Individual entrepreneur fine for an unregistered employee

Registration of an employee in accordance with the Labor Code of the Russian Federation is the responsibility of the employer, including the individual entrepreneur. An individual entrepreneur is an individual who is registered in accordance with the procedure established by the Federal Law dated 08.08.2001 No. 129 and is engaged in business without forming a legal entity. An individual entrepreneur can be either with or without employees. An entrepreneur may have the following questions: how to register an employee, what will happen if this is not done?

- contributions to the Pension Fund, which will harm future pensions;

- revenues to the Social Insurance Fund - will harm payments for sick leave and unemployment benefits;

- deductions for health insurance - you can lose free medical care.

It often happens that individual entrepreneurs ignore employment contracts, which does not relieve them of responsibility if this fact is established, especially against the backdrop of tightened control. Legal entities more often commit violations and delays in registration. Both of them face very serious, albeit different, penalties for such violations.

If such offenses are detected repeatedly, and their scale is significant, we are talking about particularly large amounts of damage. In addition to a fine for the enterprise, the perpetrators will be punished personally: HR department employees are dismissed under the appropriate article (without severance pay), and the director can spend a long time on public works or “in places not so remote.” The punishment is determined depending on the degree of damage.

To establish and suppress violations in labor legislation, there are regulatory authorities. There are quite a few of them, but the most common “headache” directly related to employee rights is tax and labor inspections. The legislative system of inspections is based on Federal Law No. 294, and the tax office inspects enterprises in accordance with Chapter 14 of the Tax Code of the Russian Federation. Both of them can catch “illegals”.

Amount of Fine for Individual Entrepreneurs for an Unregistered Worker in 2021

A citizen of another state can only be employed if he is officially registered with the existing staff and an employment contract is drawn up with the necessary job responsibilities stated. If this clause is violated, the employer will be fined. A foreign citizen is fined 5,000 rubles and expelled from Russia.

The tax service will also pay attention to additional evidence of business activity. This includes having an established customer base and conducting regular payments with them in cash and non-cash form. The placement of advertising, the existence of contracts related to commercial activities (supplies, provision of services), and the issuance of promissory notes will also not be ignored.

Many people want to start a business. However, not everyone understands that such activities must be properly formalized. Legal ignorance, lack of time or malicious intent are often the cause of violations of the law. Ignoring the rules associated with registering a citizen as an individual entrepreneur entails liability. Let's try to figure out what the fine is for an unregistered individual entrepreneur and in what cases it applies.

The motives of an unscrupulous employer are absolutely banal:

1. Significant savings on “salary” taxes (no salary, no need to pay insurance premiums);

2. You can calmly deprive an employee of vacation or let him go for a few days at his own expense;

3. It is not necessary to pay sick leave;

4. If the employee is no longer needed, it is easy to get rid of him and, again, no severance pay, that is, the employer will not have to pay anything.

At the same time, during communication with a potential employee, an unscrupulous employer uses various manipulations. For example, an employer can argue its position by saying that the employee will not have to lose 13% of personal income tax from his salary every month. This is pure manipulation, for one simple reason: an officially employed employee has the right to paid leave and sick leave, which, based on the total amounts for the year, is almost equivalent to paying personal income tax.

In other words, if we consider the long-term period, the employee practically does not lose money on personal income tax.

Unfortunately, there are many such consequences. By renouncing his right to official employment, the employee, first of all, becomes completely dependent on the employer, namely:

● Loss of a job without explanation (in this case, the employer’s decision may be completely unexpected for the employee, for example, today he works, but tomorrow he no longer needs to come);

● Refusal to pay (very often unscrupulous employers use unregistered workers for a week or a month, and then fire them without paying a penny);

● There is no opportunity to go on vacation, since there are no guarantees that it will be possible to keep the job, and the employer will not pay vacation pay;

● You can easily lose your job due to illness; not every employer will want to wait for the employee to return; as you understand, you shouldn’t count on paid sick leave in this situation either.

In the current situation with the Covid-19 pandemic, many people have fully felt the consequences of being exposed to the arbitrariness of employers.

Thus, if in relation to officially employed citizens the state, at the very least, controlled the observance of their rights, then unregistered workers were literally left without a means of subsistence and out of sight of the state.

In addition to being dependent on an employer, there are other negative consequences. Work without registration does not form a length of service, and an unscrupulous employer does not make contributions to the pension fund and health insurance fund.

It means that:

● The employee may in the future lose his pension or a significant part of it;

● The employee will have to be content with the amount of social health insurance;

● If you lose your job when applying to the employment exchange, you can only count on a minimum unemployment benefit of 1,500 rubles, as a person who has never worked.

In fact, as practice shows, the benefits and savings of the employer in this situation are not justified by high legal and other risks. The shadow economy is becoming a thing of the past. In recent years, state control over business has increased significantly. The gray turnover of remuneration is becoming more and more transparent, and the employer’s responsibility is only growing.

At the same time, for example, inspections by labor inspectorates since 2018 can be carried out without prior notification of an upcoming inspection by the State Labor Inspectorate.

For violation of labor laws, there are currently many penalties, and in some cases, employers may be held criminally liable.

So, let's look at what exactly threatens the employer if regulatory authorities reveal facts of unofficial employment.

For individual entrepreneurs

An employee can send a registered letter to the manager with a request to sign an employment agreement with him. In the event of litigation, this letter will serve as evidence that the employee wanted to work officially, and the company’s management refused him this.

First fine for an unregistered worker

Books of income and expenses are tax accounting registers, and for their absence a fine of 10 to 30 thousand rubles is imposed under Article 120 of the Tax Code of the Russian Federation (if failure to keep records did not lead to an understatement of tax). If, during the audit, it turns out that as a result of lack of accounting, the tax payable was underestimated, then the fine will be 40 thousand rubles.

In addition to the listed fines for the activities of an individual entrepreneur, additional sanctions may be applied, especially if the intervention of the individual entrepreneur caused damage to other persons. In such cases, the punishment will be much more severe than with the official registration of an individual entrepreneur.

Conducting business activities without official registration can lead to rather dire consequences. This includes an increased risk of becoming a victim of fraudulent schemes and filing claims from law enforcement agencies.

When is a fine issued for the absence of an individual entrepreneur?

Many citizens engaged in entrepreneurial activities are looking for ways to avoid responsibility for their illegal activities. In order for an individual entrepreneur to be subject to an administrative fine for illegal activities without registering an individual entrepreneur, such a fact must be proven. Moreover, an important condition for proving such a fact is the establishment of systematic business activity. Punishment in such cases is imposed only by the court. Without a court verdict, the individual entrepreneur, in this case, does not have the right to fine.

If a foreign worker started work illegally or the employer did not inform the FMS that he was hiring him, then during the inspection he will be fined in the amount of 35 to 70 thousand rubles. In this case, a legal entity faces a fine of up to one million rubles.

We recommend reading: Benefits for labor veterans in Mordovia in 2021 from February

The employer faces even more serious liability in the event of illegal employment of foreigners. A separate violation will be the labor activity of a migrant without permits or a work patent. For this reason, company managers should be extremely careful when hiring foreign citizens. For example, they need to promptly notify the migration service of this fact.

For individual entrepreneurs

Unfortunately, informal employment is becoming more and more common today. It has its advantages and disadvantages, but, as mentioned earlier, it is a direct violation of the law. The main complaint against the employer is that in this way he evades the duties of a tax agent. And there is nothing surprising here - after all, if the employer is an individual entrepreneur or the head of a company, he is obliged to pay taxes to the budget and contributions for his subordinates to the Pension Fund. This violation threatens him with criminal liability. Therefore, the absence of an employment contract always raises many questions during an inspection by regulatory authorities.

- If the foreigner does not have permission for any type of activity;

- If a special permit has not been issued to attract a foreigner to work;

- If a contract has been concluded with a migrant under which he was not notified of the terms of work;

- When a foreign citizen works in a profession other than that specified in his work permit.

If the audit reveals that the employee has not been registered for several years, and taxes have not been paid for this period, then a criminal case will be opened against the individual entrepreneur, and a demand may be made for payment of insurance premiums for the lost period in full.

Responsibility for failure to register employees as legal entities. persons

- Removal of officials from work;

- Imposition of large fines on legal entities. person in the amount of up to 100,000 rubles;

- Imposition of fines on the head of an organization in the amount of up to 5,000 rubles;

- Suspension of activities for a period of 90 days;

- Criminal prosecution;

- Correctional work;

- Arrest for up to three years.

4. Tax audit. The tax office can check everyone who pays or must pay at least one tax. They have the right to come directly to your home with an on-site inspection - to check whether you have an illegal retail outlet or underground production in your home.

1. Advertising on social networks. Tax officials began monitoring social networks to identify those running a business without registration. So a photo of a cake sent to Target may become the basis for verification - you will be asked to appear and give an explanation.

How to identify illegal entrepreneurs

2. Buyer tips. Often illegal businessmen are identified after complaints. For example, noise from a hostel apartment, an unissued check, or poor quality of a cake. And testimonies of buyers, cash receipts, transfer acts or contracts for the provision of services will become evidence for both tax authorities and the courts.

The situation is particularly acute in the case of dismissal, since unscrupulous employers refuse final payment and do not pay compensation for unused vacation. It is almost impossible to recover these amounts in court, since there is no evidence of labor relations.

The employer did not register the employee. What are the consequences for both sides?

Tax officials have promised to collect the full amount of unpaid personal income tax from “salaries in envelopes” from 2021, not from the employee’s salary, but at the expense of the employer.

Thus, offended workers, who were previously afraid to complain about an unscrupulous employer for fear that they would have to pay the entire personal income tax, will now be active, turning to the court, prosecutors and labor inspectors.

They may do this not only out of a desire for revenge, but also in the hope that they will be able to restore their seniority, replenish their pension points, and at the same time recover vacation and sick pay from the employer.

Of course, the tax authorities will not leave an unscrupulous employer alone until they have collected from him all the amounts of insurance contributions to extra-budgetary funds. In addition to these amounts, various fines and penalties will be assessed, the amount of which will depend on the specifics of the specific situation. And the real chances of coming to the attention of the tax or labor inspectorate are growing every day.

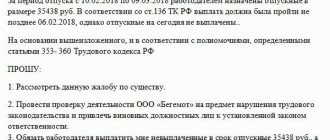

Parts 4 and 5 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation provide for a system of imposing penalties on employers for evading the execution of an employment contract.

So, if the offense was committed for the first time, then

● The guilty official will pay from ten to twenty thousand rubles;

● The individual entrepreneur will pay from five to ten thousand rubles;

● The legal entity will pay from fifty thousand to one hundred thousand rubles.

The amount within the specified penalties will be determined by the inspector, taking into account all the circumstances of the offense.

If the offense is repeated, the fines will increase:

● For individual entrepreneurs – from thirty to forty thousand rubles;

● For legal entities – from one hundred to two hundred thousand rubles. In addition, officials may be subject to disqualification for a period of one to three years.

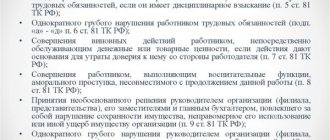

In cases where the volume of evasion from paying “salary taxes” (personal income tax and insurance contributions to extra-budgetary funds) over the past three years reaches a large or especially large amount, the employer may be brought to criminal liability simultaneously under several articles of the Criminal Code:

● 199 CC – evasion of taxes and insurance premiums;

● 199.1 of the Criminal Code – failure to fulfill the duties of a tax agent (we are talking about non-payment of personal income tax from an employee’s salary);

● 199.2 of the Criminal Code – concealment of funds or property of an organization from which taxes and insurance contributions should be collected;

● 199.4 of the Criminal Code – evasion of the employer from paying “accident contributions” (we are talking about insurance of accidents, industrial injuries and the prevention of occupational diseases).

● 159 of the Criminal Code - Fraud, which, as a rule, always goes in conjunction with the “tax articles” of the code itself.

Please note that large and especially large amounts, depending on the specific criminal offense, may be different amounts, directly indicated in the notes to the relevant articles of the Criminal Code.

- Late conclusion of an employment contract with an employee or absence of one. This means that the employee does not have official earnings and therefore does not pay personal income tax to the state;

- If the employee is not registered, then his length of service is not considered, and therefore there are no contributions to the pension fund. This will negatively affect the employee’s pension in the future.

- Medical institutions may refuse to provide medical services to an employee because he does not pay contributions to the health insurance fund.

Important!!! If a person is not officially registered at the enterprise, then he loses a number of guarantees and benefits, namely the accrual of vacation pay, sick leave pay, and settlement payments. And when bringing this issue to court, he cannot prove the occurrence of such moments.

Then how to avoid fines for unregistered employees at an enterprise, as well as administrative and criminal liability

Fines for an individual entrepreneur for an unregistered employee

If an entrepreneur does not agree with the fact of bringing him to administrative responsibility, then he has only 10 days to appeal it. To do this, he can file a claim in court, where he must state his version of what happened and attach a set of supporting documents. The complaint can be submitted by the entrepreneur personally or sent to him by mail.

We recommend reading: If a person has worked for 11

Is it possible to challenge a fine?

- The untimely conclusion of an employment contract with an employee or its absence leads to the fact that the state receives less taxes in the form of personal income tax.

- If the contract is not concluded, the employee does not have a length of service , and contributions to the Pension Fund are not paid for him, which negatively affects the amount of his future pension.

- An employee cannot count on receiving certain types of free medical care due to the fact that contributions to the Compulsory Medical Insurance Fund are not made for him.

- An employee cannot count on social benefits and guarantees provided by law : receiving sick leave payments, paid leave, maternity leave, etc.

All these bodies can begin to check the administration of the enterprise. The purpose of the inspection is thorough compliance with labor legislation. But for this to happen, you must apply through a written complaint.

The contract must include the following: last name, first name, patronymic of the person being accepted, his personal data (passport number and series, INN and SNILS numbers), residential address. The employee must provide documents confirming education and qualifications for the position held. The contract must indicate the type and nature of the work and the work week schedule. These are integral components of an employment contract that cannot be violated.

Reasons for imposing fines on company management

When a person is not officially registered at an enterprise, he loses his rights. He cannot achieve a number of payments, for example, vacation pay, sick leave payments, and final payment. And when addressing these issues to the courts, he will not be able to prove the occurrence of such moments.

This leads to the fact that the employee does not have official earnings, and therefore there is no payment to the state; If the contract is not concluded, the employee’s length of service is not counted and payments are not made to the Pension Fund, which will negatively affect the registration of an old-age pension; Medical institutions may refuse to provide free assistance to an employee of any organization due to the fact that contributions to the health insurance fund are not paid; When a person is not officially registered at an enterprise, he loses his rights.

From 1000 rubles to 5000 rubles or suspension of activities for 90 days, criminal entails a large number of unregistered workers or work without a contract for one employee, but for a long period, as well as non-payment of taxes in connection with illegal hiring on a large and especially large scale. From 100 thousand to 300 thousand rubles, but first you need to cover the tax debt, and then only pay the fine.

Fine for an unregistered employee

Then how to avoid fines for unregistered employees at an enterprise, as well as administrative and criminal liability. An individual entrepreneur must, by law, register all of his employees. In addition, since 2021, the responsibility of individual entrepreneurs for unregistered workers has become stricter. By neglecting to draw up an employment contract, the individual entrepreneur exposes not only the employee, but also himself.

If violations are recorded again, the company may be deprived of the right to continue operations. In this case, the inspection authority will be able to call the police and conduct an inspection in the presence of law enforcement officers.

Fine for an unregistered employee for individual entrepreneurs and LLCs in 2021

At enterprises of any form of ownership, the responsible persons for the employment and registration of employees are the director and employees of the personnel department.

If such a situation occurs, fines may be imposed directly on the director or HR inspector.

Also, the enterprise and responsible persons may incur the following types of liability: administrative and criminal.

| Guilty person | Amount of fine |

| Officials | From 1000 to 5000 rubles |

| For a legal entity | From 50 thousand to 100 thousand rubles or suspension of activities for 90 days |

Direct criminal liability of the employer for failure to draw up an employment contract is not provided for as such, but it may arise due to related offenses. Yes, Art. 199 of the Criminal Code of the Russian Federation (non-payment of taxes) provides for punishment in the form of a fine from 100 to 300 rubles, or imprisonment for up to 2 years. For similar acts committed on an especially large scale, the fine will be increased to 500 thousand rubles, and the prison term may increase to six years.

An entrepreneur must pay taxes on time and in full. Payment deadlines for different taxation systems are also indicated in our calendar. The fine for non-payment of taxes by individual entrepreneurs under Article 122 of the Tax Code of the Russian Federation is 20% of the amount of unpaid tax.

In addition, an entrepreneur, if he has employees, becomes a tax agent, and therefore must withhold personal income tax from their income and transfer it to the budget. For violation of the deadlines for transferring this tax, a fine is imposed on the individual entrepreneur according to the same rules, i.e. 20% of the amount not transferred.

Fine for failure to register an employee for individual entrepreneurs 2021

An individual entrepreneur is the same employer as an organization. You must conclude a written contract with your employee - labor or civil law. The fine for an individual entrepreneur for an unregistered employee is provided for in Article 5.27 of the Code of Administrative Offenses of the Russian Federation. This is an amount from 5 to 10 thousand rubles.

If this offense is discovered again, then the fine of an individual entrepreneur for an unregistered employee will increase significantly and will amount to from 30 to 40 thousand rubles. Moreover, an entrepreneur can be punished under this article even if his family members help him in business. It will most likely be necessary to prove that the help of relatives was gratuitous, inconsistent and did not have the nature of an employment relationship.

After the changes on the procedure for using cash registers came into force, there are very few situations left when the absence of a cash register is allowed.

A short delay (until July 1, 2021) for the installation of cash register systems is provided for individual entrepreneurs without employees who are engaged in:

- provision of services;

- performance of work;

- sale of products of own production.

The tax system on which the individual entrepreneur operates does not matter.

In addition, working without a cash register is now impossible when accepting online payments, as well as when receiving payment directly to an individual entrepreneur’s bank account if the buyer is an ordinary individual. The sanction for the absence of a cash register is established by Article 14.5 of the Code of Administrative Offenses of the Russian Federation. This is from ¼ to ½ of the sale amount, but not less than 10 thousand rubles.

For example, if a sale in the amount of 30 thousand rubles is recorded, then the fine may be 15 thousand rubles. And if the purchase was a penny, 100 rubles worth, then they will still charge 10 thousand rubles. That is, in this case, the fine for the absence of an online cash register for individual entrepreneurs will be 100 times greater than the sale amount!

If this evidence is not available, then bringing you to justice will be problematic. However, it is frankly difficult to conduct business without advertising and without indicating your presence in any way as a businessman. Therefore, it is better to figure out how to register an individual entrepreneur yourself and not be afraid of such consequences.

- testimony (of buyers, other sellers);

- advertisements that you regularly give on public platforms;

- the presence of an online store registered in your name (but everything there must be ready for sales);

- bank account statements, if the notes indicate the purpose of such a transaction;

- advertising in the media or on the Internet;

- any documents that confirm the transfer of products, provision of services or performance of work.

- Administrative. Applies if the violation is minor, for example, a new employee performed his duties without registration for 1-2 weeks. In this case, a fine of up to 5,000 rubles is imposed. If the violation is more severe, individual entrepreneurs may be prohibited from operating for up to 90 days. And this threatens serious losses and even loss of business.

- Criminal. This type of liability applies if it is discovered that for several years the individual entrepreneur used hired labor and did not pay taxes to the budget. The fine increases to 300 thousand rubles. Also, by a court decision, the entrepreneur may face imprisonment of up to 2 years.

For violation of immigration laws

If it is revealed that there is a violation of the legislation on the employment of migrants, then a fine for a foreign worker for an individual entrepreneur will be imposed not only on the employer, but also on the personnel officer who registered (accepted) the foreigner. Also, the employee will not escape punishment.

For violation of labor protection conditions

- a foreign visa-free specialist (for example, from Belarus) has not acquired a patent;

- the businessman did not receive a quota, but hired a visa migrant;

- the entrepreneur did not inform the Ministry of Internal Affairs that he hired or fired a migrant;

- a citizen of another country works in a specialty other than that for which he received a patent or quota.

Responsible for the correct and timely registration of employees of enterprises owned by legal entities are the director and employees involved in personnel selection. However, if the scale of violations is insignificant, they are not personally responsible for the enterprise’s failure to comply with these standards. If violations are detected, the company pays a fine. However, the matter will be limited to a fine for the enterprise only if individual and unsystematic facts of violations have been identified. If persistent violations are recorded, staff recruiters may be fired, and the director of the enterprise may be sentenced to prison or community service.

As a punishment, imprisonment for a term of up to two years is also possible, the latter means the awarding of a real, not a suspended sentence. A conviction to stay in prison is also unpleasant because along with it comes an automatic ban on the convicted person from engaging in entrepreneurial activity in the area where the offense that resulted in the conviction was committed.

We recommend reading: Group 3 Disabled People What Pension?

Liability of a legal entity in 2021

Fines for enterprises owned by legal entities for an unregistered employee start at one hundred thousand rubles. Criminal liability for employees of an enterprise where unregistered workers worked depends on the severity of the damage caused. However, it is not the same in comparison with the criminal penalties that private entrepreneurs face.

Masha decided to unload her wardrobe and is selling her dresses on Avito, and Nastya sews jeans in an improvised atelier at home. None of the girls are registered as individual entrepreneurs and pay taxes. One of them does not violate anything, while the other is engaged in illegal business. We tell you who and how can be punished for illegal business and how violators are identified.

Fine for an unregistered employee

- The absence of an employment contract leads to non-payment of personal income tax (personal income tax) to the budget.

- There are no transfers to the Pension Fund, which affects the size of a person’s future pension.

- Lack of payments to the social insurance fund leads to the loss of state guarantees in the form of sick leave, maternity leave and unemployment benefits.

- Contributions to health insurance are not made from the salary of an unregistered employee; the person may lose the opportunity to receive free care in a hospital or clinic.

Attention! It is advisable for the employee to find witnesses who can confirm the fact of his employment at this enterprise. They will most likely have to appear in court and confirm that this company employee carried out the instructions received from the company administration.

- testimony (of buyers, other sellers);

- advertisements that you regularly give on public platforms;

- the presence of an online store registered in your name (but everything there must be ready for sales);

- bank account statements, if the notes indicate the purpose of such a transaction;

- advertising in the media or on the Internet;

- any documents that confirm the transfer of products, provision of services or performance of work.

It often happens that individual entrepreneurs ignore employment contracts, which does not relieve them of responsibility if this fact is established, especially against the backdrop of tightened control. Legal entities more often commit violations and delays in registration. Both of them face very serious, albeit different, penalties for such violations.

Unpleasant consequences will also await the employees themselves. They will not receive any guarantees, including support from the state. They also won't have to rely on paid vacation or sick leave. In addition, they are unlikely to be able to defend their interests in the event of litigation.

The question arises of how to avoid a fine for an unregistered employee, as well as administrative and criminal liability. The main thing is to legitimize the relationship between the employer and the employee in a timely and correct manner.

Violations are determined by a desk or field inspection. Tax officers have the right to familiarize themselves with documentation for the current year and the previous 3. It is allowed to interview witnesses, inspect premises, and confiscate documents. Tax officials must have permission to check. Based on the results of the event, a certificate is created, on the basis of which a report is drawn up with violations and recommendations for their elimination, for which 2 weeks are allocated.

An employee can send a registered letter to the manager with a request to sign an employment agreement with him. In the event of litigation, this letter will serve as evidence that the employee wanted to work officially, and the company’s management refused him this.

Books of income and expenses are tax accounting registers, and for their absence a fine of 10 to 30 thousand rubles is imposed under Article 120 of the Tax Code of the Russian Federation (if failure to keep records did not lead to an understatement of tax). If, during the audit, it turns out that as a result of lack of accounting, the tax payable was underestimated, then the fine will be 40 thousand rubles.

In addition to the listed fines for the activities of an individual entrepreneur, additional sanctions may be applied, especially if the intervention of the individual entrepreneur caused damage to other persons. In such cases, the punishment will be much more severe than with the official registration of an individual entrepreneur.

Conducting business activities without official registration can lead to rather dire consequences. This includes an increased risk of becoming a victim of fraudulent schemes and filing claims from law enforcement agencies.

No contract

A written employment contract guarantees that the employee receives payment for work done, vacation or sick leave. It defines job responsibilities, records working conditions, wages and other important features of the relationship with the employer.

Types of violations during hiring

If three days after the start of work the employment contract has not been drawn up, the employee needs to read the employment order and make sure that an entry has been made in the work book. The employer should also be reminded of his obligation to properly formalize the employment relationship. If the employee does not take care of this, then in the future he will have to recover the money earned through the court.

Conducting business activities without official registration is fraught with various unpleasant consequences. This includes an increased risk of becoming a victim of fraudsters and unfriendly attention from law enforcement agencies. If you provide services without an individual entrepreneur, you will be subject to a fine. Which one, in what case? In fact, there are several fines, so you need to delve into this issue.

We recommend reading: Who enters information about sick leave into a disability certificate

What is the penalty for working without an individual entrepreneur in 2021?

For an employee, this mode of work has both its pros and cons.

| Advantages | Flaws |

| The employee is paid a higher salary because taxes and other payments are not withheld from him | The employer may not provide leave at all, or only a small number of days, and may not pay for it |

| Since there is no official contract, the employee cannot be held liable for damage to property, embezzlement, etc. If the employer puts pressure, you can always submit an application to the regulatory authorities. | Payment for sick leave may not be made at all, or not in full |

| Amounts under writs of execution are not deducted from wages | Special assessments are not carried out at work sites; special clothing is most often missing |

| You can work even in situations where the law prohibits this or limits opportunities (teenagers, pensioners, etc.) | Time worked does not count towards pensionable service. |

| An employee can be fired at any time, and management may not give out the money earned at all. |

Most often, it is the employer who initiates the work without drawing up a contract. This situation is beneficial, first of all, for him.

Let's consider the advantages and disadvantages of an unconcluded employment agreement for a company:

| Advantages | Flaws |

| You can save money that the employer would normally transfer to social funds (up to 35% of the salary). This represents a significant amount of savings. | If an employee damages or loses company property, he cannot be held liable, since there is no such agreement between the parties. |

| The procedure for hiring new employees and firing them is significantly simplified. Since no paperwork is completed, the employee begins to perform duties immediately. You can also fire within 5 minutes. | If the unofficial registration becomes known to the inspection authorities, this will result in serious fines for the company, and for the director in some situations - criminal punishment. |

| If necessary, the administration can involve employees in working overtime, on weekends, etc., and sometimes without proper payment for their labor. In case of refusal, it is possible to immediately fire such a person. | |

| The company can save money if there are downtime, interruptions in operations, etc. - the administration may simply not pay for them. | |

| If there are no officially employed employees, then maintaining personnel records is significantly simplified; there is no need to draw up and submit special forms. | |

| The administration may not comply with the social guarantees established by law - pay sick leave, vacations, etc. |

The responsibility of the employer-company for failure to draw up an employment contract is quite serious than that of entrepreneurs.

For minor violations, a fine can only be issued to the organization. However, if the number of unregistered workers is significant, then the officials and the manager bear the punishment.

The fine starts from 50 thousand rubles. If there are large volumes of unpaid taxes, the case may be transferred to criminal status.

Working without an employment contract is the responsibility of the employer-manager in both administrative and criminal cases.

In case of administrative liability, a fine of up to 20 thousand rubles or disqualification of up to 3 years is imposed.

If the case is transferred to the criminal category, the fine will be from 150 thousand rubles, and there may also be imprisonment for up to 2 years.

The step-by-step procedure for applying for a job with an individual entrepreneur is as follows:

- The applicant writes an application for employment according to the staffing schedule.

- The individual entrepreneur introduces the candidate (against signature) to the internal labor regulations, other local regulations that relate to his work, and the collective agreement.

- An employment contract is drawn up. When concluding it, the employee must present certain documents listed in Art. 65 TK. When it comes to a foreign citizen or stateless person, they additionally provide the documents listed in Art. 327.3 Labor Code An agreement is drawn up in writing in two copies - one each for the employee and the employer, each must be signed by the specified persons. Art. says what should be indicated in the text of the contract. 57 TK. For foreigners and stateless persons, information from Art. 327.2 TK. This document comes into force from the moment of signing by the parties (otherwise may be established by the Labor Code, other Federal Laws, other regulatory legal acts of the Russian Federation or an employment contract) or from the day when the employee is actually allowed to work with the knowledge or on behalf of the employer or his authorized representative. In fact, they can be allowed to work without drawing up an employment contract for three working days. In general, this document already indicates the formality of labor relations.

- An employment order is being prepared (Form No. T-1).

- A personal card is created for the employee.

- A corresponding entry is made in the work book.

What threatens employers for unregistered employees?

For employers, the use of informal employment seems, at first glance, beneficial, as it leads to lower costs and increased profits. However, if sanctions are applied to an enterprise (fines, bans on activities, etc.), the effect may be negative, the FSS office in Sevastopol warned.

Administrative liability has been established for evasion or improper execution of an employment contract or the conclusion of a civil contract that actually regulates the labor relationship between the employee and the employer. The commission of this administrative offense entails the imposition of an administrative fine on officials in the amount of 10 to 20 thousand rubles; for individual entrepreneurs - from 5 to 10 thousand rubles; for legal entities - from 50 to 100 thousand rubles.

Actual admission to work by a person not authorized to do so by the employer, in the event that the employer or his authorized representative refuses to recognize the relationship that has arisen between the person actually admitted to work and this employer as labor relations (does not conclude with the person actually admitted to work for work, employment contract), entails the imposition of an administrative fine on citizens in the amount of 3 to 5 thousand rubles; if the violator is an official, then the monetary penalty will be from 10 to 20 thousand rubles.

The commission of these administrative offenses by a person who has previously been subjected to administrative punishment for a similar administrative offense entails the imposition of an administrative fine on the individual entrepreneur - from 30 to 40 thousand rubles; for legal entities - from 100 to 200 thousand rubles, and for officials - disqualification for a period of 1 to 3 years.

If the organization has not concluded a written employment contract with the hired employee, then liability arises both for the organization itself and for the official who committed such an offense. In this case, the director (official) will have to pay a fine, and in case of repeated violation, he will be disqualified. The organization is also subject to fines.

If the listed facts are established, then there is a high probability of being held liable for other violations related to unofficial employment, the FSS warned.

One of the consequences of using the informal employment scheme is violations related to non-payment of taxes and insurance contributions. Unofficial employment automatically entails a violation of Art. 123 NK. It provides for a fine of 20% of the arrears incurred. Its payment will not relieve the employer from transferring both the tax itself and penalties to the budget.

In addition, the employer risks being held liable under Part 3 of Art. 122 NK. We are talking about deliberate non-payment of insurance premiums. The company or individual entrepreneur will be forced to pay a fine of 40% of the arrears, transfer all debt to the funds and penalties.

If the employee is not officially issued an IP fine 2021

If the individual entrepreneur ignores the above procedure, he will not transfer personal income tax to the state budget for an unregistered employee, which will cause damage to the state. For an employee this will mean the absence of:

- contributions to the Pension Fund, which will harm future pensions;

- revenues to the Social Insurance Fund - will harm payments for sick leave and unemployment benefits;

- deductions for health insurance - you can lose free medical care.

Under these circumstances, the individual violator will face administrative or criminal liability.

Its type depends on the period during which the worker was not registered, and, accordingly, mandatory payments were not received for him. This will allow you to calculate the amount of damage caused.

- The individual entrepreneur has not registered the employee - what will be the fine?

- Individual entrepreneur fined for unregistered seller

- What fine will an individual entrepreneur have for an unregistered driver?

- How to avoid a fine for an unregistered employee

- How an individual entrepreneur can avoid registering an employee and not receive a fine

If an individual entrepreneur has not registered an employee-driver, it is quite easy for regulatory authorities to identify violations in the field of labor legislation. Any traffic offense, when issued a protocol, will show the unofficial employment of such an employee. For working without an employment contract (if the offense is committed for the first time) you face a fine of 5-10 thousand rubles.

You can try to register unemployed workers under a contract. Only this must be a deliberate decision - the Federal Tax Service checks the availability of contracts with individual entrepreneurs, and such contracts are always under special control. And the following nuances can aggravate mistrust:

- An individual entrepreneur providing contract services is a former employee;

- remuneration under a contract is paid 2 times a month (as a salary);

- the contractor works according to the working hours of the employees;

- the contract actually masks the employment relationship.

If the tax authorities have convincing evidence that the contract was concluded for the purpose of deception, they will definitely demand that it be converted into an employment contract, and then a fine for the lack of an employment contract cannot be avoided.

The entire fiscal burden of an entrepreneur can be divided into two groups. The first of them is controlled by tax authorities, and the second by the Federal Tax Service of the Russian Federation (Law No. 125-FZ dated July 24, 1998 “On Mandatory...”).

| Name | Sum | Article of the law | Sanctions | |||

| fine under the Tax Code of the Russian Federation / Law 125-FZ | fine under the Criminal Code of the Russian Federation, thousand rubles. | forced labor, years | imprisonment, years | |||

| Taxes and fees, contributions to the Pension Fund, Compulsory Medical Insurance, Social Insurance Fund (except for accident insurance) | up to 900 thousand rubles. for 3 years or up to 2.7 million rubles. | Art. 122 Tax Code of the Russian Federation | 20% or 40% of arrears | — | — | — |

| above the specified amounts | Art. 198 of the Criminal Code of the Russian Federation | up to 500 | until 3 | until 3 | ||

| "Unfortunate" insurance premiums | up to 600 thousand rubles. for 3 years or up to 1.8 million rubles. | Art. 26.29 of Law No. 125-FZ | 20% or 40% of arrears | — | — | — |

| above the specified amounts | Art. 199.3 of the Criminal Code of the Russian Federation | up to 300 | up to 1 | up to 1 | ||

Tax evasion is punished depending on whether intent has been proven. If a tax, fee or contribution was not paid by mistake, then the fine will be 20% of the arrears, and if the concealment of tax income was intentional - then 40%.

How to find out if an employer has fines for foreign workers

- Foreigners working in the Russian Federation must obtain a Taxpayer Identification Number (TIN) and become taxpayers. The corresponding document is assigned at the time of receipt of the patent;

- To work in the Russian Federation, a migrant must obtain health insurance. He can arrange it himself or through the employer;

- Foreign students can only work in the area where the educational institution is located;

- A migrant who wants to become a driver must obtain a driver's license in the Russian Federation.

For failure to notify the Main Directorate for Migration Affairs of the Ministry of Internal Affairs

These can be citizens of Russia or any other country. However, the employment of foreigners must take place within the framework of Labor legislation. Responsibility is provided for violation of the established procedure.

Failure to pay taxes, fees and insurance contributions Failure to submit a tax return and reporting on other obligatory payments Responsibility for an unregistered employee Punishment for the lack of an online cash register Activities of individual entrepreneurs without OKVED Administrative liability of entrepreneurs Criminal liability of individual entrepreneurs Civil liability for the obligations of individual entrepreneurs Comparison of liability of LLC and individual entrepreneur How without losses complete activities and liquidate the individual entrepreneur. Conclusion An individual entrepreneur (IP), as an economic entity, has a dual status. On the one hand, he is the owner of a business, sometimes quite large, and on the other, he is an ordinary individual. This situation has both positive and negative sides for a businessman.

However, not everyone understands that such activities must be properly formalized. Legal ignorance, lack of time or malicious intent are often the cause of violations of the law. Ignoring the rules associated with registering a citizen as an individual entrepreneur entails liability.

Fine for unregistered worker from 2021

Its norms are detailed and clarified by acts of the Russian Ministry of Labor, as well as documents of other federal departments. Judicial practice is of great importance in regulating employment. Hiring an employee includes the following stages: Stage Brief description Verification (interview) Employment contracts are concluded with citizens of the Russian Federation who have reached 16 years of age.

Consequences for an entrepreneur for an unregistered employee If a violation is identified, the following negative consequences may occur for a business entity. Firstly, this is an additional assessment of unpaid taxes and fees.

We recommend reading: MFP kyocera ecosys m4125idn printer copier scanner which depreciation group belongs to

Fine for unregistered individual entrepreneur 2021

Since 2021, changes introduced to the law of May 22, 2003 No. 54-FZ “On the use of cash register equipment...” have come into force. They provide for a phased transition to new cash register models that transmit information about completed transactions via the Internet (online cash registers) to the Federal Tax Service of the Russian Federation.

In 2021 and until July 1, 2019, individual entrepreneurs without a cash register can only work if they belong to certain categories. In particular, we are talking about individual entrepreneurs using “simplified taxation” or “imputation”, provided that their types of activities belong to the preferential list. All categories of businessmen entitled to a deferment in the use of cash registers are listed in detail in Art. 7 of the Law of July 3, 2016 No. 290-FZ “On Amendments...”.

Sanctions for non-use of cash registers are provided for in paragraphs 2 and 3 of Art. 14.5 Code of Administrative Offences. For an entrepreneur, financial liability will be from 0.25 to 0.5 of the settlement amount, but not less than 10 thousand rubles. If the violation is committed repeatedly, and the amount of settlements exceeds 1 million rubles, then the activities of the individual entrepreneur may be suspended for up to 90 days.

The OKVED code shows what types of activities the individual entrepreneur is engaged in.

Strictly speaking, an individual entrepreneur cannot work without OKVED at all. If, when submitting an application for registration, he does not indicate any types of activity at all, then the documents will be returned for revision.

However, the direction of the business may change during the process. In this case, the individual entrepreneur is obliged to report the new OKVED to the registration authority within three working days (Clause 5, Article 5 of Law No. 129-FZ of 08.08.2001 “On State Registration...”).

If the individual entrepreneur does not provide this information, he may be fined from 5 to 10 thousand rubles. (Clause 3 and 4 of Article 14.25 of the Code of Administrative Offenses of the Russian Federation).

Criminal liability of an individual entrepreneur in many cases arises on the same grounds as administrative liability, but in the presence of aggravating circumstances. This applies not only to taxes, but also to other areas of a businessman’s activity.

For example, if an activity without registration or without a license resulted in the receipt of income in the amount of more than 2.25 million rubles, then it is already regarded as illegal business (Article 171 of the Criminal Code of the Russian Federation). Punishment in this case is applied in the form of a fine in the amount of up to 500 thousand rubles. or imprisonment for up to 5 years.

Similarly, if the delay in wages exceeds two months, then Art. 145.1 of the Criminal Code of the Russian Federation. The fine can be up to 500 thousand rubles, and the term of imprisonment can be up to 5 years.

Manager's responsibility for non-payment of wages

As part of its activities, an individual entrepreneur may incur various obligations - for the payment of wages to employees, settlements with counterparties, taxes, etc. The status of an individual entrepreneur leads to the fact that for debts related to business, collection can also be applied to the personal property of the entrepreneur (Article 24 of the Civil Code of the Russian Federation).

However, not all types of property can be used to pay off debts. This is established by Art. 446 Code of Civil Procedure of the Russian Federation. In particular, property liability does not apply to the only living space, clothing and ordinary household furnishings (except for luxury items), the minimum supply of food, etc.

Fine for failure to register

Unpleasant consequences will also await the employees themselves. They will not receive any guarantees, including support from the state. They also won't have to rely on paid vacation or sick leave. In addition, they are unlikely to be able to defend their interests in the event of litigation.

Causes

In both cases, the labor inspectorate will issue a fine to the organization for violating the norms of the Labor Code of the Russian Federation, since the employee is not officially registered. For individuals it will be from 5 to 10 thousand rubles, for legal entities - from 50 to 100 thousand rubles. The official responsible for personnel records will be fined from 10 to 20 thousand rubles.

In what cases are fines not imposed on individual entrepreneurs for an unregistered employee? If a person performs one-time work for an entrepreneur that lasts no more than three days. In all other cases, if violations are detected, punishment is provided for the individual entrepreneur. What is the fine of an individual entrepreneur for an unregistered employee per year?

At the same time, the legislation allows you to make some deviation from the rules and not register business activities. For example, if citizens work under civil contracts. But there are pitfalls here too. If the relationship arising under such contracts is recognized as labor, then you will have to pay a fine for an unregistered individual entrepreneur. The law also provides for additional sanctions for non-employment of an employee, including the payment of insurance premiums for him.

Responsibility for illegal business

Proving illegal business activity is a labor-intensive process. The tax service does not always closely check everyone who, for some reason, is an unregistered entrepreneur. Typically, the Federal Tax Service begins to check a person for business registration if there are complaints from affected persons. If the above signs are identified, the tax authorities will issue a fine for an unregistered individual entrepreneur.

- For what reasons is the director of the company imposed if the employees are not officially registered;

- What is the employer's responsibility in case of incorrect registration of migrants;

- What you need to consider when hiring foreign illegal immigrants;

- The amount of fines that are imposed on individual entrepreneurs and legal entities for inappropriate employment of employees.

- What is the responsibility of the legal entity in this case;

We recommend reading: Renunciation of Kyrgyz citizenship in St. Petersburg 2021 application letter

We recommend you study! Follow the link: It is difficult to hide the presence of employees from the tax inspectorate, even if they do not work in plain sight. We recommend you study! Follow the link: Every entrepreneur submits reports to the regulatory authorities, and very often the turnover indicates that the activity was carried out not only on its own. Employer's responsibility:

Fines for an individual entrepreneur for an unregistered employee

Any work must be formalized, be it the establishment of labor relations with a hired worker of an individual entrepreneur, with an employee of an LLC, a state-owned enterprise, or a company. What are the dangers of neglecting these responsibilities?

The contract must indicate: - last name, first name and patronymic of the employee; - details of the employer; - position of the hired employee; - signatures of the employer and employee. The TD must be issued within three days. Delays, errors in its preparation, inaccurate data or its absence at all can lead to penalties, even criminal liability. Depending on who uses hired labor - an individual or a legal entity - employers are assigned different responsibilities. In case of administrative violations of individual entrepreneurs may receive penalties in the amount of 1000 to 5000 rubles.