A housing savings cooperative in Kazan allows clients to purchase an apartment on favorable terms. The company has been operating since 2014. Over the past time, a significant client base has been accumulated, which allows us to draw a conclusion about the reputation of the company. Your znk.ru personal account allows you to speed up and simplify cooperation with the company.

Login to your personal account

The process of logging into the znk.ru remote service consists of the following stages:

- The login page for your personal account opens. To do this, you can use the direct link https://znkrf.ru/lk/ or go through the official website of the company.

- Next, enter your login and password sequentially. You should select the English keyboard layout.

- The window labeled “Login” is clicked.

Housing savings cooperatives or mortgages: interests of citizens against the banking lobby?

Belgorod. 05/14/2021. ABIREG.RU – Analytics – According to the Ministry of Construction of the Russian Federation and Dom.RF Bank, since 2004, the volume of mortgage lending in the country has increased 33 times. Russians are actively taking out bank loans to purchase housing, paying considerable interest to banks. At the same time, few citizens know about the existence of an alternative without overpayments in the form of housing savings cooperatives. Abireg looked into why housing cooperatives remain in the shadows in the real estate market and who benefits from this.

Cumulative or construction?

First, it is necessary to clarify that we will be talking specifically about housing savings cooperatives, which are often confused with housing construction cooperatives. There is a fundamental difference between them: if in housing cooperatives citizens unite to raise funds and build one specific house for themselves, then in housing cooperatives people accumulate money for housing in order to purchase it. Moreover, depending on the charter of the cooperative, housing can be purchased in different regions from various construction companies and individuals, both on the primary and secondary markets.

It is significant that out of 85 regions of the country, housing savings cooperatives operate in only 19 subjects - in the Republics of Bashkortostan, Mari El, Khakassia, Tatarstan, in Crimea and the Khanty-Mansi Autonomous Okrug, Samara, Belgorod, Nizhny Novgorod, Saratov and Sverdlovsk regions, Perm, Krasnoyarsk , Krasnodar, Primorsky, Altai territories, St. Petersburg and Moscow. According to the Bank of Russia, which controls the activities of all housing cooperatives, as of April 9, 2021, 44 cooperatives were included in the list of housing savings cooperatives operating in the country. The legal, economic and organizational basis for the activities of housing cooperatives are established by Federal Law No. 215-FZ of December 30, 2004 “On Housing Savings Cooperatives.”

ZhNK or mortgage: which is more profitable?

First, it is worth noting how the mechanisms of housing and mortgage lending are fundamentally different. The mortgage assumes that the apartment is registered as the property of the tenant, but remains pledged to the bank until payments are completed. ZhNK differs in that the housing is immediately transferred to the shareholder, but remains the property of the cooperative until its cost is fully repaid. However, in this case, the money contributed by the shareholder towards the purchase of the apartment remains entirely his property as long as the apartment is the property of the housing cooperative.

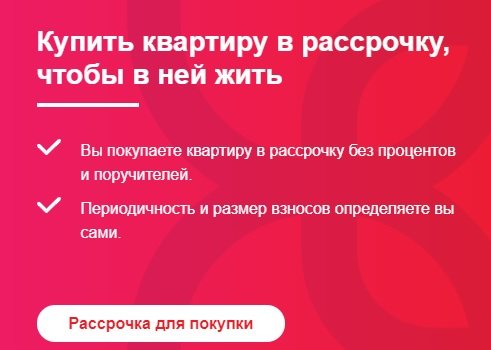

In addition, according to representatives of various housing savings cooperatives, the mechanism for purchasing an apartment or house through savings in housing cooperatives allows you to purchase housing in installments on much more favorable terms than with a mortgage from a bank. What's the secret? Firstly, during the period of accumulation of the first part, which gives the right to purchase an apartment, the buyer contributes money to the cooperative and income is accrued on it. It turns out to be such a convenient deposit with the possibility of replenishment.

Secondly, unlike a mortgage, payments in a savings cooperative after purchasing an apartment are not annuity, as in all banks, but differentiated, that is, the borrower makes different monthly payments to the housing cooperative, the amount of which decreases with each payment. In addition, there is no additional burden on the shareholder in the form of loan support, account maintenance, etc.

Also, apartment buyers are freed from the need to confirm their income, take out insurance, and attract guarantors or co-borrowers. All you need is a passport, INN and SNILS. Any person over 16 years old can become a member of the WNC, regardless of where he lives, what his level of income is and his social status. There is no upper age limit. Housing savings cooperatives are a solution for those people for whom banks do not approve a mortgage. These may include those who have recently changed jobs, as well as the self-employed and other workers with non-fixed incomes. Due to these conditions, the cooperative is accessible to the majority of citizens with different levels of income and under different life circumstances.

There is another plus - the shareholder receives income. Participation in a cooperative consists of two stages - the accumulation stage and the repayment stage. So, income is accrued on all the funds that a person deposits at the accumulation stage. At the end of the year, it is distributed to all shareholders in the form of interest on savings.

WNC WNC discord

It must be said that the procedure for admission to membership of the cooperative, determining the size, composition and procedure for making share contributions in different housing cooperatives are somewhat different and depend on the charter of the cooperative. The document itself is approved by the general meeting of members of the ZhNK.

There are savings cooperatives that implement mainly state housing programs using subsidies, government orders, etc. An example of such a cooperative is the Belgorod housing cooperative “New Life”. In this cooperative, shareholders are provided with housing in specific houses of certain categories in accordance with the program implementation plan.

Housing cooperatives differ in the geography of housing purchases and cooperation with a certain range of developers. Thus, the ZhNC “Housing Opportunities” from Kazan works with a general partner - the federal development company, which is implementing projects in Kazan, other cities of the Republic of Tatarstan, as well as in Bashkortostan and the Samara region. Among the advantages of the cooperative is working under the Trade In program, in which you can exchange your old apartment for a new one with an additional payment. The number of participants in the interest-free installment program in the Housing Opportunities housing cooperative for 2021 amounted to 5.7 thousand who joined the cooperative, 2.8 thousand are current shareholders, and a total of 4.2 thousand purchased apartments.

This housing cooperative buys apartments for shareholders without a fixed cost per square meter. But the housing savings cooperative “ZhBK-1” in Belgorod provides just such an opportunity to its shareholders, which is even more profitable for buyers.

The difference between the Belgorod ZhBK-1 ZhNK is that it allows shareholders to deposit funds in stages and fix for themselves the cost per square meter, which was established at the time of depositing funds. The same system applies to individual housing construction, with the exception that the cooperative cannot acquire land. Therefore, to purchase a house through a housing cooperative, the land must be owned by a member of the cooperative. It is important that maternity capital can be used as a share contribution.

This experience of purchasing apartments and private housing construction by square meters is unique for Russia. Over the 12 years of its existence, about 8 thousand people from all over Russia joined the ZhBK-1 cooperative. More than 2 thousand apartments were purchased for shareholders throughout the country. The management of the ZhBK-1 corporation has been trying for many years to disseminate experience beneficial to citizens at the federal level. The reliability of the method of selling apartments by square meters was tested in 2013 by the Accounts Chamber of the Russian Federation. Also, the ZhBK-1 project has been adopted by the Agency for Strategic Initiatives. Every year the work of the Cooperative is monitored and audited by the Central Bank of the Russian Federation. However, so far the mechanism has been successfully implemented only in the Belgorod region.

ZhNK & mortgage: who needs state support?

Despite some differences in the existing Russian housing cooperatives, what is common to all housing savings cooperatives in the country is their non-profit form of organization, since such a voluntary association of citizens was created to meet the needs of cooperative members in residential premises by combining share contributions. According to 215-FZ, a housing savings cooperative has no right to carry out any other activities, nor does it have the right to advertise its activities. To be more precise, a housing cooperative can attract new shareholders through campaigning, but without using the funds of the general mutual fund for these purposes.

Taking into account the competition in the real estate market, the lack of professional promotion of housing cooperatives seems to be a significant drawback, especially against the backdrop of a large number of advertisements about mortgage banking products, as well as official information about various measures of state support for the population and subsidizing interest rates for banks.

The founder of the construction corporation ZhBK-1 (Belgorod), Yuri Selivanov, is confident that if the ZhBK-1 mechanism was developed at the state level in each region, then the involvement in the construction industry per year of only 10% of the population’s savings (which is about 6 trillion rubles) and the activation of related industries would increase If the volume of capital investment in the economy was 60 trillion rubles and the housing issue would be resolved for 20-30% of the population.

Savings under protection

Anyone joining a housing cooperative must be registered by the tax service in the Unified State Register of Legal Entities (USRLE).

The interests of shareholders are protected by state regulatory authorities. In particular, the work of ZhNK is controlled by the Central Bank and undergoes mandatory audits every year. In addition, the general meeting of members of the cooperative maintains control over the activities of the cooperative, that is, any of the shareholders, upon request, can gain access to the financial and reporting documentation of the cooperative. Also in some regions, for example in the Belgorod region, the activities of housing and communal services are additionally checked by the local administration, and a certain assessment is given to it.

In addition, the money of shareholders, which is sent to the cooperative in the form of contributions, is protected from inflation, since the money of shareholders is invested in real real estate.

ZhNK in the shadows

In 2021, in a decree on national goals and strategic objectives, Russian President Vladimir Putin set the goal of radically solving the housing issue. One of the ways to achieve this could be the spread of housing savings cooperatives throughout the country.

Housing savings cooperatives operating under state supervision can become a profitable alternative to mortgages, including preferential ones, and increase the affordability of housing for the population. Moreover, the mortgage program with state support is not yet planned to be extended in all constituent entities of the Russian Federation after July 1, 2021.

However, despite all the advantages and the appropriate historical context when housing cooperatives could become widespread, in fact, cooperatives remain in the shadow of mortgage banking programs. And the main reason is that ZhNK, as a non-profit organization, cannot widely advertise its activities, since these are actual expenses of shareholders’ funds. Banks actively lobby for their own interests, including mortgage services, which are associated with related services of annual property and life insurance of the borrower.

The successful experience of individual housing cooperatives may be useful in disseminating the mechanism at the federal level. But so far there has been no corresponding decision from the government agencies responsible for implementing the presidential decree regarding the solution to the housing issue.

The founder of ZhBK-1, Yuri Selivanov, is confident that it is the state that should help the housing cooperative mechanism emerge from the shadow of mortgages: “If the state, instead of subsidizing bank mortgages, subsidized shareholders by 15-25%, then hundreds of thousands of people would join cooperatives. The money would be returned to the state many times over in the form of taxes from the construction complex and taxes from related industries.”

Preferential mortgages are terminated. What's next?

The very concept of mortgage lending in Russia is always heard, it is a term that is understandable and familiar to the average person. This is also an acceptable option for those who want to get their home as quickly as possible, albeit with an overpayment in the form of interest. According to the United Credit Bureau (UCB), in the first quarter of 2021, banks issued 390 thousand mortgage loans. This is 22% more than in the same period in 2020. At the same time, as OKB General Director Arthur Aleksandrovich notes, the growth rate of mortgage lending has slowed down. He attributes this to the fact that Russians realized their demand for mortgage loans ahead of schedule, as well as to rising real estate prices.

As for the preferential mortgage program, it should be temporary, says Deputy Governor of the Central Bank Olga Polyakova. “From our point of view, the program that was introduced during the crisis is precisely anti-crisis and is temporary in nature. Therefore, if we are talking about extension, then it must be a transformation of this program. And it should be more targeted, directed, social in nature, otherwise we will come to the conclusion that the market will be overheated,” said Mrs. Polyakova. Therefore, given the rise in real estate prices, there is no need to wait for an extension of the preferential mortgage. Obviously, this will affect housing affordability.

Thus, it cannot be denied that in the difficult economic situation in the country, citizens need to be offered alternative, affordable options for purchasing square meters. Whether this will be a housing cooperative mechanism or, based on the unique experience of existing cooperatives, as in the Belgorod region, some new, interesting solution will appear - time will tell.

Procedure for purchasing housing

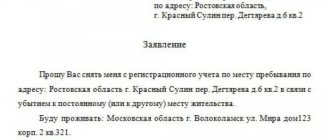

To purchase residential premises through a non-profit organization, you should prepare the following documentation:

- passport of a citizen of the Russian Federation - required to conclude an agreement to book housing in a new building at a specific address;

- individual tax number - will be needed to register in the register of legal entities in order to register for membership in the housing cooperative.

The process of buying a home using installments follows the following algorithm:

- The client independently selects a suitable residential property from among the available offers from the developer.

- An application to join the cooperative is submitted. In this case, you will need to pay 10,000 rubles as an entrance fee. Plus, 1000 rubles are paid, which is a monthly mandatory contribution.

- A special contract is concluded for the reservation of the selected residential premises. In this case, the amount of the share contribution must be at least 50% of the cost of housing. In the future, the cooperative will independently purchase the housing from the developer upon commissioning.

- The remote service service is being activated, this will allow you to track all financial transactions, as well as make payments.

- The next step is to use the services of an appraisal company. This will allow us to establish the current cost of a residential square meter in a completed construction project. Based on the assessment, the share contribution is recalculated.

- Next, the client accepts housing. This is accompanied by the signing of the relevant acts. From this moment on, he receives the right to carry out repairs, move in and register. It is also possible to repay the debt in any installments.

Important! Upon completion of the debt obligation, the client registers the apartment as his own property.

How to buy an apartment through a housing cooperative?

First you need to become a member of this voluntary structure. Collective activity has one focus - obtaining housing. The organization has a charter. It reflects all contractual aspects.

Attention!!! To join housing cooperatives in Russia, you must be 16 years old.

You can obtain ownership of the living space only after paying off the dues. The activities of the cooperative are prescribed in the Housing Code (Chapter 11). Community members may redevelop, purchase, and maintain a multifamily property. This is where the formula comes from. At least 5 citizens can participate in the project. The maximum composition of the association should not exceed the number of apartments in a residential building. A certain category of citizens has the primary right to enroll in a cooperative:

- low-income groups of the population;

- persons recognized as needing housing.

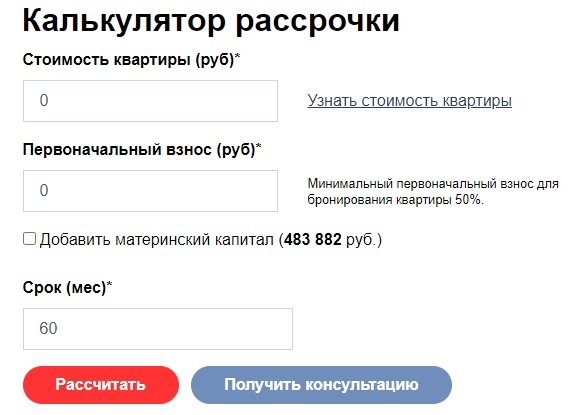

Installment cost calculator

Each client of a housing and communal services organization in Kazan can use a specialized calculator that will allow you to compare the company’s offer with banking organizations. Banks provide the opportunity to purchase housing under a mortgage program.

To carry out calculations, you will need to go to the section called “Calculator” on the company’s official website. Next you will need to enter the following information:

- the cost of the purchased residential premises;

- the size of the initial share contribution;

- desired duration of the installment plan;

- Is it planned to use maternity capital?

When you have finished entering the data, you just have to click on the box labeled “Calculate”.

How to join a cooperative?

- You submit an application, which is reviewed within a month;

- pay the entrance fee;

- a protocol is drawn up indicating the procedure for making voluntary contributions.

Recommended article: Selling an apartment with a military mortgage

Rules for registering apartment ownership

- The right is registered in the register;

- a document is submitted indicating that you have paid all fees;

- the list of documents to be submitted includes the charter;

- the final information is reflected in the protocol.

Personal account functionality

Using the remote maintenance service, the user will be able to perform the following actions:

- pay membership fees - to carry out the operation you will need to go to the section of your personal account called “Pay a membership fee”. After this, a window will load where you will need to enter the number of the payment plastic instrument and a contact telephone number. In the future, the user will be directed to the bank server to make the payment;

- make a share payment - the share contribution is made through a remote service point called “Pay the share contribution”. Subsequently, operations identical to the previous paragraph are performed;

- view your debt balance;

- get acquainted with archived financial transactions - it is necessary to take into account that when making payments for membership and share fees, they may not immediately appear in the history. This may take up to three business days;

- print payment receipts.

Important! In your personal account, you can print out a payment receipt for further payment at the cash desk of banking companies.

On the website you can study the latest news from the ZhNK company.

The following two tabs change content below.

- about the author

- The last notes

Nikita Averin

In 2021 he graduated from the Federal State Budgetary Educational Institution of Higher Education “Saratov State Technical University named after. Gagarina Yu.A.", Saratov, in the field of preparation "Informatics and Computer Science". Currently I am the administrator of the site kabinet-lichnyj.ru. (Author's page)

A short list of cons

- If you contribute 50%, you need to wait several years. This is stated in the contract. Having taken out a mortgage loan, you immediately move into a new apartment;

- late contributions are punishable by fines and the risk of exclusion from the structure;

- annual fees are not refunded if the housing cooperative is liquidated or you leave it yourself;

- continuing the point above... the cooperative may go bankrupt;

- contracts do not have state registration;

- if you leave the cooperative early, pay a penalty;

- the living space belongs to the housing cooperative until the last installment is paid off;

- defending rights in court is problematic.

We hope that in the article you found answers to all your questions about housing cooperatives in Russia. Are they an alternative to a mortgage or not?

Rate the author

(

1 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Maria Yurievna Sokhan

Date of publicationDecember 21, 2018February 25, 2019

What is a housing cooperative agreement

Expert opinion

Dmitry Nosikov

Lawyer. Specialization: family and housing law.

According to Art. 110 of the Housing Code of the Russian Federation, a housing or housing-construction cooperative (LC or HBC) is a voluntary association of citizens (shareholders) created to assist in the purchase of housing at their own expense, as well as the subsequent management of the house. It ensures the organization of work on the construction and further maintenance of an apartment building, the costs of which are paid from contributions from members of the cooperative. The latter may be a developer himself or only invest in construction, which will be carried out by another construction company.

The relationship between the association and its members (future apartment owners) is regulated by a separate document - a housing cooperative agreement (share accumulation). It contains basic information about the rights and obligations of the parties within the framework of investment construction and the conditions for the transfer of housing after its completion. After signing the document, all conditions for the sale of the apartment are considered agreed upon, and the legal relations of the parties acquire legal force.

The relationship between the cooperative and the shareholder is regulated not only by the agreement, but also by the charter. The latter may contain essential conditions for the operation of the cooperative that are not reflected in the agreement itself. By signing the latter, the shareholder automatically agrees with the provisions of the charter.

Differences from DDU

The difference between contracts for shared participation in construction (DDU) and housing cooperatives lies in the different sources of regulation of real estate purchase procedures for each of the documents. If in the first case many aspects of purchasing housing and protecting the rights of shareholders are established at the legislative level, then the resolution of controversial situations between shareholders and the cooperative when they arise is carried out on the basis of internal documents of the association.

| Criterion | Contract type | |

| Housing cooperative | DDU | |

| Legislative regulation | Section V of the RF Housing Code Charter of the organization and provisions of the agreement | Law No. 214-FZ “On participation in shared construction...” |

| Registration in Rosreestr | Only ownership is registered upon completion of all payments and completion of construction | Each copy of the DDU must be registered |

| Apartment price | The contract may include a clause stating that it is impossible to revise the price of the property. In the absence of such, there are no legislative restrictions on increasing the cost of objects if circumstances arise that prevent the completion of construction at the previously agreed amount (increase in the price of building materials, etc.). | The indicated amount is final and cannot be changed. Sometimes the developer may propose an additional agreement providing for an increase in price, which the shareholder has the right not to agree to. |

| Completion of construction | Responsibility for failure to comply with construction deadlines is not provided, unless otherwise specified in the document. | Clear deadlines, in case of violation of which the developer has an obligation to compensate shareholders for the costs incurred. |

| Payment procedure | Share contributions can be made at the construction stage and after the commissioning of the facility | The price of the object (including the possibility of installments) must be paid in full before the completion of construction |

| Protection of rights | The Law “On Protection of Consumer Rights” does not apply | Shareholders are considered consumers, and therefore have the right to defend their rights in accordance with the law “On the Protection of Consumer Rights”. |

Why did you choose ZhNK out of all the options?

In 2015, I inherited about 1.5 million rubles.

At that time, the daughter lived in rented apartments, and at the family council they decided to invest money in her housing. With this amount we could buy a small family on the outskirts of Kazan or a one-room apartment in the suburbs. Neither option suited us. We couldn’t get a mortgage because my husband and I are both freelancers, we work under civil law contracts (CLA) with different customers, and we don’t have a permanent job. My daughter just got a new job, so she couldn’t count on a mortgage either. We didn’t want to delay the purchase - in a year, due to inflation, this money would not be enough for even half of a one-room apartment - so we turned to a realtor. We agreed that he would monitor advertisements for sale, and if an inexpensive apartment appeared, he would immediately inform us. The realtor warned that the amount was small and finding a suitable option would be difficult. He suggested that we consider buying an apartment in installments through a housing and savings cooperative: there is no overpayment for interest and documents from work are not needed.