An agreement for the provision of services, or a purchase and sale, under which the contractor undertakes to perform some work for the customer, or to provide goods, may well contain an advance payment condition if the agreement is concluded for a long period, the service/product itself is expensive or difficult to perform. What is prepayment, how does it differ from an advance payment and how to legally formalize it, read our article.

Prepayment is a payment made in advance and prior to the transfer of goods, as well as the performance of work or provision of services.

What is prepayment: definition

Prepayment is a payment made in advance and prior to the transfer of goods, as well as the performance of work or provision of services. The use of this type of payment helps to stabilize relations between counterparties, guaranteeing the interests of commodity owners during unstable market conditions, inflation and a crisis in the payment system.

In accordance with the Civil Code, payment by the buyer for goods must be made either before or after receipt of them. In other words, the transfer of goods and payment should be as close in time as possible. Thus, prepayment is an advance received by the seller for the planned delivery.

Special purpose

Let's consider what prepayment means for the Customer:

- Increases the focus on collaboration, the service provider is seen as a partner;

- The buyer of the service is involved in its creation, the degree of participation in the project increases;

- Maximum interest in the result;

- The manager understands the value of this service for his business.

. Having received an advance, the contractor:

- Takes responsibility for the result;

- Interested in performing the service, loyal to the customer’s company;

- Helps promote a positive company image.

The listed positive aspects of prepayment can significantly increase the rate of successfully completed projects. According to statistics, 80% of transactions with prepayment are closed.

Types of prepayment

Prepayment means partial payment of money for a product or service. The types of prepayment depend on the terms of the drawn up purchase and sale agreement or the service provided; therefore, the following types of deposits are distinguished:

- payment of the full cost of the goods;

- partial payment of funds for the purchase of goods as a percentage or by agreement with the seller;

- conclusion of an agreement that lasts for a long time.

When returning funds deposited in advance, it is important to understand what an advance and prepayment are and what the difference is.

Differences from advance

When drawing up contracts, the concepts of advance and prepayment are often identified, which is due to the lack of specific interpretations in the Civil Code. But some lawyers insist that these terms have several significant differences, which, however, clearly do not appear in the legislation.

What is common between prepayment and advance payment:

- payments are made before the start of the transaction;

- funds transferred towards future payments are evidence that the parties are ready to cooperate, and the payer undertakes to pay the full amount of payment under the agreement;

- advance and prepayment are counted in the total amount of payment under the contract;

- if the other party fails to fulfill its obligations, the entire amount of the deposited funds may be claimed by the payer;

- Payments can be made in cash or non-cash form.

How does an advance differ from an advance payment under a contract:

- prepayment is made under sales contracts in accordance with the provisions of Art. 487 Civil Code of the Russian Federation;

- Advance payments are provided for in clause 2 of Art. 711 of the Civil Code of the Russian Federation for construction contracts;

- advance is a payment, the amount of funds transferred by the payer, and prepayment is a form of payment within the framework of contractual relations;

- an advance payment is usually made as a percentage of the total amount of the obligation, it is a partial prepayment, prepayment is a more general concept, prepayment can be made either in parts or in one amount at once.

Prepayment invoice

Issuing an invoice for prepayment is provided for in the contract. This obligation is not fixed by law and is agreed upon by the parties before signing the contract. The invoice does not confirm the provision of services or shipment of products and does not obligate the client to make payment. But, after receiving it, an invoice is issued and the corresponding postings are made.

The deadline for issuing an invoice for prepayment is 5 days after it is credited to the account (clause 2 of Article 168 of the Tax Code of the Russian Federation). Its main function is to justify the calculation of VAT. A delay or discharge at the end of the reporting period may lead to unpleasant consequences.

Refund of prepayment

If the seller, who has received an advance payment, does not transfer the goods within the prescribed period, the buyer may demand the transfer of the goods or the return of the advance payment (clause 3 of Article 487 of the Civil Code of the Russian Federation). But interest cannot be charged on prepayments under Article 395 of the Civil Code of the Russian Federation if you need the goods or work and you want to continue the contractual relationship.

If the seller, who has received an advance payment, does not transfer the goods within the specified period, the buyer may demand the transfer of the goods or the return of the advance payment

Interest can only be accrued if the contract is terminated. If the contract is terminated and the prepayment is returned, then interest under Article 395 of the Civil Code of the Russian Federation will be accrued from the moment the refunded amount is received (clause 5 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated 06.06.14 No. 35).

If the buyer still needs the goods and does not intend to terminate the contractual relationship, then he does not need to return the advance payment. In this case, there is no unlawful withholding of the advance payment by the seller, so you only need to demand performance in kind and a penalty for late delivery (resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 28, 2013 in case No. A40–46140/12–112-426).

What consequences will become apparent in case of failure to fulfill obligations regarding prepayment?

If the obligations for which an advance payment has been made are not fulfilled, the consequences may be as follows:

- If the buyer does not fulfill the obligation to pre-pay for the goods or services, the seller has the right to suspend his obligations to transfer the goods or refuse to perform the service.

- If the seller receives an advance payment and does not transfer the goods within the prescribed period, the buyer may demand the transfer of the goods or the return of the advance payment for the goods that the seller did not transfer.

- If the seller does not fulfill the obligation to transfer goods that have been paid in advance, interest for the use of someone else’s money will increase by the amount of the advance payment.

When concluding an agreement, the entrepreneur can decide for himself how to secure the obligations.

Drawing up a prepayment agreement

For a seller of any product or service, an advance is a guarantee that the buyer is going to make an order or purchase. Prepayment is often used by the seller to pay preliminary expenses when delivering the ordered goods or when providing a service. The buyer, when making an advance, risks his own funds without having yet received the goods or services.

To avoid possible fraud on the part of the seller, it would be advisable to confirm the fact of transfer of the prepayment on paper. In the event that the seller for some reason cannot provide the product or service, or the buyer changes his mind about purchasing, the advance payment must be returned to the buyer in full. If the seller is in no hurry to return the advance payment to the buyer, then the law does not prohibit the collection of interest from the seller from the advance payment amount in the advance payment agreement.

Registration of conditions

Thus, it is in the interests of the customer to play it safe and clearly state that their relationship with the contractor is in the nature of commercial lending. In this case, the contract must indicate:

- Prepayment deadline . It can be defined by a specific calendar date or a certain period of time, for example, 1 month or six months from the date of signing the contract. Also, the period can be specified not by a date, but by the occurrence of a certain event - the completion of the entire amount of work or a specific stage.

- The amount of the prepayment can be indicated as an amount (in numbers and in words, accurate to kopecks). Another option is to register the size as a percentage of the price of the service (30%, 50%, etc.). Then the payment procedure is divided into at least 2 stages - advance payment and payment of the remaining amount (final payment).

- Schedule for depositing funds : the parties can agree on depositing funds in stages. For example, the work consists of 7 stages, for each of which payment is made upon receipt, after acceptance. In this case, the advance payment is also transferred immediately; it can be determined as a percentage of the total cost of the service. All further calculations are carried out in accordance with the schedule, which can be included in the annex to the contract.

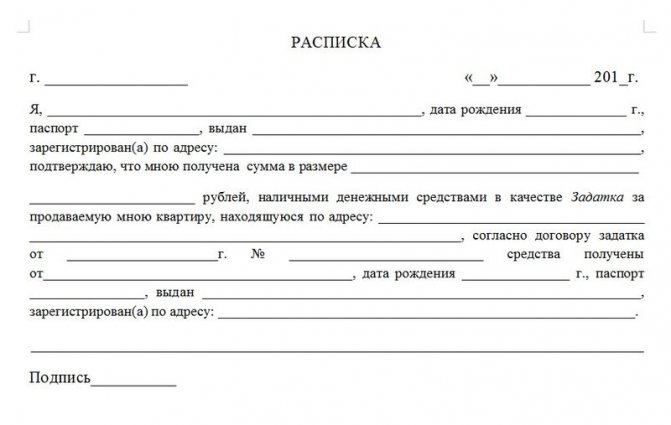

Receipt receipt

To confirm the transfer of money, you need to issue a receipt. The seller must write it in his own hand in the presence of the buyer. Moreover, not only to sign, but to put it in writing! Proving the forgery of a signature is not so difficult, but proving the entire document is much more difficult.

To confirm the transfer of money, you need to issue a receipt.

The receipt must contain:

- Passport details of the parties: full name, date of birth, series, number, by whom and when the document was issued, registration information

- Prepayment amount

- It must be written that the money is transferred under an agreement

- date

- Seller's signature, same as in the passport

Often the receipt is not issued separately. For convenience, the parties sign for receipt of money in the agreement itself.

What is the difference between advance payment and prepayment?

Quote (Civil Code of the Russian Federation): Article 711. Procedure for payment for work 1. If the contract does not provide for advance payment for the work performed or its individual stages, the customer is obliged to pay the contractor the agreed price after the final delivery of the work results, provided that the work is completed properly and in agreed period, or with the customer’s consent ahead of schedule. 2. The contractor has the right to demand payment of an advance or deposit only in cases and in the amount specified in the law or the contract. Article 735. Price and payment for work The price of work in a household contract is determined by agreement of the parties and cannot be higher than that established or regulated by the relevant government bodies. The work is paid by the customer after its final delivery by the contractor. With the consent of the customer, the work can be paid for by him at the conclusion of the contract in full or by issuing an advance. Article 823. Commercial loan 1. Agreements, the execution of which is associated with the transfer into the ownership of another party of sums of money or other things determined by generic characteristics, may provide for the provision of a loan, including in the form of an advance, prepayment, deferment and installment payment for goods and work or services (commercial credit), unless otherwise provided by law. Article 824. Financing agreement for the assignment of a monetary claim <> 1) transfer funds to the client against monetary claims, including in the form of a loan or an advance payment (advance);

Bookmarked: 0

What is an advance payment? This is a common way of depositing funds into the buyer’s accounts for services not yet provided, goods not received and other intangible assets.

It is one of the types of financial investments in various projects. Refers to the assets of the company that provided it. In taxation, this payment is made against the total amount of tax before its final and complete formation.