Inheritance by minors

Children can legally inherit any property, including debts and obligations. In inheritance matters, they have a special status, because even when drawing up a will, the testator does not have the right to ignore their interests. According to Article 1149 of the Civil Code of the Russian Federation, children are included in the category of “obligatory heirs”.

This means that minors, in any case, will inherit the property due to them, despite the will of the testator . The testator may not want to include them in the inheritance under the will, but nevertheless the heirs will have to take them into account. The main conditions for such inheritance are:

- children must be related to the testator, who can be their parent, guardian, or trustee.

- Minors, even if they are not biological children of the deceased, must be financially dependent on the testator, that is, they are his dependents. In this case, he acts as the main breadwinner.

Children of other relatives (nephews) who are not dependent on the testator and are not his children are not considered obligatory heirs.

Ways to refuse inheritance

The law protects the rights of minor heirs. Therefore, children and dependents necessarily receive a share in the inheritance, even if the testator has not protected their rights. Therefore, the child cannot refuse the inheritance by default.

Opt-out options

| No. | Option | A comment |

| Without specifying a specific beneficiary | That is, absolute. The statement is of a general nature. The heir confirms in writing his unwillingness to accept the property. The abandoned inheritance is redistributed among the remaining participants. Property is divided in equal shares. | |

| Refusal of inheritance in favor of another heir | The assignee may indicate in the application a specific entity to which he wants to transfer his part of the property. The only condition is that the applicant must be from among the legal successors called to inherit (Article 1158 of the Civil Code of the Russian Federation): • recipient of the inheritance line; • heir under a will. |

It is not permitted to transfer property to next-of-priority relatives or third parties. Also, the law does not provide for a targeted waiver of the obligatory share.

Features of the transfer of a mandatory share

If the testator makes a will for other persons, then the children, in accordance with Art. 1149 of the Civil Code of the Russian Federation, a mandatory share of inherited property is due. There are no exceptions here, since the law protects the interests of children, so the will of the testator does not play a role here. He may prohibit them from inheriting in his will, but such a decision will be considered invalid.

This means that minors receive their part of the inheritance under a will at the rate of at least ½ share of the property if they inherited by law in accordance with Article 1149 of the Civil Code of the Russian Federation. In other words, in order to calculate the obligatory share of the inheritance, you must first select all the heirs of the 1st stage, including the child, and calculate their share of the inheritance according to the law, but the “legal share” of a minor must simply be divided in half according to Article 1149 of the Civil Code of the Russian Federation.

IMPORTANT! If the testator ignored his minor children or other obligatory heirs in the will, then the document is declared invalid. The inherited shares will be distributed according to the rules of Article 1149 of the Civil Code of the Russian Federation, and the main heirs will receive much less property than they were owed according to the document.

Let's say testator N bequeathed an apartment to his mother (father died), but he has a young child from a previous marriage who inherits an obligatory share of the property.

The mother of the deceased and the child are heirs of the 1st stage. If there had been no will, then by law they would have received 1/2 of the apartment, but in reality the child receives 1/4 of the obligatory share, that is, exactly half of his 1/2 legal share. Read more about the inheritance queue here.

The testator's mother will receive 3/4 of the property. If the testator had two young children, then each of them would receive 1/6 of the apartment, and the mother would be left with 1/2 of the property according to the will. The more compulsory heirs, the smaller the share of the inheritance under the will.

As for inheritance without a will, minors receive their part in equal shares along with other heirs, so no difficulties should arise here.

The obligatory share of the inheritance is determined based on the total number of all legal, obligatory heirs and the size of the inheritance, taking into account bequeathed and untested property.

The court may individually reduce the share of the inheritance depending on the circumstances of the case and the specifics of the property. The legal heir must prove that the child has other real estate and has not previously lived in this apartment, so this will not violate his legal interests in any way.

Customer Reviews

Review by Irina D. I thank the Legal Agency of St. Petersburg for the warm, sincere welcome and the detailed, competent, thorough, conscientious legal position of lawyer Andrei Valerievich.

Review by Rychnikova G.V. I express my gratitude to your employee Andrey Valerievich Ermakov for providing me with legal assistance.

I also express my gratitude to Diana Sumarokova for her polite and tactful customer service and the very pleasant atmosphere in your office.

Gratitude from Tunnova L. Sergey Vyacheslavovich! Thank you for the qualified advice you provided regarding my question in the field of consumer protection (dispute with TC OPT, the kitchen was not delivered)

Lyubov Tunnova December 12, 2018

Letter of thanks

Gratitude from Bolotin V.S. I thank Alexander Viktorovich Pavlyuchenko for the work done as part of the investigation into the administrative case. I am especially grateful that almost all activities within the framework of the case were carried out by Alexander personally, without my involvement, which significantly saved my time. I would also like to note the efficiency with which the work was completed. I would like to wish Alexander further success in his professional activities and the successful completion of all current and subsequent cases, restoring justice to his clients.

Bolotin V.S., 02/12/2017

Gratitude from V.N. Skorokhodova Dear Alexander Viktorovich! Let me express my sincere gratitude to you for your understanding, sensitive approach to the situation, openness, emotions and professionalism. I wish you good luck, success in your work and prosperity.

Sincerely, Skorokhodova V.N.

Thanks to Pavlyuchenko A.V. from Sonets V.V. I express my deepest gratitude to Alexander Viktorovich Pavlyuchenko for the consultation and competent approach to the matter, as well as the successful outcome in my problem. I also want to express my gratitude for your kindness. I wish you success in this work that is necessary for us.

Sincerely, Sonets V.V. 05/17/2018

Gratitude from Marina Kuleshova I express my deep gratitude to Alexander Viktorovich Pavlyuchenko for his competent legal work and professionalism, as well as to his assistant Elena Vladimirovna for the qualified assistance provided. I wish you prosperity and achievement of professional heights.

Sincerely, Marina Kuleshova. 08/15/2018

Gratitude from Evgeniy N. I express my gratitude to Alexander Viktorovich Pavlyuchenko for the qualified management of my case, competent advice and informed decisions, which led to compensation for all claimed losses.

Sincerely, Evgeniy N., November 17, 2017

Review by Gavrichkova A.N. I would like to express my deepest gratitude to Yuri Vladimirovich Sukhovarov for his humane attitude towards my problem and detailed professional advice on solving it. I wish I could meet such people in my life more often.

Sincerely, Gavrichkov Alexander Nikolaevich.

Independent acceptance of property by children

Children cannot fully accept the inheritance on their own. Only legally capable persons can enter into inheritance relations, but minors have a completely different status. The legislator identifies several age categories of incapacitated persons:

- from 0-14 years (completely incapacitated);

- from 14-18 years old (limited capacity).

From 0 to 14 years of age, a child is completely incapacitated, and therefore cannot independently write an application to a notary. Parents/guardians as legal representatives are fully responsible for it, therefore they are entrusted with the task of accepting the inheritance in accordance with Art. 28 Civil Code of the Russian Federation.

From 14 to 18 years of age, a person is partially incapacitated and therefore has the right to independently accept an inheritance with the written consent of the parents in accordance with Article 26 of the Civil Code of the Russian Federation.

This means that he can personally write a statement to a notary in the presence of his parents, who sign the document and also express their consent to inheritance on a separate sheet. Children over 16 years of age may be considered fully capable if they:

- have their own earnings or income.

- They work under an employment contract.

- Doing business.

In this case, the court or guardianship authorities recognize the children as emancipated and therefore they can do everything on their own.

REFERENCE : When a minor enters into an inheritance relationship, the participation of guardianship and trusteeship authorities is not required; therefore, their final word is not required.

When does capacity begin?

When a minor citizen turns 14 years old, he becomes partially legally competent. This fact is confirmed by presenting him with the main identification document - a passport.

The fact of acquiring full legal capacity is recorded upon the citizen’s 18th birthday. But certain events can serve as a basis for recognizing a person as fully capable at an earlier age. Thus, this status is assigned to minors who have officially registered a marriage or got a job that allows them to ensure their existence and material well-being.

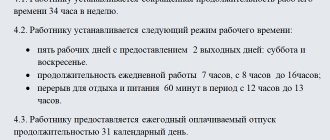

The procedure for a minor to inherit an inheritance

Many people are afraid of the question of how to do everything correctly so as not to deprive the child of the property they are owed. A similar principle of Art. 1152-1154 of the Civil Code of the Russian Federation, but with special conditions. A minor child can actually accept an inheritance in only one way, based on Art. 1153 of the Civil Code of the Russian Federation, that is, contact a notary and write an application. Depending on age, this can be done either by the legal representatives themselves, or by the teenager himself and his parents.

Where to contact?

To enter into an inheritance relationship, you must visit any notary office. It is advisable to do this at the address where the property is located or at the place of residence of the deceased testator. In the law, this is called the “place of opening of the inheritance.” Before applying, you need to collect all the documents justifying the right of inheritance.

The list of documents can be read on the official website of the notary office. Directly at the notary, parents/guardians or the teenager himself fills out an application.

Documentation

You cannot come to the notary empty-handed, as you must present documentary evidence of the right to inherit. Otherwise, the notary will not accept clients. If the heir is a child under 18 years of age, then the list of documents presented is similar to adults, with the exception of some nuances. If a minor appears in the case, the notary will require the following documents:

- death certificate of the testator (copy and original);

- passport, as well as the child’s birth certificate, where the testator is indicated as the father or mother;

- an extract from the house register, which contains all the information about all discharged and registered persons in the apartment;

- information confirming the relationship with the deceased;

- single housing document;

- an open will in which a minor citizen is indicated as an heir;

- passport of legal representatives;

- power of attorney for the child's representative (lawyer);

- other information.

The list of documents is not complete, since the inheritance situation of each applicant is individual.

Drawing up an application

To accept an inheritance from a notary, you must write an application. If the child is under 14 years old, then the document is entirely drawn up by the parents/guardians. For this, the will of one legal representative is sufficient.

If the heir is a teenager (from 14 to 18 years old), then he draws up and signs the application independently in the presence of his parents/guardians, who provide their details (full name, passport details, address) as legal representatives. On a separate sheet they write their consent to the fact that the minor child will accept the inheritance.

A signature must be affixed at the end of the application. The notary, as a rule, gives the legal representatives a ready-made form where they need to enter all the necessary information.

This makes the situation quite easy, since you don’t need to create anything on your own. The document must indicate the following details:

- Full name of the testator.

- Full name, passport details, address of parent/guardian

- Full name, passport details of the minor heir.

- Grounds for receiving an inheritance (will, law, family relationship).

- Date and signature of legal representatives and heir.

In our materials you will learn about such heirs: by right of representation, unworthy, disabled, commorients. It also talks about what to do if the heir has not entered into the inheritance within 6 months and about who the heir of the deceased heir is.

What is considered an inheritance?

In jurisprudence, this concept appears as an inheritance mass. At the same time, the concept of tangible property extends to movable and immovable property:

- bank deposits;

- card cash savings;

- securities, shares;

- units of motor transport;

- apartments (private houses), land plots

- furniture (office equipment, household appliances).

Intellectual rights to works of art (including fine art) of a specific author are recognized as intangible property. This category includes rights to video and audio materials, objects of literary creativity.

Is a power of attorney needed on behalf of a child?

Representatives of the child can be not only parents/guardians, but also outsiders, including lawyers in accordance with Article 1, Article 1153 of the Civil Code of the Russian Federation. The power of attorney must indicate the powers of the representative, which include:

- right to submit documents;

- the right to draw up an application;

- government payment duties;

- right to sign;

- obtaining a certificate.

In this case, the power of attorney must be drawn up in writing and notarized. The document itself is drawn up by parents or a teenager (from 14 to 18 years old), but only within the limits of their rights.

A minor must be present when submitting documents to a notary, but if this is not possible, then his signature on the power of attorney must be notarized.

general information

It may seem that giving up property is not a reasonable action. But in practice, such situations are encountered quite often. Most of the refusals are related to minors.

We can inherit not only the property itself, but also debts and obligations, due to which the transaction ceases to be truly profitable. Adults are still capable of putting things in order under such circumstances. But you shouldn’t transfer obligations to minors. This is why the opportunity to refuse is provided.

State duty and other financial expenses

According to clause 5 of Article 333.38 of the Tax Code of the Russian Federation, minor heirs do not pay the state fee when contacting a notary regarding acceptance of an inheritance. The main condition: they must not be older than 18 years at the time of the death of the testator.

Other financial expenses occur if parents want to use the help of a professional representative. In various notary offices it is also possible to receive legal and technical assistance (production of documents), for which a fee is charged according to tariffs established individually in each notary firm.

Situations are different, so clients often need advice. It is quite possible to avoid unnecessary expenses if the case is simple or the applicants know the legislation in detail.

Rubric “Question/Answer”

Can a child refuse his father’s inheritance not after his death, but while he is alive?

Expert opinion

Semyon Frolov

Lawyer. 7 years of experience. Specialization: family, inheritance, housing law.

Refusal of inheritance is formalized only after its opening. The time of opening of the inheritance is considered to be the day of death of the citizen - by virtue of clause 1 of Art. 1114 of the Civil Code of the Russian Federation. The notary opens the case only upon the fact of such an event. Starting from the next day, the heirs can declare their rights to the property or refuse to enter into the inheritance. As long as the father is alive and well, there is no need to write a renunciation of the inheritance. The notary simply will not accept it. All legally significant actions occur after the death of the owner (see “Time and place of opening of inheritance”).

We arrange an inheritance for a minor child. Can he formalize part of the inheritance (apartment) and refuse the debts of the deceased?

Expert opinion

Dmitry Nosikov

Lawyer. Specialization: family and housing law.

No, you can't do that. The law directly states that the heirs cannot refuse part of the inheritance and accept the second part (clause 3 of Article 1158 of the Civil Code of the Russian Federation). An exception would be inheritance for various reasons . For example, if a will is left in favor of a child and at the same time he enters into an inheritance by law. This also includes hereditary transmission - when an inheritance is drawn up in place of a deceased heir. Only in such cases can one choose: what to inherit and what to refuse? For example, you can waive debts by law, but inherit an apartment under the terms of a will (and vice versa). Or give up everything at once.

However, parents still need to notify the guardianship authorities. The PLO must issue permission to renounce inheritance - with this permission you can contact a notary.

The minor actually took over the property of his deceased father and did not have time to formalize the refusal. Is it possible to refuse an inheritance after accepting it?

Expert opinion

Semyon Frolov

Lawyer. 7 years of experience. Specialization: family, inheritance, housing law.

Yes, there is a procedure for restoring the deadline for refusing an inheritance. I note that serious arguments are needed here. Something like “I didn’t have time” or “I was late”, “I didn’t know, so I missed it” will not work. But you can refer to real circumstances that prevented you from abandoning the inheritance in time. For example, if health problems arise : surgery, rehabilitation, mental disorders. Or physical absence : work trip, military service, difficulties with entry into Russia. The basis “we went on vacation with the whole family” will also not work. Just as you can’t refer to “headaches.”

If there are good reasons, you should file a lawsuit to restore the missed deadline. Indicate the reasons for the absence and support them with evidence (certificates, air and train tickets, medical reports, checks, receipts). The court will examine the circumstances and make a decision. Fortunately, there is positive judicial practice in such cases. If the decision is in favor of the plaintiff, he will only have to pick up the writ of execution and take it to the notary. After this, the notary will allow you to write a waiver of the inheritance and register it in the Unified Information System. Do not forget about permission from the guardianship authorities (see “Refusal of inheritance after its acceptance”).

Can a child refuse an obligatory share in the inheritance in favor of someone else, and do the guardianship authorities give permission?

Expert opinion

Dmitry Nosikov

Lawyer. Specialization: family and housing law.

Theoretically, refusal of the obligatory share is not prohibited by law. However, in this case it cannot be refused in favor of another heir. Everything is connected with the nature of the “obligatory share” - this is the property right of needy and low-income citizens (pensioners, children, dependents). This right cannot be given to someone else. Therefore, the waiver of the obligatory share is always unconditional . Not for anyone’s benefit, but an absolute refusal (Article 1158 of the Civil Code of the Russian Federation)

There is little chance that the guardianship authorities will allow such a refusal. Especially if the inheritance includes real estate (house, apartment, dacha). No one will deprive a child of valuable assets. And the obligatory share is, first of all, an opportunity to obtain profitable property. Here you need to look at the situation. But off the top of my head, most likely, the AOiP will not allow the child’s parents to renounce their obligatory share in the inheritance. They may approve if the inheritance consists of 70% of debts, there is a small share in it, or the child already has a high financial position (for example, his own apartment).

An inheritance involving children is difficult in itself.

And if minors write a refusal of inheritance, the situation is doubly difficult. Here you need to understand what is included in the property, is there any value in it, who else will inherit the assets, is there a will or a mandatory share? Very often relatives want to distribute the inheritance. This is why a refusal on the part of the child is needed. You need to know how to obtain permission from the guardianship authorities. Without their consent, the refusal will not be accepted. If you are at a dead end and don’t know where to start, seek legal advice. To avoid visiting lawyers’ offices, you can leave a request directly on our website. Legal consultants will study your issue, give recommendations and suggest the best solution to the problem. Attention!

- Due to frequent changes in legislation, information sometimes becomes outdated faster than we can update it on the website.

- All cases are very individual and depend on many factors. Basic information does not guarantee a solution to your specific problems.

That's why FREE expert consultants work for you around the clock!

- via the form (below), or via online chat

- Call the hotline:

- Moscow and the Region

- St. Petersburg and region

- FREE for a lawyer!

By submitting data you agree to the Consent to PD Processing, PD Processing Policy and User Agreement.

Anonymously

Information about you will not be disclosed

Fast

Fill out the form and a lawyer will contact you within 5 minutes

Tell your friends

Rate ( 3 ratings, average: 4.00 out of 5)

Author of the article

Irina Garmash

Family law consultant.

Author's rating

Articles written

612

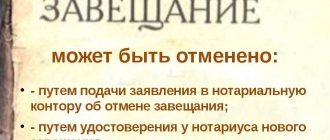

Voluntary refusal

Theoretically, a child can refuse an inheritance, but for this it is necessary to obtain permission from the guardianship and trusteeship authorities in accordance with Part 4 of Article 1157 of the Civil Code of the Russian Federation. Emancipated teenagers can freely refuse their inheritance, but all other children do not have this opportunity. The notary will not consider such applications without prior permission from special authorities.

REFERENCE: You should not confuse missing deadlines for accepting an inheritance with a real refusal of it, since these legal phenomena are not equivalent. The child becomes the owner of the obligatory share of property from the moment of the death of the testator.

Reasons

In order to refuse an inheritance, you must first contact the territorial guardianship and trusteeship authority. Employees of the institution must be convinced that the inherited property violates the interests of the child. As a rule, such grounds include cases of inheritance:

- Property responsibilities.

- Contractual or credit obligations.

- Collateral property.

- Huge debt to pay for utilities.

- Liabilities under promissory notes.

- Damaged property (apartment, house in disrepair).

The grounds for refusal may also include the presence of a minor child of similar property or the actual impossibility of living in the inherited apartment. In other words, the reasons for the refusal must be carefully argued so that such an inheritance is unprofitable for the child in a legal and factual sense.

How does this happen?

First, you need to contact the guardianship and trusteeship authorities with an application, which is submitted by the legal representative or the child, if he is 14 years old. The document must contain a request for permission to refuse inheritance. If the young heir is 10 years old (Article 57 of the RF IC), then he and his parent/guardian also write a statement expressing his consent to the refusal.

In addition, parents/guardians must provide a package of documents that is similar to when submitting an application to a notary. The guardianship authorities consider everything and make a decision within 15 days in accordance with Article 21 of Federal Law No. 48. They may refuse or allow the applicant to refuse the inheritance.

If permission is granted, the child and parents must contact a notary and write a corresponding application. If the guardianship and trusteeship authorities refuse the request, then the child can only enter into inheritance relations.

In conclusion, it must be said that inheritance of property by a minor is fraught with many nuances, although it is subject to the general rules of law. The testator's minor child is a compulsory heir, so he cannot be left without property.

In such cases, the exact age of the child, as well as all the circumstances of the case, are very important. It is necessary to take into account the number of all heirs, as well as the specifics of the inherited property, in order to know for sure how to act and not make mistakes.

Benefits of professional legal assistance

A timely contact with a competent lawyer will help you avoid surprises and exercise your right to inherit or refuse it. We will study the situation and the documents provided, familiarize ourselves with the will, propose the optimal strategy of behavior and protect the client’s rights when interacting with notarial or judicial authorities. A high percentage of successfully resolved disputes, rich experience, deep knowledge of current legal norms, narrow specialization of lawyers - all this allows you to count on success even in the most complicated situation.

15 years of experience in the legal services market

Legal Agency of St. Petersburg was founded in 2004 and has been successfully operating for 15 years

30 experienced specialists

Our team consists of competent lawyers and attorneys with narrow specialization in certain areas of law

10 years minimum legal experience

All consultations are conducted by lawyers with experience in successfully resolving similar situations, which ensures maximum assistance to the client.

91% of cases won

The results speak for themselves - since 2004, 3,756 cases have been won, 5,073 clients have been satisfied, and 874,474,045 have been paid to them

72% of appealed court decisions

We take on cases of any complexity and at any stage of the process, but the sooner you contact a specialist, the more likely a positive outcome of the case is

24 hours on call

We are ready to handle your case from start to finish, accompanying and supporting you throughout the entire process.