What is and what is not commercial real estate?

I would like to note right away that individual entrepreneurs, small and medium-sized businesses are classified as organizations - a general taxation procedure has been established for them. And in order to understand real estate taxes, you need to define what commercial real estate is. After all, not every non-residential premises is classified as commercial. Firstly, these are non-residential buildings and premises. Secondly, the specific purpose of using these objects is important.

Why is the second point important? Car spaces or apartments are also non-residential premises. And, of course, you can use them in your business activities - rent them out, for example. But upon initial consideration, these are non-commercial premises. Next, I will talk about cases when they will also be subject to taxation for commercial properties.

New tax for unemployed citizens

How to convert residential premises into non-residential ones?

How is the bet size determined?

Any type of commercial real estate is subject to tax. The rate depends on the book or cadastral value of the property. Some types of real estate are valued at the cadastral price. Such objects include:

- Shopping complexes and all premises included in them.

- Foreign real estate located on the territory of the Russian Federation.

- Administrative buildings and centers.

- Those non-residential buildings that are intended to house an office, catering facility, retail outlet or public service facility.

All other commercial premises are taxed based on the book value of the property. Since payment amounts are distributed to regional funds, it is the regions that set the amount of taxation.

Are the rates different for individuals, individual entrepreneurs and organizations?

The maximum tax rate is different for individuals and legal entities:

- For individuals and individual entrepreneurs, the maximum rate can be 2% of the cost indicated in Rosreestr.

- For legal entities maximum 2.2%.

For individuals, the rate also depends on the cost of the premises:

- if the property is cheaper than 300 thousand rubles 1%;

- 300-500 thousand rubles - 0.1-0.3%;

- more than half a million - 0.3-2%.

You can reduce the mandatory payment by 0.1-0.3% of the rate. But benefits are also distributed according to regional legislation.

Property tax for organizations and individual entrepreneurs

Owners of administrative and business centers, commercial and retail buildings and premises in them must pay property tax.

At the same time, the Tax Code exempts organizations and individual entrepreneurs operating under the simplified taxation system (STS) from property tax. But with one significant caveat: except for commercial properties, the tax on which is calculated based on the cadastral value. Finding an object for which the cadastral value has not been determined is no longer easy. In this order, the value of real estate is determined in 74 constituent entities of the Russian Federation. Every year, authorities identify more and more new objects that are used for commercial purposes, and include them in the List of retail, office objects, public catering and consumer services, subject to property tax based on the cadastral value. This list is posted on the official website of the regional authorities. For example, today in Moscow there are 30 thousand such objects in the document with a total area of about 96 million square meters. meters.

How to challenge the cadastral value of commercial real estate?

Registration and taxes of individual entrepreneurs for dummies

Commercial real estate tax from 2021

This article will answer the following questions:

- what real estate is considered commercial;

- what changes related to commercial property tax occurred in January 2021.

What is commercial real estate

Commercial is real estate that is not residential or summer cottage, and is not a personal plot of land or a garage. Although an apartment or house can be considered commercial, provided that it is rented out. In general, the purpose of such real estate is to make a profit.

Commercial real estate includes:

- catering canteens;

- cafes, bars and restaurants;

- production workshops;

- shopping and entertainment complexes;

- administrative and office premises.

- industrial (warehouses, hangars, workshops and other industrial facilities);

- social (medical centers, libraries, airports and others like them);

- residential premises for rent;

- buildings and premises for free use.

Such real estate can be divided by type:

Commercial real estate is a taxable property. Its owner calculates and pays tax. Payment terms are determined by regional authorities.

Previously, the tax on commercial real estate was calculated based on its average annual value. Then calculations for some objects began to be carried out according to cadastral value. Now the following should be calculated:

- shopping complexes and administrative premises with an area exceeding 3000 m²;

- real estate of organizations or individual entrepreneurs located outside the Russian Federation;

- office rooms;

- catering premises with a hall area exceeding 150 m²;

- residential premises, garages, parking spaces, unfinished construction projects, as well as residential buildings, garden houses, outbuildings or structures located on land plots provided for private farming, vegetable gardening, horticulture or individual housing construction.

The premises listed in the last paragraph were introduced by the new law.

Changes in 2021

On January 1, 2021, Law No. 379-FZ came into force, which makes changes to the procedure for calculating property tax. In particular, the changes affected paragraphs. 4 paragraphs 1 art. 378.2 Tax Code of the Russian Federation.

Previously, changes should have been made to paragraph 70 of Art. 2 of Law N 325-FZ. The text of the changes sounded like this:

“Other real estate objects recognized as objects of taxation in accordance with Chapter 32 of this Code, not provided for in subparagraphs 1 - 3 of this paragraph.”

That is, if the cadastral value of the property is determined, then it is the “cadastral” tax on the property of organizations that must be paid, regardless of the average annual value, address and presence in the regional list. Based on the concept of “other real estate”, we can conclude that all commercial real estate of organizations should be included in the cadastral value calculation.

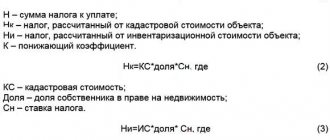

How to calculate the tax amount

The full amount of tax at the cadastral value is determined by the following formula:

TnI = Tax base × Tax rate

The amount of advance payments is calculated using the following formula:

AP = Tax base × ¼ × Tax rate

For example, the cadastral value of a real estate property is 20 million rubles. The tax rate is 1.5%. Then:

- annual tax amount - 300,000 rubles (20,000,000 × 1.5%);

- advance payments for the first quarter, half a year and 9 months will be equal to 75,000 rubles (20,000,000 × ¼ × 1.5%);

- the amount of tax payable at the end of the year is 37,500 rubles (300,000 – 3 × 37,500).

If ownership arose or ceased during the reporting period, then the amount of tax is determined based on the number of full months of ownership.

Formula for calculating advance payments:

AP = Tax base × ¼ × Tax rate × Number of full months of ownership of the property in the reporting period/3.

Formula for calculating the total tax amount for the year:

NnI = Tax base × Tax rate / Number of full months of ownership of the property in a year / 12.

The wording introduced by paragraph 70 of Art. 2 of Law N 325-FZ, did not provide a clear definition and raised many questions. For this reason, changes introduced specifically to paragraph 2 of Art. 1 of Law N 379-FZ. Thus, the list of property, the tax base of which is determined as the cadastral value, was supplemented with specific examples.

Who should pay property tax?

The law does not exempt owners of administrative, business and shopping centers who apply the simplified tax system from property tax. Moreover, it does not matter whether the taxpayer owns the entire building or just one premises.

An administrative and business center is a separate non-residential building in which at least 20% of the space is intended for business, commercial or administrative purposes. Or it is a building located on a plot of land with a permitted use for such premises.

Information about the purpose of a non-residential premises, building or land plot is contained in the Unified State Register or technical accounting data (BTI, Rostekhinventarizatsiya). Such objects include offices, meeting rooms, reception areas, parking lots and even office equipment.

A shopping center is a separate building in which, in accordance with its purpose (the purpose of the land plot), retail facilities, public catering facilities, and consumer services are located. The building will be classified as a shopping center if more than 20% of the premises are used for these purposes.

If, according to the Unified State Register of Real Estate or technical accounting data, the purpose of the building or land is different, but more than 20% of its premises are used for shops, cafes, and consumer services, for tax purposes it will be classified as shopping centers.

Instructions: how to order an extract from the Unified State Register of Real Estate?

Individual entrepreneur taxes when renting out housing

Who has the right not to pay?

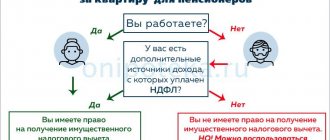

When owning commercial real estate, individuals are entitled to preferential conditions in the same way as residential property owners. The following are exempt from payment, in accordance with Article 407 of the Tax Code of the Russian Federation :

- War veterans and combatants.

- Pensioners, labor veterans.

- Participants in the liquidation of the consequences of the Chernobyl accident and persons equivalent to them.

- Disabled children.

- Disabled people of groups I and II.

It should be noted that the preference for individuals applies only to one piece of real estate. If a citizen entitled to benefits owns two or more premises, tax must be paid for the second and subsequent ones. In this case, it makes sense to choose an object with the highest tax amount.

Entrepreneurs on a simplified taxation system are exempt from paying property tax , since they pay a general tax that replaces individual ones. However, real estate included in the cadastral list is subject to property tax.

Benefits also exist for those facilities that are used to house certain types of organizations and enterprises. Thus, the owner of the property is completely exempt from payment if commercial real estate is used to accommodate:

- religious organizations;

- cultural sites;

- budgetary enterprises;

- transport enterprises, including the metro;

- defense enterprises;

- companies providing jobs for people with disabilities.

To receive benefits, you must submit an application and documents confirming the taxpayer's right to benefits to the tax authority at your place of residence. For legal entities conducting activities that are subject to benefits, it is sufficient to reflect the right to preference when filing a tax return.

Which organizations are eligible for benefits?

At the same time, there are benefits both at the federal and regional levels (Chapter 30 “Organizational Property Tax” of the Tax Code). The list is quite impressive. For example, benefits can be used by:

- religious organizations,

- public organizations of disabled people,

- pharmaceutical manufacturers,

- prosthetic and orthopedic enterprises,

- bar associations, bureaus and legal consultations,

- state scientific centers,

- organizations in the territory of the special economic zone,

- management organizations in Skolkovo and some others.

The procedure for applying benefits and the conditions under which the use of benefits is terminated are determined by tax legislation.

2021 Property Tax Calendar

4% tax on rental income – how will it work?

For whom is the tax reduced in Moscow?

Regional benefits are established by the executive power of the constituent entity of the Russian Federation. Thus, in Moscow the tax for the following objects has been reduced fourfold:

- retail and office premises that are actually used less than 20% for retail and office purposes;

- plant management (that is, these premises house the employees who manage the plant);

- organizations of education, medicine and science.

In the first and second cases, the fact of appropriate use of the premises must be confirmed by the State Real Estate Inspectorate before the end of the first half of the current year. The results are reflected in the examination report. The State Inspectorate inspects non-residential buildings with a total area of over 1000 square meters. meters, as well as apartment buildings with non-residential premises, if their share exceeds 3000 square meters. meters.

If the conclusion of the State Inspectorate is negative, you can submit other convincing evidence to the tax authority. You can challenge the inspection report in the Interdepartmental Commission at the Department of Economic Policy and Development of Moscow.

For small businesses (included in the list, which can be viewed on the Federal Tax Service website), the tax base is reduced by the cadastral value of 300 square meters. meters from the area of the object.

For hotels, the tax base can be reduced by the cadastral value of the minimum room area, multiplied by two.

The following benefits are established for the city’s priority investment projects:

- for industrial complexes the tax amount is halved;

- technology parks and industrial parks are completely exempt from property taxes.

How to convert an apartment from residential to commercial real estate?

Is it possible to register an office in an apartment?

Calculation of the amount

Legal entities, unlike individual entrepreneurs and individuals, calculate the organization’s property tax independently.

Based on the cadastral value, the tax for the quarter is calculated as follows:

Property value according to the cadastre * tax rate / 4.

To obtain information about the cadastral value of an object, you should contact the local offices of the Cadastral Chamber or the Rosreestr website. If the cost is too high, you can leave a request to review the amount .

For individuals and entrepreneurs, the tax is calculated by the Federal Tax Service, after which it sends a receipt for payment.

The calculation of the amount of tax on retail and office real estate included in the list in Article 378.2 of the Tax Code of the Russian Federation is carried out as follows:

Value of property according to the cadastre * tax rate taking into account the conditions reflected in Article 408 of the Tax Code of the Russian Federation.