Legal holidays: what to consider for the employer

Every working citizen has the right to a weekly rest - a period of time established by the internal rules of the enterprise when one can legally not attend the place of work and not perform work duties. The mechanism for determining the number of days off is prescribed in the Labor Code:

It happens that production and technical conditions do not allow the entire workforce to suspend work at an enterprise on weekends. In this case, the Labor Code of the Russian Federation allows for a different regime of weekly rest: each group of workers, in accordance with the internal labor regulations (internal labor regulations), rests alternately on different days of the week.

ConsultantPlus experts spoke about the nuances of wages on weekends for salaried employees. Study the material, get trial access to the K+ system and go to the Ready-made solution. It's free.

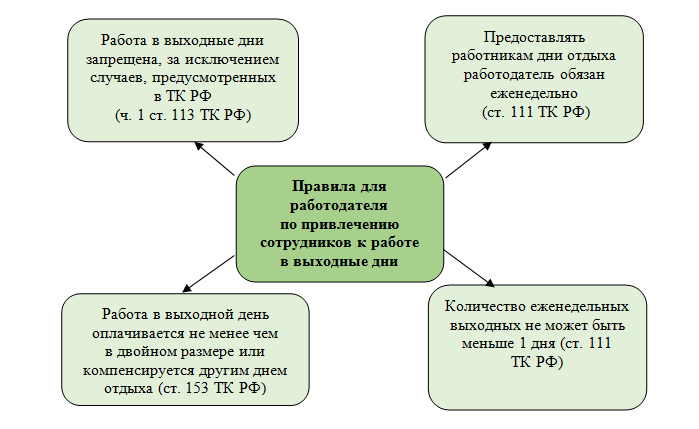

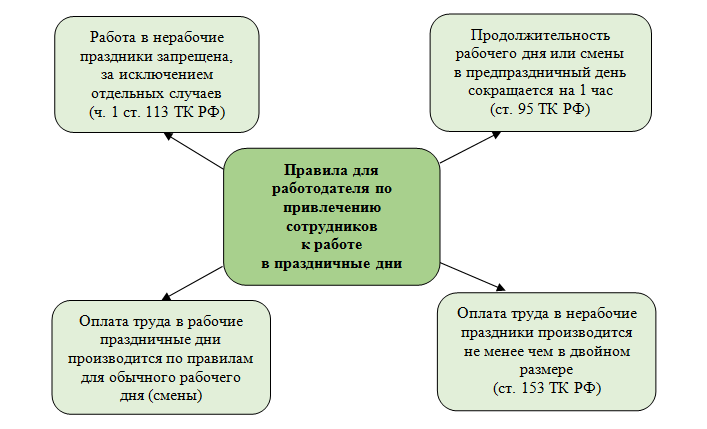

When planning work and rest time, the employer should follow the four main rules of the Labor Code of the Russian Federation on weekends:

We will talk further about who can and cannot be called to work on a day off, as well as who has the right to refuse to work on their legal day of rest.

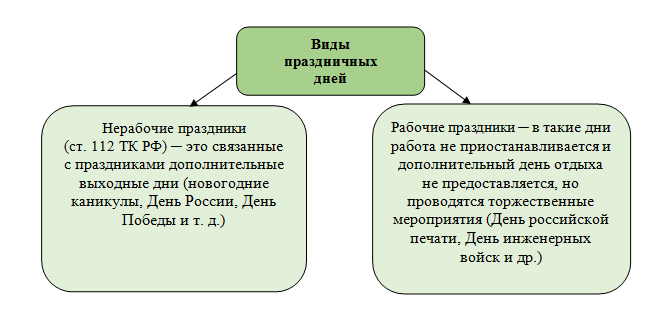

Non-working and working holidays: how to pay

We perceive a holiday primarily as additional time for relaxation. However, not every holiday allows you to legally not go to work:

Non-working days and holidays have already been approved for 2021. See our 2021 production calendar in this post.

Payment for working holidays is made in the usual manner (as an ordinary working day). Pay on non-working holidays has some nuances:

- for salaried employees, the presence of non-working holidays in a calendar month is not grounds for a salary reduction;

- Shift employees for working according to a schedule on a non-working holiday are entitled to additional remuneration, the amount and procedure for payment of which are established by internal local regulations of the enterprise.

Thus, the legislation also establishes specific rules for holidays:

The mechanism of remuneration on holidays is mainly influenced by the operating mode of the enterprise. For example, no “holiday” additional payments will be required if all employees are paid based on salary, there are no shift workers and there is no need to be called to work during holidays.

The employer should also not forget that he cannot always invite the entire workforce to work on a holiday or day off - there are restrictions and prohibitions in this matter established by labor legislation.

We explain how sick leave and vacations that fall on holidays are paid in the following materials:

- “How to calculate vacation if it falls on holidays”;

- “How sick leave is paid on holidays.”

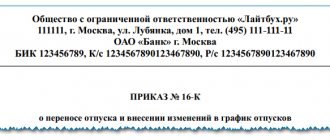

Registration of extracurricular work

The administration must warn the specialist of the intention to call him on the day of rest. The Labor Code did not resolve this issue. Therefore, the employer, at his own discretion, chooses the method of informing - possibly even oral notification.

However, in practice, written notice is often used. The procedure for using this form requires the following to be indicated in the document:

- the exact date of recruitment;

- period of work by time;

- reasons for unscheduled work;

- compensation options.

Expert opinion

Davydov Alexander Yurievich

Civil law consultant with 20 years of practice. Author of numerous articles on legal topics

The employee signs his consent. At the same time, the preferred form of compensation can be expressed. Now the company issues a corresponding order.

What an employee should check The order is an internal regulatory act with certain legal consequences. As soon as the subject puts a mark in the order about his notification with the content, he accepts the conditions put forward. Carefully read the papers that the employer asks you to sign.

This is important to know: Power of attorney to receive cargo from a transport company: sample 2021

Limitations and tolerances

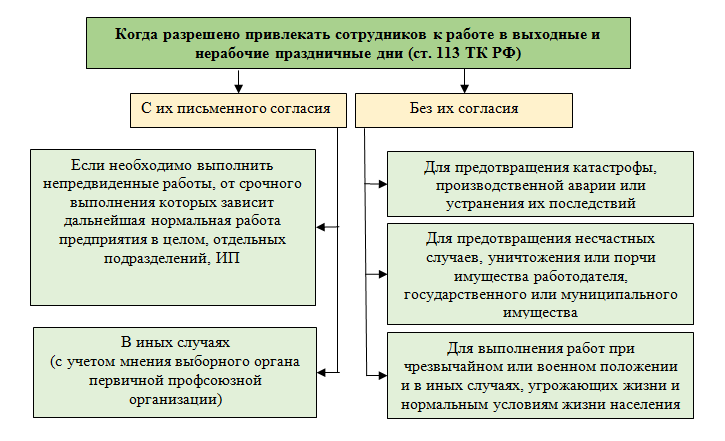

The legislator's approach to the issue of work on non-working days is reflected in Art. 113 of the Labor Code of the Russian Federation: it is prohibited to call employees to work on their legal days off and officially established non-working holidays. However, there are several exceptions to this rule:

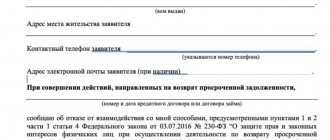

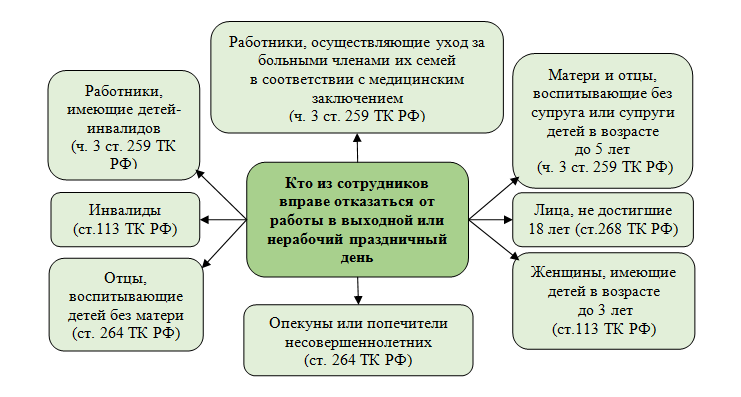

The employer is not allowed to call pregnant employees to work by the prohibition enshrined in Part 1 of Art. 259 Labor Code of the Russian Federation. In addition, there are several categories of employees who have the right to refuse to work on weekends and non-working holidays:

Labor legislation limits the employer's desire to burden the workforce with responsibilities 365 days a year, but allows that in some cases it is impossible to do without work on holidays and weekends. Therefore, according to the Labor Code of the Russian Federation, hiring employees to work on non-working holidays is permissible if it is necessary to ensure:

- continuity of the technological process at the enterprise;

- carrying out urgent loading, unloading and repair work;

- service to the population.

To be called to work on non-working holidays and weekends, the employer must issue a written order. Verbal orders in such a situation have no legal force.

Find out more about restrictions and prohibitions from the materials on our website:

- “Offsetting overpayments of taxes: the new restriction does not always apply”;

- “The land plot is limited in use: is there a land tax?”

In what situations is it possible to work on weekends and non-working holidays?

Art. 113 of the Labor Code of the Russian Federation prohibits calling citizens to work on weekends and holidays. This is the framework that employers should build upon. The purpose of this legislative provision is proper rest for workers and care for the health of citizens. Exceptions are allowed if the following conditions are simultaneously met:

- availability of employee consent;

- taking into account the opinion of the trade union (if any);

- the occurrence of urgent work, the implementation of which determines the further activities of the company.

In some situations, the law allows employees to be called to work on their days off without their consent. In particular, work on weekends aimed at preventing accidents is allowed. It is also possible to call employees to prevent dangerous situations and loss of property. In a situation of emergency or martial law, a threat to the entire population of Russia or part of it, the employer can also attract employees on weekends without their consent. Exceptions to this rule include disabled people, pregnant women and employees with young children. The legislation gives them the right to refuse such work and sets an additional condition for being hired on weekends and holidays: a medical certificate does not prohibit the employee from being involved in work on these days.

When inviting employees to work on weekends, you need to understand how a day off is paid according to the Labor Code . This is necessary for fair calculation of salaries for employees called to work on weekends.

Salary for work on a weekend or holiday with a salary and with piecework payment

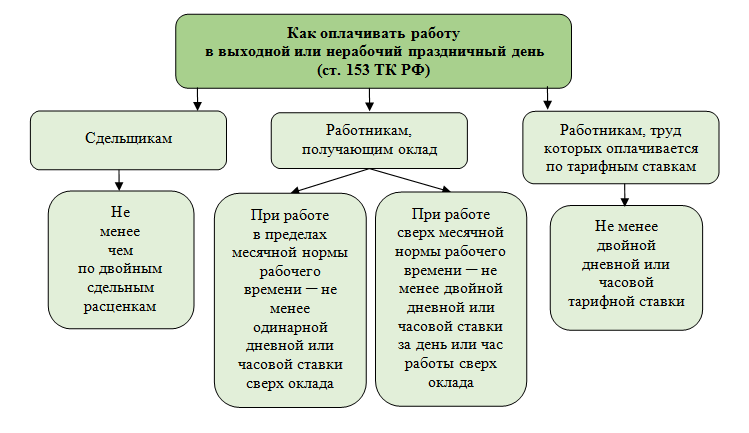

How to pay wages on holidays with a salary is indicated in Art. 153 Labor Code of the Russian Federation.

Look at the formula for calculating salary based on salary.

The same article defines regulatory approaches to payment for holidays with piecework wages:

Whether it is necessary to calculate a double tariff for working on a weekend or a holiday, taking into account bonuses and allowances, we will tell you in this publication.

The legislation limits only the lower acceptable limit of wages on weekends and holidays and reserves the right of participants in the labor process (employer and employees) to agree on and establish specific additional payments or salary calculation schemes in such situations. The results of such approvals and decisions must be enshrined in writing in the internal local acts of the enterprise and/or employment contracts.

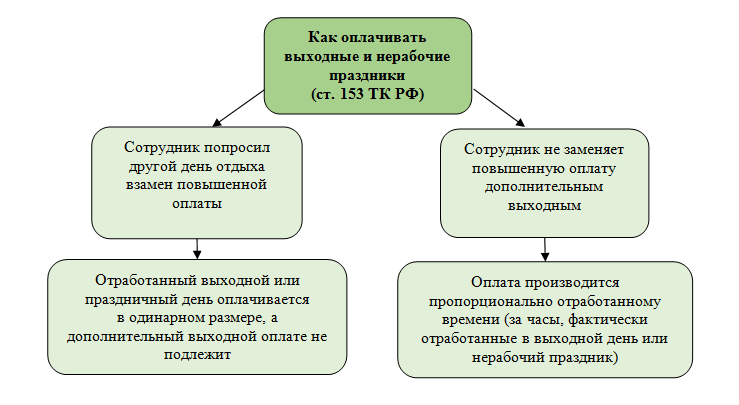

In Art. 153 of the Labor Code of the Russian Federation describes two principles that must be taken into account when paying labor on weekends and non-working holidays:

The situation is somewhat different with the calculation of wages on holidays with a shift work schedule.

Payment procedure

The specifics of remuneration for employees on weekends during standard work hours are given in Art. 153 of the Labor Code. Such work is paid taking into account the provisions of Part 1 of this article:

- For workers on piecework wages - at double piecework rates.

- For employees whose work is paid on the basis of daily or hourly tariffs - in the amount of double the daily or hourly tariff rate.

- For salaried employees - in the amount of at least a single daily or hourly rate in excess of the salary, if the work took place within the monthly working time standard, and a double rate in excess of the salary, if the work took place in excess of the working time standard.

Let's give an example of calculating the earnings of a salaried employee when he is hired on a day off . The employee worked 20 days out of 22. He was hired to work 1 day off (but he did not receive additional time off for working on a day off). His salary is 30 thousand rubles.

If the employee had worked this day beyond the norm, he would have received an additional payment of double the amount of 2,727.28 rubles. (1363*2). And then his monthly earnings would be 32,727.28 rubles.

If an employee works part-time on weekends and holidays, he is paid for the hours actually worked. That is, at an increased rate he will be paid not for the whole day, but in proportion to the time actually worked (under Part 3 of Article 153 of the Labor Code).

An employee who worked on a weekend or holiday may request an additional day of rest instead of a day off . Then work on a day off will be paid at the standard rate, but the day of rest will not be paid (according to Part 4 of Article 153 of the Labor Code).

This is important to know: Civil contract: concept according to the Labor Code of the Russian Federation, procedure for conclusion, form and sample 2021

The Constitutional Court, in its Resolution No. 26-P of 2021, indicated that payment for work on weekends and holidays is made not only on the basis of salary, but also taking into account existing compensation payments, allowances, and regional coefficients.

As for the annual bonus, it does not meet the specified criteria and cannot be taken into account when calculating pay for work on weekends. Thus, if the employer knows the size of the monthly bonus, then it is taken into account when paying for work on weekends; the timing of the payment of the bonus does not matter.

Double bonus for working on days off.

In their explanations, Rostrud specialists indicated that compensation for the cost of food, travel, and gasoline costs are not included in the wage system, and therefore do not participate in earnings calculations.

Nuances of calculating “holiday” wages during a shift work schedule

How to calculate salary on holidays with a shift schedule? In this case, it is necessary to take into account the features of shift work that can be organized (Article 103 of the Labor Code of the Russian Federation):

- to improve the efficiency of the enterprise (ensuring full utilization of equipment, increasing the volume of products or services provided);

- when the duration of production processes exceeds the permissible duration of daily work.

In such conditions, the workforce is divided into groups, each of which works according to a schedule. How shift work will be organized is determined in the internal local regulations of the enterprise. There are many options: two working days of 12 hours each alternate with the same number of days off, one working day after three days off, etc. The only limitation is that working two shifts in a row is prohibited (Article 103 of the Labor Code of the Russian Federation).

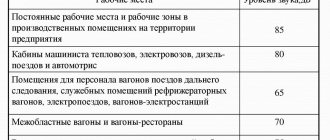

Pay on holidays with a shift work schedule has some nuances:

- Days off can be provided not only on Saturday or Sunday, but also on other days of the week (Part 3 of Article 111 of the Labor Code of the Russian Federation), therefore, work shifts that fall on Saturday or Sunday are not paid at an increased rate and are considered regular working days with payment in a generally established manner.

- Work on non-working holidays is paid at least double the amount (taking into account the principle of proportionality, which was mentioned earlier).

Paying employees at night has important features. Find out which ones exactly from the advice from ConsultantPlus. Get free access to K+ and go to the HR Guide to find out all the details of this procedure.

How is payment made on a day off if the employer was forced to invite an employee to work outside of the schedule? The general rules of Part 1 of Art. 153 of the Labor Code of the Russian Federation, when work on a legal day off is paid at an increased rate.

See an example of salary calculation for shift work.

Results

Labor legislation prohibits working on a weekend or holiday, with the exception of certain cases.

If you do have to work, wages must be paid at an increased rate - no less than double the hourly rate for piece workers or no less than double the hourly rate for each hour for workers whose work is paid at the rate. With a shift schedule, days off do not require double pay, unless the employee is called to work on his legal day off. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Financial compensation

The Law on Working on Weekends stipulates that if the employee is off during this time, compensation must be guaranteed, since such circumstances violate his rights to legal rest as prescribed in the Constitution. Compensation, as mentioned above, can be either monetary (double the amount) or in the form of paid time off.

How is work on a day off paid? We'll talk about this further. Legislation will serve as our basis.

Article 153 of the Labor Code of the Russian Federation suggests that for going to the workplace on a day off you should be rewarded twice as much. Thus:

1. Piece-rate employees receive double pay for the time worked.

2. Hourly employees receive double pay for working on a weekend or holiday.

This is important to know: Application for a refund: how to draw it up correctly, form and sample for 2021

If an employee works for a fixed monthly salary, then two payment methods are possible in accordance with Article 153 of the Labor Code of the Russian Federation:

1. If the standard hours in the current month are not exceeded, then compensation is calculated based on one daily fixed rate, which is paid in excess of the established salary.

2. If the monthly norm is exceeded, the amount of compensation will not be lower than double the fixed rate.