When can you refuse insurance?

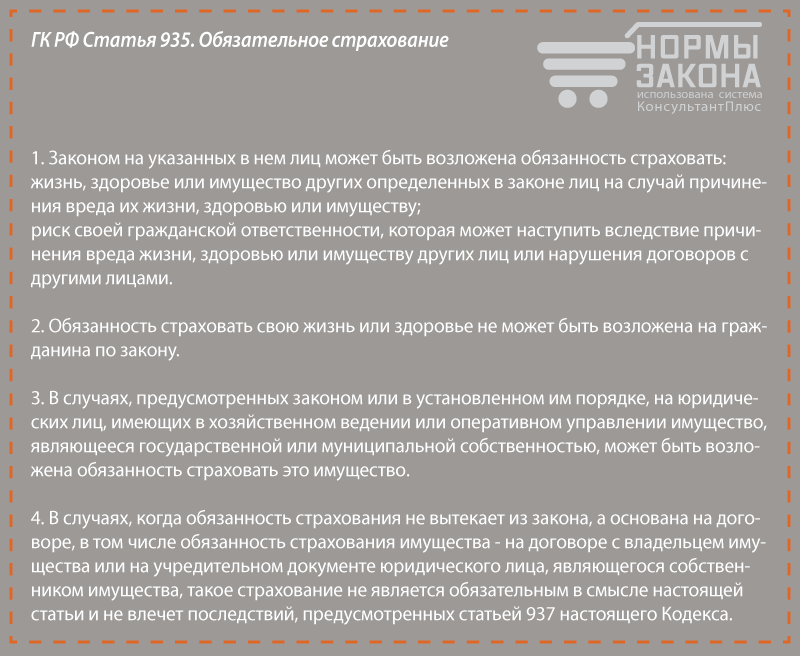

According to the Civil Code and Federal Law No. 353-FZ, a banking organization has the right to offer a future client to enter into an insurance agreement for credit obligations, and the borrower has the right to accept or refuse the offer.

You can submit a refusal within the following deadlines:

- when receiving a loan. An exception is if the client takes out a mortgage or car loan. In these cases, an insurance contract must be concluded. If you try to refuse, the bank will inform you that it is impossible to complete the transaction;

- within 14 days from the date of conclusion of the contract and payment of insurance premiums. This possibility is provided for by Bank of Russia Directive No. 3854-U. When purchasing any product or service, the consumer has time to think – a cooling-off period. In 2021 it was increased to two weeks;

- upon early repayment. The possibility of returning the money in this case must be indicated in the loan agreement.

If the last loan installment has been paid according to the payment schedule, you can withdraw the cost of the policy within three years from the date of receiving the loan. To do this, you will have to prove in court that the insurance was imposed by bank employees.

"AlfaStrakhovanie" - refund of money for insurance through the court

Refunds for obtaining insurance through legal proceedings are carried out after all other methods have been exhausted, when the insurance company has refused and the policyholder has no other options to return the remuneration paid.

The grounds for going to court are:

- Early repayment of loan obligations;

- Inability to use an insurance policy;

- Cancellation of the Policy offer with the insurance company, in which the Insurer refused to return the reward received;

- Compulsory insurance when applying for a loan.

The advantages of going to court are that the following factors are taken into account:

- lack of explanation to the plaintiff about the procedure for refusing insurance and his ignorance of his rights;

- automatic inclusion of insurance in the loan agreement;

- imposition of services by bank employees when applying for a loan.

When considering the case on the merits, the court may require the provision of other documents and evidence from the plaintiff or defendant in order to make the most fair decision on the stated dispute.

The policyholder will need the following documents:

- Statement of claim;

- Passport or other identification document;

- Loan agreement;

- Insurance policy;

- An extract on loan repayment, if the basis for going to court was the refusal of the insurance company to pay part of the insurance premium for early repayment of the loan;

- A copy of the policyholder's application for termination of the agreement between him and the insurer;

- Official refusal of the insurer to return the funds paid by the citizen;

- A receipt or other document confirming payment of the state fee.

Civil law does not prohibit independent representation of one’s interests, however, if there are conflicts between citizens and insurance companies, a lawyer is needed. Citizens will not be able to file a claim, and it will also be difficult to compete with the insurer’s professional lawyers.

If the statement of claim is drawn up in violation of the current civil procedural legislation, it will be rejected, indicating the justifications and errors. It is not a fact that when filing a new claim, other inaccuracies and errors will not be discovered.

A qualified lawyer will help you defend your rights and increase the likelihood of success in your legal case. If a line of defense is built and all the necessary documents are collected to convince the judge that he is right, the plaintiff not only will not lose anything, but will also be able to make money from the insurance company’s reluctance to follow the letter of the law.

When can an insurance company refuse?

According to the law, SK AlfaStrakhovanie-Life can refuse a client for several reasons:

- if the application is submitted after the end of the cooling-off period;

- the insurance is non-refundable;

- The bank borrower applied for payment for an insured event.

When submitting an application to terminate a life insurance contract, it is important to take into account that company employees may deliberately delay time. The chances of receiving the money spent will be higher if you issue a refusal in the first days after receiving the loan.

"AlfaStrakhovanie" - and applications for payment

The company provides insurance services in a variety of areas: travel, property, cars, life and health. In this regard, various application forms can be found on the organization’s website.

The following documents are available for download:

- "Additional forms" . Clients of the organization can also use applications for refusal of insurance, as well as a request to receive payments related to disability, the discovery of a dangerous disease, or the death of the policyholder (in these cases, a standard application is used). Download statements:

- insurance contract waiver form;

- sample of filling out an insurance waiver;

- European accident report form.

- "Life" . Here are the forms from AlfaStrakhovanie-Life. Insurance claims forms: injury or disability, dismissal or staff reduction, disability, fatal diseases. All insurance claims can be downloaded here:

- temporary disability or injury;

- dismissal or layoff;

- disability;

- deadly disease;

- death.

Procedure

If 2 weeks have not passed, it is easier to get the money and terminate the contract. The following instructions will help with this:

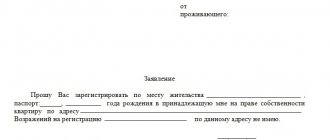

- Fill out an application.

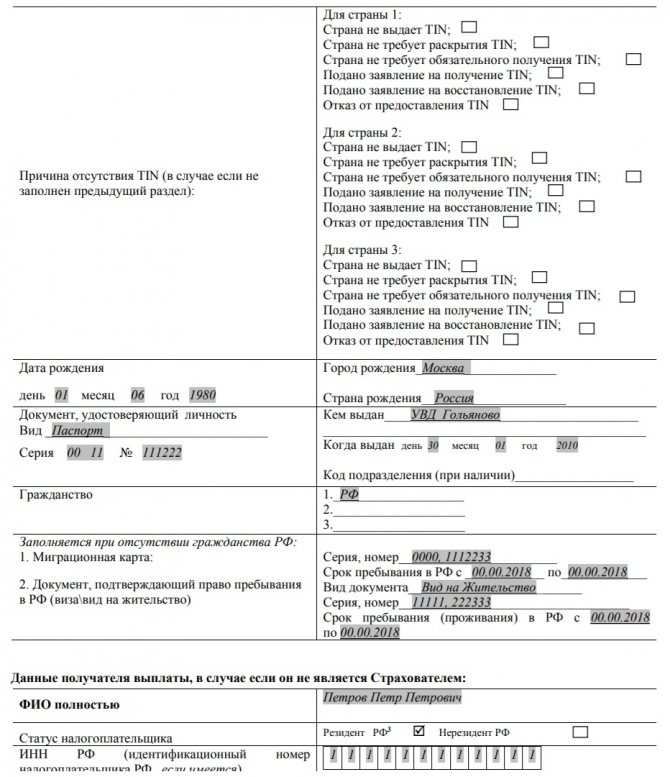

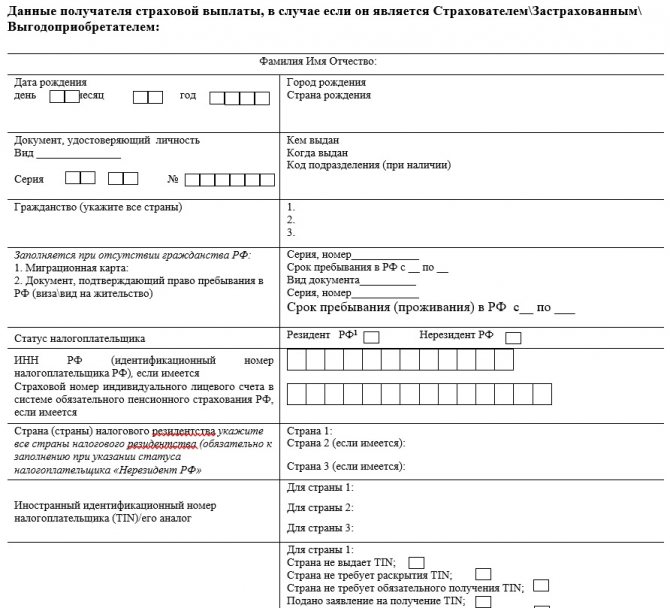

- Prepare documents: original agreement, copy of identity card, receipts for payment of fees, bank account details for receiving payment.

- Submit the package of documents to the nearest branch of Alfa-Bank or send it by registered mail to the address of the main office of IC AlfaStrakhovanie-Life in Moscow.

- Save the second copy of the application with an acceptance mark or the receipt received at Russian Post.

- After 5-7 days, clarify the answer.

The easiest way is to fill out an application on the official website of the insurer https://aslife.ru. To do this, you need to fill in the fields sequentially, indicating the applicant’s personal data, date of birth, contact phone number, email address, policy type and number, and confirm consent to the processing of personal data.

At the second stage, the permanent registration address, details for transferring funds, the date of payment of the insurance premium and the start of the policy, and the name of the creditor bank are entered. After filling out all the fields, the service will offer to print the completed application or download it in pdf format.

To speed up the review process, you can send scanned copies of the complete package of documents by email [email protected]

You can also obtain a standard form by contacting Alfa-Bank in person, where there are always several representatives of the insurance company. If the loan was issued by another banking organization, you can apply at the place of issue.

Download the application form for refund of insurance on the AlfaStrakhovanie-Life loan

View a sample of filling out an application for refund of insurance under the AlfaStrakhovanie-Life loan

Refund of insurance in Alpha Bank after receipt and upon repayment

Early repayment of borrowed funds is an independent basis for terminating personal insurance related directly to the loan. This return scheme is not suitable for corporate life insurance.

Loan agreements, if they provide for the protection of the borrower’s life, then for the entire period of the loan. At the same time, insurers have certain age requirements for life insurance clients, namely:

- at least 18 years of age;

- no older than 75.

Insurance contracts cannot be shorter than one year.

All funds paid by the borrower to the insurer before the loan is closed are non-refundable, except if the applicant raises the question of the invalidity of the insurance contract as a whole on the basis of:

- unreasonable imposition or coercion of a conclusion on the part of the bank;

- gross violation of current legislation.

In this case, both the credit institution and the insurer will be defendants in the case. If the agreement is declared invalid in court, all funds paid under it will be returned to the plaintiff.

By submitting an application, accompanied by a letter from the bank about the closure of the loan agreement, the borrower can expect to receive a refund of the amount deposited into the insurer's account and covering the period after full settlement with the bank from the moment the loan agreement is closed.

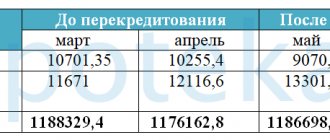

Before going to court, it is advisable to have an idea of how much money you can expect in return, and whether it is even worth undertaking an expensive and lengthy legal procedure. The state fee is paid by the plaintiff before going to court. Its size will depend on the amount of the claim. If the plaintiff loses the case, it cannot be returned.

But this will be illegal and you can demand a refund through a pre-trial claim or court for the days of insurance that have not passed. The policy is suspended from the moment you fill out an application for waiver of loan insurance, and not from the moment it begins to be reviewed, so you don’t have to worry that there is no response for a long time.

- If you are late in paying a loan at the bank Delinquency at the bank When drawing up a loan agreement, each client is sure...

- What happens if you don’t pay the loan to the bank after a court decision? Today, many credit disputes between the bank and the borrower...

If you have the patience to struggle, try it)) You need to go to Alfa Insurance, since you have insurance from them.

And this Helios, what is it anyway? These are the two points where you need to go and write an application.

I advise you to read the topic https://www.u-mama.ru/forum/gossip/everything/694673/index.html According to the mortgage law, only real estate insurance is mandatory

On November 2, 2021, Russian Post sent a set of documents to terminate the contract.

On November 7, the documents were received by an employee of AlfaStrakhovanie-Life.

Please notify me when the money will be returned to my account

I am interested in information about the termination of contract number No. L0302/596/427715/7 dated 09/10/2017.

Please clarify at what stage the application is now? And when will the money be returned?

A request will be sent to the e-mail address you provided; to confirm your registration, follow the link.

Password recovery instructions have been sent to the specified e-mail.

- Medical insurance for citizens of the Russian Federation staying in the territory of a foreign state;

- Medical insurance for foreign citizens and stateless persons who arrived in Russia for work;

- Insurance contracts by persons who, only if they have one, are allowed to work due to their professional duties;

- Contracts of civil liability insurance within the framework of international systems for vehicle owners.

As we can see, if an insurance contract is concluded during the lending process, refusal is possible. Moreover, the borrower is not initially obliged to enter into such an agreement, since the law establishes a voluntary procedure. On the other hand, refusing personal insurance usually leads to an increase in the interest rate, so it is better to calculate the overpayment in both cases in advance and choose the most profitable option for yourself. Below we will consider the features of terminating a contract with an insurance company at different stages of obtaining a loan.

How and when will the money be returned?

The return method can be specified when filling out the claim:

- cash at the bank's cash desk;

- transfer to a bank card.

From the moment the original documents are received, the insurer has 10 days to consider the application, make a decision and fulfill the client’s requirements.

If the borrower-insurer agrees to receive cash, to receive it, you must go to the bank with an ID card, fill out the return documents and collect the cost of the insurance.

Within the same time frame, the money will be transferred by the bank to the card if the client prefers a non-cash method. The period of actual crediting depends on the terms of service of the issuing bank that issued the credit card.

If you are informed of a refusal

If the cooling period has not passed, but the company refuses to pay, you can file a complaint with the Central Bank of the Russian Federation or Rospotrebnadzor.

The Bank of Russia accepts complaints from clients of insurance companies in two ways:

- by registered mail;

- in electronic form via the Internet reception. To do this, go to the appropriate section on the website https://cbr.ru and select “Submit a complaint.” The service will prompt the visitor to select the topic of the appeal, describe the situation, provide contact information, attach copies of documents and send an email.

All requests are reviewed within a maximum of 30 days. If the Bank of Russia reveals violations of the policyholder’s rights, the company will receive a demand to return the money and will be fined.

You can submit a complaint to Rospotrebnadzor in similar ways - via the Internet or by registered mail. Consumer complaints are reviewed within a month. If violations are detected, the insurer will be ordered to comply with the client’s requirements and pay a fine.

If the loan is repaid early

According to the Directive of the Central Bank of the Russian Federation and Article 958 of the Civil Code of the Russian Federation, the insurer can increase the cooling period or provide for a partial refund of the cost of insurance upon early repayment of the loan, specifying the conditions in the contract.

The terms of the standard agreement and the approved Insurance Rules do not provide for this possibility. In accordance with clauses 5.5 and 7.4, if the debt is repaid ahead of schedule, no payments are made and the company’s obligations are considered fulfilled in full. In this case, you will have to prepare for lengthy legal proceedings.