Home / Alimony / How is alimony recalculated?

Once established, alimony may subsequently change. Deterioration or improvement of the financial situation of the payer or recipient of alimony becomes the basis for revising the terms and amount of payments. At the same time, the parties are not in an equal position; the Legislator gives priority to less protected categories of citizens. More on this below.

General information on the law

Recalculation of alimony occurs constantly due to inflationary processes. They influence the increase in the cost of living, and the minimum wage (minimum wage) increases. Following this, payments to children, needy spouses, parents and other categories are revised.

The obligation to monitor calculated indicators is enshrined in the provisions of Article 117 of the RF IC . It falls on the payer’s employer, his accounting department, as well as on the bailiffs who are involved in enforcement proceedings. Often the latter drags on for months and years. During this period, changes occur that require indexation of alimony.

In addition, by law, the parties can revise the procedure and amount of payments due to changes in financial situation or other conditions. You can do this in two ways:

- Voluntarily - through signing a bilateral agreement or issuing a court order;

- Forcibly - through claim and enforcement proceedings.

Both parties can be initiators. The need to recalculate alimony will have to be justified in court.

Is it possible for the past period?

One of the parties may establish that alimony was calculated incorrectly. This may be due to:

- Lack of indexing;

- Failure to take into account certain facts that affect the amount of payments;

- Hiding sources of income;

- And others.

In this case, inequality between the parties appears. If the recipient of the money may demand a recalculation of alimony, then it is difficult for the payer to do this.

Civil legislation (Article 1109 of the Civil Code) does not allow the return of funds transferred as alimony and received as unjust enrichment. This requirement does not apply to cases of dishonesty on the part of the recipient or errors made in calculations.

Thus, if the payer presents facts to the court that objectively indicate that the amount of alimony may be reduced, they may affect the reduction of payments in the future. Recalculation of amounts paid for the past period will be refused.

Reasons for adjusting debt

If the payer does not fulfill his alimony obligations, he becomes in debt. The reasons for its adjustment are related to the accrual of a penalty - 0.1% for each day of delay. In this case, it is necessary to take into account several norms that regulate the reduction of the amount of the penalty; if it is disproportionate, there is a reason to classify it as an unjustified benefit (Article 333 of the Civil Code, 115 of the SK).

You can read more about changing the amount of alimony in a special article prepared by our editors.

Until August 2021, this provision of family law prohibited limiting the amount of the penalty. It was calculated at 0.5% for each day the debt existed and could significantly exceed the immediate debt. The Constitutional Court of the Russian Federation drew attention to this by issuing a corresponding Resolution on October 6, 2021, indicating in it the possibility of adjusting the debt by reducing the penalty. Subsequently, the Legislator made appropriate changes to the Insurance Code.

Why is it needed, and is it possible to recalculate alimony?

In the text of Art. No. 113 of the RF IC establishes a general procedure for determining alimony debt. Situations of a private nature are regulated in the articles:

- Art. No. 114 of the RF IC – provides for the possibility of reducing debt;

- Art. No. 117 of the RF IC – establishes possible ways of indexing unpaid amounts.

Expert opinion

Viktor Evgenievich

Representative of a private law firm, work experience - 7 years

Attention! Recalculation of alimony over the past period of time is necessary not only because of the deterioration/improvement of the financial situation of the recipient/payer. There is only one main reason for recalculation - inflation, which depreciates the resulting debt.

Another reason for recalculation is cases when the alimony pays off his debt by transferring the required amount to the account of the baby’s mother (recipient). And the bailiff, not having information about this, continues the procedure for collecting a debt that no longer exists.

Indexation of alimony payments

The rules for recalculating debts for child benefits can be determined by the child’s parents by drawing up a notarized agreement. It allows you to link the size of cash payments to any economic indicator.

The process of alimony indexation is possible only if payments are set in a fixed amount. Thus, if the payment is a certain proportion of the payer’s income, then the money due to the child increases along with the father’s earnings.

Note! Fathers with individual entrepreneur status, from January 2021, pay 3-10% more in alimony penalties, due to indexation carried out either by bailiffs or their own accountant.

Procedure for changing the payment amount

The algorithm or procedure depends on the selected or acceptable method. If the relationship between the parties remains good, you can:

- Make changes to the current agreement;

- Apply to the court to issue an order;

- Draw up a new contract.

The first option is possible if alimony is paid based on an agreement. The parties make additions to its clauses and bring it to a notary for certification. The second option applies if alimony is prescribed by a court order, but the recipient and the payer want to change its terms.

When we are not talking about reducing the amount of alimony, but about recalculating it upward, the parties can draw up an additional agreement . It will only concern the difference between the previous and current amounts of payments after recalculation. This simplifies the procedure if they are appointed by a court order or decision, freeing you from the need to contact representatives of Themis.

Application to bailiffs

If a voluntary recalculation procedure is not possible, you can contact the FSSP. This is permitted in the following cases:

- Indexation of payments is necessary;

- Alimony is assigned as a share of total income, and a new source of income will be found, previously hidden from the justice authorities;

- Previous payments were not taken into account;

- Other situations that do not require filing a lawsuit.

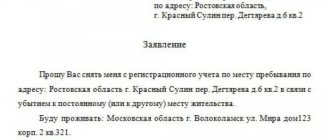

In such cases, an application for recalculation of alimony is drawn up. It states :

- Case number of enforcement proceedings when opened.

- What activities were carried out by the bailiff.

- What is their error, inaccuracy or insufficiency?

- The difference between the funds collected and those allocated for payments by law, their calculation.

- Recalculation requirements.

- Documents attached to the application.

- Date and signature of the applicant.

Special material has been prepared on the topic of filling out a sample application for recalculation of alimony - we recommend reading it.

A written appeal can be submitted personally to the bailiff involved in enforcement proceedings in the case. An alternative option is by mail by a certified letter with acknowledgment of delivery. With personal contact, the results of the review can be found out within a working week. A response to a written request will come within 1-1.5 months or more.

Trial

If you need to change the terms of payments established by a court decision or order, agreement, but the other party does not agree to the changes, you will have to file a claim in court. The proceedings will require the presentation of justifications for claims and objections.

The reasons for recalculating alimony or adjusting debt must be compelling, some of them, including inflation, are listed above. Others include :

- Loss of ability to work by the payer;

- The appearance of another child or more, other dependents;

- Serious illness, the need for expensive treatment for both the payer and the alimony recipient;

- Emancipation of a child due to engaging in entrepreneurial activity or marriage;

- Children receiving an inheritance or gift of an expensive inheritance, which provides all their needs, and the income they receive from this is disproportionate and clearly exceeds the alimony received.

There are other reasons that the court will take into account and consider them compelling in order to recalculate alimony both downward and upward. The writ of execution issued on the basis of the decision is sent to the FSSP to open enforcement proceedings. Another option is for the losing party to voluntarily fulfill the conditions specified in this act. In addition, the document can be submitted to the employer or to the bank where the payer has a current account.

When can you ask for a reduction in salary deductions?

A reduction in withholding can only be achieved in the event of an acute shortage of finances on the part of the debtor - if it can be proven that the latter does not have enough means to subsist. Dependents of the debtor (children, disabled people, elderly parents) are also subject to accounting.

Reducing the amount withheld from your salary can be achieved in several ways:

- change the percentage of payments from wages by reducing it;

- obtain permission to pay the debt in installments.

To exercise the right to reduce withholding, you need to contact the court or the Federal Bailiff Service. To do this, you need to write an application or petition and attach a package of documents to it.

The FSSP is given 10 days to consider the application.

If during this time the bailiffs reject the application and do not agree to reduce the withholding, a similar application must be submitted to the district court. A statement of claim should be filed, indicating the illegality of the actions of the bailiffs. Here it is necessary to indicate a request to the court to influence the bailiffs: they must be obliged to reduce deductions by indicating a fixed percentage of payments.

Until the court makes a decision, the deductions will be automatically suspended, which is also a good financial help for the debtor.

Among other rights of the debtor, the opportunity to submit challenges, explanations and complaints to the FSSP, including in electronic format, is indicated.

The debtor can also challenge in court any decision of the bailiff, taking into account any of his actions or inactions. The end of the proceedings may be accompanied by the adoption of a truce agreement.

How to write a statement to bailiffs to reduce the withheld interest?

As a rule, up to 50 percent is withheld from the salary. A higher percentage is typical for arrears in alimony and fine payments as punishment for an administrative offense. In non-offense situations, you can reduce the amount of withholding by up to 20 percent by filing a statement or petition.

The application is drawn up according to the following principle:

- In the “header” you should indicate the name of the FSSP and full name in the genitive case. bailiff to whom the application is sent. Here you need to write your full name. applicant. In the center, give the name of the document: “application” or “petition”.

- In the main part, provide the number, date of creation and compilers of the enforcement proceedings for which funds have to be paid. Here you should indicate in what case (number, date of decision), in what amount and in whose favor the penalties are made. Then refer to the rule according to which no more than 50% of income is entitled to be deducted from wages. After this, write that after deducting such interest, the remaining amount is insufficient - below the subsistence level.

- Based on the above, in a new paragraph, write a request to reduce the amount of deductions to a fixed percentage, indicating the number of the enforcement proceeding. Supplement the petition with an appendix containing evidence of the difficult financial situation.

- Indicate the date and certify the application with a personal signature with a transcript.

The application can be submitted on paper or electronically.

What documents need to be attached?

The need to reduce withholdings must be documented. If half of the salary is less than the subsistence minimum, one 2-NDFL certificate will be sufficient. Other “aggravating circumstances” are more difficult to prove.

It is better to prepare the entire package in order to be sure to receive approval from the FSSP:

- Parents of minors must attach the child's birth certificate. This also includes documentation of other dependents: certificates of disability or adoption.

- Use receipts and checks for utility bills to confirm that expenses are high and the remaining funds do not provide a minimum acceptable standard of living. The more such checks there are, the better.

- Use certificates to confirm the existence of alimony obligations or other additional debts that need to be promptly repaid.

It is important to note that deductions cannot be made from a number of social benefits: payments for work in harmful/dangerous conditions, disability pensions, old age pensions, loss of a breadwinner, maternity capital and child benefits, humanitarian aid.

for 2021

.

Practice of similar cases

The payer applied to the court to recalculate alimony and the debt thereon in connection with the birth of a second child. The previous court decision established the amount of payments as a fixed amount of 11.2 tr. These obligations resulted in a debt in the amount of 63.5 thousand rubles. The plaintiff demanded that the amount of alimony be reduced to 7.5 thousand rubles. and debt up to 45 tr.

The court granted the claim partially , reducing the monthly payment for child support to 8.5 thousand rubles, based on the applicant’s current income. The requests to change the amount of the debt were completely refused. The court indicated that it is not subject to recalculation.