacity, which prohibits them from taking part in any transactions related to real estate.

If the child has already turned 14, but has not yet reached the age of majority, that is, 18 years old, then he can take part in the transaction himself, but at the same time, he must have permission from his legal representatives, that is, parents or guardians. . But, since the registration of a deed of gift takes place directly between close people or relatives, the transaction itself does not foreshadow the emergence of any problems. For example, any parent can give a share in an apartment to a child during a divorce without requiring consent from his or her spouse.

How to give a share of an apartment to a minor child

When a notary draws up a gift contract, it will be possible to save time and effort, which is not typical for registration on your own. Despite this, the cost of this procedure (the amount of drawing up the contract, state duty, state registration) will be more expensive compared to drawing up the contract yourself.

- The date of its compilation.

- Information about the notary who certified this document.

- Information about the donor and legal representatives.

- Information about the donee.

- Detailed description of the donated item.

- Documents for living space.

- Documents indicating the results of the value of this property.

- A note about the encumbrance (presence of easement, mortgage).

How to give?

In order to give real estate as a gift, it must first be in your direct ownership .

Also, do not forget that you can formalize a donation in two ways - by contacting a notary, and by contacting the body that registers real estate transactions, in other words - Rosreestr .

You must collect a package of necessary documents in proper form. In addition, you should contact a representative of the minor who could help him accept the gift.

Remember that it is strictly forbidden to simultaneously act as a donor and a representative of the recipient.

After the documents are collected, you either visit a notary, who properly draws up a power of attorney, or go to Rosreestr with the representative’s signature on the papers.

There they check all the documents and information you provide, study them carefully and only then register both the transaction and the documents, and after that your child becomes the full owner.