The concept of hourly wages in the Labor Code

The legislation does not regulate the exact formulation of the concept of hourly wages. Typically, this definition refers to the method of calculating wages according to the established tariff rate per unit of time. In fact, this is an ordinary time-based payment, but in this case the unit of time is taken not one month, but one hour.

With any payroll system, tariff rates per unit of time are of decisive importance. Traditionally, the billing period is one month. Under the hourly principle, salaries are fixed for each hour of work.

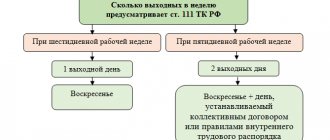

This type of performance compensation mechanism is common, for example, in the United States. The Labor Code of the Russian Federation partially reveals the mechanisms for regulating this nature of accruals. Article 91 of the Labor Code of the Russian Federation establishes the rights and guarantees of employees when paid hourly. Article 100 establishes the rules for recording working time.

The second formula for an accountant

This option involves using the average annual number of labor hours as a basis.

We need to divide the annual rate by 12: this is how we get the monthly rate. The employee's salary should be divided by this.

Hourly rate = Employee salary / (Average annual standard / 12).

You can clarify the average annual standard in an accounting program or online source.

Case Study

For Vitaly Nikanorov, who works in a warehouse, a summarized accounting of hours worked is used. Vitaly’s salary is 25,000 rubles. In January he worked 130 hours, in February - 150, in March - 155.

Official data for 2021 states that the labor standard for 12 months is 1974 days.

The hourly rate for a warehouse employee is 151.98 rubles: 25,000 rubles. / (1974 hours /12 months). Using this indicator, the accountant calculates the amount of the employee’s salary in each month of the quarter:

- January - 19,756.84 rubles (151.98 rubles * 130 hours).

- February - 22,796.35 rubles (151.98 rubles * 150 hours).

- March - 23556.23 rubles (151.98 rubles * 155 hours).

At first glance, it seems that the second method is more complicated than the first. Actually this is not true. In the first case, the hourly rate must be calculated monthly, in the second it is enough to determine it once a year. The key advantage of the method is that the salary of each employee of the organization is directly proportional to the number of his actual outputs. This value does not depend on the number of holidays and weekends that fall in a particular month.

Similar articles

- An example of calculating total working time accounting

- Number of man-hours worked by payroll employees

- Man-hours: calculation formula

- How to calculate man-hours for a year

- Number of man-hours in 2017-2018

Types of hourly wages

Depending on various factors, including management decisions, different types of hourly wages are applied:

- Ordinary . This type implies a constant rate of payment per unit of time. It does not matter the quality of work or any achievements. This form of payment is applicable in positions that require the employee to be present at the workplace for a specific time. The quality of their work is not so important (attendants, security guards, call center operators, administrators, etc.).

- Premium . This form is designed to stimulate the volume and quality of work. In this case, there is also a fixed rate, but a bonus for improved performance can be added to it. The amounts of additional payments are agreed upon in advance and added to the established tariff system.

- Normalized . In addition to the established rate, an additional payment is implied for following the terms of the work process. A similar mechanism is used in cases where exceeding the plan is undesirable for the company.

ADVICE! The hourly rate is acceptable for part-time or part-time workers, since a flexible schedule makes it difficult to set a monthly salary.

Features of hourly payment

Since the hourly wage system is a special case of the time-based one, it is possible to determine when it is more appropriate to use it from the same positions. If it is difficult to standardize work in adequate units, how can it be assessed from a financial perspective? For example, you can calculate the number of products made in an hour, but you cannot standardize the work of, for example, a lawyer or a teacher in the same way.

Types of "hourly"

Depending on the influence of various production factors, different forms of hourly remuneration may be applied.

- Regular hourly rate. 1 hour of work has a fixed price, which is not affected by the result given by the employee (“time is money”). This type of remuneration is used when the quality of work is not as important as the time actually spent at the workplace, for example, the position of duty officer, security guard, operator, administrator, etc.

- Premium hourly pay. The bonus is assigned for indicators additional to the time worked, such as volume of work, declared quality, etc. The amount of the bonus must be agreed upon in advance and is added to the established hourly rate.

- Standardized hourly rate. In addition to the rate per hour of work established by the tariff or salary, additional payment is guaranteed for strict compliance with the conditions set by the employer. It is advisable to use such a system when exceeding production standards is undesirable.

When is hourly wages beneficial?

The benefit for employers when setting hourly wages is obvious: they only have to pay for the time worked. This type of payment is especially popular for those employees who do not work full time. Examples include:

- workers with an uneven workload involved in performing work at a specific facility;

- workers whose working hours cannot be regulated (for example, teachers who teach additional classes in educational institutions);

- employees employed on a flexible schedule;

- workers whose labor productivity is very difficult to determine.

However, this system has certain disadvantages. For example, in the absence of bonus payments, employees are usually not interested in working faster and more, i.e. production efficiency decreases. In addition, the employer needs to monitor every hour the employee works, which may require an additional employee to keep track of time, leading to new costs.

Pros and cons of the hourly wage system

The mechanism for calculating wages for each hour of work has positive and negative characteristics for both parties. The benefits for the employer are as follows:

- the working hour is a constant value (while the working day can change its duration);

- it simplifies the calculation of the allowance due in the absence of an employee for a certain period of time;

- convenience in calculating salaries for part-time workers and flexible work schedules;

- payment of funds exclusively for working hours;

- more efficient use of workers' time.

The disadvantages for a manager include:

- reduced work efficiency in the absence of bonus payments;

- the need to control working hours (sometimes the introduction of an additional controller position is required).

It is worth separately considering the advantages of the hourly payment principle for the employees themselves. First of all, citizens with such a system can clearly draw up their work schedule and plan their income. Also, the tariff conditions are suitable for people with irregular schedules. For example, a teacher may be busy every day for a different number of hours, depending on the number of classes taught. With a fixed rate, the employee will receive exactly as much as he earned, since the uneven workload is taken into account.

One of the disadvantages for the employee is the lack of incentive for regular hourly pay (without bonuses). Also, situations often arise when the employer sets a significant amount of work per hour, thereby deliberately depriving the employee of the opportunity to receive a bonus.

Calculation of rates taking into account the minimum wage

There is no legally established minimum hourly wage in Russia. However, based on the minimum wage, you can calculate the lowest possible labor remuneration per hour, for example: 11,163 rubles. (minimum wage) / 184 hours = 60.67 rubles/hour.

When accruing in this way, factors such as a decrease in the working week due to harmful working conditions or other reasons for a decrease in the number of hours are also taken into account. Under such circumstances, tariffs will be slightly higher.

The general formula for calculating wages involves multiplying the tariff by the amount of time worked. In this case, additional coefficients may be included in certain situations.

If the salary is less than the minimum wage

In the case of part-time work, the employer can pay for the time actually worked in accordance with the minimum wage. In this case, recalculation is carried out for hours actually worked, so in a monthly calculation the salary amount may be lower than the minimum wage. This is not a violation of the law. In this case, the number of working hours should not exceed 40 per week. If the tariff for days worked is not lower than calculated according to the minimum wage, then the monthly salary may be lower than the minimum income level, and this is a common practice in cases of irregular work schedules.

Payroll example

The basic formula for calculating wages according to the considered system is as follows:

ZP = T * V , where

- ZP – salary;

- T – tariff established for a specific employee;

- B – actual time worked.

Specific formulas for calculating hourly wages can be established within enterprises. They may take into account qualifications, bonuses, and preferential conditions.

For better understanding, consider an example. Employee A is a security guard in the company. The employment contract stipulates conditions, including an hourly rate of 75 rubles. In May, the employee worked 200 hours. In this case, the salary for the billing period will be: 200*75=15,000 rubles.

Calculation of the minimum hourly wage in Russia in 2021

If we talk about the minimum wage for hourly workers, then it is necessary to mention the minimum wage, the amount of which, from January 1, 2021, was equal to the subsistence level in the country. In the future, it is planned to adjust both of these indicators simultaneously.

The “new” minimum wage was adopted in the amount of 12,130 rubles and this is the minimum amount that the employer is obliged to pay to employees who have worked the hourly rate per month. The hourly rate is established by local acts of the organization. On a monthly basis, these numbers can be found in the production calendar.

Hours worked beyond normal, as well as on weekends and holidays, are paid additionally. At the same time, the hourly rate on working days that fall on a weekend or holiday increases by at least twice. The employer may establish other payment conditions on these days, but comply with the rule of applying the minimum coefficient.

To calculate the minimum hourly rate, the maximum number of working hours per month in a particular year is taken. In particular, in 2021 it will be the month of July, where their number will be 184. Then the minimum threshold for the cost of an hour of working time should be:

12130 / 184 = 65.92 rubles.

Example 1. Citizen Kuznetsova works on an hourly basis with a set hourly cost of 100 rubles. According to her report card, she actually worked 112 hours per month, so her salary will be:

100 × 112 = 11,200 rubles.

Example 2. An employee of an organization is paid an hourly wage at a rate of 65 rubles per hour. In April 2020, he worked 167 hours, and was also involved in work on a day off for 3 hours, for which double pay was provided. Then his salary will be accrued for the month:

(167 × 65) + ((3 × 65) × 2) = 11,245 rubles.

Let us clarify that the payment is accrued wages minus personal income tax. At the same time, the minimum wage is the minimum amount not of payment, but of accrual.

Minimum size

The legislation does not establish a minimum hourly wage rate in 2021. But when calculating it, it is necessary to take into account the following: the minimum monthly salary of an employee who has worked the full working time cannot be lower than the minimum wage. From January 1, 2019, the federal minimum wage is 11,280 rubles. It is obvious that the hourly wage rates of workers for 2021 will not be lower than those calculated from the minimum wage.

The hourly tariff rate from the minimum wage for a 40-hour work week is calculated using the formula:

If a regional minimum wage has been established in the region where the organization operates, the company should focus on it. For example, in Moscow the minimum wage is 20,195 rubles, and in St. Petersburg - 18,000 rubles.

How to calculate overtime

Calculating the hourly tariff rate is necessary to correctly pay the employee for overtime hours. According to the Labor Code, for the first 2 hours the rate per hour of work is multiplied by 1.5, for subsequent hours - by 2.

Example 3.

An urgent job arose that cannot be “postponed until tomorrow,” and the proofreader worked 11 hours instead of 8. Then he will be paid for 3 hours (using the average hourly wage rate in 2021 from Example 1):

121.82 (hours) × 2 (first 2 hours of processing) × 1.5 (increasing factor) + 121.82 (hours) × 1 (third hour of processing) × 2 (increasing factor) = 609 ,1 ruble.

Teenagers under 18 years of age cannot be involved in overtime work, so we will not provide formulas for courier workers.

How to calculate salary

We have already looked at how to make calculations based on an employee's annual earnings. But sometimes situations arise where data from one or several months is used.

To find out the hourly wage rate for a certain month, if the salary is known, we again turn to the production calendar, but we look at the number of working hours not for the year, but for specific months (the numbers will be very different if there are public holidays in the month in question).

Example.

Let’s take the most “difficult” months: February, March, April 2020.

A storekeeper works 40 hours a week.

His salary is 30,000 rubles.

In February - 151, in March - 159, in April - 167 working hours.

Formula: salary / number of hours.

Obviously, the average hourly wage rate of a worker is lowest in April (30,000 / 167 = 179.64 rubles), and highest in February (30,000 / 151 = 198.67 rubles).

If we count for the whole year, the average hourly rate in 2021 will be: 30,000 × 12 / 1970 = 182.74 rubles.

Payroll example

The basic formula for calculating wages according to the considered system is as follows:

ZP = T * V , where

- ZP – salary;

- T – tariff established for a specific employee;

- B – actual time worked.

Specific formulas for calculating hourly wages can be established within enterprises. They may take into account qualifications, bonuses, and preferential conditions.

For better understanding, consider an example. Employee A is a security guard in the company. The employment contract stipulates conditions, including an hourly rate of 75 rubles. In May, the employee worked 200 hours. In this case, the salary for the billing period will be: 200*75=15,000 rubles.

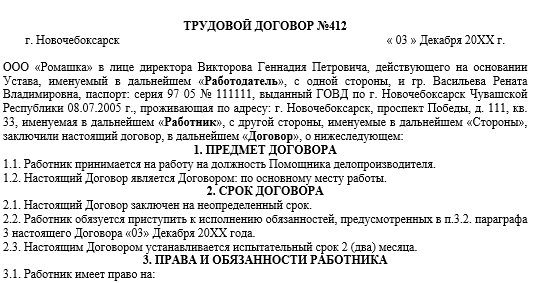

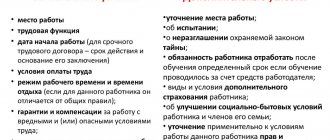

How to specify payment terms in an employment contract

All working conditions are mandatory specified in the employment contract. Thus, the rate system must be included in the document; in addition, in some cases an additional agreement is concluded with the employee.

The agreement must indicate the following information:

- the tariff at which labor remuneration will be calculated;

- the procedure for calculating monetary allowances;

- terms of bonus payment;

- payment conditions on weekends and night shifts;

- payroll days (at least twice a month);

- other conditions provided for by the company’s local regulations.

IMPORTANT! When transferring an employee from monthly to hourly pay, the employer is required to notify about this at least two months before the transfer. Such changes are fixed in orders and included in the employment contract.

Sample employment contract

An example of an employment contract with an hourly wage (clauses regarding the terms of payment for employees are indicated):

What features need to be taken into account in an employment contract for hourly wages - sample

When employing an employee, all aspects relating to the calculation and payment of wages are usually discussed between him and the employer, which must then be formalized in writing by signing an employment contract. In it (or an additional agreement to it), the Labor Code obliges to prescribe the conditions for hourly wages, if one is established for the employee.

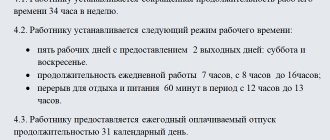

It is advisable to stipulate in the employment contract:

- the amount of the hourly wage rate (salary);

- tariff category;

- the procedure for calculating wages for the month;

- bonus conditions;

- terms of payment for holidays, weekends and night hours;

- deadlines for issuing wages>;

- other conditions, which may include a probationary period, social guarantees, etc.

Download a sample extract from an employment contract regarding the establishment of an hourly wage system and hourly rate from the link below.