Penalty in 44-FZ

According to 44-FZ, the state contract must provide for the amount of penalties that the procurement parties will have to transfer to each other’s accounts in the event of poor performance of obligations. The fine is paid by the culprit, even if it was not specified in the contract. In this situation, the amount is fixed and depends on the cost of the goods (Article 332 of the Civil Code of the Russian Federation).

Penalties are accrued for each day of delay by the parties in fulfilling their obligations in the amount of 1/300 of the key rate of the Central Bank of the Russian Federation established on the day of payment of the sanctions.

Part 4 of Article 34 talks about the mandatory inclusion in the contract of a liability clause for both the supplier and the customer in the event that the parties have not fulfilled or performed their contractual obligations poorly.

It is necessary to include in the contract all cases in which a fine may be imposed in order to avoid evasion of responsibility on the part of the contractor.

The current legislation states that payment of penalties for delay, improper performance or failure to fulfill obligations can be avoided if the organization has irrefutable evidence that the conditions were not fulfilled due to force majeure or the fault of a third party (Part 9 of Art. 34 44-FZ). In other cases, payment of sanctions must be made without fail.

Everyone is equal before the court

In the Kaliningrad region, the budget debt has decreased over the past year and a half from 500 million to 214 million rubles. According to regional business ombudsman Georgy Dykhanov, this was partly due to new fines, partly due to a more active position of regional authorities and control and supervisory authorities.

“Now the main thing is not to stop legislative work,” Georgy Dykhanov emphasizes. — It is necessary to ensure that officials who have incurred debts are personally responsible to entrepreneurs. Let me give you a specific example. The Kaliningrad construction company, which built a sports and recreation complex, a kindergarten, wastewater treatment plants and several other important facilities in the region, is now in bankruptcy due to budget contracts not being paid on time. Even if the officials who provoked the crisis pay fines to the budget, this will not help the entrepreneur.

To introduce personal liability of the customer to the contractor, a whole set of amendments to federal regulations will be required. This legislative work will take years. But there are also reforms that will have a quick positive effect and that can be carried out quite quickly. We are talking, for example, about equal rights of entrepreneurs and officials in the eyes of the court.

“A state or municipal authority does not have to pay a fee to initiate legal proceedings with a contractor,” continues Georgy Dykhanov. “Officials are actively taking advantage of this and going to court with various claims in order to delay payment of the contract. Even if the court ultimately finds the claim unfounded, the customer will not bear any responsibility. And the entrepreneur will be without money the entire time the proceedings last. It seems to me that judicial procedures should be paid for both authorities and entrepreneurs. Both of them in this situation act as parties to economic activity. In order for the budget to allocate money to pay the fee, officials will have to justify the need to go to court. And then bear responsibility if the spending of budget funds turns out to be ineffective.

Normative legal acts

To find the necessary information about penalties, you should refer to the following documents proposed by law:

- In the Civil Code of the Russian Federation: Art. 530, 533, 534, 384, 720, 783.

- In 44-FZ: Article 34.

- Decree of the Government of the Russian Federation of August 30, 2017 No. 1042 “On approval of the Rules for determining the amount of a fine...” (hereinafter referred to as Decree No. 1042). It is this document that customers rely on when calculating penalties. The current liability measures related to the execution of the contract are reflected here. Courts and regulatory authorities use them in their activities.

Resolution No. 1042 states that the amount of the fine directly depends on the amount of the contract. The procedure for calculating fines for representatives of SMP and SONCO is given. And also for fines when bargaining is carried out for an increase (in this case, the law is to protect the customer). There is an emphasis on an important point: for each violation it is necessary to impose appropriate penalties.

In the Resolution you can find the term “cost obligation”. What does it mean? According to Article 424 of the Civil Code of the Russian Federation, contractual obligations that can be expressed in monetary terms are called value Thus, obligations that cannot be expressed in monetary terms will be non-valuable

On August 14, 2021, Decree of the Government of the Russian Federation No. 1011 dated August 2, 2019 . It makes changes to Resolution No. 1042. What has changed in the new regulations? The adjustments affected fines.

- Now fines, by analogy with penalties, are not calculated according to the norms of RF Resolution No. 1042. The legislation of the Russian Federation establishes a different procedure for calculating fines. This is stated in paragraph 13, which was not previously in RF PP No. 1042.

- Clause 4 of this resolution has been completely changed. Now fines for non-fulfillment or improper fulfillment of procurement obligations carried out only for representatives of SMP and SONCO are set at the same amount. This is 1% of the price of the contract or its stage, but not less than 1 thousand rubles. and no more than 5 thousand rubles.

- The rules for calculating the fine for the contractor who signed the contract at the highest price (when bidding for the right to conclude) have become more complex. Now, if the contract price is less than the NMCC, then the penalty is:

10% NMCC if the contract price is less than 3 million rubles; 5% NMCC, if the price is 3-50 million rubles; 1% NMCC, if the price is 50-100 million rubles.

If the contract amount is higher than the NMCC, then the penalty is:

10% of the contract price if the contract price is less than 3 million rubles; 5% of the contract price if the price is 3-50 million rubles; 1% of the contract price, if the price is 50-100 million rubles.

The difference between the first and second cases is obvious: in the first case, interest is taken from the NMCC, and in the second - from the contract price.

- The instructions regarding the total amount of the penalty have changed. Previously, it should not have exceeded the contract price. From August 14, this amount does not include penalties. That is, the total amount of accrued fines for both the customer and the contractor should not exceed the contract price.

As for the calculation of penalties, it essentially has not changed. In Resolution No. 1042, the clause regarding how penalties are calculated by the customer for late fulfillment of obligations by the supplier has become invalid. The name of the Resolution has also changed: “Rules for determining the amount of the fine accrued in the event of improper performance by the customer, non-fulfillment or improper fulfillment by the supplier (contractor, performer) of the obligations stipulated by the contract (except for delay in fulfillment of obligations by the customer, supplier (contractor, performer)."

Thus, on August 14, RF PP No. 1042 does not regulate the rules for calculating penalties, but establishes a procedure only for fines.

The calculation of the penalty has not changed - it is specified in Parts 5 and 7 of Article 34 of 44-FZ.

Late payment under contracts will result in fines.

As of August 6, 2017, penalties were introduced for failure to meet payment deadlines to suppliers. This is done to ensure that customers comply with the 30-day payment deadline, which has been in effect since May of this year.

As of August 6, 2017, penalties were introduced for failure to meet payment deadlines to suppliers. This was done to ensure that customers adhere to the 30-day payment period, which has been in effect since May of this year. We will tell you about the size of the fines that will apply, as well as what payment deadlines customers need to adhere to when working with various categories of suppliers in order to avoid penalties.

Who will be fined and how much if payment deadlines are not met?

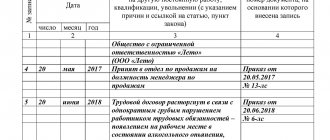

Now customers will be fined for violating deadlines and payment procedures. Penalties are also imposed for late payment of advance payments. In this case, controllers will apply Art. 7.32.5 Code of Administrative Offences. It was introduced by Law No. 189 of July 26, 2021.

It is worth paying attention to the fact that the fine for late advance and payment will be 30 - 50 thousand rubles. Penalties will be imposed on the officials responsible for payment. In case of a single violation, only payment of a fine is provided, and in case of a repeated violation, the responsible person may be subject to disqualification for 1 - 2 years.

Deadlines for settlements with suppliers

Law No. 83 dated May 1, 2017, which came into force on May 1, 2017, changed the terms for settlements with suppliers. Now, if the supplier is SMP or SONO, payment must be made later than the 15th day (working day) following the day the acceptance document was signed. As for other suppliers, settlements will need to be made with them within 30 days (calendar).

How to calculate deadlines in working days and calendar days

Payment terms for SONO and SMP are calculated in working days, and for settlements with other suppliers, calendar days are taken. With SONO and SMP suppliers, the settlement period begins on the day (working day) that follows the day of signing the acceptance document. With other suppliers, the starting date is the calendar day that follows the acceptance date. In this case, weekends are included in calendar days.

When do you need to pay with SONO and SMP?

If the supplier is SONO or SMP, then the customer must make payment no later than the 15th day (working day) following the day of signing the acceptance document. The terms of the contract with SONO and SMP must specify that the payment period is calculated in working days. This condition applies only when concluding direct contracts with SONO and SMP. If they act as subcontractors, then the calculation is made on general terms, that is, no later than the 30th day (calendar) from the date of signing the acceptance document (Government Decree No. 1466 of December 23, 2016). Table No. 1. Payment terms for small businesses

| Provider | Payment period | |

| 1. | SONO and SMP - direct contract | 15 days (working days) |

| 2. | SONO and SMP – subcontracting | 30 days (calendar) |

When to pay other suppliers

For other suppliers, the payment deadline is the 30th (calendar) day from the day following the signing of the acceptance document. If the payment deadline falls on a weekend, it can be made on the nearest (working) day following it. For contractors providing supplies in the field of security and defense, the payment deadline is set by the Government.

Table No. 2. Payment terms to other suppliers

| Suppliers | Due date | |

| 1. | Others | 30 days (calendar) |

| 2. | Other (in the field of security and defense) | Established by the Government |

Tags : fine,

August 25, 2017

Number of views: 7207

Please rate how useful this material was.

Rating: 5/5 — 6 votes

Similar articles:

- The Constitutional Court of the Russian Federation figured out whether it is possible to attract charges under Part 7 of Art. 7.32 Code of Administrative Offenses of the Russian Federation for late execution of a government contract (87)

- FAS Russia clarified issues regarding the inclusion of information in the Register of Unscrupulous Suppliers (85)

- The Government of the Russian Federation has determined when a purchase from a single supplier must be approved by the Federal Antimonopoly Service of Russia (83)

Comments ()

- Vladimir March 19, 2021, 14:34 0

What is the procedure for issuing a fine on the responsible person for the delay in signing the Certificate of Completion of Work and payment for work performed, which is introduced in the Code of Administrative Offenses of the Russian Federationanswer

- Effective technologies March 19, 2021, 15:47 0

Vladimir, good afternoon! In order for the customer to be fined under Part 1 of Art. 7.32.5 of the Code of Administrative Offenses for violation of the deadline and procedure for payment for work, when making purchases to meet state and municipal needs, you can submit an application (complaint) to the control body in the field of procurement.

The following have the right to consider cases of administrative offenses on behalf of the control body in the field of procurement (Part 2 of Article 23.66 of the Administrative Code): - heads of federal executive bodies in the field of procurement and their deputies; — heads of structural divisions of federal executive authorities in the field of procurement and their deputies; — heads of territorial bodies of federal executive authorities in the field of procurement and their deputies; — heads of executive authorities of constituent entities of the Russian Federation in the field of procurement and their deputies; — heads of structural divisions of executive authorities of constituent entities of the Russian Federation in the field of procurement and their deputies.

According to the Letter of the Ministry of Finance of Russia N 24-04-06/55025, FAS Russia N RP/59080/17 dated 08.25.2017 “On the position of the Ministry of Finance of Russia and the FAS Russia on the application of the Federal Law of April 5, 2013 N 44-FZ in the implementation control in the field of procurement" and Art. 23.66 of the Code of Administrative Offenses of the Russian Federation, control bodies in the field of procurement consider cases of administrative offenses in violation of the deadline and procedure for payment for industrial and technical equipment. At the same time, on behalf of control bodies in the field of procurement, within the limits of their powers, officials of federal executive authorities in the field of procurement, executive authorities of constituent entities of the Russian Federation in the field of procurement have the right.

In paragraph 2 of the Decree of the Government of the Russian Federation of August 26, 2013 N 728, the Federal Antimonopoly Service is defined as a federal executive body authorized to exercise control (supervision) in the field of procurement of goods, works, services to meet state and municipal needs.

Thus, you can send a complaint about a violation of the deadline and procedure for payment: to the territorial OFAS or to the central office of the FAS (for procurement at the federal budget level this is the only option), or, if this is a procurement at the level of a constituent entity of the Russian Federation or local administration, then find a control body in procurement area of the executive branch of the relevant constituent entity of the Russian Federation, and contact it.

Since this is a fairly new norm in the law (and, frankly, we also have no practical experience in bringing the customer to administrative liability for non-payment), we are ready to draw up such a statement for you just to be able to write about it to other readers. If the offer is interesting, write by email. But we have quite a lot of real experience in collecting debts from customers through the courts, and we can help with this.

answer

Write a comment

Types of penalties

In procurement, two forms of penalties are used. They are radically different from each other, and replacing one with another is impermissible.

- Penalties are charged for late fulfillment of obligations. For example, when the contractor must deliver the goods today, but delivers in a month.

- Fines - for poor quality performance (except for cases of delay), failure to fulfill obligations under the contract. For example, the contractor delivered expired products or brought goods in the wrong assortment.

Customers reflect all fines and penalties in the text of the contract and also specify them in the project. To protect themselves, auction organizers indicate as much as possible all possible fines and penalties, because at the project development stage, they do not always know the contract amount on which the penalty depends. Therefore, the supplier should carefully study the procurement documentation and know what awaits him in the event of improper performance of obligations and if he does not meet the deadline.

Clients included in the project include:

- the amount of the fine in the form of a fixed amount accrued for improper fulfillment of obligations by the customer (except for delay);

- the amount of the fine in the form of a fixed amount accrued for non-performance or improper performance by the supplier (except for delay), incl. guarantee obligation;

- the amount of the penalty accrued for each day of delay in the fulfillment of the obligation by the supplier and the customer, starting from the date of expiration of the established period.

Penalty under the contract - due to the security amount

Experts from the Legal Consulting Service GARANT Valeria Schetchikova and Alexey Alexandrov explain whether the state customer, in the event of a supplier’s failure to fulfill obligations, can withhold the funds transferred to secure the execution of the contract against the amounts of penalties payable.

Does the customer have the right to withhold from the supplier, in the event of improper performance by the latter of its obligations under the contract, a penalty (penalties, fines) from the funds transferred to the customer as security for the execution of the contract? If yes, then in what order is such a deduction made, and for what specific violation can it be applied?

According to Part 27 of Art. 34 of the Federal Law of 04/05/2013 N 44-FZ “On the contract system in the field of procurement of goods, works, services to meet state and municipal needs” (hereinafter referred to as Law N 44-FZ), the contract includes a mandatory condition on the terms of return by the customer to the supplier ( to the contractor, performer) (hereinafter referred to as the counterparty) of funds contributed as security for the performance of the contract (if such a form of security for the performance of the contract is used by the counterparty).

In accordance with Part 6 of Art. 34 of Law N 44-FZ, in case of delay in performance and in other cases of non-fulfillment or improper fulfillment of obligations under the contract, the customer sends to the counterparty a demand for payment of penalties (fines, penalties).

However, neither the provisions of Law No. 44-FZ nor other regulations regulate the procedure for returning the security amount, as well as the procedure for collecting penalties (fines, penalties) payable for non-fulfillment or improper fulfillment of obligations under the contract. In the absence of clear legal regulation, the question of the possibility of the customer retaining part of the funds transferred to him by the counterparty as security for the execution of the contract against the amounts of penalties (fine) payable by the counterparty, unfortunately, does not have a clear answer.

Provided for in Part 3 of Art. 96 of Law No. 44-FZ, the method of ensuring the execution of a contract in the form of depositing funds into the account specified by the customer is not referred to as a pledge anywhere in the text of this Law, in contrast to the no longer valid Federal Law of July 21, 2005 No. 94-FZ “On placing orders for the supply of goods , performance of work, provision of services for state and municipal needs”, in which a similar method of ensuring the execution of a contract was called a pledge. Therefore, in our opinion, this method of ensuring the execution of a contract should be considered as a special method of ensuring the fulfillment of obligations, not named in the Civil Code of the Russian Federation (clause 1 of Article 329 of the Civil Code of the Russian Federation). In this regard, there are no grounds for applying (except by analogy) to the specified method the provisions of civil law on any other methods of ensuring the fulfillment of obligations.

In judicial practice, one can find examples of the recognition that it is lawful for the customer to withhold certain amounts (sanctions, losses, etc.) from the security amount transferred to him by the counterparty due to non-fulfillment or improper fulfillment by the counterparty of obligations under the contract (see, for example, the decisions of the Arbitration Court of the North Caucasus District dated January 13, 2015 N F08-9866/104, Fifteenth Arbitration Court of Appeal dated January 15, 2015 N 15AP-21743/14, Fourth Arbitration Court of Appeal dated November 28, 2014 N 04AP-5761/14).

We believe that the customer’s withholding of a penalty (fine, penalty) from the contract security amount transferred by the counterparty in the absence of a judicial act can be considered legal only if the counterparty recognizes the corresponding debt or if such withholding is provided for in an agreement between the customer and the counterparty (see, for example, resolution of the Eighth Arbitration Court of Appeal dated December 16, 2014 N 08AP-10345/14, Fourth Arbitration Court of Appeal dated December 4, 2014 N 04AP-5140/14, Fifteenth Arbitration Court of Appeal dated September 17, 2014 N 15AP-10269/14). In other cases, it cannot be ruled out that such a deduction by the customer of the amount of interest (fine) from the security amount transferred to him by the counterparty may be considered unlawful. This is indirectly confirmed in the letter of the Ministry of Finance of Russia and the Federal Treasury dated December 25, 2014 NN 02-02-04/67438, 42-7.4-05/5.1-805, which indicates that partial or complete withholding of the security amount is carried out in accordance with the terms of the contract.

However, the following must be taken into account. Civil legislation, establishing the general principle of the need for proper fulfillment of obligations (Article 309 of the Civil Code of the Russian Federation), provides the opportunity to choose one of the methods for terminating an obligation provided for in Chapter 26 of the Civil Code of the Russian Federation, including termination of an obligation by offsetting counter-similar claims (Article 410 of the Civil Code of the Russian Federation) .

Let us recall that offset as a method of terminating an obligation is a unilateral transaction, the completion of which requires certain conditions: the demands must be counter-claims, homogeneous, with deadlines for fulfillment (Clause 2 of Article 154, Article 410 of the Civil Code of the Russian Federation). By virtue of Art. 410 of the Civil Code of the Russian Federation, the obligation is terminated in whole or in part by offsetting a counterclaim of the same type, the due date of which has come or the due date of which is not specified or determined by the moment of demand. For offset, a statement from one party is sufficient.

As follows from the said Art. 410 of the Civil Code of the Russian Federation, in order to set off, it is necessary that the creditor for one obligation is the debtor for another, and the debtor for the first is a creditor for the second obligation.

The Presidium of the Supreme Arbitration Court of the Russian Federation in paragraph 7 of the information letter dated December 29, 2001 N 65 “Review of the practice of resolving disputes related to the termination of obligations by offsetting counter-similar claims” explained that Article 410 of the Civil Code of the Russian Federation does not require that the requirement for offset arise from the fact the same obligations or from obligations of the same type. To terminate the obligation by offset, the application for offset must be received by the relevant party (clause 4 of the specified information letter). To confirm this fact, the organization should send such a request by registered mail with return receipt requested or register it as incoming correspondence with the counterparty.

Thus, the counterparty’s obligations to pay a penalty (fine, penalty) in case of delay in performance and in other cases of non-fulfillment or improper fulfillment of obligations under the contract, and the customer’s obligation to pay for what was performed under the contract by virtue of Art. 410 of the Civil Code of the Russian Federation can be terminated at the request of one of the parties (in whole or in part). The possibility of such repayment of counter-similar claims of the parties to a state (municipal) contract is also confirmed by judicial practice (see, for example, the decision of the Third Arbitration Court of Appeal dated 01.08.2014 N 03AP-2849/14, the decision of the Eighteenth Arbitration Court of Appeal dated 08.07.2014 N 18AP-6125 /14). Of course, in case of disagreement with the amount of the penalty calculated by the customer, the counterparty will be able to go to court with the corresponding demand (see, for example, the decision of the Arbitration Court of the Sverdlovsk Region dated 04/08/2013 N A60-2225/2013, the resolution of the Ninth Arbitration Court of Appeal dated 06/02/2014 N 09AP -16900/14, resolution of the Third Arbitration Court of Appeal dated November 26, 2013 N 03AP-4416/13, resolution of the Thirteenth Arbitration Court of Appeal dated July 17, 2014 N 13AP-12653/14).

The GARANT system will help you get acquainted with the texts of the documents mentioned in the experts’ response without spending a lot of time on independent analysis.

As an advertisement

How to calculate for the customer?

When calculating fines and penalties under the contract (penalties), the customer must follow the special procedure specified in Government Decree No. 1042 of August 30, 2021. But first it is necessary to clarify by what indicators the penalty will be applied:

- Whether the contractor was late in the work, and the number of days of this delay. This criterion forms the basis for calculating penalties under the contract;

- Whether there were violations of other obligations by the performer. They are of value and non-value type.

In the first case, penalties will be calculated according to the formula:

1/300 St * C * D, where:

St – the value of the Central Bank key rate on the day of payment of penalties;

C – contract price or amount of unfulfilled obligations;

D – number of days of delay.

For example: Contract amount – 300 thousand rubles. The date for payment of late fees is February 15, 2021. The refinancing rate is 6.25%.

According to the terms of the contract, delivery took place in 3 stages:

- For the first one, it was 29 days overdue. The products were fully delivered, but the customer did not accept the work because... some of the goods do not meet the requirements of the contract. Based on the acceptance results, the customer accepted the goods for 30 thousand rubles. The delay is calculated from the entire contract price, because the conditions were fulfilled only 29 days after the end of the period. The size of the penalties will be:

(1/300 * 6.25%) * 300000 * 29 = 1812.50 rub.;

- in the second stage the delay was 10 days. During this period, products worth 170 thousand rubles were supplied. The penalty is calculated from the contract price reduced by the amount of the accepted part in the first stage, i.e. 270 thousand rubles. Using the formula we find the penalty:

(1/300 * 6.25%) * 270000 * 10 = 562.50 rubles;

- in the third stage, the last part of the goods was delivered in the amount of 100 thousand rubles, but with a delay of 20 days. Penalties must be calculated from the last amount not fulfilled during the established period, i.e. from 100 thousand rubles:

(1/300 * 6.25%) * 100000 * 20 = 416.70 rubles;

To find out the total amount of penalties, you need to add up the 3 numbers obtained in each stage:

1812.50+562.50+416.70=2791.70 rub.

In the event that the supplier violated the terms of the contract under any conditions (except for delay), Government Decree No. 1042 approved the amount of fines as a percentage of the contract price (for value obligations) or as a fixed amount (for non-value obligations). Such penalties are taken into account when calculating the penalty.

Penalties for violation of cost obligations applied to the contractor - NOT a small business entity (SMB):

| Contract price (RUB) | Fines as a percentage of the contract price |

| Less than 3 million | 10 |

| 3-50 million | 5 |

| 50-100 million | 1 |

| 100-500 million | 0,5 |

| 500 million-1 billion | 0,4 |

| 1-2 billion | 0,3 |

| 2-5 billion | 0,25 |

| 5-10 billion | 0,2 |

| More than 10 billion | 0,1 |

If the contractor belongs to the SME - see section 2 “Regulatory legal acts” of this article

When the contract value is lower and higher than the NMCC - also see section 2 “Regulatory legal acts” of this article.

For violation of non-valuable obligations, fines are assessed in the form of a fixed amount of the contract price, and it does not matter whether the contractor belongs to the SMP or not:

| Contract price (RUB) | Fixed fine (RUB) |

| Less than 3 million | 1000 |

| 3-50 million | 5000 |

| 50-100 million | 10000 |

| More than 100 million | 100000 |

Exceptions to the rules

It is worth recalling that according to Law No. 44 (Article 34, Part 15), the customer has the right not to fulfill the requirement regarding the mandatory stipulation in the contract of the amounts of penalties and penalties if the purchase is carried out from a single supplier:

- for an amount that does not exceed 100 thousand rubles (Law No. 44, Article 93, Part 1, Clause 4);

- to conclude an agreement to visit a theatre, zoo, concert, cinema, museum, circus, sporting event or exhibition (Law No. 44, Article 93, Part 1, Clause 15);

- if medicines are purchased (Law No. 44, Article 93, Part 1, Clause 28).

Tags : penalties, fines, 44-FZ, calculation example,

08 April 2016

Number of views: 23165

Please rate how useful this material was.

Rating: 0/5 — 0 votes

Similar articles:

- Regulations have been approved for checking delivered goods using both video and photographic equipment for compliance with information under the contract (166)

- Court: in the notice of public procurement, information can be indicated in the form of a reference to documentation (146)

- FAS RF: when conducting a repeat procurement in the field of construction, the participant will only need to submit “consent” to participate (134)

Comments ()

- Sergey May 03, 2021, 12:26 0

Tell me, if the contract went into the red during an electronic auction (offer for the right to conclude a contract), what amount of the fine according to Government Resolution 1063 should the customer write in the contract?answer

- Semyon 03 May 2021, 14:47 0

Hello, Sergey! In this case, we also recommend that you follow the methodology for calculating fines and penalties imposed for violation of government contracts, which is specified in the “Rules for determining the amount of fines assessed for improper fulfillment of contractual obligations” - i.e. depending on the proposed contract price, even if it is for an increase. In this case, you can also refer to paragraphs 3 - 5 of these Rules.

answer

- Yulia April 13, 2021, 04:31 pm 0

Tell me, according to the contract (where the customer is a budget organization), the supplier was late in delivering the machine. The customer compiled and sent a claim where the amount of the penalty was incorrectly calculated, how can the customer correct the error?

answer

- Effective technologies April 13, 2021, 16:41 0

Julia, hello! If you are interested as a customer, we recommend that you send a second letter to the supplier, in which you indicate that in the previous letter dated No.___ of such and such a date, an error (typo) was made, and ask to pay penalties in the amount indicated below + attach the correct calculation. Or you can wait for the Supplier’s response, in which he himself will point out the mistakes made. But if you then go to court for collection in the absence of voluntary payment, then you need to act according to the first option, since the supplier may not answer you. If you are a supplier, draw up your calculation of the penalty, in which you indicate the mistakes made, and send it to the customer.

answer

How to pay the supplier?

During the execution of the contract, the customer may also violate his obligations. When calculating penalties in relation to the customer, the supplier must be guided by Part 9 of the Rules, as stated in Resolution No. 1042. The customer is subject to fixed fines for poor performance of obligations (except for delays).

| Contract price (RUB) | Fixed fine (RUB) |

| Less than 3 million | 1000 |

| 3-50 million | 5000 |

| 50-100 million | 10000 |

| More than 100 million | 100000 |

If the customer is overdue for payment for the work to the supplier, then he is subject to a fine in the form of interest on the amount of the debt in accordance with Article 395 of the Civil Code of the Russian Federation.

In this case, the same formula is used as for calculating the penalty for the performer:

1/300 St * C * D

For example: Contract value – 300 thousand rubles. The contractor belongs to the SMP, which means the customer must pay for the work within 15 days after final acceptance. And the customer made payment only after 30 days (according to general principles), i.e. 15 days late. We calculate using the formula:

(1/300 * 6.25%) * 300,000 * 15 = 937.50 rub.

Online calculator

To help persons entering into contracts, a special online calculator has been developed for calculating fines and penalties. There are many of them on the Internet, let’s look at the example of the website dogovor-urist.ru.

The calculator finds the amount of the penalty based on the parameters entered in the window:

— Amount of debt; — Period of delay; — Share of the Central Bank rate; — Application of interest rates, etc.

Important point! From February 10, 2021, the key rate of the Central Bank of the Russian Federation has been lowered to 6% .