Litigation on inheritance issues is one of the most popular types of property proceedings...

But if the property owner makes a will in advance, they can be avoided.

From September 1, 2021, a law will be in force in Russia, thanks to which the opportunities for citizens to bequeath their property in the event of death will expand. The law will introduce a new concept for Russian legislation – an inheritance fund.

The real estate portal superrielt.ru found out what features will need to be taken into account when drawing up this document and when inheriting property.

What property can be bequeathed?

A person has the right to bequeath any property: jewelry, housing, money, cars, etc. In this case, the heirs receive property rights and obligations: for example, they will have to pay a mortgage loan if the testator purchased the inherited property with a mortgage that he did not have time to repay.

Often in wills you can find the wording “all property that turns out to belong to me.” It prevents the testator from drawing up a new document each time during his lifetime if the composition of the property changes - say, he bought another apartment.

The same object of ownership (for example, housing) can be transferred to several heirs, and the testator can determine the shares of each of them in the document. If none are specified, the heirs receive equal shares of the property.

Who can receive property under a will?

A Russian has the right to bequeath his property to any persons: friends, relatives, other citizens of the Russian Federation, foreigners, legal entities, and the state. He also has the right to disinherit his legal heirs without explanation. But if the testator has children under 18 years of age, disabled children (spouse, dependents or parents), they will be able to receive a share in the inheritance, even if they are not specified in the will.

In addition, a “spare” heir can be written into the will - he will be able to claim the inheritance if one of the “main” heirs dies or refuses to accept the inheritance.

According to the new law, which will come into force on September 1, the testator can order in his will the creation of an inheritance fund, which will act as one of the heirs along with the persons or legal heirs specified in the document.

If the will does not indicate the obligatory heirs, their full circle will be established after the opening of the inheritance and the recalculation of the shares by the notary.

Legislation on inheritance by will

The procedure for drawing up a will, the terms and procedure of inheritance are regulated by the Civil Code of the Russian Federation (Part 3): there is no special legislation in this area. In addition, certain provisions regarding inheritance are also contained in the Family and Tax Codes, as well as in the Federal Law “On Notaries”.

Thus, the legislation clearly defines the moment the will comes into force, as well as the period of time during which all actions required by law must be performed.

To whom will the property be transferred if its owner did not leave a will?

There are two types of inheritance: by will and by law. The first involves the transfer of property according to the will of the deceased owner. If a person has not made a will during his lifetime, inheritance occurs according to law. At the same time, there is a sequence of inheritance of property by relatives. A total of eight inheritance queues are defined.

First priority heirs include the spouses, parents and children (or grandchildren if the children are deceased) of the testator. If there are no such heirs, the property is divided between the second-order heirs - these are the testator's sisters and brothers with whom he shares one or both parents, as well as nieces and nephews. Third-degree heirs include aunts, uncles, and cousins and brothers of the testator. The heirs of the fourth to sixth lines are more distant relatives of the deceased: great-grandparents, great-great-grandchildren and great-grandsons, great-aunts and grandfathers, great-aunts and grandsons, great-aunts and uncles, first-cousin nephews and nieces. If there are no heirs listed above, the heirs of the seventh order can claim the property of the deceased - these are the stepdaughters, stepsons, stepmother and stepfather of the testator. The state is the heir of the eighth stage. The property becomes his property if there are no other heirs.

What is a legacy fund?

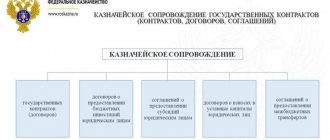

This is a legal entity whose main functions are the management of the testator’s property: business, money and other assets. The fund is created only if the deceased expressed such a desire (this is indicated in the will), and only after the death of the person. Thanks to the fund, it is possible to preserve the property of the testator and dispose of it in accordance with the expressed will of the person.

That is, all the bequeathed property of the testator after his death is retained in the foundation. The charter and conditions for managing the fund are prescribed in the will: the size, procedure, methods and terms for the formation of property, the procedure for disposing of existing property and income, and the persons who have the right to manage them. Part of the property accumulated in the fund or from the income from this property can be given to a circle of persons specified in the will - relatives of the deceased, citizens who are not heirs, or organizations.

First of all, the possibility of opening such a fund is relevant for wealthy citizens, business owners who have many assets. But there is no property qualification. For example, if a person has several apartments that he rents out or resells, receiving income from this, he can establish a fund that will continue this activity after his death, and the proceeds will be transferred to the persons specified in the will.

In what cases can you do without a notary?

After drawing up a will, the notary checks its text, prints the document on a special form, and then certifies it. There are also closed wills, the contents of which the notary does not see - he only receives a sealed envelope in front of two witnesses. In some situations, when drawing up a will, you can do without notarization - if a person does not have the opportunity to contact a notary, or if special circumstances arise that pose a threat to his life. Then the will is drawn up in writing and signed by the testator in the presence of two witnesses.

Will. Basic provisions

Expert opinion

Semyon Frolov

Lawyer. 7 years of experience. Specialization: family, inheritance, housing law.

The basic principles of drawing up a will are freedom of expression and maintaining the secrecy of the testamentary disposition . The essence of the first principle is that the owner of property has the right to transfer it to any individuals or legal entities in any shares, on any terms (except those contrary to law). The essence of the second principle is that he is not obliged to inform the heirs about the preparation of a testamentary disposition, nor to disclose its contents.

When drawing up a will, the following features must be taken into account:

- The circle of heirs is determined by the testator himself. He can transfer inherited property to any persons, he can deprive legal heirs without specifying reasons (freedom of expression will be limited only by the provisions of the law on compulsory share - according to Article 1149 of the Civil Code of the Russian Federation);

- If the testator's disposition concerns not all of his property, but only a part, the rest will be distributed among the legal heirs in order of priority;

- A will may contain orders relating not only to existing property, but also to property that will be acquired in the future;

- In addition to the main heirs, the testator has the right to nominate additional heirs if there is reason to assume that the main heirs will die earlier, be removed or refuse to inherit;

- The testator has the right to establish testamentary refusals - to set any conditions that do not contradict the law, upon fulfillment of which the heir can become the owner of the property.

- The testator can cancel the will at any time, make changes or additions to it - without specifying the reasons or notifying interested parties.

A will must be drawn up in writing, signed personally by the testator and certified by a notary . Any deviations from this rule must comply with the provisions of the law (on drawing up a will in special circumstances, on signing the document by other persons, on certification by other officials instead of a notary), otherwise it will not have legal force (see “How to correctly draw up a will for inheritance").

You can enter into inheritance after 6 months

To accept an inheritance, six months are allotted from the date of the death of the testator or his declaration of death. To enter into inheritance rights, you must contact a notary with an application to open an inheritance case. This is done in the area where the testator was registered and where his death certificate was received.

If at the time of the testator’s death the heir lived with him in the same apartment and was registered there, he has the right to open an inheritance case at any time. In fact, it is considered that he accepted the inheritance, and he does not fall within the 6-month period.

Procedure for entering into inheritance

The inheritance procedure involves a certain sequence of actions. You must contact the notary who certified the document. When drawing up a document, one copy is kept by the testator, the second is kept by the notary until the heirs apply. If there are applicants for the allocation of a mandatory share in the inheritance, the interests of this category of citizens must be taken into account. If this value is not taken into account, distribution occurs regardless of the presence of a will.

We recommend reading: Land share as an inheritance

It will be possible to receive a certificate of right six months from the date of opening of the inheritance.

To exercise your rights to inheritance, you must contact the specialist who certified the document. After the death of the testator, the original document must be found from the deceased. If the paper could not be found, you should find out the address of the office that certified the document.

An application for a desire to receive an inheritance is submitted to the notary's office. The document is submitted in person, through a representative, or by mail. A document sent by mail must be notarized and delivered with notification. The representative must have a power of attorney.

Along with the application, you must provide a package of documents:

- Passport;

- A document confirming the death of the testator;

- Certificate from your last place of residence;

- Will;

- Property papers.

If there are no obstacles, six months from the opening of the inheritance, a certificate of property will be issued. Upon receipt, you must pay a state fee, depending on the degree of relationship, the value of the property, and the availability of benefits.

After receiving the certificates, it is necessary to complete the registration through government agencies. The vehicle must be registered with the traffic police within ten days. The apartment is registered through Rosreestr. The registration period for real estate is seventy-five years from the date of receipt of the certificate. Without registration, the new owner will not be able to sell, formalize a deed of gift, or transfer by inheritance.

If the owner decides to sell the inherited property before the five-year period, he will have to pay tax. The amount of the contribution will depend on the cost of the property and the availability of benefits.

Unified information system of notaries

The will may be kept by the testator or by a notary. After the will is certified, information about it is entered into the electronic register of the Unified Notary Information System, which also contains data in the event of replacement or cancellation of the document. The system is open to all notaries in Russia. Thus, if the heirs do not know the place of storage of the will drawn up by a relative, in any notary office in the country they can be provided with information about the notary who certified the document.

It is imperative to find a will, since it may happen that the heirs of the first priority will inherit according to the law, and if other heirs later appear who have a will, all transactions with the inherited property will be contested.

What documents do heirs need to inherit?

When contacting a notary, the heir must take with him documents: the original or duplicate of the death certificate, a certificate of persons who lived with the testator at the time of his death, documentary evidence of family ties (marriage or birth certificate). If the chain of documents confirming family relationships is long, it is necessary to show everything - with marriage and birth certificates of all relatives who are between the heir and the testator.

Effective time

The will comes into force simultaneously with the opening of the inheritance, that is, from the date of death of the testator. From this moment, the appointed successors have the opportunity to accept the property, rights and obligations determined for them by the testator during his lifetime.

The date of opening of the inheritance is confirmed by the date indicated in the medical report and subsequently in the death certificate. If there is no such information (the body of the testator was not found), the day of his death is established by the court. This happens when:

- the testator did not appear at his place of residence and his family members did not hear anything about him for five years;

- six months have passed since he disappeared under life-threatening circumstances;

- the serviceman did not return to his place of residence and did not make himself known in any way from the day he disappeared and after two years had passed from the end of hostilities.

It is important for heirs to remember that the validity period of a document is limited to six months from the date of death of its originator. After this period, the inheritance is considered not accepted and the rights to it are transferred to the designated successors, distributed among those who have already registered the property of the deceased or those who in this case acquire the possibility of inheritance by law.

The period can be extended only if the omission was made for valid reasons, and the “unpunctual” citizen will be able to prove this to the court. Or rely on the goodwill of the remaining heirs, who, after registering their rights, will give unanimous permission to include the late successor in their circle.