Filing complaints and applications to challenge the actions of tax inspectorates or their officials via the Internet is becoming increasingly popular. This method is convenient and efficient, does not require additional costs or payment of state duty. How to file a complaint against the tax inspectorate through State Services? First of all, you need to understand what legal standards govern this procedure. The ability to submit complaints online arose in 2021, after changes were made to the Tax Code. From this moment on, in addition to submitting a regular paper document to the state fiscal authority, letters in electronic form or special online templates began to be used.

What are citizens most often dissatisfied with?

A complaint against the tax service in pre-trial appeal through State Services is mainly filed in case of such violations of the procedure for the provision of services:

- failure to meet deadlines;

- unreasonable return of documents to the applicant;

- failure to comply with the date of registration of requests;

- refusal to correct errors and typos;

- incorrectly collected tax;

- demanding illegal fees for the provision of public services;

- refusal to accept documentation;

- unaccounted benefit;

- requirement of unspecified papers.

Complaint about inaction of the tax inspectorate: sample

), then this payer has the right to file a complaint about the inaction of the inspectorate (Art.

137 of the Tax Code of the Russian Federation). A complaint is filed with a higher tax authority (clause 1 of Art.

138 of the Tax Code of the Russian Federation), that is, to the Federal Tax Service of the region to which the inspection about which you decided to complain belongs.

You can go to court only after the inaction of the tax authorities has been appealed to the Federal Tax Service (Clause 2 of Article 138 of the Tax Code of the Russian Federation).

By the way, it is also possible to file a complaint against the tax inspectorate with the prosecutor’s office (Art.

10 Federal Law of January 17, 1992 N 2202-1)

| Dear visitors! The site offers standard solutions to problems, but each case is individual and has its own nuances. |

| If you want to find out how to solve your particular problem, call toll-free ext. 504 (consultation free) |

How to write a complaint to the tax office using the State Services website

IMPORTANT! Any citizen has the right to write a letter through State Services. To do this, you need an electronic signature key obtained from a certified organization, which is valid at the time of signing and sending the electronic document.

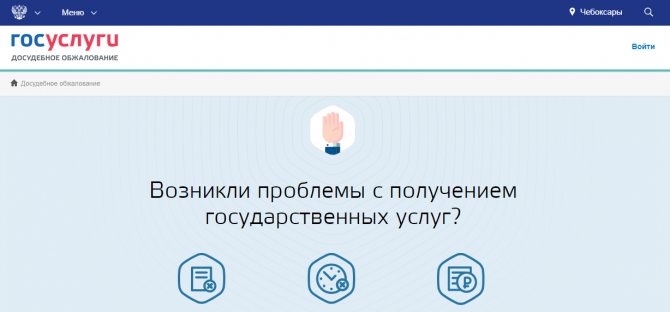

Step-by-step instructions on how to file a complaint with the Federal Tax Service through the State Services website:

- enter the “pre-trial appeals” section;

- select the desired federal body;

- indicate the date of submission of the application;

- write the reason for the complaint and provide an explanation;

- if necessary, insert applications: documents, photographs, audio and video recordings, etc.;

- state the requirements;

- write the preferred way the service should send the response;

- click the “Send” command.

Alternative shipping method:

- go to the list of site services;

- select the service that will be complained about;

- drag the slider down and select the “Submit a complaint” marking in the lower right corner.

How to anonymously file a report against an organization that has violated the law

An anonymous filing of a claim with the tax office is possible in cases where the employer is engaged in concealing income. In this case, the applicant must provide the following information:

- full name of the organization, full name of the head;

- reason for application (“black” wages, tax evasion, etc.);

- dates of commission of illegal actions;

- other information relevant to the case.

A sample of such a statement can be found on the website of the tax department.

NOTE! Anonymous letters cannot be submitted through the “Public Services” website due to the identification system implemented on it.

Operation of the Federal Tax Service hotline and other means of communication with the tax office

The Federal Tax Service (FTS) of Russia is subordinate to the Ministry of Finance, its main tasks are:

- monitoring compliance with laws on taxes and fees;

- calculation of tax fees;

- checking the timely payment of taxes and duties;

- supervision over the use of cash registers;

- currency control.

By appointment, taxpayers are personally received at the territorial divisions of the service. To make it easier to interact with the tax authorities, interactive services have been created. Basic information can be obtained by calling the hotline , but other methods of seeking advice .

Hotline

hotline number is 8-800-222-22-22. Calls to this number are free from all landline and mobile phones in the Russian Federation; calls from both individuals and representatives of legal entities are accepted.

A call involves independently obtaining the necessary data from an automatic informant or contacting an operator. Contact center specialists will provide background information regarding servicing taxpayers, work schedules and addresses of regional tax authorities, explain the procedure for citizens’ requests, the operation of online services, and, if necessary, redirect to the necessary department of the Federal Tax Service. The operator can be contacted during business hours, taking into account time zones in the regions:

- Monday, Wednesday from 9:00 to 18:00;

- Tuesday, Thursday from 9:00 to 20:00;

- Friday from 9:00 to 16:45.

Telephone number for calls from abroad +7 (495) 276 22 22. Call fee according to the tariff of your telecom operator.

Helpline of the Federal Tax Service of Russia +7 (495) 400-63-67

Helpline of the Central Office of the Federal Tax Service of Russia +7 (495) 913-00-70

Helplines operate around the clock , calls to them are anonymous and are intended to identify facts of corruption in the work of the inspectorate.

Taxpayer personal account:

For the convenience of users, a personal account has been developed on the tax inspectorate the Federal Tax Service 24/7 :

- real estate;

- vehicles;

- tax charges;

- taxes paid;

- overpayments;

- debt;

- filling out tax returns;

- receiving receipts;

- appeal to the Federal Tax Service;

- payment of taxes and duties through online services of partner banks;

There are three options for gaining access to your personal account:

- To receive a registration card with a login and password by contacting any tax authority , you must have an identification document with you. If data is lost, it can be restored, but a visit to the tax office .

- Get an electronic signature. The key certificate for it is issued by a Certification Center accredited by the Ministry of Communications of Russia and is stored on any external media (USB key, smart card, etc.).

- Obtain access details from the operator of the Unified System of Identification and Authentication (USIA), these can be found in branches of the Russian Post, MFC, etc.

Taxpayer personal account for individuals: nalog.ru/rn77/fl

Personal account of an individual entrepreneur taxpayer: nalog.ru/rn77/ip

Personal account of a taxpayer of a legal entity: lkul.nalog.ru

Mobile applications are also available for individuals and individual entrepreneurs:

- Google play play.google.com/store/apps/details?id=ru.fns.lkfl

- App Store apps.apple.com/ru/app/tax_fl/id1286819946

Feedback form on the Federal Tax Service website

It is possible to submit an application to the tax office directly on the official website www.nalog.ru; all electronic applications are registered on the day of receipt, or, if it is a weekend or holiday, on the next business day.

The appeal is considered within 30 days; when writing it, you must indicate the postal or email address to which the response will be sent, otherwise there will be no response. Applications containing obscene language, incorrectly composed, or requiring certified copies of documents and signatures will not be accepted (such applications must be sent to a physical postal address).

Application form: nalog.ru/rn77/service/obr_fts

Social media

The latest news from the Federal Tax Service , it is possible to write a comment and get answers from other users.

facebook.com/nalog.ru

vk.com/nalog__ru

twitter.com/nalog__ru

Mailing address

Address for correspondence: 127381, Moscow, st. Neglinnaya, 23.

The Federal Tax Service is constantly working on the digitalization of tax authorities, which will simplify tax administration and eliminate the need for a personal visit to the territorial tax authorities.

Who receives complaints

There is a way to write a letter to the tax office through State Services via other sites. In addition to the State Services portal, you can write to the e-government address and a separate website for do.gosuslugi.ru. At the same time, government agencies and extra-budgetary funds of the Social Insurance Fund, which provided any services to citizens through the portal, will receive complaints and process them. The unified processing system also includes requests submitted through departmental websites and multifunctional centers for providing municipal services class=”aligncenter” width=”1024″ height=”682″[/img]

How should a complaint be sent to the tax office?

You can submit your complaint to the inspectorate in person, send it by mail, or use our “Online Complaint to the Inspectorate” service and send it online without leaving your apartment or office. In the first case (when submitting it in person), make a complaint in two copies. Give the first one to the inspectorate. The second one will remain with you.

In the second case (by mail), send the complaint by letter with acknowledgment of delivery. Be sure to keep the postal receipt and any subsequent notification you receive. These documents will confirm that the complaint was sent to the tax office.

Procedure for consideration of appeals

The service of the State Services portal allows you not only to complain to a government agency, but also to track the result of the review. After sending the request, it automatically goes to the fiscal service website. After that, it is sent to the required regional department, the head of which decides which structural unit and officials will consider it. Any citizen can submit a complaint, regardless of status: president, governor, worker, pensioner, unemployed, etc.

To the Federal Tax Service with an appeal

You can contact the Federal Tax Service in different ways:

An appeal (including a complaint) is considered within 30 calendar days from the date of registration (Part 1, Article 12 of the Federal Law of May 2, 2006 No. 59-FZ). In exceptional cases, the period for consideration of a letter to the Federal Tax Service of Russia may be extended by no more than 30 days, and the applicant must be notified of the extension in writing or by email.

You can send an appeal not only to the Federal Tax Service, but also to its territorial tax authorities, whose contacts can be found on the official website of the tax department at nalog.ru.

When a complaint may be refused

Taxpayers often make mistakes when paying generally obligatory payments and then demand an immediate refund of the overpaid amounts. In this case, before submitting an application to the tax office through State Services, you need to take into account that the Federal Tax Service has 30 days to return such payments. Before this period expires, complaints are unfounded. Also, consideration of a complaint may be refused in the following situations:

- the stated issue is not within the powers of the tax department;

- the letter contains obscene language;

- the same person repeatedly addresses an issue that has already been considered.

Filing a complaint against government agencies through a unified online portal for government services is the most optimal method today. The system is fully automated; the timing of consideration of applications and the adoption of measures to eliminate violations or inaction of officials is strictly controlled. Such an appeal is guaranteed to be considered, and the applicant will have the opportunity to track the progress of consideration in feedback mode.

When is notarization required?

- During registration. Moreover, the application must be notarized as when registering a legal entity. persons, and during the registration of individual entrepreneurs.

- When making changes to information about the company.

In particular, the most common applications to the Federal Tax Service that require notarization are:

- Form P11001 – registration of a new enterprise.

- Form P13001 – change of legal entity. addresses of the enterprise, changes in the composition of the LLC.

- Form P14001 – change of general director of the legal entity. persons, adding types of activities according to OKVED, changing the composition of an LLC, changing passport details or registration of the general director.

You can find out about the need for notary certification of forms submitted to the tax service from tax consultants or by reading the relevant regulations. The notary can also answer questions related to the execution of necessary legal actions with enterprises.