What is a guarantee

The supplier must guarantee the performance of the contract before signing. As collateral, he transfers funds to the customer’s bank account. Or issues a bank guarantee “to ensure the execution of the contract.”

A bank guarantee allows the supplier not to withdraw large funds from circulation for a long time. Instead, he receives, for example, a bank guarantee from Sberbank, paying only a one-time fee for the issue.

Essentially, the BG is a record number from the electronic register of guarantees, the existence of which the customer can check on the procurement portal. This means that the bank does not transfer money directly to the customer. Payment occurs only if the supplier fails to fulfill its obligations.

There are 3 other types of guarantees that are used a little less frequently in public procurement: to secure an application, to guarantee security, and to return an advance payment.

Requirements for a bank guarantee

The entire list of requirements is presented in Article 45. If the participant does not adhere to them, the customer will refuse to accept the security.

The party that violates these requirements when ensuring the execution of the contract will face either a refusal to participate in the procurement procedure or, even worse, a refusal to conclude a contract and further proceedings in the FAS. If the case comes to trial in the FAS, then most likely the participant will be included in the RNP.

At the legislative level, the following requirements may be imposed on a bank guarantee:

- The bank guarantee must first of all be irrevocable

- In addition, it must comply with procurement requirements.

- It must also be entered into the EIS register.

Bank guarantee in Sberbank

In 2021, Sberbank PJSC ranks first in the number of guarantees issued. Positive completion of the scoring procedure (client assessment) is possible for tender companies of different levels: both beginners and experienced participants in 44-FZ procurement.

By contacting Sberbank, LLCs and individual entrepreneurs receive the following benefits:

- expedited review within 2 hours;

- collecting a minimum set of papers for registration;

- without guarantees, collateral or collateral;

- no requirement to open a current account;

- Preparation of a personal warranty project for the customer.

As related services, Sberbank opens special accounts for participation in tenders and also issues tender loans.

Submit a warranty request →

Types of guarantees

Sberbank has created a full line of guarantees not only for tender clients, but also for other areas of business activity. The following types are issued:

- to secure bidding: contract, application, guarantee, advance payment;

- for the execution of commercial contracts;

- payment;

- tax;

- customs.

The design method also differs, divided into two types:

- Express guarantee in 2 hours. Issued only through the personal account of Sberbank Business Online, since this is what saves time on review and issuance. Issued only if the bank does not need collateral or guarantee. This is determined by copies of documents uploaded by the procurement participant himself when creating the application.

- Standard warranty. This includes any guarantee (with or without collateral) obtained at the bank's office. If a requirement for a pledge or guarantee was put forward, then you must contact directly the Sberbank branch that works with legal entities. The review period is therefore increasing.

Submitting claims under a bank guarantee

The beneficiary can submit his claim to the guarantor bank no later than the expiration date of the bank guarantee itself - if the deadline is missed, the bank has the right to refuse compensation. The requirement is made in writing with the necessary documents attached, the list of which is indicated in the text of the guarantee. A mandatory condition for the beneficiary is to include in the sample request for payment of a bank guarantee the circumstances in connection with which the bank must make payment for the debtor.

The bank, having received the demand, urgently notifies the debtor-principal about this and gives him a copy of the document with attachments. In the general case, 5 days are allotted for consideration of the claim, but the guarantee may indicate another period not exceeding 30 days (Article 375 of the Civil Code of the Russian Federation). If the bank considers the creditor's request appropriate, it transfers the money according to the details specified in the document.

Conditions for issuing a bank guarantee at Sberbank

Legal entities and entrepreneurs are guided by the following conditions and tariffs of Sberbank of Russia:

| Method of obtaining | In 2 hours | Standard |

| Scope of warranty | from 5,000 rub. up to 15,000,000 rub. | from 50,000 rub. until – determined by the bank |

| Commission amount | from 2.5% of the guarantee volume, minimum RUB 2,000. | |

| Issue date | up to 36 months | up to 60 months |

| Surety | depends on the amount, which is decided by the bank | |

| Pledge | ||

| Currency | Russian rubles | |

| Availability of a current account | not necessary | |

| Possibility of changing the text to suit the customer | There is | |

| Rate upon occurrence of a warranty case | from 10.6% per annum | from 11.73% per annum |

| Penalty for late payment upon occurrence of a warranty claim | 0.1% of the overdue amount for each day of delay | |

| Requirements for the borrower |

| |

What should be reflected in a bank guarantee under 44-FZ?

The bank guarantee must be irrevocable and include the following conditions:

- the amount of the bank guarantee that will be paid to the customer by the bank in cases specified by law;

- obligations of the supplier (contractor, performer), which will be secured by the credit institution under a bank guarantee;

- the bank's obligation to pay a penalty to the customer in the amount of 0.1% of the amount that must be transferred by the credit institution for each day of delay;

- a condition under which the bank’s obligation to pay a sum of money to the customer is considered fulfilled after the money arrives in the customer’s account;

- a list of documents that must be provided by the customer to the bank in order to receive payment under a bank guarantee (the list is specified in Decree of the Government of the Russian Federation No. 1005 of November 8, 2013);

- a suspensive condition, which provides for the need to sign an agreement on the provision of a bank guarantee for the supplier’s obligations (introduced in the case of a bank guarantee upon conclusion of the contract);

- validity period of the bank guarantee. If the guarantee secures the application, then such period is at least 2 months from the deadline for filing applications; if the guarantee is related to obligations under the contract, the guarantee period must be at least 1 month longer than the contract period;

- a condition on the customer’s right to undisputed debiting of a sum of money from the bank account if the credit institution did not voluntarily transfer the required amount within 5 working days at the customer’s request (if such a condition is specified in the procurement documentation);

- a condition on the customer’s right to transfer the right to claim under a bank guarantee if the customer changes;

- the condition that the bank itself must pay the costs of transferring money to the customer under a bank guarantee;

- a condition on the customer’s right to submit a written demand to the bank for payment of money if the supplier fails to fulfill its obligations.

Also, regulations establish a number of conditions that are prohibited from being included in a bank guarantee:

- the bank’s right not to pay under a bank guarantee if the customer does not send a notice to the supplier of his violation of the terms of the contract or of termination of the contract (exception - if such a condition is included in the procurement documentation);

- the customer’s obligation to provide the bank with a report on the execution of the contract;

- other documents that are not specified in Decree of the Government of the Russian Federation No. 1005, provided together with the request for payment of the amount under the bank guarantee;

- a condition on the customer’s obligation to provide the bank with a judicial act regarding the supplier’s failure to fulfill obligations under the contract.

Note! No matter who you receive the bank guarantee from, be sure to independently check its availability in a special register. This register of bank guarantees can be found on the government procurement website (https://www.zakupki.gov.ru/epz/bankguarantee/extendedsearch/search.html).

Instructions for registration

For new clients

To find out the exact conditions, new clients must submit documents to the office or access Sberbank Business Online via a computer or telephone.

Registration in your personal account occurs remotely and does not require opening a business account. At the stage of drawing up the application, the system will offer to issue an electronic signature (EDS) for remote interaction with Sberbank. The service is free and takes only a few minutes.

Next, the individual entrepreneur or legal entity will have to upload scans of some documents to the account.

After connecting and logging into Sberbank Business Online, only one tab will be available - “Loans”. By clicking on it, a calculator will be displayed to calculate the preliminary cost of the commission, and functionality will also appear for drawing up a BG under 223 and 44 Federal Laws.

For existing clients

Existing clients can also contact a branch serving legal entities or submit an application through Sberbank Business Online. To do this, you need to log in, select the “Loans” section, and click on the “Submit Application” button.

A form will open where you need to select “Guarantees” from the list, then “Fulfillment of obligations under government procurement and contracts with state corporations,” specify the “Amount” and “Term” fields, click on the “Contract Performance” product, and then follow the suggested steps.

Review period

The “2-hour guarantee” is considered within 2 hours only if you have a current account with Sberbank. Otherwise, the average period increases to 1-2 business days. The review process will take the longest when applying to the department.

If it is necessary to change the text of the guarantee to the customer’s form, Sberbank lawyers will additionally require another 5 days for approval.

List of documents for obtaining a guarantee

To issue a guarantee, you need to sign two main documents: an application for provision, as well as an application form for the applicant. When submitting an application online, they will be generated and sent to the bank automatically.

The application and questionnaire are drawn up on the basis of the papers submitted by individual entrepreneurs and legal entities:

- passport and SNILS of the entrepreneur or manager;

- constituent documents of the LLC (charter, decision or order, etc.);

- financial statements marked by the Federal Tax Service (tax return, etc.);

- competitive documentation under 44-FZ or 223-FZ;

- licenses if licensed types of activities are carried out;

- seal, if used.

Leave a request for BG →

Irrevocable bank guarantee

This type of security is considered the most reliable, since this document implies that the financial institution does not have the right to revoke it under any circumstances. In other words, the guarantor is obliged to fulfill all the terms of the agreement in full.

According to Article 378 of the Civil Code of the Russian Federation, the bank’s obligations to the customer lose force when:

- The bank paid the entire amount that was guaranteed;

- The warranty period has expired;

- The beneficiary himself renounced his rights;

- Mutual agreement between the bank and the customer on termination of the agreement.

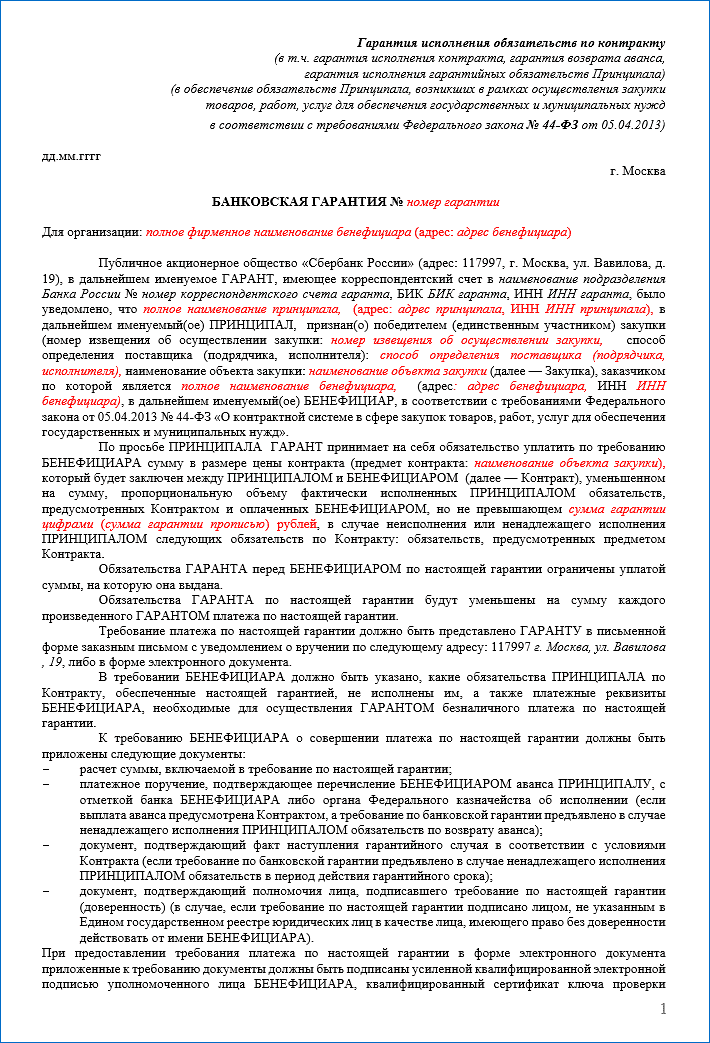

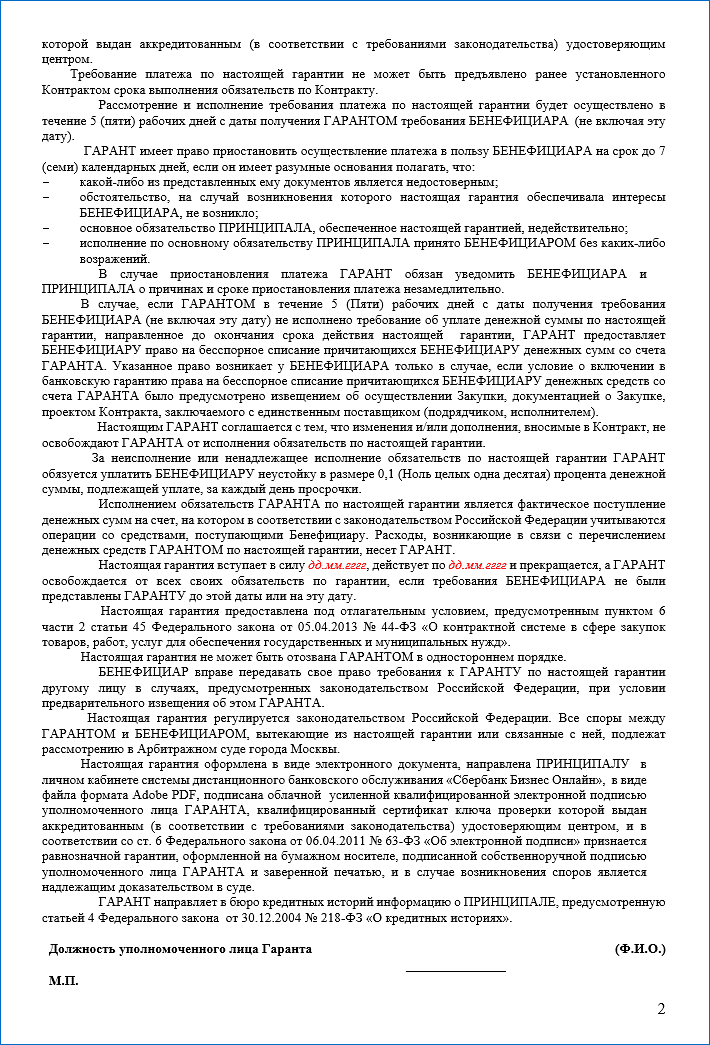

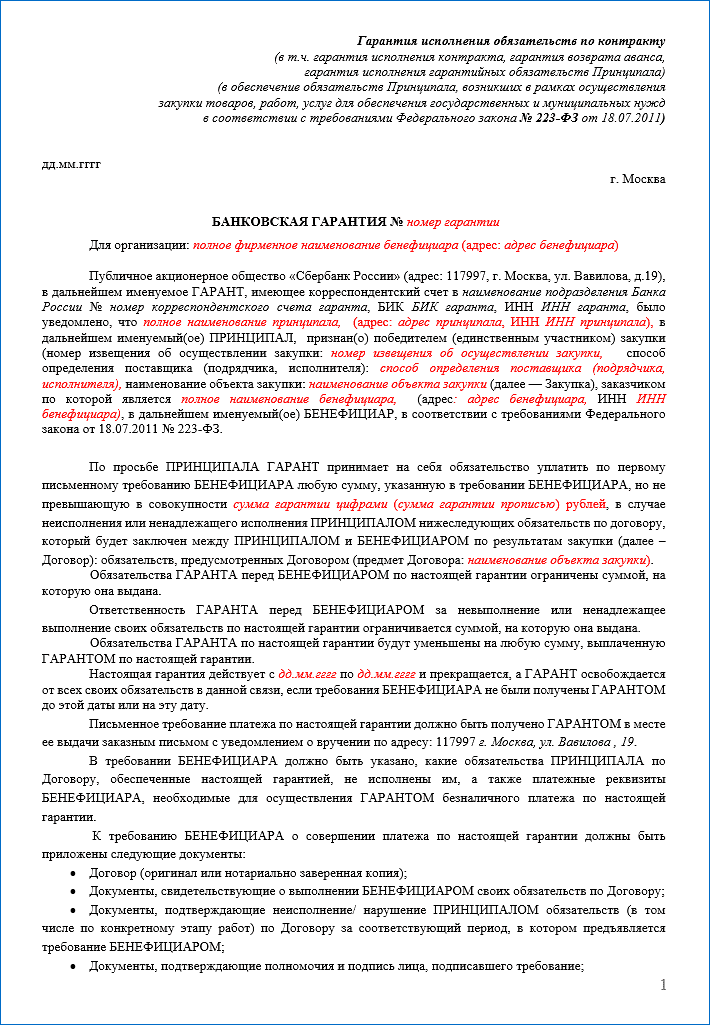

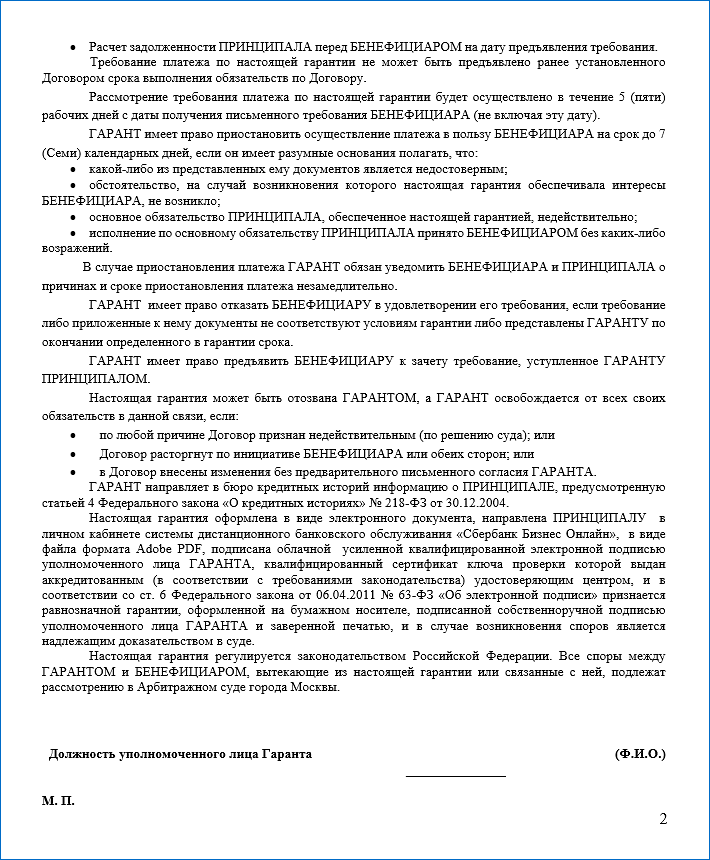

What does a sample guarantee look like in Sberbank?

Sberbank issues both identical (standard) guarantees and those edited to suit the customer’s requirements. The standard text has three different versions depending on the federal law under which the procurement is carried out (44, 223, 615-PP/185-FZ).

Below are two samples of a typical BG, suitable for the execution of the contract, return of the advance payment and warranty obligations in 2021.

Example for 44-FZ

Sample 1 page ()

Sample 2 pages

Example for 223-FZ

Sample 1 page ()

Sample 2 pages

Bank guarantee requirement: sample

Forms of requirements can be approved by various departments, depending on the purpose of the bank guarantee, or developed by the parties to the agreement. For example, the form of demand that the tax authority sends to the bank when the deadline for paying taxes changes, in accordance with Art. 74.1 of the Tax Code of the Russian Federation, approved by order of the Federal Tax Service dated 08/07/2017 No. SA-7-8/609.

Let’s take a closer look at the form of requirements for public procurement. It was approved by government decree No. 1005 of November 8, 2013, and a list of documents attached to the requirement is also provided here (the last changes were made on July 18, 2019).

The requirement for a bank guarantee, a sample of which according to 44-FZ is given below, includes:

- information about the beneficiary customer, bank and principal,

- guarantee details,

- data of the contract or application for participation in public procurement,

- listing of obligations violated by the principal,

- details of the account to which funds must be transferred,

- the deadline for fulfillment and the condition of a penalty in case of failure to fulfill the requirement on time,

- a list of attached documents to support the requirement (according to Resolution No. 1005);

- date of delivery of the document and signature - the official of the beneficiary, the bank employee who received the request.

The request for payment under a bank guarantee should be accompanied by: a calculation of the amount, a payment slip (with a note from the bank), according to which the customer transferred an advance to the principal, confirming a document confirming the occurrence of a guarantee event in accordance with the government contract (in case of improper fulfillment of obligations during the guarantee period), as well as a power of attorney for the official who signed the request, if he does not have the right to act without a power of attorney (clause 2 of the List, approved by Resolution No. 1005).

Request for payment of a bank guarantee - sample

How to check the warranty

Until July 1, 2021, all issued guarantees under 44-FZ were publicly available in a single register on the government procurement portal (EIS). According to the new rules, the check can only be performed by the customer for whom it was issued, as well as a bank employee with the appropriate authority.

In 2021, the supplier cannot do the authentication themselves. Therefore, the main recommendation now is to make sure in advance that the selected bank is on the list of permitted financial organizations for issuing bank guarantees. You need to find out this before you start receiving. Obviously, PJSC Sberbank of Russia is one of such organizations.

Often, suppliers need to find the registration number. To do this, you need to download the guarantee in electronic format in your personal account or contact the bank for an extract from the register.

What to do if the customer refuses to agree on the text of the bank guarantee?

In this article from the series “Typical mistakes when issuing a bank guarantee,” based on our own practical experience, we will consider a situation where the customer refuses to agree on the text of the bank guarantee.

We have been working in the field of public procurement for several years and over the years we have acquired a large amount of knowledge that we want to share. The material will help you avoid mistakes that often arise when issuing bank guarantees. Based on our own experience, as well as the experience of our clients, we will answer the most frequently asked questions.

Is the customer obliged to agree on the draft guarantee?

First, let's figure out whether the customer must approve the draft bank guarantee? Neither Law No. 44 nor No. 223 imposes such an obligation on the customer. However, there is such a concept as “business custom” (Article 5 of the Civil Code of the Russian Federation) - an established and widely used rule of conduct in any area of business or other activity, not provided for by law, regardless of whether it is recorded in any document. In the field of public procurement, agreeing on the text of the guarantee with the customer is a business practice. The fact that the customer refuses to approve the draft guarantee will be one of the factors on the basis of which one may not be included in the RNP if, after signing the contract, the customer refuses to accept it. But to do this, it is still necessary to at least send the draft guarantee to the customer for approval.

Requirements for the text of the guarantee under 44-FZ

According to Part 5 of Art. 45 of Law No. 44, the customer considers the bank guarantee received as security for the execution of the contract within a period not exceeding three working days from the date of its receipt. At the same time, it checks:

1) is there information about the bank guarantee in the register of bank guarantees?

2) does the bank that issued the bank account comply with the requirements established by the Government of the Russian Federation (specified in Part 1.1 of Article 45), and is there information about it in the corresponding list maintained by the Ministry of Finance?

3) is the bank guarantee irrevocable?

4) does the bank guarantee contain the conditions specified in parts 2 and 3 of Art. 45:

- the amount of the bank guarantee to be paid;

- obligations, the proper fulfillment of which is ensured by this guarantee;

- the bank’s obligation to pay the customer a penalty for each day of delay;

- the condition according to which the fulfillment of the bank’s obligations is the actual receipt of funds into the account, which, in accordance with the legislation of the Russian Federation, accounts for transactions with funds received by the customer;

- warranty period (taking into account the requirements of Art. and Law No. 44);

- is there a suspensive condition providing for the conclusion of an agreement for the provision of a bank guarantee for the obligations of the principal arising from the contract at its conclusion, in the case of a bank guarantee being provided as security for the execution of the contract;

- the list of documents established by the Government of the Russian Federation, provided by the customer to the bank simultaneously with the requirement to pay the amount of money under the bank guarantee;

- the customer’s right to undisputed write-off, if provided for in the notice of purchase, procurement documentation, draft contract concluded with a single supplier (contractor, performer).

5) whether the bank guarantee meets the requirements contained in the notice of procurement, the invitation to participate in determining the supplier (contractor, performer), procurement documentation, draft contract, which is concluded with a single supplier (contractor, performer).

Requirements for the text of the guarantee under 223-FZ

If we talk about Law No. 223, it does not contain clear instructions on the conditions that a bank guarantee should contain. Here you should always be guided by Part 4 of Art. 368 of the Civil Code of the Russian Federation, as well as procurement documentation (including the draft contract). At a minimum, the warranty must specify:

- date of issue;

- principal, beneficiary and guarantor;

- the main obligation, the performance of which is ensured by a guarantee;

- the amount of money to be paid or the procedure for determining it;

- warranty period;

- circumstances upon the occurrence of which the guarantee amount must be paid.

The guarantee may contain a condition on reducing or increasing its amount if a period or event specified in it occurs.

Conclusions and recommendations

From the above, we conclude that it is ALWAYS necessary to send the draft guarantee to the customer for approval, as well as carefully check the term, amount, details of the parties and compliance of the text of the bank guarantee with the requirements of the documentation. To do this you need to do the following:

- Carefully check the amount of the guarantee, while not forgetting about the anti-dumping requirements established by Art. 37 of Law No. 44. You can comply with the requirements of the law and documentation using our step-by-step Instructions for providing information about the good faith of the participant when concluding a contract. By the way, if the guarantee amount increases due to a fall during the procurement, you need to compare the amount received with the amount specified in the customer’s documentation, as well as in the draft contract or agreement sent to you for signature. In some cases, the customer incorrectly indicates the amount of the guarantee due to incorrect rounding. Agree, it would be a shame if the warranty was rejected due to a discrepancy of just one penny. In such cases, you can change the amount of the guarantee in the contract by drawing up a protocol of disagreements or ensure that the guarantee is issued in the amount required by the customer.

- Check the validity period of the bank guarantee. According to Law No. 44, it must be at least one month longer than the duration of the contract. According to PP No. 615 (overhauls), the warranty period must be at least 2 months longer than the contract period. Please note that the countdown starts from the end date of the contract, and not from the completion of the work by the contractor (they almost always do not coincide). And it is not a fact that the customer will explicitly state this requirement. According to Law No. 223, the Customer independently sets requirements for the validity period of the BG. In the documentation, he has the right to specify a specific period, to note that the warranty period is two, three or more months longer than the contract period. In addition, on the government procurement website, the customer often places an empty contract with blank start and finish dates for work. In such a case, when submitting an application to the bank for a bank guarantee, you need to focus on the maximum deadline for completing the work. The main thing here is the mandatory verification of compliance of the warranty period with the period specified in the project sent by the customer for signature.

- Check whether all documentation requirements are taken into account in the draft bank guarantee. Many banks, without reading the customer’s documentation, almost always present the bank’s draft guarantee for approval in the form in which they received it. This is why double-checking the text of the draft guarantee is so important.

There may be a different number of specific warranty requirements. The most common ones include the following.

- Customer requirements regarding the indication of a specific place for the consideration of disputes under a bank guarantee (as a rule, this is the location of the customer);

- Requirements for disclosure of obligations that are provided by the guarantee. For example, in documentation you can often find the following wording: an irrevocable guarantee must contain the following conditions for its execution by the guarantor bank if:

- the principal does not fulfill his obligations stipulated by the contract upon delivery of goods;

- the principal violated the deadlines for eliminating detected deficiencies in the supplied goods, established by the customer;

- if the principal performed the work stipulated by the contract poorly.

In addition, the documentation may provide for a specific form of bank guarantee. In this case, two options are possible: look for a bank capable of agreeing on the customer’s layout, or check the bank’s draft guarantee for the absence of contradictions, and then ensure its approval by the customer.

Therefore, it is important that the bank, your broker (if you work with one), and the customer are involved in the process of agreeing on the draft guarantee.

Tags : errors when registering a BG, approval of a guarantee, 44-FZ, 223-FZ,

April 14, 2019

Number of views: 11051

Please rate how useful this material was.

Rating: 4.4/5 — 7 votes

Similar articles:

- The national regime in public procurement will be applied to disposable medical products not only made from PVC (24)

- The court found the wording of the guarantee regarding the amount of liability of the guarantor bank consistent with the documentation (18)

- Courts: the winner of a public procurement may not be included in the RNP due to the absence of a bank guarantee in the register (17)

Comments ()

Write a comment

Tender loan from Sberbank

Instead of a bank guarantee, government procurement participants can apply for a tender loan without collateral from Sberbank. Size – up to 20 million rubles.

The guarantors can be a spouse, relative, or a third party. The application is processed in approximately 1 business day. The initial rate is from 15 percent per annum. Specific loan terms are calculated individually depending on the client’s financial condition.

Having a current account with Sberbank is mandatory. The duration of the business must be at least six months.