Salary fund

The wage fund (abbreviated as payroll) is a special economic entity , nationally considered part of the national income.

Payroll should be distributed among employees and employees depending on the quantity of work and its quality, as well as their qualifications and other important factors. Payroll is perceived as an indicator of the labor plan; it is the main part of the plans for the annual development and economic growth of enterprises and organizations. The fund contains the amount necessary to cover payments to employees, both permanent and working under a temporary employment contract, as well as to cover expenses for time not worked through no fault of the employee (for example, payments to women on maternity leave). The fund provides funds for making payments based on calculated tariffs and salaries, as well as incentive payments, allowances and various additional deductions.

The formation of the fund occurs in accordance with established fixed standards; if it is an enterprise fund, and not a state fund, then the funds come from business income.

The size of the fund is calculated taking into account the number of personnel employed in production, the average wage at the enterprise and expected costs.

About payroll planning

Payroll planning is part of the financial and economic activity plan. Planning this fund allows you to predict and estimate in advance the organization's expected labor costs. This is especially true where the share of labor costs constitutes a significant part of the cost of production (performance of work, provision of services).

Labor costs are included in the cost of production. The higher the costs, the lower the profit. Determining the amount of the payment fund serves to develop cost-saving measures. Consequently, the organization has the opportunity to increase production profitability.

An organization's wage fund is the amount of money required to pay personnel for completing the established amount of work. Typically, the share of labor costs in the total expenses of the organization is 55% .

Payroll planning is carried out using the method of collecting information on all types of accruals, based on actual data and taking into account changes for the coming year.

Documents required for planning the wage fund:

- staffing schedule;

- Regulations on remuneration;

- collective agreement;

- Regulations on the procedure for remuneration of employees engaged in the provision of paid services (in institutions);

- vacation schedule.

Each organization develops its own Regulations on remuneration, which provides for the specifics of calculating wages both from allocated subsidies for the implementation of government tasks (KFO 4) and from funds from income-generating activities (KFO 2).

The regulation on bonuses has legislative force; it determines how incentives and bonuses are awarded to employees.

Notes

1. Bonus is an incentive payment awarded for achieved results in work.

2. Bonuses are a method of stimulating employee interest in the results of the organization’s activities.

An employment contract must be drawn up accordingly with an employee whose work is paid from various sources of financing. An employment contract is an agreement between an employer and an employee, according to which the employer undertakes to provide the employee with work for a specified job function, to provide working conditions provided for by labor legislation and other regulatory legal acts.

The main employment contract must provide for ongoing payments from various sources of financing. The contract with employees who perform work and provide services for business activities provides for a monthly payment as a percentage of the income received from extra-budgetary activities for the previous month.

The remuneration system provides for the following payments:

- basic salary;

- compensation payments;

- incentive payments.

Basic official salary (basic wage rate) is the official salary of an employee of a state or municipal institution without taking into account compensation, incentives and social payments.

Compensation payments - additional payments and allowances of a compensatory nature, including for work in conditions deviating from normal ones.

Incentive payments - additional payments and allowances of an incentive nature, bonuses and other incentive payments: payments for intensity and high results of work, for the quality of work performed, for length of continuous work, length of service, bonus payments based on work results (for a quarter, half a year, 9 months, year).

Remuneration of full-time employees for budget activities is planned based on basic salaries, compensation and incentive payments.

Structure

It is quite difficult to describe the structure of the enterprise fund. The fund's funds consist not only of fixed salary contributions, but also of compensation and various types of allowances.

The general structure looks like this:

- Payments according to the employment contract for the amount of time worked:

- Deductions of fixed wages, according to established standards.

- Deductions for employees working on a piecework basis.

- The cost of products that were made available to employees as payment in kind.

- Allowances, incentive payments, bonus payments (payments in kind are also calculated).

- Deductions in the form of compensation for working conditions or overtime.

- Deductions to third-party specialists hired under a one-time employment agreement.

- Contributions for employee development or retraining.

- Deductions for the payment of part-time employees.

- Payments that compensate for the difference in wages in the case of working as a deputy.

- Fees for non-staff employees.

- Payment for time not worked by an employee, while maintaining his right to wages:

- Vacation deductions.

- Privileges.

- Vacations due to training.

- Deductions for employees who donate blood.

- Payment for any downtime that was not the fault of the employee.

- One-time incentives:

- Annual deductions for quality of work, length of service or based on the results of work.

- Payments of financial assistance to employees in need.

- Additional deductions related to vacation.

- Compensation for unused vacation rights.

- The monetary value of other incentives or special promotions and bonuses for employees.

- One-time incentives include the cost of gifts if they are paid from the fund.

- Payment of expenses related to the specifics of the work:

- Payment for free meals for employees.

- Payment of benefits for food and accommodation of employees.

- Compensation for utilities or housing costs.

- For transportation companies – reimbursement of fuel costs.

AccountingWeb

According to the law, the wage fund includes payments in cash and in kind.

Wages in kind are understood as goods and materials received for work performed.

The wage fund includes:

— payment for time worked, including wages for persons hired on a part-time basis, as well as wages for pensioners;

-payment for unworked time (payment of annual and additional vacations, preferential hours, downtime through no fault of the workers, etc.);

- one-time incentive payments (one-time bonuses, remuneration based on the results of the year and annual remuneration for length of service, financial assistance, additional payments for annual leave and other one-time incentives)

-payments for food, housing, fuel (the cost of free utilities provided to workers in certain sectors of the food economy, the cost of free utilities provided to housing workers, or the amount of compensation for not providing them free of charge).

The sources of formation of the wage fund are:

— Budget funds;

— Extrabudgetary funds. Enterprise income received from:

production and sale of products, performance of work, provision of services;

other receipts of funds provided for by law, which include expenses for wages and material incentives for employees, including funds transferred by individuals and legal entities in the form of a gift or donation.

Payment amounts accrued to employees can be divided into four parts:

labor costs attributable directly to production (distribution) costs, as well as to operating costs of non-industrial farms that are on the balance sheet of the organization’s core activities;

labor costs for operations related to the procurement and acquisition of inventories, equipment for installation, and capital investments;

payments in cash and in kind from the portion of profit and consumption funds remaining at the enterprise;

income paid to employees on contributions to the organization’s property and securities.

The composition of the first and third parts is determined by the Regulations on the composition of costs included in the cost of production (approved by Resolution of the Cabinet of Ministers of the Azerbaijan Republic No. 111 dated August 6, 1996)

In accordance with the Regulations on the composition of costs, the cost of production includes the basic and additional wages of the main production personnel. The accounts of production and distribution costs also reflect incentive payments (bonuses for production results, including remuneration based on the results of work for the year, bonuses to tariff rates and salaries)

The following payments to employees in cash and in kind, as well as costs associated with their maintenance, are not included in the cost of production, but are attributed to the reduction of profits remaining at the disposal of the enterprise, and other targeted income:

bonuses paid from special purpose funds and targeted revenues;

financial assistance;

interest-free loan;

payment of additional vacations provided to employees under the collective agreement;

pension supplements, and other allowances not directly related to wages.

see also

Purchasing currency from a client - a legal entity or individual entrepreneur at the expense of a credit institution on the client’s instructions for mandatory sale in the event of the Bank of Russia introducing. Based on the client’s order to carry out the mandatory sale of part of the foreign exchange proceeds, the credit organization transfers part of the proceeds subject to mandatory sale, including ...

Regulation of financial accounting in different countries The main goal of any user is to obtain objective and reliable information about the state and results of the enterprise. Since setting up and maintaining financial records is related to...

Definition and recognition criteria of intangible assets IFRS 38 defines intangible assets as identifiable non-monetary assets, without physical form, controlled by past events from which economic benefits are expected...

Payroll formula

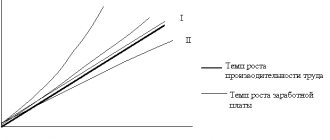

The rate of economic growth of the enterprise, as well as the success of forecasting expenses, depends on how correctly the required volume of payroll is calculated.

It is important to use appropriate statements, to have information about the exact number of employees on staff, as well as about freelance employees and the average cost of paying them.

First of all, it is worth saying that the calculation is based on average indicators for the reporting period; it is recommended to use data for at least 12 months of work.

In fact, there is no strict formula for calculating payroll; you need to take into account the specifics of the enterprise, as well as data on all employees. To calculate the annual indicator, the average wage is multiplied by the number of employees, and then by 12 (if the reporting period is a year).

There are also special formulas. The most commonly used is this:

FOT=salary (TS+DV+k); ZP – salary;

TS – salary or tariff rate;

DV - additional payments, allowances, bonuses, etc.;

k – regional coefficient, expressed as a percentage, set separately for each region (for example, northern allowances).

Instructions for calculating various types of funds

To instantly calculate the payroll resource, first of all, you need to decide on the time period. Most often, annual data is taken into account. The amounts that were paid to employees in the form of permanent contributions are added up. It is important not to take into account time costs, as well as one-time costs. This helps eliminate the accounting for unforeseen payments, such as financial assistance or unplanned bonuses.

Then the indicators from the reporting sheets are studied. You need to calculate the time worked by employees for the entire selected period. It is important that the organization has someone responsible for maintaining the timesheet and constantly enters the number of hours there.

Then the average number of employees is calculated. To do this, you need to separately, for each month, make a calculation using the following formula: the number of personnel working for each day is added up and divided by 30. After everything is calculated by month, you need to add up the indicators and divide by 12. This will be the average number employees at the enterprise per year.

It happens that you need to calculate the monthly payroll, and not the annual one. Then the amount of all payments for the year is divided by 12. And then the number of days that the employees worked is also divided by 12. Then the average monthly earnings of all employees in the state are divided by 30, and the result is divided by the number of employees who were employed per month.

You can calculate the daily asset in approximately the same way. A small caveat is that you need to further divide by 30 to get the daily average. It does not matter for what period the calculation is being made (30 is the standard number for division; it does not matter whether the fund is calculated for a month with a different number of days or not).

Components of the indicator

The payroll includes the following payments:

- salary for time actually worked, in cases established by law - for time not worked;

- income from enterprise securities from deposits;

- allowances, bonuses and other additional payments, if they are included in the incentive wage fund;

- various types of compensation;

- social assistance, payments due to financial situation, as well as other deductions of a permanent nature.

All funds allocated to employees, including in kind, are subject to accounting.

Such deductions in the form of social payments provided from public funds, the state budget of various levels or extra-budgetary funding are not taken into account.

Piece wage fund

The wage fund for piece workers is included in the hourly fund. The form of remuneration for piece workers depends on the quantity of products produced or the quality of services provided.

Based on this, an acceptance certificate or work order is drawn up, which specifies the number of units of finished products or the amount of services provided. For the organization, constant amounts of payment for piecework services are established.

You can find out the salary of a pieceworker using the formula:

Z = KR*SR

Where KR is the amount of work performed or units of production.

CP - piecework labor price.

Piece-rate wages are possible if:

- there is a way to measure performance indicators;

- it is possible to technically standardize labor;

- it is documented to exceed the norm of production in the department where the piecework form of payment exists;

Situations when the use of piecework payment is unprofitable for an enterprise:

- has a negative impact on product quality;

- interferes with the normal functioning of technological processes;

- leads to overuse of resources;

- violates sanitary and safety regulations at the enterprise;

Formation of payroll

To form the wage fund, the following methods are used:

- calculation of the ratio of established standards to the actual volume of production, expressed as a percentage;

- incremental method - with each increase in production volume, employee wages increase by the same percentage;

- residual method - the fund is considered part of the enterprise’s income and is calculated taking into account profit.

If there is a shortage of funds, amounts taken from the enterprise's reserve fund are used, in the formation of which it is necessary to take into account the possible excess of the expenditure of funds included in the payroll fund. Often, in addition to the main fund, employee development and support funds, as well as social funds and assets, are created. The more indicators are taken into account when forming the payroll, the more rationally the funds are spent and the more rationally their distribution occurs within the team of employees.

How to find out the relative size deviation?

The relative deviation of the size of the wage fund makes it possible to assess the impact of savings or overexpenditure of the wage fund on the activities of the enterprise due to its connection with the production plan.

The relative deviation of the wage fund, the formula is calculated in a similar way with the adjustment of the actual figure by the coefficient of fulfillment of the production plan. But only the part of the payroll associated with variable wages is adjusted.

∆FOTrel = FOTplan – (FOTsd.fact x Ipr.plan + FOTpv.fact),

where the payroll p.f. includes payroll funds for both temporary workers and salaried workers.

The new value shows the relative savings or relative overexpenditure of the Payroll Fund.