The amount of land tax directly depends on the cadastral value of the land plot. At the same time, planned revaluation of real estate is carried out rarely and en masse, which leads to unreasonable overestimation or underestimation of prices. In this case, the owner has the right to file an application for review, justifying his claims and providing the necessary package of documents.

How often does the price of land change, is annual revaluation possible?

The procedure and conditions for cadastral valuation of land are regulated by Federal Law No. 135-FZ of July 29, 1998 (hereinafter referred to as the Law).

The cost of land plots within populated areas may change by decision of executive authorities during a planned recalculation or at the request of the owner. There are a significant number of factors that positively or negatively affect the price and are taken into account when forming or changing it:

- location of the land plot, surrounding infrastructure;

- area, building materials, soil fertility and quality;

- land surveying, presence of completed construction projects, their age;

- purpose, category of land;

- significant change in market value (read about market value and its differences from cadastral value);

- prospects and plans for the development of the settlement;

- errors or changes in the original assessment data.

Changes can be made no more than once every 3 years according to Art. 24.12 of the Law.

For federal settlements this period is 2 years. The maximum term without cost adjustment is 5 years. During this period, the price according to the cadastre must be revised at least once. The assessment is made before January 1 of the year in which the changes are made.

How often does it change?

Cadastral value indicators have different values for individual categories of land, mainly differing in their purpose or useful quality .

From time to time, prices for certain categories of plots are revised. This is often due to the fact that key indicators change over time, which have a significant impact on its value.

In general, the revaluation procedure is determined by Federal laws, and the terms themselves are established by the State Real Estate Cadastre.

There are time frames within which the cadastral value revaluation procedure is carried out.

Thus, the maximum period is limited to 5 years , and the minimum is 2 years - in this case, the main factor on which they rely when revising prices is the region in which the site is registered.

In some cases, the revision of the cadastral value may be initiated ahead of schedule .

In particular, such cases may be:

- Changing the area of a plot of land towards decreasing or increasing;

- Carrying out land surveying;

- Changing the purpose of areas. For example, the conversion from land for growing crops to plots for individual residential construction automatically increases the price;

- Commissioning of a facility built on a specific plot of land. As a rule, such actions significantly increase the price of the plot;

- With significant development of infrastructure around the land plot, since the presence of hospitals, schools, kindergartens and other facilities in close proximity to them significantly increases its value;

- Changes in indicators at current market prices.

Reasons for the increase

The cadastral value of real estate during a planned assessment is not calculated locally, but is carried out by appraisers based on publicly available sources of information and average market prices. As a result, the final markup can be up to 30% and may not correspond to the actual condition of the land plot. For several:

- regional programs to improve settlements, infrastructure development (opening schools, kindergartens, services);

- incorrect or inaccurate definition of the category of permitted use;

- low frequency and mass revaluation, averaged data;

- making changes to the state register in connection with an increase in area, construction of buildings and engineering facilities on the site;

- directive from executive authorities to increase the tax base for calculating land tax.

The last circumstance is the subjective opinion of some experts, but it is not without reason. It is based on the value of the land according to the cadastre that the tax levy is calculated, which increases proportionally.

An increase in the average market value of similar real estate in a locality or nearby regions may also have an impact on the increase.

Forecast

According to the adopted Federal Law No. 360 dated July 3, 2016, with amendments currently in force in all regions, the growth of cadastral value has been suspended for some time - it will not be revised until January 1, 2021 .

At the end of this period, the price for plots will be revised, but in accordance with Federal Law No. 237 “On State Cadastral Valuation”, this process will be carried out by independent public sector institutions under the supervision of Rosreestr.

By whom and on what basis is the recount carried out?

In any case, a written statement from an authorized person or organization is required to re-evaluate or change the cadastral value of the land plot. These include the owner of the property (individual or legal entity), municipality or territorial executive authorities.

According to Art. 9 of the Law the grounds are:

- agreement between the appraiser and the individual or legal entity that owns the land plot;

- determination of a district, arbitration or arbitration court;

- resolution of territorial executive authorities.

It is possible to initiate a revaluation or change in value if the property undergoes a planned revaluation by the State Cadastre, land surveying is established or the boundaries of the territory are changed, the type of permitted use or category of land changes.

The owner has the right to submit a corresponding petition in connection with other circumstances that objectively affect the assessment (decrease or increase in soil fertility, natural disasters, cadastral and audit errors).

Not only full owners, but also persons with the right of indefinite residence, inheritable ownership and tenants (with the consent of the owner, if the housing is not social) have the right to apply for a revaluation or change in the cadastral value.

How to change the indicator?

First of all, check the current cadastral value through the Unified State Register of Real Estate (USRN) extract (how to get an extract?). It is necessary to apply for a review if errors are identified in the assessment data or if it is necessary to establish a market price. It is also possible to form an appeal if the characteristics or condition of the property change.

Where to go for review?

- regional executive authorities;

- delegates of the Union of Entrepreneurs (monitoring the situation on the real estate market);

- qualified appraisers;

- accredited by a self-regulatory organization (SRO).

The petition is sent to the chairman of the commission. Documents and applications may be submitted to the MFC if available in the region.

Statement

The application is drawn up in any form in printed text on an A4 sheet, indicating the full name and address of the applicant, as well as the full name of the chairman of the commission. Indicated:

- link to article 24.19 of the Law;

- view;

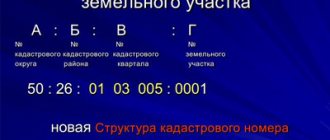

- address and cadastral number of the property;

- basis for review.

The appendix contains a list of documents confirming the applicant’s rights and arguments. Consideration will be refused if the necessary documents are missing or the five-year statute of limitations has been missed (Article 24.18 of the Law).

Documentation

The application form is provided at Rosreestr . It can also be found on the official website of the institution. If a third party acts on behalf of the owner, it is necessary to provide a notarized power of attorney. List of documents:

- an extract from the Unified State Register on the cadastral value of the land plot;

- documents confirming the unreliability of the information used for assessment (if necessary);

- report on establishing the market value of the land;

- receipt of payment of state duty.

There is no need to attach title documents to the application.

In some cases, other written evidence supporting the applicant's arguments is allowed. For example, the conclusion of a geological examination about a change in the chemical composition of the soil, if the reason is a decrease in fertility.

How much does the procedure cost and when is it performed?

- According to Part 6, Clause 1, Art. 333.19 of the Tax Code of the Russian Federation, the state fee when challenging the cadastral value by individuals in court is 300 rubles. Legal entities will need to pay 4,500 rubles.

- The work of the appraiser is also paid by the owner, where the price of the service varies between 3-10 thousand rubles.

- If necessary, the services of legal intermediaries and consultants are paid (15-20 thousand rubles).

- Making changes to the state register will cost 350 rubles for individuals and 4,000 rubles for organizations.

The application is considered within 1 month, and the applicant is informed about the date and time of the meeting within 7 days from the date of application.

The owner is notified of the results within 5 working days from the moment the decision is made (Article 24.18 of the Law).

Presentation of results by a special commission

Upon a positive decision of the commission, within 10 days the information is sent to the Unified State Register of Real Estate with prior notification of the owner.

Changes are registered in the database and posted on the official website of the institution within another 10 days. Within the same period, the applicant has the right to challenge the commission’s decision in court if there is a refusal and the requirements are not fully satisfied.

How will the frequency of state cadastral valuation change?

The next state cadastral assessment will be carried out 4 years from the year of the last assessment. Cities of federal significance will be able to reduce this period by half.

Nowadays, as a general rule, the next assessment is carried out no more than once every 3 years, but at least once every 5 years. In cities of federal significance, real estate cannot be revalued more than once every 2 years.

The new rules will begin to apply:

- from January 1, 2022 - in relation to land plots;

- from January 1, 2023 - in relation to buildings, premises, structures, unfinished construction sites, parking spaces.

Recalculation of land tax

391 of the Tax Code of the Russian Federation, the cadastral value of real estate acts as a tax base for calculating land tax, and accordingly entails a revaluation of its value. There is no need to submit a written request to the Federal Tax Service, since the recalculation is carried out automatically. The amount of tax will change for the reporting period in which the owner filed an application with the court or collegial commission. The procedure is carried out from the moment of registration of changes in the state register.

Innovations in challenging cadastral value

From January 1, 2023, a new procedure for challenging the cadastral value of real estate will be in effect. However, regions can already put the updated rules into effect ahead of schedule.

What are the innovations? First of all, you first need to apply for a revision of the cadastral value to a special budget institution. And only after that you can go to court. The transition period is valid until 2023.

How can I find out if a region has introduced a new cost review procedure without waiting until 2023? To do this, you need to go to the website of the regional department of Rosreestr.

How to reduce the rate?

Reducing the cadastral value is relevant when the usefulness of the land decreases, as well as in a number of other cases:

- damage to the fertile soil layer, drought, natural disasters;

- formation of a swamp, ravine, landslide;

- establishment of a gratuitous easement;

- transfer of land into the ownership of several persons.

The application must be submitted to the city cadastral chamber in accordance with the general procedure. Documents confirming the applicant's arguments are attached to it.

How to challenge it in court?

The decision of the commission is similarly contested within 10 days from the date of its issuance. A copy of the defendant's statement of claim is certified by a notary and sent to the address of the territorial office with a notification of delivery and a list of attachments. Thus, the cadastral value of a land plot can be challenged in several cases when the condition and characteristics of the property change.

An application for a change in value must be submitted to the territorial department of Rosreestr or the MFC, having collected the necessary package of documents. The appeal will be considered within 1 month, and then within another 20 days it will be registered in the state register if the decision is positive.