Concept and composition of inheritance

Inheritance law is a set of legal norms that is regulated, in addition to the Constitution, by other laws and regulations of Russia. The basis for regulating inheritance relations is the Civil Code of the Russian Federation, however, some of these legal relations are regulated by the norms of the Federal Law on joint-stock companies, cooperatives, family law, the law on notaries, etc.

The right of inheritance is closely related to private property rights. When inheritance occurs, property passes from the testator to the heirs by law or by will, according to the rules of universal succession. This means that the inheritance is received by the heirs as a whole, as a single whole. Inheritance law guarantees the freedom to draw up a will, which allows any citizen to realize his will. The composition of the inheritance is determined in the provisions of Article 1112 of the Civil Code of the Russian Federation.

The inheritance includes all the property of the deceased, including property rights and material obligations lying on it. But, taking into account the norms of the law, not all property rights, as well as the obligations of the deceased, can be included in the inheritance.

The rights and obligations belonging to the testator that are associated with the personality of the deceased are not included in the inheritance.

Also, the restrictions established by Art. 1185 of the Civil Code of the Russian Federation and Art. 1112 of the Civil Code of the Russian Federation, do not contain a complete list of rights and obligations not included in the inheritance.

It is necessary to note who the testator is. It can only be an individual, regardless of age and state of legal capacity, whose property passes after death to the heirs specified in the will, as well as those determined in the order of inheritance by law.

Inherited property

In accordance with the norms of civil legislation of the Russian Federation, inherited property

- this is a set of property (and in some cases, non-property) rights and obligations of the testator, which are transferred by inheritance to other persons - the heirs.

When inheriting

the property of the deceased (inheritance, hereditary property) passes to other persons in the order of universal succession, that is, unchanged as a single whole and at the same moment.

Included in inherited property

includes things and other property that belonged to the testator on the day the inheritance was opened, including property rights and obligations.

Not included in the inheritance

rights and obligations inextricably linked with the personality of the testator, personal non-property rights and other intangible benefits, as well as rights and obligations, the transfer of which by inheritance is not permitted by the legislation of the Russian Federation.

Household furnishings and household items are usually not included in the estate and are transferred by law to the heirs who lived together with the testator before his death (at least a year). If there are no persons living together with the testator, then, at the request of the heirs, household furnishings and household items can be included in the inheritance property.

Certificate of right to inheritance

for an unfinished house is issued by a notary, subject to the heirs providing him with certificates from the relevant authority about the work performed and the assessment of the unfinished house.

Included in inherited property

cannot be included:

- unauthorized erected buildings;

- benefits for the birth of a child not received due to the death of a parent who had the right to receive it (paid to family members living together);

- lost payments due to temporary disability, as well as lost wages of the testator (paid to family members living together);

- the right to alimony, as well as the right to compensation for harm caused to the life or health of a citizen (testator);

- the right of authorship, the right to a name, the right to protect the reputation of the author of a work.

Property copyrights

pass to the heirs to the extent that they belonged to the author (testator) during his lifetime.

Inheritance of civilian weapons,

registered with the internal affairs bodies, is carried out in the same manner as any other property, if the heirs have a license to purchase such weapons.

Property bequeathed to two or more

to heirs without indicating their shares in the inheritance and without indicating which things or rights included in the inheritance are intended for which of the heirs, it is considered bequeathed to the heirs in equal shares.

Indivisible thing

is considered bequeathed in shares corresponding to the value of these parts. The procedure for the use of this indivisible thing by the heirs is established in accordance with the parts of this thing assigned to them in the will. In the event of a dispute between heirs, their shares and the procedure for using the indivisible thing are determined by the court.

Inclusion of property in inheritance

When property is included in the estate, a claim is filed with the courts. Such cases are considered in accordance with the general procedure. Often, the application for inclusion in the inheritance includes objects that belonged to the deceased, the rights to which, for certain reasons, were not registered by him in the manner prescribed by law during his lifetime. In this case, the court will have to prove that the testator owns the property when it is included in the estate.

The inheritance of certain types of property is regulated by the provisions of Chapter 65 of the Civil Code of the Russian Federation. In most situations, this concerns the inheritance of enterprises, rights to participate in cooperatives, rights that involve participation in commercial organizations, if the inheritance concerns the rights to the property of peasant farms, etc.

The inheritance of a participant in business partnerships and companies includes shares (shares) in the authorized (share) capital of other business partnerships and companies that belonged to him at the time of death. For example, the inheritance of a participant in a joint stock company includes shares that belonged to the deceased participant. The heirs who inherited such shares respectively become members of the joint-stock company.

Deadline for receiving property by inheritance

Inheritance of property is a procedure during which the transfer of values to legal successors occurs. After opening a case, six months are allotted for preparing documents and registering rights, but it is not always possible to accurately determine the date of death. This is done according to a death certificate or a court conclusion, if the exact day of death is unknown (the person went missing, died under unknown circumstances, etc.)

6 months is the general period established by the Civil Code of the Russian Federation. You can get the hereditary mass faster. If there are no other applicants, and this is documented, the notary reduces the entry period to three months. But if there are special conditions when the court or notary office extends the period for another 3 or 6 months:

- The hereditary mass has changed.

- New claimants, obligatory heirs have appeared, and another will has been discovered.

- The main heir was found unworthy following a court hearing.

- Some of the applicants abandoned the property (with or without specifying a successor).

- One of the legal successors died, having managed to write an application for inheritance.

Missed deadlines are restored in court. If the reasons for absence are objective, significant and supported by documents, an additional 6 months are assigned. Then the next inheritance case is carried out as usual.

Right to alimony as part of an inheritance

If we are talking about obligations that relate to the payment of alimony, then it should be noted that the provision of Part 2 of Article 120 of the Family Code provides for the termination of such obligations from the moment of the death of the debtor, since they are inseparably linked with his personality. This means that the heir cannot inherit those obligations that belonged to the testator, which ceased due to his death.

The right to receive alimony cannot be inherited. If the beneficiary dies, the heirs will not be able to receive any alimony due to him or her.

What is included in the inheritance under a will?

According to the law, in particular Article 1119 of the Civil Code of the Russian Federation, every person has the right to bequeath property to whomever he wishes, but only his part of the inheritance. The testator can include strangers and relatives in the will, give his valuables to the state, a charity or an inherited foundation. At the same time, he has the right to distribute the goods in shares between the children or leave each an equal part, as described in the provisions of Article 1122 of the Civil Code of the Russian Federation. The testator determines the composition of the inheritance, indicates in the list the real estate, things and jewelry that will be transferred to the daughter or son after the death of the testator.

When making a will, the part of the property that belongs to the obligatory heirs is not divided. Article 1149 of the Civil Code of the Russian Federation states that property acquired jointly will remain with the husband and is not subject to division if the wife dies. The living spouse owns the share that was in his property before the written expression of the will of the deceased. They cannot remain without inheritance:

- disabled and minor children;

- parents;

- dependent persons living in the house with the testator.

The composition of the inheritance under a will is determined based on the instructions:

- general, where it is reflected that the property will belong to a specific person or enterprise;

- distributions in parts for each heir;

- separation of specific things and values.

If the testator did not reflect the shares, but indicated that the apartment would belong to 2 daughters, they will take possession of the property ½ part for each.

Inheritance of rights of a member of a consumer cooperative

If the deceased was a member of a consumer cooperative during his lifetime, then his share will be included in his inheritance. The heir of a deceased member of a dacha, garage, housing or other consumer cooperative can count on being accepted into the cooperative. To do this, you will need to submit an application to the chairman of the board of the consumer cooperative. A sample application can be obtained from the board of the cooperative.

Which of the heirs of a deceased member of a consumer cooperative, in what order and within what time frame will inherit the share, is determined by the current legislation and the constituent documents of the cooperative.

It should be taken into account that upon full repayment of the share contributions of a member of a consumer cooperative, he receives ownership of the property of the cooperative. In this regard, it is necessary to distinguish, when the opening of an inheritance occurs, the inheritance of a share from the receipt of property.

What is included in the inheritance during hereditary transmission?

In the order of hereditary transmission, in the absence of a will, the right is transferred from one heir to another if a relative, in accordance with the order, began the procedure for opening the inheritance, but did not have time to take advantage of it and died. This transition is regulated by Article 1156 of the Civil Code of the Russian Federation.

Under normal circumstances, 6 months are given to open inheritance - Article 1154 of the Civil Code of the Russian Federation. After the death of the heir, the transmitter must have time to complete the documents in the remaining time. The period can only be increased to 3 months. As can be seen from judicial practice, judges in special cases make concessions, if there are compelling reasons, and extend the time for formalization procedures.

The inheritance mass includes property that was registered by the deceased successor - valuables, money, houses.

Determining the composition of the inheritance

To determine the composition of the inheritance, as well as its protection, the notary has the right to request relevant information at his request. The information received about the opening of an inheritance, as well as what objects are included in it, is reported by the notary only to the executor of the will or directly to the heirs.

When an inventory of property is made, the executor of the will, the heirs, and, in some cases, representatives of the guardianship and trusteeship authority have the right to be present. Subsequently, upon their application, an assessment of the property included in the inheritance mass is assigned.

What is included in inheritance according to the law?

Inheritance by law occurs in the absence of a will in the order of priority approved by legislative acts; such provisions are specified in Articles 1141, 1142, 1145, 1148 of the Civil Code of the Russian Federation. The queue starts with close relatives, and if they are not there, it moves to the next level of relationship:

- children, spouses, parents, grandchildren;

- siblings;

- uncles, aunts;

- great-grandparents;

- passed on to cousins and grandmothers;

- great-grandchildren;

- stepsons, stepfathers;

- dependents.

Relatives of the next level can begin to formalize the composition of the inheritance if there are no previous heirs in line.

In chapter 61 art. 1110 of the Civil Code of the Russian Federation states that the material assets of the deceased are accepted as a whole, in the order of universal succession. The estate includes items that were owned by the testator. The composition of tangible and intangible assets of the inheritance is divided into groups:

- Personal movable and immovable property - furniture, jewelry, collections, household technical devices, vehicles, buildings and land acquired by the testator himself. Article 128 of the Civil Code of the Russian Federation lists things that belong to the objects of civil rights.

- Cash can be in the form of company shares, securities, natural banknotes and savings in bank accounts.

- Obligations. In accordance with Article 1175 of the Civil Code of the Russian Federation, the heir, as part of the inheritance, receives not only the material benefits of the deceased, but also obligations for debts. His responsibility is to repay loans in the amount of the accepted shares. If an apartment with unpaid utilities is transferred into ownership, according to the standards of the Housing Code of the Russian Federation, Art. 154, the debt must be repaid in full.

The heir acquires the rights to receive funds that were not paid to the testator during his lifetime; income from the intellectual property of the deceased - musical works, inventions, books - is transferred to him.

When the inheritance is transferred, the right of ownership of the property by the previous owner is documented, the objects of the inheritance are assessed, except for small things that have no value.

Claim for inclusion of property in the inheritance

In cases where there are questions regarding the composition of the inheritance mass that require resolution in court, which, for example, most often are disputes about the inclusion of property in the inheritance, the courts consider them in litigation proceedings. Such claims are of a property nature and are subject to assessment. To consider them, it is necessary to file a claim in accordance with the jurisdiction determined by procedural law. A sample claim is usually located in court on the information stand.

It is necessary to dwell on the meaning of a certificate of inheritance. Its issuance is a notarial act; it is issued at the place where the inheritance is opened. In order for the heir to receive it, it is necessary to submit a corresponding application to a notary or an authorized official.

A sample application can be obtained from a notary. If the heir actually accepted the inheritance and provided the indisputability of this fact to the notary, but he was refused to issue a certificate, the heir has the right to appeal the actions of the notary. A sample application to appeal such actions can be found on Internet resources.

If such facts are not enough to prove acceptance of the inheritance, then it is necessary to consider the case in court to establish legal facts. You can order the preparation of an application during a consultation with a lawyer. The certificate, in accordance with the general rules of legislation, is issued to the heirs at any time after six months have passed from the date on which the inheritance was opened.

Author of the article

The procedure for registering real estate as property by inheritance

The standard procedure involves contacting a notary. To do this, choose a notary office located at the location of the hereditary property. Based on an official statement supported by evidentiary documents, an inheritance case is initiated. A list of property, a list of possible applicants is formed, and shares are assigned.

Based on the results, a certificate is issued that allows you to re-register the property in your name at the state registration authorities. In this case, a state duty is paid, calculated in accordance with the share of the property accepted. Debts that “stretch” behind the property are subject to repayment by the successor. Utility bills are paid in full, otherwise Rosreestr will not mark the change of owner.

Procedure

When inheriting real estate by law or by will, the procedure is identical. The following steps are provided:

- Preparation of documents.

- Payment of state duty.

- Drawing up an application.

- Obtaining a certificate.

- Re-registration of property.

It will not be possible to force events. Six months are allotted for everything. If deadlines are missed for a good reason, they can be restored in court.

Application: sample

The text must indicate the circumstances and facts that allow you to claim the property. All arguments are supported by documents indicating the legality of hereditary claims. In addition to the list of attachments, the document must have the following mandatory attributes:

- date of writing;

- event city;

- applicant's details;

- signature with transcript.

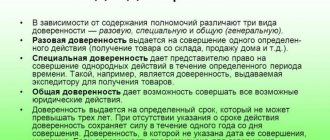

Otherwise, the document is considered invalid, as it loses its legal force. It is possible to submit an inheritance application in person, by mail or through a representative. In the latter case, it is better to involve a professional lawyer who, on the basis of a notarized power of attorney, will defend the interests of the applicant.

Documentation

For personal identification, take your passport with you. Make sure it is not expired. It is also important to confirm that the applicant actually has inheritance rights. Relevant papers are provided for this. It is important to prove the existence of family ties that give the right to put forward inheritance claims in relation to the property left behind. If you have a will, you do not need to adhere to this aspect - a passport is enough.

When the declaration of will is in hand, attach a copy to the application. Restore the missing papers or get duplicates. It is also advisable to bring documents describing and identifying the property being inherited. Receive the opinion of the evaluation commission. This allows you to correctly calculate the amount of the duty and determine the amount of the buyout if there are several applicants, and the property should go to one of them.

Expenses

When accepting an inheritance, the inherited property must be assessed if we are talking about real estate. Based on the amount, the amount of the state duty is calculated. For immediate family it is 0.3%. Everyone else pays twice as much - 0.6%. Costs may be higher if you have to:

- Recover lost documents.

- Use the services of intermediaries.

- Go to another city, district, region.

- Order additional notary services.

- Hire a lawyer.

Standard services are paid according to the tariffs published on the website of the selected law firm. But the initial consultation on key points is free. Add to the list the need to pay off the debts the testator left behind. Debt obligations are transferred along with property and claims.

The heir is obliged to repay debts on the testator's loans, utility bills, etc. But alimony and payments for personal injury are written off at the time of his death.

Deadlines

Six months are allotted for everything. The main thing is to correctly calculate the period, which is 6 months from the date of death of the testator. The first day of the inheritance process is not difficult to determine. This:

- The moment indicated in the death certificate issued on the basis of the conclusion of a medical examination.

- Date of issue of the judicial act declaring him dead. This is the case when it is impossible to actually determine the moment of death.

- The time specified in the judicial act declaring a missing citizen dead (issued by the court based on the results of the hearing).

The period can be reduced to 3 months if the applicant is the only formal heir. A judge or notary can also extend the period of the inheritance procedure if special facts concerning the property, successors, will, or testator become known.

What is included in the inheritance of an LLC participant?

A limited liability company can be organized by 1 person or several persons by contributing funds to the authorized capital and dividing it into shares in the amounts determined by the constituent documents - Federal Law-14 Article 2. The transfer of funds is carried out in accordance with the Federal Law on LLC Art. 21.p.1, which provides for legal succession. You can inherit the property of an LLC as a whole, according to universal legal succession, as stated in Article 1110, paragraph 1 of the Civil Code of the Russian Federation. After the death of the testator of the LLC participant, the share of the authorized capital is transferred to the heirs.