Considering the fact that for many Russian families or future newlyweds, real estate is the most valuable property asset that can be at their disposal, it is advisable for those getting married or spouses to ask questions about how to correctly draw up a marriage contract when buying an apartment or how to correctly draw up a marriage contract for already purchased housing.

The division of responsibilities and rights under a marriage contract mainly depends on how the parties to the agreement purchase the apartment. Basically, housing is purchased in 4 ways:

- The cost of the apartment is paid in cash or money available in accounts, without borrowing funds.

- Housing is purchased in whole or in part with a mortgage loan.

- Part of the amount of money required to purchase an apartment is paid using maternity capital.

- The apartment is purchased under an equity participation agreement (DPA).

As for the purchase under the DDU, it does not matter whether a multi-storey building is being built during the conclusion of the DDU, or whether the developer is just planning to start building the house. Spouses need to indicate one important nuance in the marriage contract, which is that their duties and rights in relation to the apartment will begin to apply only from the moment the rights to it are registered in Rosreestr. This is due to the fact that until the registration of housing, the spouses are not the official owners of the property, which means they do not have property rights to it, which they prescribed in the marriage agreement.

Circumstances of execution and legal features of the contract

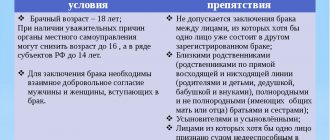

A marriage contract can be concluded between the bride and groom before the wedding, as well as legal spouses at any time before the divorce. It must be borne in mind that a contract certified by a notary before the wedding begins to be valid only after the marriage union is registered. As for the contract certified by a notary during marriage, it comes into force on the day of certification.

If the parties to a future agreement are going to purchase an apartment with their own money, without using loans and government assistance measures (maternity capital), then they need to do the following:

Decide when they will draw up an agreement: before purchasing a home or after it.- Negotiate the terms of the future contract.

- The next step is to draw up the text of the contract. Due to the high workload of notaries, it is unlikely that they will help the parties to a marriage agreement in writing legally correct wording of the agreement, so you need to seek help from qualified lawyers or try to write the text yourself using this sample.

- Next you need to prepare: Passports of both parties to the contract.

- 3 copies of the contract.

- Cash to pay for notary services (about 5,000 - 10,000 rubles). Notaries themselves determine the full price of the service, based on the size of the notary fee (500 rubles), office costs, wages for assistants, rental premises and other expenses.

- Marriage certificate, if the official relationship has already been registered.

- Title documents for the apartment. Firstly, this is a certificate of ownership; secondly, this is a purchase and sale agreement, an equity participation agreement, and a mortgage agreement.

Marriage contracts for a mortgaged apartment and for apartments purchased with maternity capital are drawn up according to the algorithm described above, taking into account several features indicated in the table.

| Marriage agreements for a mortgaged apartment | Marriage agreements for apartments with capital |

|

|

Property of spouses under a marriage contract

By concluding a marriage contract, along with the property regime, the spouses also have the right to regulate all relations regarding the division of jointly acquired property in the event of divorce. In particular, paragraph 1 of Art. 42 of the IC allows them to determine the property that will be transferred to each of them during a divorce and division of property, the procedure and timing of its transfer, the amount and procedure for paying monetary compensation, etc.

The general rule established by paragraph 1 of Art. 45 of the IC states that, for the obligations of one spouse, it is permissible to foreclose only on his personal property . If it is insufficient to satisfy the creditors' claims, they have the right to demand the allocation of the debtor's share from the marital property in order to foreclose on him as well. In this case, the procedure for dividing property provided for in the marriage contract in case of divorce, since it is tied to such a condition, does not apply.

We recommend reading: How Many Hours Should a Group 3 Disabled Person Work?

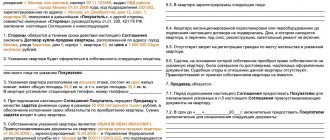

Subject of the agreement, rights, obligations and responsibilities of the parties

The subject of the agreement is the legal relations of the parties, which can be regulated by it in accordance with the current legislation. The Family Code defines the list of legal relations that are included in the subject of the marriage contract. These are the rights and responsibilities in relation to:

- Expenses for maintaining the apartment, for example, payment of utilities, current or major repairs, expenses for replacing plumbing, etc.

- Apartment ownership regime. Housing can be divided into shares, remain in joint ownership, or become the full ownership of one of the marriage partners.

- Purchasing an apartment in the future. Spouses have the right to specify in the contract the exact period when they will buy real estate, indicate the shares of their contributions or their size, determine the amount of expenses for the apartment, for example, the cost of repairs, and distribute these expenses between them.

- Division of the apartment in case of divorce.

- Possible use of the apartment for earning money. For example, the distribution of income received between spouses from renting out an apartment.

- Extracts from the home after divorce.

The law strictly prohibits establishing conditions in a marriage contract that relate to:

The civil legal capacity of the party to the agreement, for example, establishing a prohibition for the spouse-owner to freely own his share of the real estate.- The civil capacity of the party to the transaction, for example, the restriction of the right to dispose of an apartment, which is expressed in the prohibition on the sale, exchange, donation, bequest of property to other persons.

- Non-property personal legal relations. For example, a husband does not have the right to demand that his wife give birth to two children and offer his share of the apartment for this.

- Restrictions on the right to appeal to judicial authorities.

- Division of an apartment in the event of the death of one of the marriage partners. For these purposes, you need to make a will.

Civil liability measures that may be imposed on a party that does not comply with the provisions of the contract are:

- Fine. This is a one-time payment of a certain amount of money for a one-time violation of an obligation. For example, a husband is contractually obligated to buy his son sports uniforms and shoes every year for classes. If for some reason he did not do this, and his wife solved this problem instead, then, if there is an appropriate condition in the contract, she has the right to demand that he pay a fine.

- Indemnification or compensation. It applies if the violation committed by a party has serious consequences. For example, a wife and husband agreed to pay a mortgage in the following proportion: the husband pays 75%, and the wife – 25%. After full payment, the parties receive ownership of the apartment in the following shares: husband - 3/4 shares, wife - 1/4 shares. If, for example, a wife cannot repay her part of the loan for any reason, and the husband takes on the wife’s obligation, then, according to the agreement, the wife may be deprived of her share of the apartment.

- Penalty. It applies to ongoing offences. For example, the husband’s contractual responsibilities include full payment of utilities. If he does not do this before the deadline specified in the utility bills, then he pays in favor of his wife a percentage of the debt amount determined by the contract for each overdue day.

Why do you need a prenuptial agreement for a mortgage?

In Russia, few people know what a prenuptial agreement for a mortgage looks like. Citizens of the country lack minimal knowledge in the field of jurisprudence. In most Western countries, this document is mandatory. It regulates the financial and material obligations of spouses to each other.

Current legislation provides that spouses are jointly obliged to pay the bank for the received mortgage loan ( and ). Who is the title borrower and who is the co-borrower does not matter. There are two exceptions:

- the husband or wife are not citizens of Russia;

- there is a valid marriage contract that provides for a special procedure for owning real estate or other property.

It is important to note that spouses can sign the agreement before submitting an application to the registry office and after, but before the divorce. The document must be endorsed by a notary.

There are many reasons to enter into a prenuptial agreement before taking out a mortgage. Let's pay attention to the main ones:

- the husband or wife does not want to either buy real estate or go to the bank. A prenuptial agreement for a mortgage for one spouse allows you to purchase an apartment and protect it from the claims of the other half;

- money to pay the down payment is taken from pre-marital savings or donated (borrowed) by parents. And this spouse expects that he will own more square meters;

- The credit history of the husband or wife is not impeccable, or there is a criminal record. Without delineation of responsibilities, the bank will refuse to issue money. Credit institutions prefer not to deal with such clients;

- the spouses decided in advance who would receive what property in the event of a divorce;

- an apartment is purchased for parents, children from a previous marriage, office location, etc. The buyer becomes the sole owner and cannot require the other half to bear the costs associated with servicing the loan.

For what reason the marriage contract was signed when applying for a mortgage does not matter. It must be presented to the bank manager when submitting an application. Then the income of the spouse who does not claim ownership of the purchased real estate will not be taken into account as part of the total income.

Banks treat prenuptial agreements differently. The situation is being clarified regarding who will pay and from whom the penalty will be collected in case of delays. There is an understanding that spouses take finances seriously and are not inclined to make hasty decisions.

At the same time, if there is no solvent co-borrower, the bank has the right to refuse to issue a mortgage loan. A spouse who wants to purchase an apartment will have to look for another co-borrower, which is quite difficult to do. Few people want to take on other people's responsibilities. In addition, a credit institution can significantly reduce the loan amount if it calculates it based on the income of only one person.

It is impossible to cancel or change the marriage contract after receiving a mortgage without the knowledge of the bank. This will be considered a violation of the loan agreement. The inevitable consequence is a requirement to return the entire amount ahead of schedule.

Recommended article: What to do after accepting an apartment with a mortgage in a new building

Features of the termination procedure

With mutual consent of the parties

In order for the contract to terminate, the spouses must draw up and notarize the termination agreement. A sample of this agreement can be found here.

In addition to the termination agreement in three copies, marriage partners are required to prepare before a personal visit to the notary:

- Passports of both parties to the contract.

- Originals of the marriage contract in the amount of 2 copies, one for each spouse.

- Marriage certificate.

- Cash. The exact price of the service should be obtained from a notary.

Termination of the contract is permitted by law only when both spouses personally come to the notary and confirm their will as stated in the agreement. After certification of the termination agreement, the marriage contract is recognized as having lost legal force.

Unilaterally

At the sole request of the party to the transaction submitted to the court, the marriage contract is terminated if:

A party to the contract has violated its terms, and the violation must be considered significant. This means causing such damage to the injured party that, as a result, it is deprived of the benefits and rights that it could have counted on at the time the contract was concluded.- It is declared invalid due to the use of violence, deception or threats against one of the parties; presence of violations of civil and family legislation; material misconception of one of the parties; shamness of the contract; the pretense of the contract; identification by the court of extremely unfavorable conditions for one party to the contract.

- A change in circumstances that is significant for the parties to the contract. This means that if the parties to the prenuptial agreement could have foreseen the occurrence of such circumstances, they would not have entered into the contract or would have entered into it on different terms.

Before taking a dispute to court, you should try to resolve differences without involving government agencies. This needs to be done with 2 goals in mind:

- If it is possible to reach an agreement with the other party to the contract without intermediaries, then this fact will save money and time.

- If it is not possible to reach an agreement with the other party to the contract, then the future plaintiff will have evidence in his hands that directly confirms that he tried to solve the problem without involving the court.

What do we have to do? A proposal to terminate the contract should be prepared and sent via mail by letter with a registered notice attached (it can be tracked) and an inventory. The proposal must indicate a deadline that is given to the recipient to think about it, for example, 30 days.

If there is no response or the other party refuses the offer, the notification and inventory returned by mail will serve as evidence in court that:

- There really was a letter.

- The letter did contain a proposal to terminate the contract.

- The defendant actually received it.

The claim is resolved in a court located at the place of residence of the defendant or at a place determined by agreement of the parties on jurisdiction. Cases are heard by district or magistrate courts. Jurisdiction of cases depends on the claims made by the plaintiff.

| Magistrate's Court | District Court |

|

|

Sample statements for various categories of claims are presented in the list below:

- The application, which states the request for termination of the marital agreement based on a change in circumstances or violation of the provisions of the agreement by the defendant, is located here.

- The application requesting that the court invalidate the prenuptial agreement can be found here.

Additional documents that must be attached to the claim are:

Marriage certificate.- Original marriage contract.

- Evidence of the arguments presented by the plaintiff in the application (written documents, for example, certificates from medical organizations, certificates from government agencies, contracts, correspondence; witness statements; examination results).

- Receipt for payment of state duty.

The fee for non-property claims, for example, for recognizing the invalidity of a contract, is 300 rubles. The duty for property claims is calculated according to the formula described in clause 1) part 1 of article 333.19 of the Tax Code of Russia. The fee can be transferred in the following ways:

- Cash at any bank.

- Cash via ATMs.

- In Internet banking.

- On the State website).

- On electronic money services, for example, Yandex.Money.

After the fee has been paid and the documents have been prepared, the papers must be submitted to the court. This is done using one of the methods described below:

- Sending by registered mail with an inventory through the post office.

- The plaintiff personally delivers the documents to the court office.

- Claim documents are sent electronically through the State Automated System “Justice”.

- The plaintiff's representative transfers the documents to the court office.

If the documents are accepted and the judge begins proceedings in the case, you should arrive on time at each meeting and defend your point of view at it. If for any reason you are unable to attend the meeting, you must:

- Submit a written request to the judge asking him to consider the dispute without the presence of the plaintiff.

- Send a representative to the trial in your place.

If the case ends with a decision that is favorable for the plaintiff, then from the date of its entry into force the marriage contract is recognized as having ceased to be valid and dissolved.

After the divorce process is completed

The same 2 methods described above apply:

- The spouses come to a common point of view on the situation that has arisen in their lives and decide to terminate the marriage agreement. Then they or hired lawyers draw up a termination agreement. This agreement must be certified by a notary. Only after this is it given legal force, and the agreement terminates.

- If the husband and wife do not come to a common point of view regarding the future fate of the marriage contract, their disagreements are resolved in court according to the algorithm described in the chapter “Unilaterally”.

The procedure for dividing property under an agreement

Property is divided according to the marriage contract in accordance with the following rules:

- The terms of the agreement have indisputable priority over the norms of legislation on the division of family property. If the division of assets occurs in court, then the judge will proceed from the provisions of the agreement, and not from the provisions of the Family Code, when resolving controversial issues.

- The part of the joint property that the spouses decided not to divide under the marriage contract is distributed between them during the divorce in accordance with the norms of the Family Code.

- If the contract is declared 100% invalid or the provisions of the contract regarding the division of marital property are declared invalid, then the division of assets occurs according to the norms of family law.

Arbitrage practice

In the practice of Russian courts, there is a case in which one party, according to the marriage contract, was supposed to purchase an apartment in favor of the other party after the divorce. However, according to the ex-husband, his wife did not fulfill her obligation. In October 2021, this case was heard in the Maykop City Court of the Republic of Adygea.

So, the ex-husband demanded in court to force the ex-wife to fulfill the obligation she accepted under the marriage contract and to transfer to him an apartment that complies with the terms of the agreement. The apartment must be one-room, not on the top floor and not lower than the 2nd floor.

In turn, the ex-wife stated that the plaintiff has no grounds to demand the apartment, because she fulfilled her obligation. The defendant presented the court with a purchase and sale agreement, under the terms of which the ex-husband received sole ownership of a 1-room apartment that met the conditions set out in the marriage contract.

Taking this fact into account, the court decided that the defendant had fulfilled her obligations. Therefore, there is no reason why the court should take the plaintiff’s side. In this regard, the ex-husband's claim was rejected.

Price of a prenuptial agreement for a mortgage

and they say that the marriage contract is subject to notarization. Without this, the document is considered void. Neither the court nor the bank will accept it for consideration.

For certification of a marriage contract, the cost of a notary for a mortgage is fixed and amounts to 500 rubles. If additional technical work is carried out, the actual text of the agreement is developed, the material side of the life of the applicants is studied, the cost of the prenuptial agreement for a mortgage will increase significantly.

The notary is obliged to explain to the spouses the legal consequences of their actions. The document is checked for compliance with current legislation. Before the agreement is signed, it is allowed to make adjustments and add new clauses.

The notary certifies the marriage contract for a mortgage in triplicate. Each spouse receives one. Another one remains in the archives. Additionally, information about the document is entered into the all-Russian register of notarial actions of the unified notary information system. The possibility of future counterfeiting is completely excluded.

Recommended article: How to get a mortgage for a single woman with a child

How long does it take to make a prenuptial agreement for a mortgage? It all depends on the complexity of the situation. In the simplest case, it is enough to fill out a standard form and make an appointment with a notary. If you need to study documents and involve lawyers, the procedure can take weeks.

Regulatory framework

| Laws | Articles |

| Family code | Article 40 sets out the definition that the law gives to a marriage contract. Article 41 establishes the legal nuances according to which marriage agreements are concluded. Article 42 defines the subject of the contract and legal relations that cannot be regulated by the contract. Article 43 establishes the methods and procedure for terminating a marriage contract. Article 44 describes cases when a marriage agreement can be declared invalid. |

| Tax Code (Part 2) | Section 333.19 determines the amount of money paid to the state as a fee for court services. Article 333.24 determines the amount of money paid to the notary at the notary fee. |

| Civil Code (part 1) | Chapter 9, paragraph 2, sets out the list of grounds on which the invalidity of a marriage contract is determined. Article 450 defines what constitutes a “material breach by a party of the terms of the contract”. Article 451 establishes the definition of the concept of “significant change in circumstances”. |