The repayment schedule is one of the factors influencing the size of the payment and the total overpayment on the loan. It can be annuity or differentiated. The bank lends to customers with only one repayment system or gives them the right to choose. If under an annuity the amount of payments does not change during the entire period, then with a differentiated scheme the payment gradually decreases and reaches a minimum amount by the end of the term.

Car loan from Credit Europe Bank

| Max. sum | 6,000,000 RUR |

| Bid | From 11% |

| Credit term | Up to 7 years |

| Min. sum | 500,000 rub. |

| Age | From 18 years old |

| Solution | 1 day |

More details Checkout

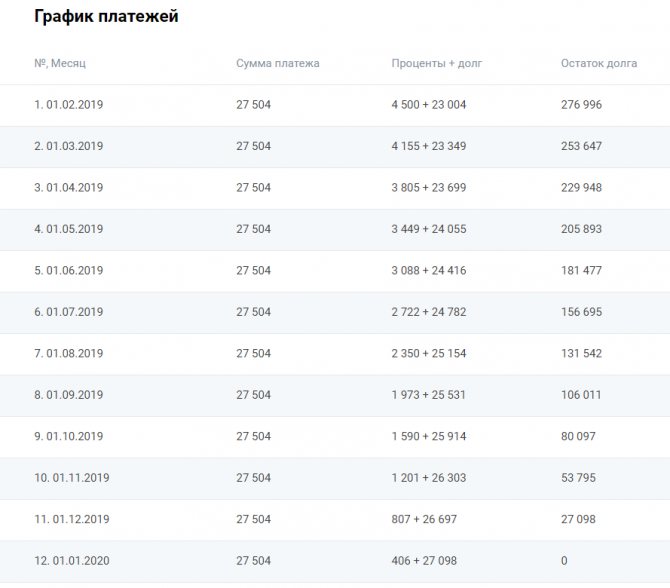

Example graph

For example, consider this annuity payment scheme, in which the borrower borrows 300,000 rubles for 12 months at 18.5% per annum. The calculation was carried out using a universal loan calculator from Brobank.ru:

In this situation, the overpayment will be 30,048 rubles, the monthly payment will be 27,504 rubles.

We see that repayment is carried out monthly in annuity payments. What does it mean? The borrower must deposit money into the account in the required amount by a certain date every month. On this date, which remains the same every month, the system will write off the money.

The payment amount is also the same every month. But in the next column, a different amount appears each month. The fact is that with the annuity method of loan repayment, the payment each time consists of different components: part is accrued interest, the second part is the principal debt, that is, the amount that is spent on closing the loan body.

The formula is:

x = S*(P+P/(1+P)N-1)

x is the amount of the monthly payment; S is the amount of the loan issued; P - 1/12 of the interest rate. The rate is annual, and the payment is monthly, so you need to calculate what rate applies in monthly terms; N—loan term.

The payment schedule is generated automatically using a formula entered into the system. Borrowers do not need to make calculations themselves.

Correction of credit history Sovcombank

| Max. sum | RUB 300,000 |

| Bid | 33,3% |

| Credit term | up to 18 months |

| Min. sum | RUR 4,999 |

| Age | 20-85 years |

| Solution | 1 day |

More details Checkout

Refinancing loans Promsvyazbank

| Max. sum | RUR 3,000,000 |

| Bid | From 5.5% |

| Credit term | Up to 7 years |

| Min. sum | 50,000 rub. |

| Age | 23-65 years old |

| Solution | 1 day |

More details Checkout

Refinancing loans from VTB

| Max. sum | RUB 5,000,000 |

| Bid | From 6.4% |

| Credit term | Up to 7 years |

| Min. sum | 50,000 rub. |

| Age | From 21 years old |

| Solution | 5 minutes. |

More details Checkout

Pension loan from UBRD Bank

| Max. sum | RUR 2,000,000 |

| Bid | From 6.5% |

| Credit term | Up to 10 years |

| Min. sum | 50,000 rub. |

| Age | 65-75 years |

| Solution | 15 minutes. |

More details Checkout

Car loan Home Credit Bank

| Max. sum | 1,000,000RUR |

| Bid | From 10.9% |

| Credit term | Up to 5 years |

| Min. sum | 10,000 rub. |

| Age | 22-70 years |

| Solution | In 1 min. |

More details Checkout

Advantages and disadvantages of differentiated loan payments

Many borrowers cannot decide on cash repayment schemes the first time - differential or annuity?

Strengths of differentiated payments:

- When choosing a differentiated schedule, the main debt, as well as the monthly payment, are reduced every month. This is a colossal benefit, especially felt when the loan is repaid ahead of schedule.

- The total overpayment with differentiated payments is less than a loan for the same period with annuity (identical) contributions.

- Mortgage loans require mandatory collateral insurance. If the loan principal decreases more rapidly, then the insurance fee is reduced, because insurance is always calculated based on the amount of the principal debt.

Weaknesses of differentiated payments:

- The first loan payment can be so high that the client has no money left to survive.

- It is very rare to find such a payment scheme in banks. And all because such a loan cannot be provided to most clients with an average income. They simply do not have enough solvency to service it at the very beginning of payments.

- To obtain a loan with this type of payment, the client must have considerable income so that the bank can approve the application. And this, again, is connected with the first payments.

Cash loan to UBRD depositors

| Max. sum | 1,000,000RUR |

| Bid | from 6.3% |

| Credit term | Up to 7 years |

| Min. sum | 50,000 rub. |

| Age | 19-75 years old |

| Solution | 1 day |

More details Checkout

How to make a calculation

A differentiated mortgage is not always easy for the client to understand, because he is not able to calculate the payment amount on his own. In principle, this is not necessary insofar as the bank attaches a schedule of monthly payments to the loan agreement; if you want to read the mortgage according to the differentiated system yourself, then there is nothing complicated here. Let's give an example with calculations; to do this, consider a mortgage with the following parameters:

- amount 1,800,000 rubles;

- annual interest – 8.9%!;(MISSING)

- loan term – 120 months.

To begin with, let's calculate the constant part of the monthly payment as follows: 1,800,000/120 = 15,000 rubles - this is the amount of the principal debt divided by the number of payment periods. Next, you should calculate the amount of the monthly payment, taking into account interest:

- 1 month 15000+(1800000*0.089/12)=28350 rubles;

- 2nd month 15000+((1800000-15000)*0.089/12)=28238.75 rubles;

- 3 month 15000+((1800000-15000*2)*0.089/12)=28127.5 rubles;

- 4th month 15000+((1800000-15000*3)*0.089/12)=28016.25 rubles;

- 5th month 15000+((1800000-15000*4)*0.089/12)=27905 rubles;

- 6 month 15000+((1800000-15000*5)*0.089/12)=27793.75 rubles;

- 120 month 15000+((1800000-15000*119)*0.089/12)=15111.25 rubles.

Please note that independent calculation of the monthly loan payment amount is preliminary insofar as these calculations involve not the nominal annual interest rate, but the effective one.

As you can see, it is quite possible to calculate the loan yourself; from this example it follows that the amount of the monthly payment will decrease with each period. This is truly beneficial for the client, especially given the long mortgage term. But, unfortunately, not all banks are ready to provide a mortgage loan using a differentiated system for calculating monthly payments.

How to take out a loan to pay off another loan, and is it profitable?

Home Credit loan refinancing

| Max. sum | 1,000,000RUR |

| Bid | From 7.9% |

| Credit term | Up to 7 years |

| Min. sum | 10,000 rub. |

| Age | 22-70 years |

| Solution | 1 min. |

More details Checkout

Cash loan Minbank

| Max. sum | RUR 3,000,000 |

| Bid | From 6.9% |

| Credit term | Up to 7 years |

| Min. sum | 50,000 rub. |

| Age | 22-65 years old |

| Solution | 15 minutes. |

More details Checkout

Which of these schedules is more beneficial for the borrower? Let's look at this in the article. We calculate our interest and payments using a loan calculator.

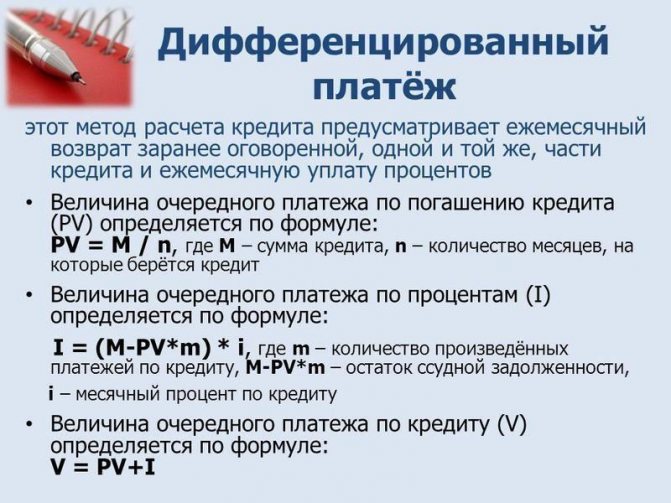

What is differentiated payment?

As a standard, we imagine loan repayment as depositing the same amount into a bank account every month. This is the annuity schedule, which is the most common and is used when using most loan products. With a differentiated schedule, the monthly payment amount is constantly decreasing. That is, initially a citizen begins to pay one amount, and as he pays from time to time, the monthly payment changes downward.

Differentiated loan calculator

If a differentiated scheme is used, it is only for large loan amounts. When concluding contracts for standard or small limits, banks predominantly use the annuity scheme; there may be exceptions, but very rarely. Differentiated payments are most often used when applying for housing loans, including loans secured by real estate. But this is not a common occurrence here either.

Features of the annuity repayment schedule

The annuity schedule involves repaying credit debt in fixed payments. As you pay, the payment structure changes. At first, the main part of the payment falls on overpayment of interest; the amount of the principal debt (loan body) remains practically unchanged. As the term approaches the end of the term, the share of the principal debt becomes larger and the interest payment decreases.

Where is the lowest interest rate on loans now ⇒

Calculation of annuity payment

Every month the borrower pays the same amount, which is calculated as follows:

K*(P+(P/(1+P)N-1))

where K is the loan body;

P — interest rate per month (annual percentage/12);

N - loan term in months.

What are the most profitable cash loans now ⇒

Advantages and disadvantages

This repayment system has its advantages for both the lender and the borrower:

- For a credit institution, the annuity scheme involves obtaining maximum profit even with early repayment.

- The amount is fixed. The borrower knows the exact amount of the payment and can plan his budget.

Flaws:

- An annuity payment involves a higher overpayment than a differentiated payment.

- In case of early repayment, the bank will receive the maximum amount of interest that the borrower is forced to pay in the first terms.

Which banks issue a loan using a passport on the day of application ⇒

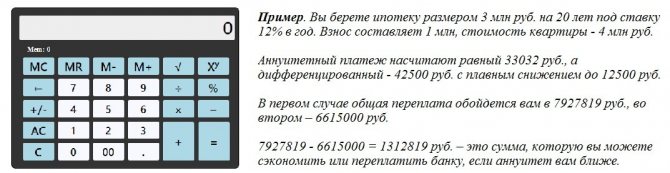

What type of payment to choose for a mortgage, annuity or differentiated

A mortgage is a loan that is taken out for a long period of time and for a large amount. Therefore, you need to think carefully before choosing a repayment method. In the case of a housing loan, annuity and differentiated systems do not change their essence. Those. With an annuity, you will pay the accrued interest, and only then will the gradual repayment of the loan body begin.

Having chosen a differentiated type, you will have to pay large contributions to the bank in the first half of the loan term, so that later they become smaller than the previous ones. Consequently, annuity payments will delay the payment of the principal debt. As a result, at the same cost of the loan, the amount of interest paid becomes larger.

And because with differentiated payments, interest is accrued on the balance of the debt, which is repaid first, then we can conclude that the less you owe the bank, the less interest will be charged. It turns out that annuity or differentiated payments on a mortgage, as in the case of a consumer loan, need to be analyzed based on the benefits and the total amount of the overpayment.

But due to the fact that a mortgage is many times larger than a consumer loan, this means that the first payments for differentiated repayment will be larger. For many people, they are beyond their means, given that they have to take out a home loan at the limit of their financial capabilities. Experts argue that in order to receive loans under a differentiated scheme, a person must have a satisfactory level of solvency.

In this case, the lender will approve a smaller amount. This is due to the fact that the annuity type helps banks minimize the risks of non-repayment. If we proceed from early repayment, then it does not matter which scheme you choose. At least this way, paying off the debt ahead of schedule will make the client’s situation easier. Please also take into account that banking structures increase the requirements regarding the borrower’s creditworthiness if differentiated payments are preferred.

But the disadvantage of a differentiated system overshadows its main advantage - savings. With a mortgage, you can save about a million or more in your wallet.

What type of payments to choose for a mortgage (video)

Differentiated schedule

The calculation of differentiated payments is much simpler and clearer. The principal debt is divided by the number of payments. The amount received will be a fixed share in the payment structure. And interest is calculated every month on the remaining amount of the debt.

How else can you save on your loan ⇒

Payment calculation

Differentiated payment = O*P+D

Where O is the balance of the debt;

P - interest rate per month;

D - fixed share of the main body of the loan.

The amount of debt decreases every month, and the overpayment of interest decreases accordingly. The closer to the end of the term, the lower the monthly payment becomes.

Where to get a bank loan at a lower interest rate ⇒

Advantages

- Gradual reduction of financial burden. The main credit burden falls on the client in the first months of repayment. Further, when the main part has already been repaid, you can plan other expenses.

- The overpayment of interest is less than under the annuity schedule.

Which banks issue loans without refusal with any history ⇒

Flaws

At first, the borrower will have to pay maximum amounts, which can seriously hit the family budget. And such expenses will have to be borne approximately during the first quarter of the entire lending period. Not every person will find this regime comfortable.

Since payments change, each month you will have to adjust the payment amount according to the schedule. It is quite problematic to plan your income with constantly changing contributions.

In addition, with a differentiated system, the credit limit is always lower. This is explained by the high risk of non-repayment due to the overwhelming credit load in the first months.

Annuity and differentiated payments

Annuity loan repayment schemes seem more convenient to most borrowers, since the amount of the monthly payment remains fixed throughout the entire repayment period. But this principle was developed by bankers specifically to shorten the path to a potentially larger amount of income. If you compare the amount of overpayment on a differentiated loan and an annuity under the same conditions for issuing a loan, the figures are guaranteed to speak in favor of the first option.

Despite its apparent simplicity, most of the first annuity payments are interest. In fact, this means that in the first few years the borrower pays the bank the cost of the loan, and only after that the actual amount of debt begins to decrease.