Find out debt from bailiffs online

Important: If you discover that all your wages have been withdrawn from your card, this is a reason to go to court with a complaint against the actions of the bailiffs.

According to the Labor Code of the Russian Federation, the amount of salary withheld on account of debt is calculated in the following proportions:

- by law - 20% of salary;

- according to federal law or court decision - 50% of salary;

- exceptions to the rules (for example, alimony) – 70%.

The most common rate is 50% withholding from wages towards credit debt.

If the borrower has children, the amount of withholding is reduced:

- The presence of 1-2 children - bailiffs do not have the right to withhold more than 30%;

- The presence of a child studying at a university not on a budgetary basis – 30%.

- Death of a spouse and presence of minor children – 25%.

- Death of a spouse and absence of minor children – 50%.

For which debt can funds be held first?

The first on the list is alimony payments. According to them, the bailiff can deduct up to 70% of the debtor’s income. Second in line are loan debts. They are collected if the debtor has enough income to pay off first-priority debts. The amount of payments on debt obligations of the second stage is 50% and no more. (Article 99. Amount of deduction from wages and other income of the debtor and the procedure for calculating it)

Attention! If you need protection from bailiffs, we can help you on the legal advice page, go and ask questions in the application form for free!

In cases where the debtor does not have enough funds to pay off debts under several writs of execution at once, the bailiff has the right to withhold the debt under the second writ of execution only after the debts under the first have been repaid. That is, the debtor first pays off the child support debt in full, and then, depending on how much money is left, pays off the loan debt.

Important! If at the debtor’s place of work two writs of execution have been received from the bailiffs for the payment of debts of different priority, then the bailiffs can withhold the debt under the second writ of execution only after the debt under the first has been paid.

For example, according to a writ of execution for compensation for harm caused to health (applies to first-priority debts), 60 percent of the total amount of income is deducted from the debtor’s salary. This means that withholding funds for debts for a loan in the amount of 50 percent of the salary can be written off only after compensation for harm to health.

What portion of the funds will be collected?

Employees of the Federal Bailiff Service claim that no one has the right to apply an increased rate of 70% to writs of execution, for which a maximum 50% limit applies.

The amount of collections directly depends on whether the limit is enough to retain the debt on the loan and all the others or not. That is, if the amount of penalties falls within the limit, then the amount of debt can be withheld under all writs of execution or orders of bailiffs.

Important! The chief accountant has the right to calculate the maximum amount of deductions from the amount that the debtor receives directly in hand, after deducting personal income tax (taxes).

If the accounting department of an organization or enterprise collects 50 percent or more of alimony for a child, then it will be impossible to withhold anything from the second-priority debt payments (loan).

How much interest can the bailiff keep?

The court of first instance makes a decision, which will come into force after one month. The defendant or plaintiff can appeal the judge's decision within these four weeks. If no applications are received from them, then the decision comes into force and the defendant legally acquires the status of a debtor.

Attention! If you need protection from bailiffs, we can help you on the legal advice , go and ask questions in the application form for free!

A writ of execution is drawn up in court, which is then sent to the bailiffs to begin enforcement proceedings. Based on the sheet, the bailiff has the right to prepare a resolution indicating the debtor’s place of work, his legal address, information about the court decision, debt obligations, and determines the percentage that should be withheld from the debtor’s wages. The bailiff sends a notification of the decision made regarding the debtor and a copy of the resolution to the organization where the debtor works by registered mail.

In addition to the bailiff, according to the law, it is possible to take your copy of the writ of execution to the debtor’s place of work to the plaintiff himself and submit it to the accounting department.

How much can bailiffs deduct from wages?

When are wages garnished?

The bailiff sends the employer a writ of execution to collect debts from the employee if at least one of the following conditions is met (Article 98 229-FZ):

- periodic payments are collected;

- the debt does not exceed 10,000 rubles;

- insufficiency of the debtor's property to repay the debt being collected.

The FSSP can obtain information about the debtor’s place of work from the debtor himself, as well as by sending requests to the Federal Tax Service and the Pension Fund. Each employer provides these regulatory authorities with information about the place of work and accrued income of each employee.

The employee received several enforcement documents

If a company receives several writs of execution for an employee, then a logical question arises for the accountant: how to properly make deductions. In this case, it is necessary to refer to Article 111 229-FZ, which establishes the order of repayment of claims. For individuals it will look like this:

- Alimony, compensation for harm to health and life, damage caused by a crime.

- Mandatory payments to the budget and extra-budgetary funds.

- Other requirements.

When enforcement documents are received for debt collection under the claims of one queue, they are executed in calendar order.

It is important to know! What to do if money is debited from your card for a fine

How is part of the income retained?

The salary account may be seized if a case is initiated and a debt collection order is issued. When the bailiff receives the document in hand, he will send the paper to the debtor’s place of work.

Typically the resolution contains the following information:

- place of work of the debtor;

- legal address of the organization;

- company postal address;

- information about legal proceedings;

- information about the decision made;

- the amount of money that can be withheld.

All necessary documents are sent to the debtor's employer by mail. Papers are sent by registered mail.

Typically, all received documents are transferred to the director of the organization. He must sign the resolution and submit it to the accounting department for execution.

Typically, the company strives to cooperate with bailiffs and fulfills all necessary instructions.

Having received the document, the accountant will make a calculation based on the executive requirement. The wages will be less. At the end of the month, the citizen will receive an amount less than the standard amount.

Writing off part of the money from wages to pay off debt is one of the softest options for repaying debt.

As soon as the payment of the obligations is made, the person will again be able to receive wages in full. If a person believes that the write-off is being carried out excessively, he can contact a lawyer and get advice on this matter.

How much can be deducted from salary?

Bailiffs act in strict accordance with the law. Employees of the organization have the right to write off part of the funds from a citizen’s salary in the following situations:

- there is a writ of execution allowing you to demand a certain amount;

- the debtor’s place of work is known;

- the amount of debt on a loan or other obligations is at least 10,000 rubles;

- the person does not have funds or property that can be used to pay off the debt.

The hold will be carried out by one of the employees of the Federal Bailiff Service. The specialist will send the writ of execution to the address of the debtor’s employer. The document serves as the basis for writing off funds to pay the debt. If a citizen decides to resign, information about this will be transferred to the Federal Bailiff Service. The writ of execution will be sent to the new place of work.

When figuring out how much bailiffs can deduct from wages if there are children, a citizen will find out that the maximum amount cannot exceed 30%. If a person is raising a child alone, the retention rate is reduced to 25%. In standard situations, no more than 50% of the income received will be written off under a writ of execution.

Not all funds can be used to pay off debt. The law prohibits the seizure of:

- payment that a person receives in connection with a layoff at work;

- benefits provided in connection with an occupational illness or as a result of an accident occurring at work;

- payments and benefits that are provided on the occasion of the birth of a child;

- the citizen has children under 3 years of age;

- additional payment received by a person working in hazardous working conditions.

An organization that has received a writ of execution does not have the right to refuse to execute a court decision. Therefore, it will not be possible to resolve the issue of writing off part of the funds with the management of the organization. Experts advise entering into a dialogue with bailiffs. Previously, employees of the organization received bonuses for debt collection. This incentive has now been cancelled. Therefore, a citizen can try to come to an agreement with the bailiff by discussing convenient conditions for closing the debt.

How is money withheld from your salary?

According to Article 98 Part 3 of the Federal Law “On Enforcement Proceedings”, interest on the debt may begin to be withheld from the day the accountant receives a writ of execution from the claimant or a bailiff’s order. The accountant or cashier who issues wages to employees must withhold from the debtor's salary the percentage of funds specified in the resolution, and then transfer or pay them to the debt collector within three days.

If the organization has the opportunity to issue advance payments to its employees, then 50 percent can also be withheld from them. The bonus, if there is one, will also be divided into two parts.

When a debtor is dismissed and transferred to another job, according to the law, the writ of execution is transferred to the department to another bailiff, who will continue to carry out enforcement actions in the territory under his jurisdiction. Debtors are always required to notify bailiffs about a change of place of work.

How is part of the income retained?

The salary account may be seized if a case is initiated and a debt collection order is issued. When the bailiff receives the document in hand, he will send the paper to the debtor’s place of work.

Typically the resolution contains the following information:

- place of work of the debtor;

- legal address of the organization;

- company postal address;

- information about legal proceedings;

- information about the decision made;

- the amount of money that can be withheld.

All necessary documents are sent to the debtor's employer by mail. Papers are sent by registered mail.

Typically, all received documents are transferred to the director of the organization. He must sign the resolution and submit it to the accounting department for execution.

Typically, the company strives to cooperate with bailiffs and fulfills all necessary instructions.

Video

Having received the document, the accountant will make a calculation based on the executive requirement. The wages will be less. At the end of the month, the citizen will receive an amount less than the standard amount.

Writing off part of the money from wages to pay off debt is one of the softest options for repaying debt.

As soon as the payment of the obligations is made, the person will again be able to receive wages in full. If a person believes that the write-off is being carried out excessively, he can contact a lawyer and get advice on this matter.

What restrictions exist if the debtor has a child?

The Labor Code states that no more than 30% of income can be deducted from the salary from parents with minor children or student children studying on a paid basis. According to the law, only 20-25% can be written off from the salary of a mother or father raising a child alone. If a male debtor is unexpectedly widowed and has a minor child to raise, he pays the same amount as a single father.

The following are not subject to collection:

- Payments from the Social Insurance Fund against accidents and diseases associated with production activities.

- Part of the additional amount that is charged for harmful working conditions.

- Additional payment for caring for a relative or child with a group I disability.

- Benefit paid as a result of staff reduction.

- Payments due to a woman upon the birth of a child.

How much can a salary card be withheld by law?

For any claim, no more than 50% of all receipts can be written off from the card to which the debtor’s payment is received.

A salary card may be seized if there is a claim for repayment of a debt, utility debts, alimony, or in case of late payment of interest on a loan.

Author of the article

Dmitry Leonov

Work experience 15 years, specialization - housing, family, inheritance, land, criminal cases.

Author's rating

721

Articles written

712

about the author

Useful information on bailiffs

- How long after the trial do the bailiffs arrive?

- Can bailiffs withdraw money from a Sberbank bank card?

- How much can bailiffs deduct from salaries?

- Can bailiffs withdraw money from a salary card?

- Seizure of a car by bailiffs, is it possible to drive?

- If the bailiffs are inactive, a complaint against the bailiffs

- Who can you complain to about bailiffs?

- Submission of a writ of execution to the bailiff service

- Can bailiffs describe parents' property for children's debts?

- Actions of bailiffs on a writ of execution

- Sample complaint to the prosecutor's office against the bailiff

- Can bailiffs seize a credit account?

- Inquiry about the progress of enforcement proceedings

- The paid traffic fine was handed over to the bailiffs

- Do bailiffs have the right to withdraw money from pensions?

- Do bailiffs have the right to open an apartment without the owner?

- How to negotiate with bailiffs to pay the debt in installments

- The bailiffs do not comply with the court decision, what should I do?

- Can bailiffs seize a salary card?

- Terms of enforcement proceedings with bailiffs

- Does a bailiff have the right to seize a pension?

- Can bailiffs seize child benefits?

- Can bailiffs seize the only home?

- Can bailiffs seize a car?

- Can bailiffs seize a Sberbank card?

- Car arrest

- Can bailiffs describe property without a court order?

- How do bailiffs find out the debtor’s place of work?

- What property can bailiffs describe?

- How to remove a lien from an apartment

- Seizure of property not belonging to the debtor

- If the debtor does not pay according to the writ of execution

- Information about arrests of bailiffs

- How to revoke a writ of execution from bailiffs

- How not to pay bailiffs according to a court decision

- How to find out fines from bailiffs

- Can a bailiff withdraw money from an account without notice?

- How to submit a writ of execution to bailiffs

- What accounts cannot be seized by bailiffs?

- Search for debtors by bailiffs

- How to remove a car from being seized by bailiffs

- What to do if you receive a letter from the bailiffs

- Find out the debt from the bailiffs of the Altai Territory

- Amur region

- Arkhangelsk region

- Astrakhan region

- Belgorod region

- Bryansk region

- Vladimir region

- Volgograd region

- Vologda region

- Voronezh region

- Transbaikal region

- Ivanovo region

- Irkutsk region

- Kaliningrad region

- Kaluga region

- Kamchatka region

- Kemerovo region

- Kirov region

- Kostroma region

- Krasnodar region

- Krasnoyarsk region

- Kurgan region

- Kursk region

- Leningrad region

- Lipetsk region

- Magadan region

- Moscow region

- Moscow

- Murmansk region

- Nizhny Novgorod region

- Novgorod region

- Novosibirsk region

- Omsk region

- Orenburg region

- Oryol region

- Penza region

- Perm region

- Primorsky Krai

- Pskov region

- Republic of Bashkortostan

- Republic of Mordovia

- Republic of Tatarstan

- Rostov region

- Ryazan region

- Samara region

- St. Petersburg

- Saratov region

- Sakhalin region

- Sverdlovsk region

- Smolensk region

- Stavropol region

- Tambov region

- Tver region

- Tomsk region

- Tula region

- Tyumen region

- Udmurt Republic

- Ulyanovsk region

- Khabarovsk region

- Khanty-Mansi Autonomous Okrug

- Chelyabinsk region

- Chuvash Republic

- Yaroslavl region

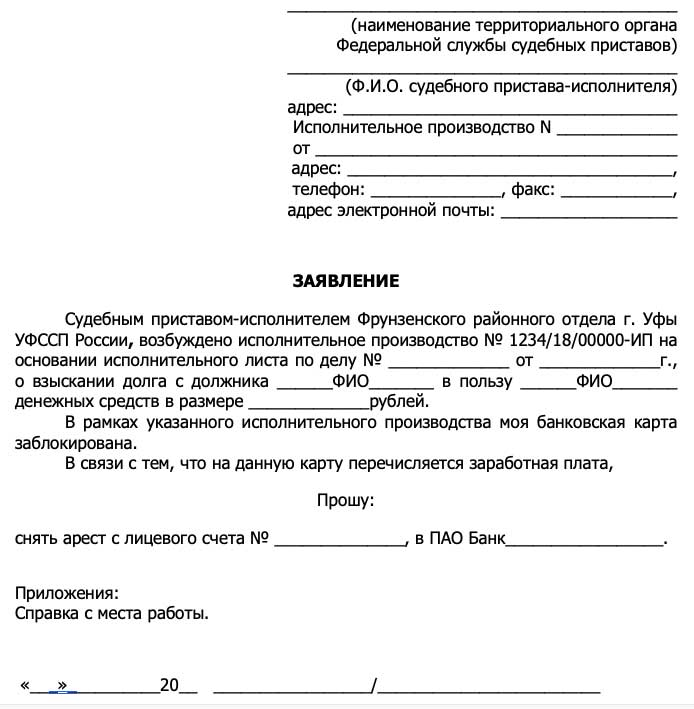

Application for lifting arrest

If a bank card is seized, you need to fill out a statement with the following information:

- Data from both sides.

- Information about enforcement proceedings, bank card details, information about arrest.

- Application to cancel the arrest, indicating what cash receipts are coming to the card.

- List of documents that have been attached.

- Indicate the date when the application was made.

Usually the bailiffs consider the application on the same day and meet the applicant halfway. But debts continue to be collected in the established amount.

And the FSSP also has information about the place of work, and they send a writ of execution there.

Articles:

Can bailiffs withdraw money from Sberbank cards?

Do bailiffs have the right to seize child support?