Home » Buying and selling an apartment » Deposit, deposit when buying an apartment

12

Buying an apartment can be a complex and multi-step procedure. The buyer wants to be sure that the seller will not refuse the deal in the final stages, and the seller, in turn, wants to make sure that the buyer really intends to purchase this home, and is not just looking through options. It is to secure preliminary agreements that a deposit is usually used.

What is the difference between a deposit and a deposit when buying an apartment?

When buying or selling an apartment, two main types of advance payments are used: deposit and advance payment. The wording “collateral” is practically not used. Based on the very meaning of this word, it is more like a deposit, but in the context of this article we will consider this concept as an advance.

Pledge

If we take as a basis that a deposit is an advance, called differently, then it is preferable for the seller, but not desirable for the buyer. The essence of the advance is that it is simply an early payment for the apartment. This amount will be considered as part of the payment in the final payment for housing. However, it does not impose any obligations or restrictions on the buyer or seller. In case of refusal of the transaction, the seller simply returns his deposit/advance payment to the buyer, without any penalties or other conditions.

Example : Let's assume that housing costs 3 million rubles. The buyer, at the preliminary stage (at the stage of initial agreements), makes 500 thousand rubles as a deposit/advance payment. If the transaction had been completed in the usual manner, the buyer would have had to pay only 2.5 million, since he had already paid 500 thousand rubles. But the seller finds another client who is ready to pay 200 thousand rubles more for the same housing. Logically, the seller returns 500 thousand rubles of deposit/advance payment to the first buyer and enters into an agreement with the second.

Deposit

Unlike an advance/deposit, a deposit involves penalties in case of refusal to purchase or sell. As a result, sellers do not really like to enter into such agreements, especially if they themselves are not sure that they are ready to sell the apartment to this particular person. The specific terms of the agreement and penalties can be very different, but often, if the buyer refuses to purchase a home, he loses the deposit. And if the seller refuses to sell the apartment, he must return double the amount of the deposit to the buyer.

Example: Based on the example above, if the buyer refuses the transaction, he will lose the deposited 500 thousand rubles.

And if the seller decides that he would rather sell the home to another person who is willing to pay 200 thousand rubles more, then he will first have to pay a fine of 500 thousand rubles (in fact, he will return to the buyer not 500 thousand, but a whole million rubles). As a result, under such conditions there is no point in refusing the deal, because the amount of the fine will be much higher than the potential benefit.

Is the deposit returned if you refuse to purchase an apartment?

As mentioned above, the deposit is not returned in case of refusal (or is returned in double amount, if we speak from the seller’s point of view). This is precisely the main difference between this type of arrangement and other options (advance). But the amount of the fine/refund can be any. The parties have the right to agree on conditions that suit everyone.

As a result, the fine may be reduced or increased. Additional conditions or restrictions, time frames, etc. may apply.

Example: The deposit agreement may contain a condition that in case of refusal to sell, the seller must return the deposit in double amount, but this is relevant only 1 month after the conclusion of the agreement. As a result, the seller, during the first month of negotiations, can calmly terminate the transaction and return the deposit amount without penalty. In practice, most often the conditions are still more stringent.

Documentation of the deposit

A prerequisite for registration is the preparation of a document “Contract/Agreement on Deposit” written by hand, and the word “deposit” must be spelled out in a mandatory manner, otherwise the amount will be considered an advance. If drafted correctly, the contract is based on Art. 380 and 381 of the Civil Code of the Russian Federation. This motivates the seller and buyer to take the consequences and their intentions as seriously as possible.

Legislative force affects the contract as follows: failure to comply with the terms of the deposit on the part of the seller obliges him to pay double the original amount. If the buyer refuses, the funds spent on the deposit are recognized as property and pass to the seller.

The deposit agreement must contain the following points:

- Basic information and passport data (if the owner of the property is more than one person, then it is necessary to obtain a power of attorney from each).

- Indicate which property the deposit is valid for (write the address and all information about the apartment).

- Deposit amount (indicate in both numbers and words).

- Confirm that the deposit is included in the full price of the property.

- Write the period for providing the deposit (exact dates).

- At the end, confirm the document with signatures.

The deposit agreement itself is written independently according to a sample that can be taken from open sources, but it is better to contact a knowledgeable lawyer to avoid possible inaccuracies when drawing up the document. It would also be a good idea to seek the help of a notary, especially for the buyer, since he always risks more. The notary will become an official witness upon agreement between the parties and payment of the deposit.

Amount, amount of deposit, deposit when purchasing an apartment

There are no clear definitions in the legislation of the recommended or required level of collateral/deposit/advance payment. The parties themselves decide what amount suits them. It is logical that the buyer wants to pay less, and the seller wants to get more.

On average, the deposit amount rarely exceeds 5% of the cost of housing. Usually the parties stop at the level of 1-2%. Also, the amount is often rounded to a “pretty figure”.

Example: An apartment can cost 3 million 250 thousand rubles. 1% of this amount is 32.5 thousand. In such a situation, they usually round up to 30, 40 or 50 thousand rubles.

In some situations, the seller may ask for a larger amount in order to have time to resolve some financial problems with the apartment before the end of the sale transaction. For example, pay utility bills or legalize redevelopment. All this is also discussed and often the buyer may agree to pay more of the deposit, but at the same time reduce the total cost of the apartment.

Preparation of additional documents

In addition to the deposit agreement, it is necessary to prepare several more documents: a receipt and a purchase/sale agreement. This is done to ensure that all necessary legal consequences are applied to it in case of non-compliance with the conditions described in it.

The receipt confirms the fact of transfer of the deposit to the seller. When drawing up the document, you must indicate the following:

- Basic data of the parties recorded in the passport.

- Confirmation that the funds transferred to the seller are not an advance or a deposit, but a deposit.

- Enter the full amount of the deposit.

- Confirm the document with mutual signatures.

The second important document is the “Preliminary Purchase/Sale Agreement”. Here, both the conditions and agreements reached by both parties are indicated, and the necessary documents, data, material things are written down - in general, everything that in any way relates to the real estate involved in the transaction.

For example:

- any documents necessary for the transaction;

- deposit size;

- the final price of the property is indicated;

- details confirming the sending of funds to the seller;

- Any furniture or equipment remaining in the apartment must also be registered.

Amount and period for which the deposit is provided

No official document specifies the specific amount of the deposit. The seller and buyer have the right to decide this themselves, but the funds paid must motivate both parties to act in accordance with the terms of the contract.

The amount for the buyer must be set such that it would not be profitable for him to lose it if a better offer is suddenly found. In the case of the seller, the deposit warns against selling the property to another candidate offering more favorable conditions, since this threatens to pay double the amount and the possible benefit will be lost. As a rule, the deposit is several percent of the total amount (100 - 200 thousand rubles).

The term of the deposit is determined by the willingness of the seller and buyer to complete the transaction. Since when buying an apartment it is necessary to collect and prepare documents, the parties agree in advance. After all, the deposit itself is needed primarily so that during the purchase/sale process no one changes their mind and the transaction takes place. It is also worth considering that not only the seller, but also the buyer needs time to check and analyze the necessary documents, so the deadline for making a deposit is always set with a reserve. After all, if it expires, then legal liability will arise, and it is not prohibited by law to make a transaction earlier.

Tags: Apartment, MKD

How to properly prepare a deposit or deposit when buying an apartment

The pledge or deposit is drawn up in the form of a separate agreement/contract. They often replace the preliminary purchase and sale agreement. As a rule, such a document is signed after the parties have reached some basic agreements.

Procedure

To draw up a pledge/deposit agreement you must:

- Discuss the terms of the transaction with the buyer/seller.

- Determine the amount of the deposit/deposit and the method of transferring money (cash or non-cash).

- Draw up a deposit agreement.

- If necessary, have the agreement certified by a notary.

- Sign this document.

- Give the seller the money.

It is recommended to request a receipt from the seller for receipt of the deposit. The agreement only emphasizes the intention of the parties to transfer/receive money, but not the fact of transfer itself. A receipt is required to record this.

Documentation

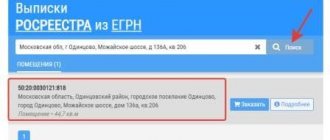

At the stage of signing such an agreement, only the minimum required documents are required:

- Passports of the parties.

- Extract from the Unified State Register of Real Estate.

- Legal documents.

The buyer can also request a complete list of all papers to make sure that everything is in order with the apartment, but this is not a mandatory condition.

Costs and deadlines

The parties themselves decide when and under what conditions it is convenient for them to draw up and sign such an agreement. If you do not plan to contact a notary office for certification, then there will be no additional costs.

Contents of the deposit agreement

This type of agreement should include the following information:

- Passport details of the parties (full name, series and number of the passport, who issued it and when, registration address, etc.).

- Information about the essence of the agreement.

- Information about the apartment that will be purchased.

- Deposit amount.

- Total cost of the apartment.

- Duration of the agreement.

- Terms of the deal (penalties in case of termination).

Sample deposit agreement

Features of making a deposit when purchasing a mortgaged property

It is possible to make a deposit even when purchasing real estate with a mortgage loan. Just describe in the deposit agreement the procedure for paying with mortgage funds and other important nuances. The procedure for submitting a deposit is as follows:

- enter into an agreement between the parties, specifying the procedure for disposing of credit funds;

- notify the banking institution of your desire to make a deposit by sending it a copy of the agreement, and agree with it on all the conditions - the bank will deduct the amount of the deposit from the first installment;

- if you are a buyer, give the seller a deposit;

- if you are a seller, issue a receipt;

- send a copy of the receipt to the bank.

Deposit when buying an apartment with a mortgage

If an apartment is purchased with a mortgage, the general principles of drawing up an agreement, the features of the pledge/deposit and receipt remain unchanged. The only difference is that the bank must be notified of the existence of such an agreement. Based on this document, the loan amount will be adjusted. There are no other features or differences.

A deposit, deposit or advance payment when purchasing an apartment is, although not mandatory, a very important element that literally “binds” the parties to each other with certain obligations. Fraudsters often use this system to get money from the buyer, but not give anything in return. Experienced lawyers will tell you about the main features of such agreements during a free consultation. They can also accompany the entire purchase and sale procedure, thereby eliminating the possibility of fraud and any other potential problems.

FREE CONSULTATIONS are available for you! If you want to solve exactly your problem, then

:

- describe your situation to a lawyer in an online chat;

- write a question in the form below;

- call Moscow and Moscow region

- call St. Petersburg and region

Save or share the link on social networks

(

1 ratings, average: 5.00 out of 5)

Author of the article

Natalya Fomicheva

Website expert lawyer. 10 years of experience. Inheritance matters. Family disputes. Housing and land law.

Ask a question Author's rating

Articles written

513

- FREE for a lawyer!

Write your question, our lawyer will prepare an answer for FREE and call you back in 5 minutes.

By submitting data you agree to the Consent to PD processing, PD Processing Policy and User Agreement

Useful information on the topic

4

How to get deceived when buying an apartment

Fraud when buying an apartment occurs, if not constantly, then very...

16

How does the purchase and sale of an apartment through a safe deposit box work?

The purchase and sale transaction of an apartment involves many risks, one of which is...

60

What expenses do the buyer and seller bear when buying or selling an apartment?

Purchasing an apartment is associated with high costs. The lion's share of the buyer's expenses...

2

Buying an apartment with a mortgage encumbrance

When applying for a mortgage loan, the bank requests collateral. They can perform...

9

Termination of the preliminary agreement for the purchase and sale of an apartment

In case of expropriation of an apartment for compensation, the Seller and the Buyer may not…

3

What you need to know when buying an apartment through a real estate agency

Real estate agencies actively advertise their services, promising to find housing much more...

Advance payment when purchasing an apartment

Advance is the amount of money that the buyer contributes to pay for the purchased property. This leads to two consequences that distinguish an advance from a deposit:

- if the transaction does not take place, the advance amount when purchasing an apartment is returned in full, regardless of who is to blame for the failure;

- neither the seller nor the buyer are subject to penalties.

That is, the advance performs only one function - payment. However, an agreement must also be drawn up about it, so that neither party is tempted to call making an advance payment when purchasing an apartment a deposit. There is one more subtlety: funds contributed under an agreement subject to state registration are considered an advance until it is registered.