Features of the procedure

Registration of a mortgage is the final stage of purchasing real estate on credit, which represents the inclusion of data about the property being purchased and the conditions for its acquisition in the database of the unified state register. This procedure confirms the transaction at the state level and protects the rights of all parties to the mortgage agreement. By law, this responsibility is assigned to Rosreestr. And the registration of mortgages is carried out by the territorial body of the federal state registration and cadastre service - the registration chamber.

In addition to the agreement with the bank, Rosreestr can register a purchase and sale agreement for property between the seller and the buyer. Thus, the seller reduces its risks by officially placing an encumbrance on the buyer until full payment of the contract price.

However, it should be borne in mind that not all real estate can be included in a single Rosreestr. Such objects include: dachas, land plots that are state property and plots not allocated from public property, premises intended for business activities, isolated rooms. Also, ships and aircraft, as well as real estate that cannot be assessed due to various circumstances, are not registered.

Depending on the type of mortgage, the procedure for registering it differs.

Legally, there are 2 types of mortgages:

- By virtue of the contract. The collateral for the loan is the borrower's existing housing. With a contractual mortgage, there is no need to confirm the purpose for which the loan is taken, and the terms of the loan are specified in a separate agreement. This type of mortgage is a certain risk for the bank, since it acquires rights to the collateral property only after the mortgage agreement is registered, which occurs within three months allotted by law. To protect themselves with a negotiated mortgage, banks require the borrower to provide guarantors for the loan and set an increased interest rate for the period of registration of the agreement.

- By force of law. The most common type of mortgage. In this case, the borrower takes out a loan from the bank to purchase a home, which is registered as the buyer’s property and at the same time becomes a security deposit for the funds taken. Mandatory conditions are a change in the owner of the property and the provision of a loan for the purchase of housing from the bank's targeted funds, which can be issued to the borrower only upon provision of one of the following documents:

- agreement of shared participation in the construction of a house;

- contract of sale;

- agreement for the assignment of rights to real estate.

For more information about what a mortgage is by force of law and by force of contract, how they differ and how each type of mortgage is registered, read the detailed article on our website.

There are 4 main differences between one type of mortgage and another:

- The presence of a bank representative when registering a mortgage is required only when lending by virtue of an agreement;

- A mortgage by force of law exempts the bank from paying state duty;

- With a legal mortgage, the collateral is the housing purchased with loan funds, and with a contractual mortgage - any real estate of the borrower;

- In the legal form, the registration of the mortgage agreement is carried out simultaneously with the registration of the borrower’s ownership of the purchased apartment, and in the contractual form, the purchase and sale agreement is registered first, and then the mortgage agreement.

Mortgage by operation of law, what does it mean?

When they talk about a mortgage by virtue of law and contract, they mean the reason for the creation of the pledge. A mortgage by force of law occurs when an encumbrance is placed on the property automatically, as required by law. This happens when you receive a targeted loan for the purchase of real estate. When you buy an apartment with a mortgage loan, it becomes collateral to the bank for the period of repayment of the debt. This rule is called a mortgage by force of law.

The articles on mortgages by virtue of Federal Law No. 102-FZ (Federal Law “On Mortgage” dated July 16, 1998 No. 102-FZ, as amended on December 31, 2017) describe in detail all possible options for mortgaging real estate and cases of its occurrence.

But what if you do not want to mortgage the property you are purchasing or take out a non-targeted loan secured by your property? The legislation offers another option for registering an encumbrance - a mortgage by virtue of an agreement. It applies when you already own an apartment and you voluntarily pledge it for a loan. The documentation drawn up when encumbering an object also differs; in this case, a mortgage agreement will be required.

Mortgage secured by existing real estate

The procedure for registering a mortgage and its removal after paying off the debt for both types of mortgages is practically no different. During the loan repayment period, restrictions on its use will be imposed on the property. You will not be able to sell, exchange or gift real estate, because transactions are prohibited. Mortgage restrictions by law also apply to the registration of new residents. To register someone in a mortgaged apartment or house, you must first obtain written permission from the bank.

Theoretically, the lender can agree to the sale of the mortgaged property. For example, another client of his decided to buy your apartment. In this case, the pledge and ownership rights are re-registered to the new owner. The proceeds go to pay off the debt, and the rest goes to you. Under other circumstances, obtaining permission to sell from the bank is extremely difficult.

How to register: 7 steps

The legislation also regulates the procedure for state registration of a mortgage transaction. It involves 7 sequential steps for a person registering his ownership rights to real estate:

- Find out which registration authority you need to contact. This can be done at the creditor bank or on the Rosreestr website;

- Collect the documents necessary for registering a mortgage. Please note that some documents have a limited validity period, so they must be obtained immediately before submitting to the registration authority. A consultant at the registration chamber will help you collect all the documents you need. He will not only provide a list of documents needed in a particular situation, but will also indicate the validity period of each of them;

- Pay the state fee. Without confirmation of payment of the fee, the registration authority will not begin the procedure for registering ownership of real estate;

- Sign up at the Registrar's Office to submit documents. This can be done on the State Services website or directly at the registration authority;

- At the appointed time, come to the Registration Chamber and submit documents to register the mortgage agreement. The employee who accepts the documents will immediately announce the completion date of registration;

- The submitted documents are then examined to determine their authenticity and factors that make registration of ownership impossible. If any are identified, then the person registering the title will be required to provide additional documents, which he is obliged to provide as soon as possible;

- If no obstacles are identified, then within the specified period the person is notified that the registration of housing ownership has been completed. If necessary, he can obtain an extract from the unified state register confirming this right.

There are a number of nuances that need to be taken into account.

If an apartment in a new building is purchased with a mortgage in an unfinished building, then the DDU is registered in Rosreestr, and ownership rights can be issued only after the house is put into operation. Typically, in such situations, the developer himself submits documents to Rosreestr, but this can significantly delay the registration process. Therefore, the owner has the right to collect documents and independently start the mortgage registration process.

When registering rights to secondary housing, a pledge or mortgage agreement is also required. Once entered into the register, the property becomes the property of the borrower, but he has limited rights to dispose of it.

And one more important point: the property owner must submit documents in person. If housing is registered in the name of several persons, then all owners must be present when submitting documents. It is allowed to delegate rights to your representative, but he must have a notarized power of attorney.

Features of a mortgage by force of law

When obtaining a home loan, borrowers should consider the important consequences of registering a transaction:

- If there are regular late payments, the bank may transfer the right to the collateral to third parties (for example, a collection agency) or sell it by court order. In this case, written notification to the borrower about upcoming procedures is required.

- Mortgage by force of law by minor owners is permitted by law, but under one condition. If children become the new owners of real estate, you must first obtain the consent of the guardianship and trusteeship authorities for the pledge. The fact is that such a transaction affects the interests of the child, so the state must assess its legality.

- The pledged property must be in an unchanged condition, and the borrower is obliged to take all possible measures to preserve it. It is for this reason that banks require collateral insurance during the repayment period of the mortgage loan. What happens if you don't get mortgage insurance?

- If a situation arises where there is a threat of damage or destruction of property, its owner is obliged to immediately notify the mortgagee.

- The bank has the right to check the condition of the collateral at any time. Although in practice, representatives of a credit institution rarely go to inspect it themselves. Is it possible to do redevelopment when the apartment is under mortgage?

- The owner of the property has no right to rent it out without the consent of the mortgagee. The fact is that tenants can damage the security deposit, which will affect its value. Is it possible to rent out an apartment purchased with a mortgage?

Recommended article: Sberbank mortgage terms for building a house

Of course, according to the documents, the property belongs to the borrower and his family members. They can use it for personal residence and household needs, but not make transactions and not use it for earnings (with the exception of a commercial mortgage). In any case, the bank acts as a potential owner of this property. He has the right to take it away and put it under the hammer if the client does not comply with the essential terms of the loan agreement.

List of documents

What documents are required to register a mortgage agreement with the Rosreestr authorities? The following papers are required:

- Passports of all owners. If a purchase and sale agreement is registered, then passports of both the buyer and the seller are needed;

- Statement from the borrower and lender. It must be signed in the presence of a representative of the registration authority;

- An agreement under which a loan is provided for the purchase of real estate and an encumbrance on it is registered, along with a full list of attachments to it;

- Contract of sale;

- Documents for real estate confirming the seller’s right to it;

- Cadastral passport for housing;

- Real estate valuation document for a mortgage;

- An extract from the house register of registered housing and a certificate of absence of debt for housing and communal services;

- Mortgage note with attachments;

- If there are one or more minors among the owners, then a certificate from the guardianship authorities is required, in which they consent to the transaction;

- Notarized consent of the seller’s spouse to sell the home;

- Receipt for payment of state duty.

To register a mortgage, additional documents may be requested, depending on the specific situation.

For example, when registering an apartment in a new building, you will need documents that the company building the house must provide:

- Share participation agreement;

- Permission to put the house into operation from the municipality;

- Registration certificate of the house, issued by the BTI;

- The act of transferring the apartment to the owner, signed by a representative of the architecture;

- A protocol confirming the distribution of residential and commercial zones in the house itself and in the local area;

- A document indicating the address and zip code assigned to the house.

When registering a secondary home, documents may be required confirming the technical condition of the house and the absence of alterations in the apartment.

You might be interested in:

How to use maternity capital to pay off a mortgage, what important nuances need to be taken into account, a step-by-step scheme for taking out a mortgage using maternity capital in this article.

How to restructure a mortgage with the help of AHML and the state, who can count on approval of an application for restructuring, a step-by-step procedure for completing the procedure, as well as useful tips.

Registration of mortgage by operation of law and repayment of record

State registration of a mortgage by force of law in Rosreestr occurs as follows:

- You have received approval from the bank for your mortgage application and are ready to enter into a deal. The loan specialist prepares all the necessary documents. As a rule, this is a loan agreement with a clause on the registration of collateral, a purchase and sale (or construction) agreement and a mortgage.

- The basis for registration of a pledge will be an application for registration of a mortgage by force of law from one of the parties to the credit transaction or the notary who registered the transaction. His participation is mandatory if you buy real estate in shared ownership.

- Registration of ownership and pledge in favor of the bank occurs within 5 days. After which they will issue an extract from the Unified State Register of Real Estate stating that you are now the owner of the property. The line on encumbrances will indicate a mortgage by force of law in favor of your creditor bank.

Please note that there is no state fee for registering a mortgage by law.

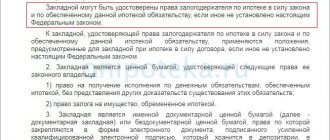

Separately, it is worth mentioning such an important document as a mortgage note by force of law. According to Federal Law N 102-FZ, it is not a mandatory condition for registering a mortgage transaction. To a greater extent, a mortgage is necessary for the bank to provide additional guarantee of debt repayment.

It is printed by the bank and contains the basic conditions for pledging real estate and repaying the loan debt. The borrower and other mortgagors (if any) put their signatures on it and submit it to Rosreestr together with other loan papers. The original document is kept in the bank's archives, and after the mortgage debt is paid off, it is issued to the property owner to remove the encumbrance.

Since 2021, bank clients have the opportunity to issue an electronic version of the document. The client and a representative of the credit institution fill out a special application on the Rosreestr website and certify it with electronic signatures. A mortgage issued in this way has a legal meaning similar to the paper version.

After full payment of the loan debt, the borrower should remove the encumbrance from the collateral property. This is the final stage of the mortgage. Removing the encumbrance is not so difficult:

- Receive a certificate from the bank about fulfilled obligations.

- Contact the Rosreestr office or the MFC with an application to repay the mortgage by force of law. If the personal presence of a bank representative is required, you need to coordinate with him the time of visiting the government institution. To remove the encumbrance, you need to take with you a certificate from the bank, a loan agreement, a mortgage and a passport.

- After 5 days, you will receive an extract from the register of rights, where the encumbrance in favor of the bank will no longer appear in the collateral line.

There is no need to remove the encumbrance the day after the mortgage is paid off. The certificate you will receive from the bank has no expiration date. You can address this issue at any time convenient for you. Now that you can submit documents to the MFC, the procedure for removing the collateral does not take much time. It is enough to visit the branch of the multifunctional center twice to submit an application and receive a “clean” extract.

Useful tips

To ensure that the state registration procedure for a mortgage goes quickly and safely, you need to take into account a few tips from experienced lawyers:

- Before signing any documents - a purchase and sale agreement, a loan agreement or any other, be sure to read them carefully. If you yourself are afraid of misunderstanding or losing sight of something, then contact a lawyer who will check the documents for correctness and compliance with the interests of all parties to the process.

- When buying an apartment with a mortgage, be sure to check its reliability: the encumbrances that are on it, debts for housing and communal services. You can find out about encumbrances in the same registration chamber by ordering an extract for the purchased housing.

- Before you start collecting documents for registration, consult with the registrar which documents you need to provide. This will save time and protect you from possible errors in providing documents.

And the most important advice: if you have questions, be sure to consult with professionals. There's no shame in not knowing something. It will be much more unpleasant to make mistakes and then correct them. But the price of an error may be refusal to register the mortgage and recognition of the transaction as void.

Procedure

Federal Law No. 102 “On Mortgages” provides a clear procedure for registering a mortgage. This procedure is described in Article 20 of Chapter IV of the law. The borrower needs to follow the following algorithm:

- Collect documents . There are not many papers, so this stage will not cause any particular difficulties. The list of documents will be given a little lower in this article.

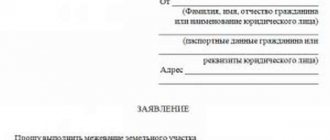

- To write an application . This must be a joint application of the borrower and the bank, but the borrower himself must initiate the procedure. We will also tell you more about writing an application below.

- Submit documents to Rosreestr . The following must be present: the mortgage borrower, a representative of the bank, the owner of the mortgaged property (or land). The owner of the property must have written consent from his spouse and/or other owners, certified by a notary. The presence of all owners is not required. Read about how to register a mortgage agreement in Rosreestr and what documents are required for submission, as well as the cost and deadlines here.

- Pay the state fee . It is paid by the mortgage borrower.

- Wait until registration is completed . The process may take 30 days (calendar), but usually everything happens faster.

Where should the borrower go?

First, the borrower must go to the bank and write a joint application. Afterwards, in order for the mortgage agreement to be registered, you must contact the Rosreestr authorities.

This can be either an authority at the place of current registration, or a branch at the place where the mortgaged apartment is located. In Rosreestr, except for the payment of state duty, all services are provided free of charge .

For speed and convenience, you can use the services of the MFC (multifunctional center). He charges a fee for his services, but registration is much simpler. At the MFC, a person simply issues a power of attorney for an employee of the center, after which he does everything else (goes to institutions, collects documents, stands in queues).

What documents are needed?

The list of necessary documents for state registration of a mortgage is as follows::

- joint application of the bank and the borrower (2 copies);

- mortgage agreement (2 copies);

- loan agreement secured by a mortgage (also 2 copies);

- passports of all participants in the process (borrower, owner, bank employee);

- receipt of payment of the state fee (what is the amount of the state fee for registering a mortgage for a legal entity and an individual?);

- mortgage, if available.

Rosreestr may require additional documents related to the subject of the mortgage (real estate). By default, they do not need to be provided - only upon request. Most often, Rosreestr requires the consent of the apartment owners to sell it if it is an apartment from the secondary market. Sometimes you may need notarized copies, although originals are usually sufficient.

How to write an application?

To write an application, the borrower must contact the bank. The document must be filled out together with a bank representative. The application is written in the prescribed form (the form is available at the bank) on behalf of the borrower and an employee of the banking institution.

Information that must be contained in the application:

- Full name of each participant.

- Legal basis. This text is already included in the application form; you do not need to enter it manually. But you should check that it really exists.

- Parameters of the mortgage object. Area, cost, loan term, total transaction amount including interest.

- Address and cadastral number of the mortgaged property.

- Date written and signed by each participant.

TIP : There will not be any particular difficulties when writing an application, because bank employees fill out this document for every mortgage transaction. The borrower just needs to make sure that they don’t try to deceive him - sometimes this happens.

Registration of a mortgage agreement: terms, fees, features of the procedure

The period for registering a mortgage agreement in Rosreestr is strictly regulated at the legislative level. The time frame is specified in paragraph 5 of Art. 20 Federal Law “On Mortgage” and are:

- For land plots – up to 15 working days .

- For real estate – up to 5 working days .

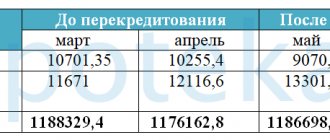

Another important point is the payment of the state duty, which falls on the shoulders of the mortgagor (the person who purchases housing or land on credit). If the obligation arises due to the operation of a certain law, then the state fee for registering a mortgage agreement is paid on preferential terms (this procedure is valid when applying for real estate loans for military or government employees). If a mortgage pledge agreement is concluded, as a general rule, the amount of state duty is paid in full.

Attention! The amount of the state duty is determined by the Tax Code of the Russian Federation in clause 28.1 of Art. 333.33. The amount reaches 1.0 thousand rubles. for citizens of the country, 4.0 thousand rubles. – for organizations.