Contract enforcement is a very important aspect. If something goes wrong at this stage, the signing of the contract may be disrupted. Sometimes this happens due to the provision of a “poor quality” bank guarantee, which the customer does not accept. In order not to lose the contract, a decision is made to provide cash security. Not all suppliers know, but during the execution process, the method of securing the contract can be changed, and its amount can be reduced . We'll tell you how to do this in today's article.

Let's review the basics

Contract security refers to a certain security that the supplier provides to the customer. Its purpose is to cover the latter’s losses if any arise as a result of the supplier’s failure to fulfill its contractual obligations.

Collateral amount

The amount of security is determined by the customer, but it cannot exceed 30% of the NMCC . The security is indicated in the procurement notice, so the supplier knows what amount is involved even before submitting the application. Why is it important? After winning the procurement procedure, the supplier will not have much time to provide security. And he must assess his capabilities in advance. After all, if the winner does not provide security, the contract will not be signed. Moreover, he will be recognized as having evaded signing the contract and will be included in the register of unscrupulous suppliers.

Registration in the ERUZ UIS

From January 1 2020 , in order to participate in bidding under 44-FZ, 223-FZ and 615-PP, registration in the ERUZ register (Unified Register of Procurement Participants) on the EIS (Unified Information System) portal in the field of procurement zakupki.gov is .ru.We provide a service for registration in the ERUZ in the EIS:

Order registration in the EIS

In practice, sometimes completely conscientious suppliers are included in the register, who did not have the goal of evading signing a contract or otherwise deceiving the customer. They just made some mistakes, for example, they did not calculate their strength and did not have time to provide contract security.

Methods for depositing collateral

The contract is enforced in two ways:

- direct, that is, by depositing funds into the customer’s account;

- bank guarantee - a written obligation of the bank to cover the customer's losses caused by the actions of the supplier, within a certain amount.

The choice of method remains with the supplier. Practice shows that the preferred option is a bank guarantee. The problem is that not all suppliers can get it. Banks issue guarantees only to experienced and reliable organizations, and newcomers have to secure contracts with cash.

A bank guarantee is a good way to ensure the fulfillment of a contract, but it is not suitable for everyone

Under advance contracts, replacement of collateral is acceptable

If there was an advance in the contract, the goods must be delivered based on the advance paid - and then the security can be changed. For work performed or goods supplied as part of the advance payment, the security funds can be returned to the supplier.

Case Study

The supplier performed work to replace the school's porch, paid for as part of the advance contract for the major renovation of the building. I sent a letter to the customer with a request to recalculate the security. The customer agreed to the proposal and carried out a recalculation.

Replacement of collateral

Let's assume that the supplier initially chose to secure the contract directly, that is, in cash. He could have made such a choice, for example, due to lack of time to apply for a bank guarantee. However, during the execution of the contract, the funds that he transferred to the customer’s account were needed for other projects. So, the supplier has the right to replace the method of securing the contract . In this example, this means that he can provide the customer with a bank guarantee and demand his money back.

When can collateral be replaced?

Replacement of contract security is allowed after the supplier has partially fulfilled its obligations. In other words, the contractor cannot immediately after concluding the contract demand his money back from the customer in exchange for a bank guarantee. Before this, the contract must be at least partially fulfilled (letter of the Ministry of Finance dated July 3, 2017 No. 24-03-07/41938).

When the contract is partially fulfilled, the supplier can contact the customer with the aim of not only replacing the security, but also reducing its size . That is, new security is provided for a smaller amount. And it decreases in proportion to the cost of fulfilled obligations.

Procedure for replacing and reducing collateral

Having decided to replace and at the same time reduce the security, the supplier sends a letter to the customer with such a proposal. At this point, partial fulfillment of the contract must be documented. This means that the goods, works or services supplied under the contract must be accepted by the customer, and this fact is supported by relevant documents.

It follows from the provisions of Law 44-FZ that the customer cannot deny the supplier his right to change the method of securing the contract, as well as reduce its amount. Thus, if the supplier did everything correctly, then the customer is obliged to fulfill his requirements. If a refusal nevertheless follows, the supplier may go to court.

Replacement of contract performance security under 44-FZ

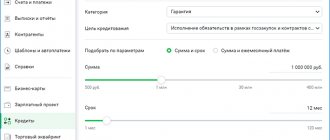

The choice of method of securing a contract, in accordance with Part 3 of Article 96 of Federal Law No. 44, is the privilege of the performer/contractor/supplier. If it is decided that this will be a bank guarantee, it will take some time to complete it. Due to delays and unforeseen circumstances, situations often arise when the winner, in order not to break the law and sign the contract on time, is forced to abandon this idea and transfer to the customer’s account the amount required as security. However, Federal Law No. 44 (in accordance with Part 7 of Article 96) provides for the possibility of returning money at any time by replacing the method of ensuring the execution of the contract.

When can contract security be replaced?

The contractor may take the initiative to replace the collateral at any time, regardless of whether he has begun to perform the contract or not. Moreover, this can be either the provision of a bank guarantee instead of deposited funds, or vice versa. The law does not provide for the customer’s ability to refuse such an offer.

Therefore, if he creates any obstacles, does not accept the letter, or simply says that a replacement is impossible, the contractor/contractor/supplier has the right to file a complaint with the Arbitration Court.

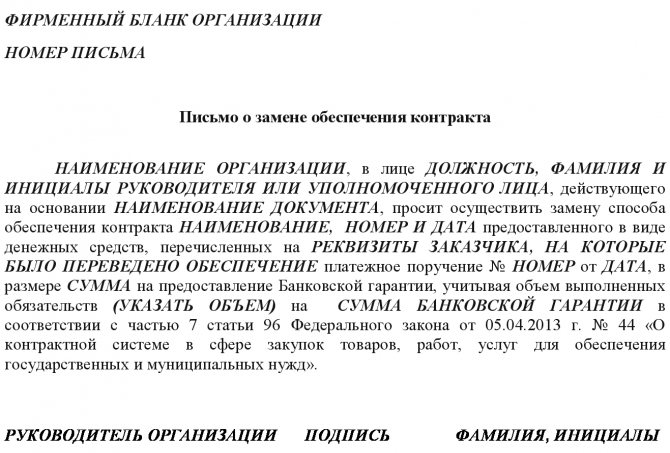

How to change contract security

In order to replace the contract security, the performer/contractor/supplier must send a letter to the customer requesting this action. It must be on company letterhead and may look like this:

After this, two cases are possible, depending on what joint decision the parties come to.

- An additional agreement to the contract is drawn up, which specifies information about the new security. The customer does this by providing the contractor/contractor/supplier with a ready-made project for signature.

- A change in the method of enforcement occurs without concluding an additional agreement.

Both options are legal, but in the case when a bank guarantee is replaced with cash, the contract, in accordance with Part 27 of Article 34 of Federal Law No. 44, must contain information about the timing and procedure for returning the amount paid as security. That is, the conclusion of an additional agreement becomes mandatory.

Federal Law No. 44 does not regulate the period for returning the amount deposited as security in the event of replacing the method with a bank guarantee. Some believe that this period should not exceed three working days, in accordance with Part 5 of Article 45 of Federal Law No. 44, but this issue is quite controversial. Therefore, it is better to discuss it with the customer privately and try to come to an agreement.

Reduced contract enforcement

In accordance with Part 7 of Article 96 of Federal Law No. 44, the performer/contractor/supplier may at any time change not only the method of ensuring the execution of the contract, but also reduce it in proportion to the amount of fulfilled obligations. However, this fact must be documented, that is, the contractor must have a certificate of work performed/services rendered or a delivery note.

For example, a contract was initially concluded for the supply of office supplies throughout the year in batches for a total amount of 500,000 rubles. The security is set at 30% (that is, 150,000 rubles). By the time the supplier decided to replace the cash collateral with a bank guarantee, he had supplied 250,000 rubles (this fact is confirmed by invoices), which is 50% of the total amount of obligations. That is, he must provide a bank guarantee in the amount of 75,000 rubles, respectively (50% of 150,000 rubles, the initial security).

When is it beneficial to replace contract security?

Each performer/contractor/supplier decides for himself whether replacing contract security is beneficial in a given situation or not. However, it can be said with confidence that the revocation of a bank guarantee is always unprofitable from an economic point of view, since no organization is obliged to return the money for issuing it.

On the other hand, it is always beneficial to replace the cash security with a bank guarantee if its execution began before the conclusion of the contract and the contractor/contractor/supplier simply did not have time to receive all the documents on time.

3.6136363636364 Rating 3.61 (22 Votes)

conclusions

So, even before submitting an application, the supplier must find out the amount of security and decide how it will contribute. It is critically important to post the security within the legal deadline. If receiving a bank guarantee fails, there is always the option of paying it in money (if you have the required amount). This is a much better option than avoiding signing a contract.

If during the execution of the contract it is decided to change the method of provision, then there should be no obstacles to this on the part of the customer. At the same time, the supplier may demand a reduction in the amount of security by the amount of obligations fulfilled by him.

Video tutorial on contract enforcement:

Answer

As a general rule, changes to a warranty are possible only if this is provided for in the text of the warranty itself. However, from the analysis of judicial practice it follows that it is not possible to change any conditions, but only the period (in terms of extension) and the size upward.

The deadlines for making changes are not regulated by law. However, from the analysis of the provisions of Law No. 44-FZ, it follows that it is impossible to make changes to the bank guarantee to secure an application after the deadline for submitting applications, as well as at the stage of concluding a contract based on the results of the procedure in electronic form.

Changes to the guarantee must be submitted in the same form in which the guarantee itself was issued, or in the form provided for by the guarantee. To make changes to a bank guarantee, you must contact the bank that issued the bank guarantee. Changes to the guarantee must be entered by the bank into the register of bank guarantees no later than the next working day after the changes.

Replacing a bank guarantee under a government contract: dangerous nuances

Many bid winners do not think that replacing a bank guarantee under a government contract can be accompanied by dangerous complications. To prevent this from happening, it is important to know some nuances:

- The standard period for replacing a guarantee from the bank, provided by the customer, is 10 days.

- Failure to comply with this clause may lead to unpleasant consequences, including the provision of an illegitimate document and the danger of being sued for fraud.

- Before you think about replacing a bank guarantee under 44 Federal Laws, you must study it without fail. There are nuances that will help you quickly and correctly collect the package of necessary documents.

- It is important to know that every certificate and examination result must be genuine so that failure can be avoided. All manipulations to replace the bank guarantee must be agreed upon with the customer! Otherwise, misunderstandings may arise, leading to termination of the contract.

An important factor is also the feasibility of replacing a bank guarantee under a government contract. The fact is that the timing of the release of money from the collateral and the amount itself play a big role. Banks issue bank guarantees to tender winners, but set their own percentage for this. If you decide to cancel the guarantee without good reason, you may have to pay interest costs. It follows from this that due to a sudden and unreasonable replacement of the guarantee for a large amount and a long period of execution of the contract, the company may suffer significant losses. However, if the amount is relatively small and the period is up to three months, the losses will be insignificant. 44 of the Federal Law explains in detail all the nuances of the legality of this operation and shows what can happen if it is carried out illegally. Each director of the company that wins the auction is obliged to study its provisions and follow them in the future.

If, after reading this material, you still have questions, you can discuss them with our employees by phone or leave a question on the website.