How to write off loan debts? This question plagues many debtors who cannot service their obligations in a timely manner. In this article we will look at all the ways to write off debts that currently exist, and also give them an assessment.

- CAN ALL DEBT BE WRITTEN OFF?

- THE BANK WILL NOT HELP WRITE OFF DEBT

- DUBIOUS WAYS OF WRITTEN OFF DEBT

- BANKRUPTCY IS THE ONLY WAY TO COMPLETELY WRITT OFF DEBT

A mortgage for the purchase of a long-awaited home, a loan for a child’s education, a loan for urgent treatment, consumer loans for repairs, the purchase of household appliances—the reasons to take on an additional financial burden are becoming more and more every day.

TinkoffJournal, having analyzed the situation in the credit market, came to the conclusion that the debt burden of Russians has almost reached the level of government spending for the year - 17.6 against 19.5 trillion rubles! And these are only bank loans without taking into account debts to microfinance organizations - short-term loans have a high turnover rate: they are issued quickly and for short periods. Statistics show that Russians' debts on microloans amount to 165 billion rubles - 1% of the total debt obligations.

People with lower than average incomes mostly take on debt, and they have to spend at least 20% of the total budget on debt repayment - most often the burden of repaying the debt becomes unbearable and the question arises of how to write off loan debts.

Get a free consultation

Method one. Buying back your debt from a bank or debt collector.

From the point of view of the law, the creditor has the right to assign the claim for debt collection to another person. This stipulates the so-called “assignment agreement”. In practice, two main schemes for the redemption of credit debts by the debtors themselves

:

- the bank sells the debt to collectors, and the debtor buys the claim from them, acting independently or through representatives (lawyers);

- the debtor redeems the debt from the bank, acting through another individual, for example, a relative, or a legal entity, for example, his employer, brought in for the transaction.

General conditions for writing off debts from a bankrupt

Debt forgiveness through bankruptcy is a release from obligations. Such a decision can be made by the Arbitration Court or an official of the MFC. The debtor will not have his debt forgiven automatically, since bankruptcy is not a debt amnesty.

To get a write-off, you need to:

- confirm signs of insolvency and insolvency, i.e. prove to the court your objective inability to pay your obligations;

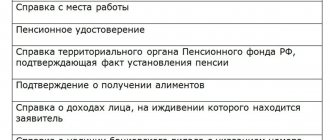

- submit to the court or MFC a complete set of documents required by law, comply with the requirements for their form and content;

- undergo mandatory checks and bankruptcy stages (their list differs for procedures in arbitration and the MFC).

There are additional conditions for write-off. For example, you can contact the MFC only for obligations from 50 to 500 thousand rubles, if the FSSP has completed the proceedings due to the debtor’s lack of assets. There are also risks of refusal to write off debts if the bankrupt violates the law and knowingly provides false information and documents.

Complete relief from debts does not occur if the court introduces a debt restructuring plan or if a settlement agreement is concluded between the debtor and creditors. But even in these options for completing bankruptcy, you can count on partial debt write-off. For example, under the terms of a settlement agreement, creditors have the right to release the debtor from part of the obligations in order to encourage him to pay off the bulk of the claims.

How much will debts be written off?

The amount of debt is important at the stage of initiating bankruptcy proceedings. For example, you can apply to the MFC if the amount of obligations is from 50 to 500 thousand rubles. A penny more or less - the MFC will not accept the application.

When going to court, the amount of debt is not that important. It also does not matter what size the creditors' claims will be at the time of completion of the sale. If the debtor has fulfilled all the requirements of the law, acted in good faith and completed the sale of assets, his debts will be written off for any amount.

But there is a catch here - even a conscientious debtor will not be released from some types of obligations. More on this below.

Method two. Repayment through the purchase of receivables.

Full repayment of the debt is possible for 5-10% of its amount through the acquisition of accounts receivable (debt of various types of organizations to other legal entities and individuals). The debtor acquires someone else's receivable, which subsequently becomes his property and through which he, in turn, pays off with his creditor. Another option in this case is to wait until the end of enforcement proceedings due to the claimant’s refusal to accept the debtor’s property.

Accounts receivable is, in principle, a very profitable asset. The main thing is to make the right choice, with which professional lawyers can help.

Video on the topic

Bankruptcy Law (127-FZ)

Author:

Vladislav Kvitchenko

CEO . Practicing lawyer in the field of bankruptcy of individuals. persons Since 2015, she has been successfully handling insolvency cases. Vladislav is brilliantly versed in bankruptcy law, gives expert comments on legal situations and actively publishes in specialized publications.

Method four. Challenging the creditor's claims.

A method in case your creditor files a lawsuit to collect the debt. In such a situation, you have the right to ask the court to refuse to satisfy the claim due to the creditor missing the statute of limitations or due to the recognition of the contract as invalid, not concluded, executed, etc. Again, it is better to contact a qualified lawyer for this service.

Qualified lawyers will advise you on the best way to write off debts in a particular case. In Krasnoyarsk, professional legal assistance is provided to debtors.

Debt write-off options

If you have accumulated large debts, but still expect to pay them off gradually, you can take advantage of various preferential programs:

- get a mortgage or credit holiday;

- conclude an agreement with the bank on debt restructuring or loan refinancing;

- receive executive holidays from bailiffs (this is a special installment plan for pensioners);

- defer or spread out payments in a lawsuit if the bank has filed a lawsuit for collection.

You can also wait until documents for retention are sent to your place of work. In this case, up to 50% of your salary will be withheld monthly, which will allow you to gradually pay off the entire debt. You can learn more about the nuances, advantages and disadvantages of each of these methods of action from our lawyers.

We will discuss options for completely writing off citizens’ debts below.

Debt forgiveness

The Civil Code of the Russian Federation allows debt forgiveness if the creditor makes such a decision. But it is almost impossible to imagine a situation in which credit institutions or microfinance organizations would take such a step.

Even if the statute of limitations has expired, the loan will not be written off, and collection will continue out of court.

Missing a deadline

After three years have passed since the delinquency occurred, the bank will have problems with collection. The debtor has the right to declare in court that the claim for missed deadlines is rejected. If such an application is submitted, the judge is obliged to consider and satisfy it.

But even the expiration of the terms does not guarantee that you can forget about the presence of debt:

- the bank can sell an overdue loan to a collection company, and the countdown of the statute of limitations for the new structure will begin from scratch, but only if you sign a document acknowledging the amount of the debt or make at least one payment (which is also a fact of acknowledging the debt);

- you can obtain a court order, which will be issued if there are no objections from the debtor;

- Since the statute of limitations on the loan is determined for each monthly payment, it is extremely difficult to count on a complete denial of claims.

Even if you manage to get your claim rejected, you will still be pestered with calls from collectors, bank employees or microcredit organizations. And even if they can’t get money from you, they will ruin your nerves.

Bankruptcy

Therefore, it is advisable to decide to go through bankruptcy. The Law on Writing Off Loan Debts describes the procedure for going through a bankruptcy case and the requirements for documents. Until September 2021, this could only be done through arbitration. The new law with amendments to 127-FZ provides for a simplified procedure through the MFC.

Declaration as bankrupt releases you from tax and credit obligations, and from housing and communal services debts. Only some personal obligations will not be written off. For example, these include alimony, wage arrears, compensation for property damage and harm to health.

In some cases, the debtor can choose which procedure to go through bankruptcy - through the court or the MFC. For example, if the amount of the overdue amount does not reach 500 thousand rubles, but the debtor’s insolvency is confirmed, he can apply to the MFC or the court. Below we will tell you what advantages and disadvantages the federal law on debt write-off 127-FZ provides for both options.

Method five. Bankruptcy.

If the debtor does not have enough income and property to fully pay off creditors, the court declares him bankrupt. A citizen declared bankrupt is exempt from further fulfillment of loan requirements.

What debts can be written off through bankruptcy:

- debts on loans and credit cards

- debts under loan agreements and receipts

- debts to microfinance organizations

- debts to housing and communal services

- tax debts

- debts from entrepreneurial activities of individual entrepreneurs

- debts under enforcement proceedings arising from the above debts

What law allows for the write-off of loan debts?

There is no point in hoping that banks will forgive you the loan or not collect the overdue payment. Until the borrower himself takes active steps to write off his debts, he will have to pay exorbitant interest, endure pressure from creditors, debt collectors and bailiffs, and often even hide about those who demand repayment of the debt.

To get rid of arrears on loans, taxes, housing and communal services, citizens can use Law No. 127-FZ “On Bankruptcy”. This is not the simplest procedure, so debt cancellation cannot be guaranteed 100%. And if you are going to start organizing your bankruptcy, you need to approach it thoughtfully.

To successfully go through a bankruptcy case, you need

:

- confirm the signs of your insolvency and insolvency - for example, indicate the fact that the period of arrears on the debt has already exceeded 3 calendar months. It is also necessary to indicate the amount of debt, declare the absence of property, disclose other circumstances that do not allow repaying debts, for example, report a decrease in income;

- send documents to the court or MFC. You must go to court if your debt exceeds 500 thousand rubles. Simplified bankruptcy through the MFC was introduced on September 1, 2021; you can use it if you are overdue from 50 and strictly up to 500 thousand rubles;

- go through the mandatory stages of the procedure - for judicial bankruptcy this is restructuring and (or) sale of property, and the simplified procedure involves checks at the MFC and 6 months of waiting for objections from creditors.

These are just general points that need to be taken into account when going through bankruptcy proceedings.

You can avoid payments on overdue loans if the bank misses the statute of limitations. This is only possible if the bank does not demand repayment of the debt for three years.

In this situation, it is necessary to promptly send to the judicial authority an application to terminate the case due to the expiration of the deadline. If you fail to do this, the judge may grant the claim even if the statute of limitations has expired.

Also keep in mind that denial of a claim due to deadlines does not prevent you from claiming debts out of court. The bank has the right to send out claims or call the debtor, or sell the debt to a collection agency. All demands for debt repayment can be completely stopped after the bankruptcy case is completed.

Can loans be written off automatically?

It is impossible to automatically write off debts, although such a bill in relation to various groups of the population, for example, whose income does not exceed 1 minimum wage per person in a family, has been tried more than once to be submitted to the State Duma of the Russian Federation.

Rejection of such an initiative is logical, since the state is obliged to protect not only the rights of borrowers, but also the interests of banks, microfinance organizations, housing and communal services and other creditors.

Writing off debts without court or bankruptcy is allowed only for certain types of taxes and fees on individuals. individuals and entrepreneurs. The tax amnesty applies only to debts deemed uncollectible. And the last time the state came up with such an initiative was in 2015.

When a judge refuses to write off all debts

A bankrupt may be completely refused to write off all debts, regardless of their type and amount. Such a decision will be associated with dishonest or illegal actions of the debtor.

A refusal decision may be made:

- if the court held the debtor administratively or criminally liable for violations committed during bankruptcy (for example, this includes fictitiousness, premeditation of bankruptcy);

- if it is confirmed by a court ruling that an individual the person did not provide the required information to the manager or the judge, or this information was deliberately unreliable (for example, if the debtor deliberately distorted information in the inventory);

- if it is proven that the debtor committed fraud when the obligation arose, maliciously and deliberately evaded repayment of the debt, or provided knowingly false information when receiving a loan;

- if the debtor deliberately destroyed or hid his assets from court inspections and from the administrator.

The court's ruling will indicate the reasons why the bankrupt was not released from his obligations. Most of the grounds for refusing to write off debt can be verified before filing for bankruptcy.

In order to avoid getting into a situation where debts are not written off, it is better to contact a lawyer in advance. It will be necessary to submit all documents about debts, property, current obligations and transactions in recent years. If there are real grounds for prosecution or refusal to write off debts, the lawyer will suggest other options for solving debt problems.

What debts are not written off during personal bankruptcy?

When the asset sale stage is completed, the manager draws up a report. It will indicate which of the creditors and in what amount the proceeds were sent. If the sale was not carried out due to the lack of property, this will also be indicated in the report. Based on the documents of the administrator, the court will decide on release from obligations.

Article 213.28 of Law No. 127-FZ specifies the grounds when a bankrupt will be denied release from obligations. There is also a list of debts that will remain after the bankruptcy of an individual. Creditors will be able to continue collecting on them.

Current payments

After opening a bankruptcy case, the debtor may have new debt obligations. They will also be repaid from the proceeds from the sale of assets. If current payments are not repaid after the sale, they will continue after the bankruptcy is completed. Typical examples of such obligations will be current payments for utilities, new traffic police fines, new receipts for borrowing money, microloans and other debts.

Obligations associated with the identity of the creditor

Some personal obligations will not be written off from the bankrupt, even if he has absolutely nothing to pay.

The list of such debts includes:

- compensation for harm caused to the health or life of the creditor;

- debts on wages, severance pay - in the event that the citizen is an individual entrepreneur with the right to hire employees;

- compensation for moral damage;

- alimony obligations.

The listed obligations will have to be paid until the debts are fully repaid, or until payments are cancelled. For example, the obligation to pay child support is canceled after the child reaches adulthood.

Debts under subsidiary liability

The so-called requirement for subsidiary liability of controlling persons is not subject to write-off of the debt of an individual declared bankrupt.

Such liability may arise for citizens who were previously decision makers in large and medium-sized companies: founders, chief accountants or financial directors of companies going through bankruptcy. If these debts were recognized for them by a court decision, and subsequently they themselves go bankrupt, then the court will not write off debts under subsidiary liability.

Other types of debt

There are also a number of debts from which the arbitration court will not release the bankrupt:

- claims that creditors did not know and could not know about at the time of completion of the sale of assets;

- losses that the bankrupt intentionally or through gross negligence caused to the organization while he was its founder or was a member of the management body;

- property damage caused intentionally or due to gross negligence;

- claims arising from challenging transactions and declaring them invalid.

For the listed requirements, creditors will receive separate writs of execution after completion of the implementation. Collection will continue through the bailiffs.