Features of donating real estate to your child

In the life of every person there are special moments, holidays, when you want to give an original gift so that it is necessary and worthwhile. This situation might include your daughter’s wedding. On her happiest day, who better than her parents should present the most original gift.

An apartment is best. Firstly, this will ensure her a happy life, and a deed of gift for her daughter’s apartment will allow her to remain its owner in the event of an unhappy marriage.

This is very simple to do, you need to conclude an appropriate agreement and your son or daughter will instantly become the owner of the specified housing. The specifics of the procedure depend on the age of the child.

Minor children cannot sign a document; one of the parents or guardian does this for them , providing the child’s birth certificate (we talked about the nuances of donating an apartment to a minor child in a separate article). Also, to donate an apartment to a mother to her daughter or son, there is no need to go to a notary.

If the parents are divorced, then the second spouse , who is not the donor, must give his consent to this gift.

You ask: “I want to give an apartment to my daughter, do I need to pay tax?” This is another important plus - there is no tax when donating an apartment to a native child .

The main feature is that after the transaction is completed, the child is not required to pay financially , since the procedure does not provide for this.

Are there any differences in gifting housing to a daughter versus a son?

Let us answer right away that no. Donation occurs on a general basis and does not imply any special features for different people .

The steps of the procedure are identical and will not take much time. All that is needed is your positive decision about this step.

See the following video for details of the transaction between relatives:

Registration of a gift agreement

After the contract has been drawn up, you need to take all the papers that were used to draw it up to Rosreestr. A document is added to them, which indicates payment of the state fee. Currently, the state fee for registration of a deed of gift is two thousand rubles.

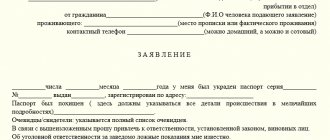

ATTENTION: You also draw up an application in which you ask to register the donation transaction, which means to issue a certificate of ownership to a new person.

The application can be drawn up by you at home, but for this you need to use the appropriate form, or it can be drawn up at the Rosreestr branch. True, in this situation, the likelihood that you will make a mistake is somewhat less, since a Rosreestr employee will help you.

Papers to be submitted to the Registration Chamber

Thus, in order for the gift transaction to be concluded, you need to provide the following set of documents to the Registration Chamber.

- Passport of the donor and recipient, or birth certificate.

- Certificate of ownership.

- Technical documentation.

- Certificate from the Inventory Bureau.

- Certificate from the management organization.

- Application for registration.

- Donation agreement.

- Receipt for payment of state duty.

- Other documentation that takes place. For example, the consent of other owners or a spouse to carry out a transaction.

A sample of writing a spouse’s consent to donate an apartment.

Application form for registration of a transaction.

ATTENTION: Each document must have at least two copies. Be sure to prepare copies and place them in the package. The Rosreestr employee will decide which documents he will attach, and how, and which ones he will give to you.

This completes the procedure, and all you have to do is study in detail all the nuances that we have outlined. In fact, correctly submitting documents to the registration authority is almost half the battle.

Conditions

Conditions depend on the age of the child.

Until the age of 14, all transactions are signed for him by his parents or guardians . During this procedure, the presence of the gifted person is not required.

But children from 14 to 18 years old can already be present when drawing up documents for a gift and sign on their own, but still in the presence of their parents or guardians.

At an adult age, a child can independently participate in such transactions , as well as dispose of donated real estate.

Who can give real estate to?

The easiest way to give such a gift is to close relatives. Therefore, we will tell you how to make a deed of gift for your daughter’s apartment.

In this situation, you will not have to pay a tax of 13% of the estimated cost of housing. But a gift to a friend or acquaintance will entail payment of a fee.

You will find more information about the taxation of gift transactions between relatives in a special article.

The law defines a number of persons who, due to the specifics of their work, cannot give or receive a gift - real estate . And their relatives too. This list includes:

- civil servants;

- employees of city municipal services;

- employees of educational, medical organizations and social protection institutions.

Minors do not have the right to donate property, as well as incapacitated people.

What documents are needed to donate real estate?

To complete the procedure, you will need a certain list of documents:

- Identity cards. Relevant for both the donor and the recipient.

- Documents fixing the property right to the real estate object that became the subject of the transaction.

- Cadastral passport, which allows you to establish the necessary data about the apartment.

- A special certificate that must be obtained in advance from the BTI to confirm the estimated value of the living space. Despite the fact that the daughter is not required to pay tax to the state, a certificate is still required for documentary reporting.

- A notarized certificate with a list of citizens living in the transferred living space. The certificate must be obtained from the passport office.

- In order not to pay the thirteen percent tax, you need to provide a document that can confirm the relationship between the donor and the donee. In this case, it is the daughter's birth certificate.

- If the object is not personal property, but is considered as marital property, it cannot be donated without the written, notarized consent of the second spouse.

- If the living space is in shared ownership, the same consent will be required from all persons who have property rights to it.

- You will also need permission from your daughter's other parent if she is under fourteen years old.

- Paid state duty and a receipt indicating this.

How to give an apartment to your daughter in Russia?

Before you issue a deed of gift for your daughter’s apartment, you need to prepare your property. The main points to pay attention to are:

- status of payment for utilities;

- checking how many people are registered in the apartment.

If you discover a debt, pay it off immediately. If more than one person is registered, they will have to be discharged.

Next, you must inform the recipient about your gift and obtain his consent . If the daughter is not yet 18, then her representative must give it for her.

Consent to complete a real estate transaction.

If the child is a minor, then you need to notify the guardianship and trusteeship authorities about your decision , where you will submit all the documents on this case. You can find out more about what documents are needed for a deed of gift for your daughter’s apartment below. Next, the staff will check all the information and, if the decision is positive, they will issue you a corresponding certificate.

Next, you can collect the remaining necessary documents, draw up a gift agreement , taking into account all the features and register your application in the Unified Register. After verification and a positive response, your daughter will become the full owner of the apartment.

We described in this material what stages the process of issuing a deed of gift to relatives consists of.

Features of giving a gift to a minor daughter

As noted above, to draw up a gift agreement for a minor daughter, you will need her birth certificate. In addition, the other parent must consent to the transaction. It is he or another close relative who can sign the contract for the daughter, being the legal representative. One parent cannot sign for both parties. That is, if, for example, a mother gives an apartment to her minor daughter, the father’s signature in the contract will be sufficient.

If the state has an interest in the donated real estate, the guardianship and trusteeship authorities must participate in the transaction. For them, you will need to prepare a second package of documents similar to that prepared for the registration authority.

If there are other children living in the apartment in question besides the donee, consent to the donation from the guardianship authorities will also be required. In this way, the state monitors other children and protects them from harm.

I want to give an apartment to my daughter: what documents are needed?

To complete the transaction, you need to come together with the recipient to the nearest notary. Let's find out what documents are needed to formalize a deed of gift for your daughter's apartment:

- passports of both parties to the transaction and their photocopies;

- documents confirming your rights to living space;

- drawn up gift agreement;

- receipts for payment of fees, if any;

- power of attorney, if the true owner is not involved in the transaction;

- an extract from the BTI confirming the absence of debt;

- written consent of the second spouse;

- certificate from the housing office about the composition of residents.

Now you know what documents are needed to donate an apartment to your daughter. Let's move on to the execution of the contract itself.

We reviewed the full list of documents that will be needed to prepare a deed of gift for relatives here.

How to pay tax

After registering the gift transaction, the donee (aka the new owner) must submit a 3-NDFL declaration and documents for the apartment by April 30 of the next year. And pay the tax by July 15th. Otherwise there will be fines and penalties.

For example, the recipient was given an apartment in 2021. He must submit the 3-NDFL declaration for 2021 by April 30, 2021 and pay the tax by July 15, 2021.

If the donee is a minor, their parents (guardians/trustees) must file a tax return and pay the tax - clause 2 of Art. 27 of the Tax Code of the Russian Federation and clause 1 of Art. 28 Civil Code of the Russian Federation.

Other articles

After donating an apartment, the owner can register in it - instructions.

Now the instructions themselves:

- The recipient must fill out a tax return on income and expenses (3-NDFL) for the year in which the apartment was donated.

On the official website of the Federal Tax Service there is a declaration form 3-NDFL. You can also install a program on your computer to fill out this declaration. In the income section of the declaration, you must independently indicate the value of the donated apartment - cadastral or market value according to the assessment report. - Then the donee must visit the tax office at your place of permanent residence/registration - clause 3 of Art. 228, paragraph 2 of Art. 229, paragraph 1, art. 83 and Art. 11 of the Tax Code of the Russian Federation. And submit the following documents:

- Completed 3-NDFL declaration;

- Your Russian passport;

- A document confirming ownership of the apartment. Since 2017, this document has been an Extract from the Unified State Register of Real Estate. Certificates of registration of rights have been canceled and will not be issued since July 2021. How to obtain an extract from the Unified State Register for an apartment;

- Donation agreement;

- The act of acceptance and transfer of the apartment. If there is none, a gift agreement is sufficient;

- If you decide to pay tax on the market value, a valuation report as of the date of donation.

- The recipient will be given a receipt for payment . The tax must be paid by July 15.

- Pay the receipt with the tax amount at any bank branch.

If the donee has problems with money and cannot pay the tax on time, it is possible to apply for a deferment or installment payment - Art. 64 Tax Code of the Russian Federation. The decision to provide such a benefit will be at the discretion of the tax office.

How to draw up a contract correctly?

A sample agreement for donating an apartment to your daughter is specified in the law and is the same for everyone. All basic information must be clearly stated, without errors or amendments .

Both parties to the transaction must be present when drawing up the contract. This is the basic rule, so, unfortunately, it is impossible to donate an apartment without the recipient’s knowledge.

The contract should be like an appeal from the person who makes the gift to the future owner. The donor (as the person who started the procedure will be called) indicates all his personal data, full name, registration address, and the same data must be indicated about the recipient (hereinafter the new owner of the apartment). The document describes all the information about the transferred object :

- address;

- size of living space in square meters;

- number of rooms;

- assessed value.

The donor describes all the points that will come into force after registration of this agreement . He also describes that the former owner guarantees that this is his property and confirms with relevant certificates.

He further undertakes to vacate the apartment 10 days after signing the document . Both parties must declare with confidence that the transaction is voluntary, no one is forcing or inducing anyone to it through threats, and the procedure is taking place in a healthy mind and consciousness.

The donor takes full responsibility for any payment.

You can find out how much it will cost to complete a deed of gift between relatives, taking into account state fees and notary fees, here.

As a result, you draw up two copies of the document, the first remains with the notary where the transaction took place, the second is handed over to the new owner. At the end, the signature of both parties is placed. Next, the agreement is sent to the registry, where it is registered and begins to operate.

Sample agreement for donating an apartment to a daughter.

You can learn about the rules for drawing up a gift agreement between relatives here, and in this material you can familiarize yourself with the structure of the agreement when drawing up a deed of gift for your son.

Stages of hand-written contract execution

In order to register a contract with your own hand, you need to draw up an agreement and register the contract in a special chamber.

According to the civil code of the Republic of Kazakhstan, the agreement must be filled out only in the hand of the donor. To correctly draw up the agreement, you should fill out a sample; the deed of gift will contain the following items:

- Data about the donor and recipient.

- The essence of the agreement.

- The name of the object being sent as a gift.

- Information about the alienated real estate (area, address, etc.).

- Documents confirming ownership.

- Signatures of both parties.

As evidenced by the Civil Code of the Russian Federation (Article 574), the agreement must be signed and officially registered with the registration authorities at the place where the housing is located. This could be the registration chamber or the MFC.

Registration takes place according to the following scheme:

- Both parties appear at the local authority to sign the agreement.

- The recipient pays a state fee of 2,000 rubles. This can be done at banks or at the registration office itself.

- The parties present a package of collected documents, including originals and copies. In each case, the package of documents may differ, and depending on individual characteristics, additional information may be requested.

- After paying the state fee and providing all the required documents, the registrar draws up a certification. Each party must read it carefully and sign.

- After signing, all documents, in addition to the passports of both parties, remain with the employee of the institution. The donee receives a paper indicating the date of receipt of the certificate for the right to use the real estate and the donation agreement.

The registration process may take up to 10 business days. After which the certificate must be collected. When registration is completed, the donee already becomes the owner of the apartment and can dispose of it as he pleases.