Procedure after completion of the trial

After the court makes a decision to pay the debt, a writ of execution is drawn up. It contains information about the debtor, the collector and provides a decision on the case. There are two scenarios for the development of events:

- If the debtor agrees with the amount of payment awarded to him, then he can contact the accounting department at his place of work and ask them to withhold a certain amount and then transfer it to the plaintiff - or make the transfers themselves.

- If he does not want to voluntarily pay the money, then the claimant applies to the FSPP to initiate enforcement proceedings.

Already in the application, the claimant can ask the bailiff to seize the debtor’s property in order to thus ensure the execution of the court decision and return his money. There is a loophole that debtors take advantage of: immediately after the court makes a decision to pay the debt, they transfer the property they own to other persons. “They take him out”, in other words, because the absence of property that can be seized is not an offense.

Procedure for notifying the debtor

The procedure for notifying the defendant is simple. Once the document is ready, it is sent to the debtor for review. If no objections are received from the debtor within 10 days, the document enters into legal force.

Important! The storage time for postal correspondence is counted from the date of its arrival at the place of departure (post office). The date of arrival of the court letter at the place of delivery is marked with a stamp on the envelope. Notification of the arrival of the court letter is delivered to the recipient personally. If you did not receive a notice or you found it in your mailbox several days later, it is likely that the letter with the court order has already been sent back to the court, and the document has entered into legal force.

Apply to the court to cancel the court order, proving that you are unable to submit objections to the court within the period established by law (10 days). Documents confirming your absence (travel certificate, moving to another place of residence) serve as evidence.

Should you be afraid? I can’t pay my loan - what should I do with bailiffs?

The Bailiff Service is an executive body in the system of the Ministry of Justice, and bailiffs are civil servants who are engaged in the forced seizure of funds, their detection, and the seizure of accounts. They operate strictly within the framework of the law (unlike the same collectors), and if the debtor is not hiding and does not enter into an open conflict, he should not be afraid. Moreover, it is necessary to show respect, because it is the bailiff who will describe the property and sell it, and it is he who can influence the granting of a deferment or installment plan.

It should be noted that in recent years, temporary restrictions on traveling abroad of the Russian Federation have become widespread for debtors. Currently, the amount of debt limiting travel is 30,000 rubles. The reason for this restriction is the failure to execute a judicial or executive act within the prescribed period without good reason.

Therefore, we emphasize once again: compliance with the requirements of the law and court decisions will help the debtor survive this stage with minimal losses.

Due to the fact that the bailiff is a representative of the authorities, he can be held accountable for exceeding his official powers. In particular, file a complaint with a higher-ranking bailiff, the prosecutor's office or the court. You can appeal both his illegal actions and inaction in a certain situation. Prosecutor's check is very effective. Therefore, there is no need to be afraid - these are not “black collectors”, but government employees on duty.

What will happen if it is not fulfilled?

Failure to comply with a court order (JW) is punishable by a fine of up to 50,000 rubles and in the amount of the salary of the person in respect of whom it was drawn up.

According to the law, a debtor for obstructing the execution of a judge’s decision can be punished with 240 hours of compulsory labor or correctional labor for up to one year.

For failure to comply with the joint agreement, the debtor may be imprisoned for one year or arrested for three months.

Punishment awaits employees of government bodies, municipal organizations and other structures who do not comply with the court order. In this case, the fine and the term of imprisonment are significantly greater: 200,000 rubles and imprisonment for up to two years, respectively.

How will the bailiff act?

At the first meeting, the bailiff introduces the debtor to the writ of execution and offers to repay the debt within five days. Let's consider two situations:

- In case of voluntary payment, the debtor has two options:

- pay the entire amount before the start of enforcement proceedings, usually within 5 days;

- pay the amount in progress. Then the debtor will also have to pay the enforcement fee. Usually it is 7 percent of the debt amount, but cannot be lower than 1,000 rubles. A person with a minor delay can ask for a reduction in the specified fee. To do this, it is enough to submit an application to the court, which may rule in favor of reducing the amount of the fee.

If he agrees with the amount of debt awarded to him, but is not ready to pay it for financial reasons, he can ask the court for an installment plan or deferment of debt collection. You need to motivate yourself to prove the complexity of your financial situation and justify the possibility of partial payment, indicating feasible amounts and terms.

- In case of forced collection, the bailiff may:

- instruct the bank to repay the debt from the debtor’s bank account;

- oblige the debtor's employer to withhold part of his wages or other regular income (according to Article 99 of the Law on Bailiffs, more than 50% of wages and other income cannot be withheld);

- to seize property for the purpose of its further sale, and the value of the seized property must be commensurate with the amount of debt.

Once the entire amount of the awarded debt has been repaid, enforcement proceedings are completed. It is very important to notify the bailiff in a timely manner about the payment in full of all amounts due in order to avoid overpayment. In this case, he notifies the bank, the debtor’s employer and other responsible persons about the end of the withholding of the funds of the now former debtor.

Article 36 of the Law on Enforcement Proceedings sets the duration of the procedure at two months. However, if the debtor does not have property to repay the debt, the case may simply “hang” for an indefinite period.

To summarize: payment of debt by court decision occurs on the basis of a writ of execution. The debtor can do this voluntarily and immediately, and save his money (by not paying an additional fee). Or maybe, by cooperating with the FSPP, you can achieve the most comfortable payment schedule for yourself.

In what cases is it used

A court order as a method of debt collection is used in relation to loan debtors, persistent defaulters on utility lines, as well as those who do not return borrowed funds taken on a receipt.

Loan collection

In this case, the judge issues an order to collect the debt at the request of the financial institution.

The application of the financial institution is considered within six months, during which the debtor has the right to challenge it. If the order is not contested, it enters into legal force and is transferred to the bailiffs. The advantage of this situation for the borrower is that from this moment the amount of the loan debt stops growing and becomes fixed.

Attention! If the court handed over the writ of execution to the bailiffs, this is not a “verdict”. You can agree with them to repay the debt within five days, avoiding forced collection and seizure of property.

By receipt

In this case, the plaintiff (the person to whom the borrowed funds were not returned according to the receipt) applies to the court with an application, attaching the text of the receipt certified by a notary. Evidence of the debtor’s evasion of voluntary repayment of the loan is attached to the text of the receipt - correspondence on social networks, recordings of telephone calls, a bank transfer receipt from the plaintiff to the debtor, as confirmation of the transfer of the loan.

The court, having considered the case, prepares a court order for collection and transfers it to the bailiffs.

For housing and communal services

The basis for applying to court to a company providing utility services is that the service user owes no more than 500,000 rubles, and the debt is documented (there are unpaid bills).

The judge can make a decision and write an order without the presence of the defendant. The case is considered in an expedited manner up to five days. As a result, an order is prepared, which is submitted to the bailiffs as an executive document, on the basis of which debt collection is carried out.

Where and how to check for court orders

The presence of a court order is checked by last name. This can be done on the website of the judicial system of the Russian Federation. All cases are entered into an electronic database, so it’s easy to check whether a case has been opened against you.

To obtain accurate information on the “Justice ” website (result of the case, presence of an order), you need to enter the order number, if you know it. If you do not have such data, find the judicial district to which you belong geographically.

The second search method is the database on the website of the FSSP of Russia. In the search bar on the main page, enter your full name, date of birth, region and exact registration address. If there are enforcement proceedings in your name, you will see a list of them on the website page.

Other ways to get information:

- Personal visit to the FSSP office. Please note that production documents are issued only to participants. If you ask a relative or friend to obtain this information, they can only confirm the fact of your presence on the lists of debtors against whom enforcement proceedings are being carried out. To obtain accurate information and copies of decisions, you will have to visit the FSSP in person.

- Send a request by mail . The response from the bailiff service will take a long time. This method is only suitable if you are sure that you have no problems with debts and you need to get official confirmation of this.

This is interesting:

What to do if the bank sues for non-payment of a loan and what the consequences may be.

What is a loan and who can get it.

What does the Federal Law say about credit histories: its contents and recent changes.

Cancellation of a court order for debt collection

If the ten-day period is not missed, there will be no difficulties in canceling this document. But in case of delay, two applications must be submitted to the court with a request to restore the period for canceling the order and to cancel it. It is possible to combine both requirements in the text of one application.

Important! Cancellation of the joint venture is not a radical solution to the debt issue, but your chance to present your arguments for disagreement with the position of the plaintiff.

To restore the cancellation period, you must provide documentary evidence of the reason why you were unable to go to court in time to demand the cancellation of the document sent to you.

Who has the right to do this and in what cases?

The judge cancels the document upon receipt of objections from the debtor and a request to cancel the order. In this case, the judge explains to the collector (bank, utility service or individual demanding repayment of the debt on a receipt) that he can submit his demand for repayment of the debt in the form of a lawsuit.

The court sends the parties a copy of the reversal of the decision within three days from the date of issuance.

How to do it

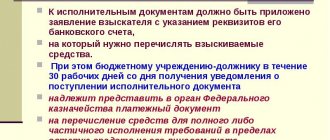

Submit an application to cancel the order. Indicate in the text the number of the court district in which the order was issued, the case number, the applicant’s details (bank details, full name of the creditor), your data, the essence of the order (debt collection under a loan agreement).

They also indicate the amount of collection and the fact that you were not notified that debt collection proceedings were initiated . The text must also indicate the date when you received a copy of the document by mail. Indicate that you are exercising your right to appeal to the court with objections regarding the execution of the order because you do not agree with the amount of the penalty.

At the end of the application, indicate that you are asking for a copy of the decision on cancellation to be given to you. It is advisable to attach to the text a copy of the application for the claimant, a copy of the postal envelope and a copy of the document you received.