What is a deed of gift

A deed of gift is an agreement that implies the recipient receiving the property of the donor free of charge.

As a result, the donor loses ownership of the object, it passes in favor of the person to whom the apartment was assigned. Any property can be transferred by deed of gift, but most often an apartment is re-registered in this way.

A privatized apartment is transferred by deed of gift. If the donor's property rights are not properly registered, the apartment will not be transferred. You can donate not only an apartment, but also a share in it.

The most important condition for drawing up a gift agreement is the voluntariness and consent of both parties to the transaction.

It must be formalized in writing, since the cost of the apartment exceeds the maximum threshold for an oral agreement of 3,000 rubles.

Answered by lawyer, K. Yu. n. Yulia Verbitskaya:

No. Property and “registration”, or rather registration at the place of residence, are fundamentally different concepts. By registering ownership of this apartment in Rosreestr, you can independently make decisions regarding the fate of this apartment and the persons living in it. If they are all adults and their presence in the apartment given to you is unpleasant, you can discharge them through the court without providing any space in return. If those “registered” are minors or disabled, you will have to tolerate their presence or agree on a procedure for using the apartment that will suit all parties.

Is a gift taxable if the holding period is less than a year?

Can I expel a relative from the apartment given to me?

What documents are needed to formalize a deed of gift for an apartment?

How to properly issue a deed of gift for an apartment to a relative? The gift deed itself can be ordered from qualified lawyers or from a notary.

A deed of gift can be drawn up without a notary, but this does not lose its legal force. But this agreement will be declared void without its official registration in Rosreestr. The party is given 1 year to do this, otherwise the deed of gift will be cancelled.

If the donor dies without having time to register the deed of gift with Rosreestr, it will not be taken into account when distributing the inheritance. Such an agreement is not equivalent to a will.

The parties usually resort to the services of a notary if there are doubts that relatives will not want to challenge the gift agreement. The notary will be able to confirm in court that the donor was aware of his actions, and there was no pressure or blackmail on the part of the recipient of the apartment.

Rosreestr will need to provide:

- application for registration of deed of gift and re-registration of rights;

- 3 copies of the contract;

- certificate of ownership of the donor;

- documents for the apartment from the BTI;

- extracting books from home;

- receipt with paid state duty.

For a deed of gift drawn up in favor of a minor , along with the main package of documents, the written consent of the parents will be required to conclude the transaction. For an apartment registered as joint property of spouses, the consent of the second spouse to the transaction will be required.

If there is an MFC in the city, then documents can be submitted through it. It is also possible to transfer documents through a proxy.

Based on the documents received, Rosreestr issues a receipt. It will indicate the date when the donee can come to obtain a new certificate of ownership in his name. Rosreestr specialists are given no more than 10 days to process the submitted information.

To receive a new certificate, the recipient must have a receipt and a passport with him.

What documents may be required to donate an apartment to a stranger?

- Identity documents of all participants in the transaction;

- Title documents for the apartment: an extract from the Unified State Register of Real Estate, a certificate of ownership, or a purchase and sale agreement. Or any other document;

- Cadastral and technical documentation of the living space with a detailed description of its characteristics.

All submitted documents are thoroughly checked first by the BTI, and then by a notary or lawyer.

After drawing up the gift agreement, both parties sign the document. A notary's signature is also required. The contract specifies all the information about all participants, information about the apartment, the date of the event, etc.

You should register the deed of donation with the MFC or ROSREESTR https://rosreestr.ru/site/, and then pick up an extract from there indicating that the transaction was completed successfully and the ownership right belongs to the new owner.

Be careful and you will succeed!

If you want to read how to calculate the tax deduction for purchasing an apartment with a mortgage, follow the link.

How much does it cost to draw up a gift deed for an apartment?

There is no tax on the gratuitous transfer of an apartment by deed of gift only for immediate relatives.

These include parents, grandparents, sisters and brothers, and children. Otherwise, if the transaction is concluded between distant relatives or just acquaintances, the property received as a gift acts as the income of the donee. He will have to pay 13% of the value of the property he received to the budget.

If the parties decide to notarize the agreement, then it will be necessary to pay 1.5% of the agreement amount (the estimated value of the apartment).

A mandatory payment will be the payment of state duty to Rosreestr for the transfer of ownership and registration of the gift agreement. Now it is 2000 rubles.

Thus, it is impossible to unequivocally answer the question of how much it costs to draw up a gift deed for an apartment. To do this, you need to take into account a complex of factors.

What documents will be required?

To register in the Rosreestr database, bring:

- Identity document;

- Title documents for the apartment;

- Technical or cadastral passport for housing;

- Receipt for payment of state duty;

- Previously issued deed of gift.

Be careful and you will succeed. Draw up documents correctly and follow the law.

If you want to find out whether it is possible to transfer a donated share in an apartment, follow the link.

Gift deed for an apartment: pros and cons

A gift agreement has its advantages and disadvantages, so before deciding to enter into such a transaction, you should carefully analyze and weigh everything.

A deed of gift for an apartment is the simplest and most profitable way to transfer ownership of real estate in favor of another person. This is precisely its key advantage.

Gift deed for an apartment, advantages of registration

Among other advantages of registering a deed of gift, we note:

- The deed of gift exempts immediate relatives from additional costs associated with registration of inheritance . When transferring property by inheritance, relatives will have to pay 0.3% of the price of the apartment to the notary, as well as pay for technical and legal services. In the case of a deed of gift, relatives are exempt from paying for the purchased property.

- Tax exemption for immediate family members . This point is very important, since personal income tax on the transfer/sale of an apartment can reach several hundred thousand rubles.

- The deed of gift is easy to draw up : the document does not require notarization, but only requires the submission of the established package of documents to Rosreestr.

- Targeting of the gift agreement . This point is especially important for spouses who are planning to divorce. An apartment received by gift does not belong to jointly acquired property, because received free of charge. This means that such property is not subject to division in a divorce.

- It allows you to bypass some legal restrictions . Thus, it allows you to transfer a share in real estate even without the consent of other owners. This is especially true if other owners interfere with the execution of the purchase and sale agreement.

- Speed of re-registration of property rights . By gift, an apartment can be transferred extremely quickly, which is especially important in the event of a serious illness of the donor or his intentions to go abroad.

- The donor does not pay tax in any case : the tax burden is shifted to the donee. When completing a purchase and sale transaction, it would be the seller who would have to pay the tax.

Disadvantages of donating an apartment

The deed of gift is not without its shortcomings. The following disadvantages of donating an apartment can be identified, including:

- A deed of gift can be contested, this is its difference from a purchase and sale agreement . Moreover, this can be done not only by the participants in the transaction, but also by third parties (usually dissatisfied relatives). Although rare, a deed of gift may be declared invalid for the following reasons: if the transaction was completed by a socially unprotected relative, thereby worsening his living conditions; the deed of gift was written by an elderly relative or someone with mental impairment; the transaction was concluded under the influence of blackmail or pressure on the donor.

- Taxation of transactions between strangers and distant relatives . The recipient of the apartment pays 13% of its cost to the budget, which is a very significant amount. Therefore, the parties often prefer to formalize imaginary purchase and sale transactions, in which the donor pays personal income tax on the sale amount over 1 million rubles. (this is exactly the size of the property deduction today).

- The donor cannot indicate special conditions for the property being donated . The deed of gift is recognized as an unconditional transaction and upon its conclusion, all rights to the apartment are transferred to the recipient. He can sell it, rent it out or give it away at his discretion.

Thus, the gift agreement has become widespread among transactions involving the transfer of ownership of real estate in favor of another person. This is due to its inherent advantages. The most popular is a deed of gift for an apartment between close relatives; the advantages of drawing up such an agreement are obvious to them. The remaining categories prefer to draw up purchase and sale agreements rather than transfer the apartment by deed of gift, which is due to unfavorable taxation for them.

Video: Pros and cons of drawing up a gift agreement in comparison with a will.

How to draw up an apartment donation agreement between strangers: step-by-step instructions

To execute a written transaction you need:

- Communicate your intention to make a gift to the recipient. This is important because he has the right to refuse a donation before actually receiving the gift (Article 573 of the Civil Code of the Russian Federation). You need to set a date, place and time for signing the deed of gift.

- Draw up an agreement. The parties can do the drafting themselves, or entrust it to a lawyer.

- Sign the deed of gift. The DD is drawn up in three copies: one remains with the parties to the transaction, the third is transferred to the registrar for re-registration of ownership of the donee. If citizens turn to a notary, the signing takes place in his presence.

- Submit documents to Rosreestr or MFC to register ownership of the donee. Both parties must appear. If the donor is unable to come, he can issue a power of attorney for a representative. The donee does not have the right to represent the interests of the donor before the registrar.

- Receive an extract from the Unified State Register of Real Estate. The new owner of the property comes to the MFC or Rosreestr (depending on where the documents were submitted) for it 10 calendar days after the application.

It should be taken into account that the donor will be purged by the owner before the new owner is registered. Until this moment, the donee cannot dispose of the property: donate, sell, exchange, pledge to the bank, etc.

Contents of the gift agreement

It is important to correctly draw up the deed of gift, otherwise the registrar will refuse to accept the documents.

What information must be indicated in the DD for the apartment:

- Full name, passport details, dates of birth of the parties;

- date of signing the document;

- address, area, number of rooms, details of the donor’s certificate of ownership of the housing;

- intention to transfer the gift to the other party free of charge;

- start date of contract execution: immediately or within a certain period;

- liability of the parties in case of violation of the terms of the transaction;

- conditions for changing or terminating the contract.

At the end, the parties put their signatures.

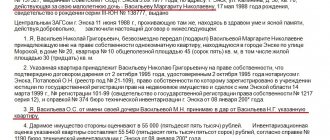

Sample agreement for donating an apartment to a stranger:

Consultation on document preparation

The sample gift agreement varies depending on the type of property being transferred. A prerequisite is a detailed description of the gift, allowing it to be individualized.

Documentation

To donate real estate, you will need the passports of the parties, as well as other documents:

- cadastral passport;

- a contract of sale, gift, exchange or other document on the basis of which the donor formalized ownership rights;

- extract from the Unified State Register of Real Estate;

- technical passport if the housing is privatized but not registered in the cadastral register.

Note! To register property rights, a similar list is provided, but you will additionally need a copy of the gift agreement.

When donating a car you will need:

- document of title (donation agreement, purchase and sale agreement, certificate of inheritance rights);

- STS;

- PTS.

State duty

State duty is paid in the following cases:

- For registration of property rights to housing. For individuals the amount is 2,000 rubles, for enterprises – 22,000 rubles.

- For notary services. The cost is determined individually, depending on the specific notary office and the type of property.

- For registering a car. 650 rub. - upon re-registration and 2000 rub. - when changing license plates.

Are you tired of reading? We’ll tell you over the phone and answer your questions.