According to what legal principles does inheritance occur abroad?

In the case of receiving an inheritance abroad, various legal norms may apply to the inheritance matter:

- The personal law of the heir or the law of the country in which he permanently lives . For an heir from Russia, the process is regulated on the basis of the Civil Code.

- The law of the location of the testator's property . This situation may arise if the testator was not only abroad, but also owned property outside his country of residence. For example, real estate.

- The law of the place of death of the deceased testator . Most often it applies to cases where the testator’s property is located in the territory of the country where he lived and died.

In situations where an inheritance case is opened for objects of movable property, the person responsible for carrying out the procedure for transferring inheritance follows personal law. In most European countries, property is transferred to heirs according to similar patterns of action. However, local nuances should be taken into account so as not to encounter obstacles when opening a inheritance case abroad.

Wills and inheritance by law. What does the procedure for distributing inheritance abroad look like?

In the vast majority of countries, the procedure for obtaining an inheritance depends on the presence of a will. If it exists, then the property will be distributed according to the principle specified in it. In this case, the will itself must be drawn up according to the law, and the testator must be fully capable when writing it. Otherwise, the will may be contested and revoked. It is worth noting that inheritance under a will almost always has the same form regardless of the country, and the will itself is a kind of “international” document. Thus, a will drawn up and certified in England will be valid in France or Germany. However, this rule is not universal, so be careful.

Transferring inheritance by law is a completely different matter. The fact is that each country, although subject to the general inheritance algorithm, always contributes something of its own . This may apply to both the entire procedure as a whole and its individual details. Let's look at some of the issues where differences are most common.

How to find out about inheritance abroad?

The easiest way to find out whether a person has an inheritance abroad is to maintain stable contact with foreign relatives. If the relationship is good, you can hope that a will will be drawn up that includes the name of the heir. But this does not always happen, and therefore there is a greater chance of getting a share when dividing the inheritance according to the law.

If contact is maintained with relatives, they can independently notify the heir of the death of the testator. If information about a foreign heir is indicated in the will, the duties of the notary opening the inheritance case will include searching for all the heirs specified in the will . These actions of a lawyer are provided for in many countries around the world.

Inheritance abroad, how to get it?

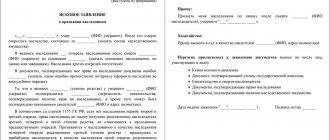

If the heir has received a letter about an inheritance from abroad, he will need to draw up an application at the notary office at the testator’s last place of residence.

Typically, heirs must independently appear before a notary to declare their rights to the inherited property. At the same time, most states provide the opportunity to defend the interests of a foreign heir to another person if they have a notarized power of attorney for a lawyer. If the heir himself cannot visit the notary's office, he will need to provide documentary evidence for this. To enter into the right of inheritance abroad, you need to know what documents may be needed:

- Death certificate of the testator.

- The heir's identification document is a passport.

- Certificate of right to inheritance.

- Documents confirming the fact of relationship of the heir with the deceased.

This is the most necessary list of papers that will need to be provided. But depending on the situation, other documents may be required. An example would be inheriting a bank deposit. Before obtaining rights to it, you must provide:

- documents confirming the ownership of the deposit;

- notarial or administrative acts, etc.

At the same time, it is advisable to find out exactly how to register an inheritance abroad in accordance with the legal norms of the country where the inheritance case is opened. Also, if a foreign account is transferred as an inheritance, the heir is not required to notify the tax authorities about this, since this obligation is not specified in regulatory documents.

Features of receiving an inheritance from abroad

The complexity of such a legal procedure as receiving an inheritance from abroad creates the need to find an experienced lawyer. It will be extremely difficult to resolve all issues on your own, without knowing the language and especially the laws of the country. It will be somewhat easier to obtain an inheritance in those countries with which Russia has entered into an agreement on the provision of legal assistance (Greece, Poland, Mexico, China and others). In addition, legalization requirements apply to documents related to receiving an inheritance.

Another important nuance is paying taxes. In some countries, tax rates depend on the value of property received by heirs. In others, the amount of tax is affected by the amount of income of the heir. There are states in which various tax discounts are applied to the testator's immediate relatives. You should be prepared for the fact that you will have to pay taxes both in the country where the property is located and in Russia. The exception is states that have an agreement with our country to avoid double taxation.

Inheritance from abroad: tips

So, to receive an inheritance abroad, you need:

- collect a package of documents confirming inheritance rights;

- submit an application for the right of inheritance to the notary's office;

- receive a special document on the right of inheritance abroad (with an apostille - confirmation of the authenticity of signatures and seals);

- carry out the required actions related to the inheritance procedure in accordance with the laws of a particular country. If you cannot attend in person, the presence of a representative is allowed, but you must provide documents confirming the impossibility of personal presence;

- after receiving the inheritance, pay the necessary taxes.

It should be noted that there is no point in delaying the registration of a foreign inheritance, since after a certain period of time (different in each country), the property passes to the benefit of the state. In addition, the inheritance may be received by other relatives, without taking into account your interests. Finally, property left unattended for a long time may simply be looted.

And one more thing: if you have the slightest suspicion that you have relatives abroad, it is better to take measures in advance to find them, especially since many structures provide this service free of charge.

How to receive an inheritance abroad and in what time frame

In almost all countries, regardless of whether there is an inheritance abroad or a person enters into inheritance rights in his home country, the distribution of inherited property occurs either according to the will of the testator or by law, if there is no testamentary document left .

If the testator left a will, this greatly simplifies the work, since the property of the deceased is distributed in accordance with the last will of the testator. The document also usually contains information about the heirs under the will. In the event that there are no specific orders of the deceased regarding the distribution of property between the heirs, it is divided equally among all the heirs indicated in the document.

When the testator does not leave a will, the entire inheritance is divided according to the law, and in this case the degree of relationship of the heirs with the deceased is decisive. Depending on the country, the order of inheritance for different categories of relatives may vary. But in most countries the first stage includes:

- children;

- parents;

- brothers and sisters;

- Grandmothers and grandfathers.

Many people have a question: if the inheritance is abroad, how to receive it on time and not miss the deadline for entering into inheritance rights? In Russia, this period is six months from the moment of death of the testator in case of inheritance by law or from the moment of proclamation of the will, if there is one. In other countries, the period for accepting an inheritance varies from 3 to 6 months, and in some countries even more . Residents of Latvia can contact a notary within a year, and in Bulgaria, an inheritance case can be opened after six months established by law.

Refusal of inheritance

If inheriting the property of a relative abroad for some reason is not included in the plans of the heir, he may refuse this opportunity, as well as according to the laws of his country. When drawing up a waiver of inheritance, a number of features should be taken into account:

- The refusal must be carried out before the inheritance is entered into . If the heir has valid reasons, the period of entry into inheritance rights can be extended.

- The refusal should be addressed to the notary opening the inheritance . If you are unable to complete the paperwork yourself, you can use the services of an official representative. But to do this, you must draw up a power of attorney, which will stipulate the ability of the representative to formalize the refusal on behalf of the heir.

- Cancellation of a refusal is not possible . You can't take it back either. The refusal occurs in favor of the heirs by will or heirs by law, with the exception of those who were indicated in the will as deprived of the right to inherit.

Ways to receive an inheritance

Legislation, queues for inheritance and registration of property - all these difficulties pale in comparison with the most important problem - how to get your inheritance? The process is extremely complicated not only because you will need to know the laws, but you will also need to cross the border and spend some time in another state. And it is impossible to determine this period in advance, since it can be a week or a whole year. In this regard, there are three ways to receive an inheritance.

- Independently on several trips. If you have the opportunity, you can travel between countries, if necessary sending the necessary documents by email or fax. However, such travel becomes problematic if the country in which the inheritance is issued has a visa regime with the Russian Federation. In this case, you can apply for a multiple-entry visa after your first visit to the country, or contact the embassy with a special request. At the same time, no one is stopping you from constantly re-applying for a visa, but this is labor-intensive and impractical;

- On your own, settling in the country. If you have a lot of free time, you can work remotely, or there is nothing particularly keeping you in the Russian Federation, then a very convenient option would be to move to another state while receiving an inheritance. To do this, you will need to prepare papers that will allow you to stay abroad longer than the validity of your visa. Their type and quantity depend on foreign legislation;

- With the help of a lawyer. Few people want to endure long flights, studying foreign legislation and other difficulties associated with receiving an inheritance. In this regard, the services of inheritance lawyers, both Russian and foreign, are very popular. In order for a specialist to represent your interests, he should be given a general power of attorney. However, to receive the inheritance itself, you will still have to visit a foreign country once. Be careful and do not give power of attorney to just anyone . It is a good idea to have your trustee's work checked by a notary.

Share:

Inheritance tax

As for Russia, heirs are not required to pay a special tax on property and funds received as a result of inheritance. But if the inheritance occurs in another country, you may be required to pay inheritance tax according to the laws of the place where the inheritance was opened. To relieve the heirs from paying tax, the testator can transfer property to them using a gift agreement . But here it is also necessary to carefully study the legislation, since in some countries the gift tax exceeds the inheritance tax.

Is it possible to refuse

Refusal of inheritance received in other countries is also possible. Worth considering:

- refusal is possible only until the moment of inheritance. If the deadline has been missed, then the refusal can only be carried out in court;

- the refusal is made at the place of its opening, by submitting an appropriate application to a notary. It is allowed to send it by mail;

- Cancellation of a refusal is not provided if it was not made under the influence of deception, threats, delusion, etc.;

- refusal is possible both without reservations and in favor of other heirs.

Scammers

In matters of inheritance, extreme caution should be exercised, especially if the news was received by unknown persons, and not through official means of notification. For example, many scammers can simply come to your home and introduce themselves as lawyers dealing with the issue of obtaining a foreign inheritance. They also offer their services in registering this inheritance and require a monetary reward in advance for the work.

The main difference between lawyers and scammers is the lack of time, especially for a personal visit to each presumptive heir. Therefore, the heirs are notified either by telephone or by mail with notification in the established form.

Since registering an inheritance abroad can bring with it some difficulties, it is better to consult with an experienced lawyer on procedural issues.