Tax on winnings

Tax on winnings in Russia

The thirst for easy money has always worried the minds of people, no matter what country they live in. Millions of lottery tickets are sold around the world every year. And our country is not at the bottom of this list. Over the past three years, their sales have increased by 56%.

According to the data provided by Russian Post, and it is in their branches that the bulk of sales occur, every year residents of our country win on average about nine million prizes totaling one and a half billion rubles. And each winner must pay taxes on their lottery winnings. And the tax on lottery winnings is divided into two categories: 13% and 35%.

How much winnings are taxed on?

According to the law, if the amount of your winnings does not exceed 4 thousand rubles, then it is not subject to tax. If you are lucky enough to win a larger amount, but it does not exceed 15 thousand rubles, then you receive the winnings in full, but at the end of the year you will need to report it to the tax service. Winnings over 15 thousand rubles are subject to tax deduction automatically, that is, the winner receives the amount minus the established tax.

Do I have to pay tax?

Paying taxes is the responsibility of citizens. In case of non-payment, the payer will be charged a fine in the amount of 100 rubles. and more, depending on the amount. If a fact of malicious non-payment of tax or an attempt to hide information is discovered, the fine may be increased to 40% of the unpaid amount, with penalties accruing daily.

In case of late filing of the declaration, the fine will be 5% per month of the tax amount, the maximum fine will be 30%.

If a large amount of tax is hidden, the tax office has the right to seize the property and bank accounts of the defaulter. If a criminal case is opened for non-payment of tax, the defaulter may face imprisonment for up to one year with a fine of up to 300 thousand rubles.

If the amount of debt is more than 2,700 thousand rubles. the defaulter will incur criminal liability with imprisonment for up to 3 years and a fine of up to 500 thousand rubles.

The amount of income tax on winnings in Russia

Regardless of whether you hit the Jackpot, won a car or a trip to Paris, in any case, a certain tax will be deducted from you on your winnings. The tax on lottery winnings in Russia and the method of payment depends on several factors. This is the amount of the winnings, how the drawing was carried out, and the size of the tax is influenced by the citizenship of the winner. Let's consider all the factors in more detail.

35 percent tax on winnings in incentive lotteries

This tax applies to winnings from the promotional lottery. By incentives we mean those draws in which participation is free, they are usually held for advertising purposes.

Example

For example, a certain trademark decided to make itself known and hold a lottery in a large shopping center. The entire draw is held at the expense of the organizer, and in fact, the winner, without spending anything, receives, for example, a brand new phone or a trip to Turkey. But, in order to collect his winnings, he will need to pay 35% of the market value of the prize.

Tax on winnings 13% in lottery draws

In Russia, all winnings from lottery drawings are subject to a rate of 13%. It is at this rate that all the most popular state lotteries work, these are:

- Gosloto “6 out of 45”,

- Golden Key,

- Lotto million,

- First national lottery

- Lottery "Victory"

- Gosloto “5 out of 36”,

- Gosloto “7 out of 49”,

- Golden horseshoe.

Tax on winnings 30% for non-residents

Tax rates of 13 and 35% apply only to citizens of the Russian Federation. If the lucky winner of the prize turns out to be a citizen residing temporarily in Kazakhstan, or in Belarus and Ukraine, then the tax for him will reach 30%. This applies to all non-residents.

This is also important to know:

Property deduction when selling an apartment, features of receipt in 2019

Does the tax rate depend on who conducts the drawing - a state or non-state lottery?

In this case, government support will not affect the tax rate in any way. All types of lotteries are divided strictly into two parts: incentive lottery (promotional, advertising) - 35% and dangerous lottery (when a person invests a certain amount in purchasing a ticket) - 13%. The organizer is not important here.

What taxes do you need to pay on winnings in the Russian Federation?

It should be noted right away that tax must be paid on any winnings, regardless of its form. In particular, you can win not only cash prizes in the lottery, but also cars, apartments and travel packages. In any case, a person receives a financial benefit, therefore, must make the required contributions to the state budget. The size of such deductions directly depends on citizenship, the method of drawing prizes and the amount of winnings.

Tax rate on winnings

Incentive lotteries - 35%

This type of lottery refers to drawings that are held free of charge. In most cases, such lotteries are held for advertising purposes, to attract attention to goods and services.

For example, a certain company is promoting its new product and inviting all buyers of the product to take part in a free prize draw. Typically, this requires entering a promotional code or fulfilling other conditions of the lottery organizer. In any case, the drawing is free and is essentially a pleasant bonus for purchasing a product.

Regardless of what prize the winner receives, he will have to pay 35% of the cash equivalent of the winnings.

Lottery drawings

Most lotteries held in Russia operate according to this scheme. The essence usually comes down to the fact that the player needs to guess certain numbers that will appear during the drawing and mark them on his ticket. In most cases, the prizes in such lotteries are cash, and 13% must be paid on the profits received.

For non-residents of the Russian Federation

Non-residents are considered lottery participants who do not have Russian citizenship. This status does not prevent you from taking part in various drawings, but the tax rate changes. In particular, non-residents must pay 30% of the value of the prize received. By the way, a similar rate is relevant for any profit received by foreign citizens in the country.

In all of these situations, there is one caveat. The specified tax rates apply to everyone without exception, regardless of the organizers of the drawing. It is no secret that lotteries can be conducted by the state and private companies. In any case, the winner will have to pay tax in the prescribed amount.

Tax by type of winnings

Tax on foreign lottery

If a resident of Russia is lucky in a foreign lottery, then there may be one not very pleasant moment. Namely double taxation. You will give part of the winnings to the treasury of the country that is holding the drawing, and then the Russian tax service will also issue you an invoice.

In order not to be left without most of your winnings, you need to understand two points:

- Firstly, there is a list of countries with which an agreement has been signed to eliminate double taxation, that is, you pay the tax only once.

- If fortune smiles on you in a country that is not included in this list, in this case, many companies offer their clients to remain incognito. Whether to do so or not will depend on your honesty. You should always remember that tax evasion may incur administrative or criminal penalties.

Tax on winnings from a bookmaker (fonbet, betting league and others)

Over the past year, bookmakers have become very popular in the country; this surge occurred largely due to the fact that betting entered the online space. And of course, in Russia there is a tax on winnings at a bookmaker’s office.

This is also important to know:

Property deduction when selling an apartment, features of receipt in 2019

Free legal consultation We will answer your question in 5 minutes!

Ask a Question

In 2021, changes were made to the Tax Code, according to which winnings from a bookmaker's office are taxed if the amount is 15 thousand rubles. and higher. In this case, the person will receive the amount won minus 13%. If the winning amount is less than 15 thousand, the bookmaker pays it to the client in full, but at the end of the year, this citizen will have to independently make a contribution to the tax service.

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Tax on casino winnings

And although casinos are prohibited on the territory of our country, except for specially designated gaming areas, there are online roulettes and sweepstakes, and so far neither the Criminal nor the Administrative Code has a significant impact on their activities. Most online casinos are registered offshore, and their turnover amounts to billions.

The tax on casino winnings in Russia is also 13%, but payment here is on the conscience of the player, and most often people go to all possible tricks in order not to give the due portion to the State. If you take legal machines, then the amount less than 4,000 rubles is not taxed. If the size of the winnings is larger, then you must share and separate the required 13% with the state.

Tax on car winnings

How to pay tax on winning a car or an apartment, because you can’t separate part of the living space and give it to strangers? The same rate applies here as for a cash win, it is either 13 or 35% of the value of the win.

The cost of the prize won is reported by the organizer of the drawing and, of course, confirms this information with documents. If the lucky ticket holder does not have the amount to pay the tax, he can put his prize up for sale and then receive the amount minus tax contributions.

Tax on prizes in promotions

Very often the winning prizes are washing machines, televisions, computers, fur coats and other “clothing” lots. In this case, no tax will be collected from you, but the organizer conducting this drawing will notify the tax office of the income you received and the impossibility of withholding tax. After this, all responsibility and obligation to pay the tax falls on your shoulders.

By law, the rate for advertising sweepstakes is 35%. To clarify the amount, you must also contact the organizer, ask them for a receipt or any document confirming the value of the prize. If you agree with this amount, you always have the opportunity to contact independent appraisers.

What to do if the winnings turned out to be too expensive?

For example, you won a one-room apartment, and the organizer provides you with documents indicating its value of 10 million rubles. Although the market value does not exceed two. There is no time for joy or celebration of victory, because you need to pay a tax on property winnings in the amount of 35%.

This is also important to know:

Property deduction when selling an apartment, features of receipt in 2019

There are several options here:

- Conduct an independent assessment of the value and try in court to prove the fact of an illegal increase in the value of the prize.

- You can also pay this amount, or refuse the winnings altogether.

Taxation by type of draw

Currently, there are quite a few lotteries held in the country, where cash and in-kind prizes are awarded. Let's briefly look at the main options for drawings and tax rates when receiving winnings.

Read also: Law on Atmospheric Air Protection

Online casino

Let's start with the fact that such activities are prohibited on the territory of the Russian Federation.

Despite the current restrictions, the gambling business continues to actively develop, albeit online. Many online casinos operate through offshore zones, so it is impossible to completely block them. It follows that it is extremely difficult to track payments of winnings to players. This can only be done by requesting bank card statements, but Russian legislation prohibits doing this in relation to individuals without compelling reasons.

In any case, winnings at online casinos are subject to tax at the rate of 13% of the amount received.

Bookmakers

Here the situation is reminiscent of the online casino option discussed above. In particular, not all bookmakers operate within the legal framework, but unlike casinos, such organizations can operate not only on the Internet, but also in real life.

Winnings from betting are also subject to a 13% tax. It is assumed that the management of the bookmaker’s office independently makes the necessary deductions if the winning amount exceeds 15,000 rubles. In other cases, filing a tax return is the player's responsibility.

Lotteries

Regardless of the organizer of the draw, winners pay tax on winnings in the amount of 13 or 35%. The second rate is relevant for incentive lotteries, in which you can take part free of charge.

"Russian Lotto"

This is an analogy to a popular family game. The bottom line is that participants purchase tickets, which are a copy of home lotto cards. On the day of the drawing, the presenter pulls out kegs from the bag, and the participant who fills in all the fields can win the Jackpot.

Considering that you have to purchase a ticket to participate in the Russian Lotto with your own money, such drawings cannot be classified as incentive lotteries. Therefore, the tax rate for winners is 13%.

If a car is offered as a prize

Three tax rates may apply here:

- 13%

- 30%

- 35%.

The specific amount depends on the status of the winner (resident/non-resident) and the method of the drawing. Please note that the exact amount of deductions is usually announced by the organizers of the drawing. In this case, the winner can invite an independent expert to confirm the declared value of the car.

Here you need to clarify that you need to pay the tax before receiving your winnings, otherwise you will not be able to collect the prize. If the winner does not have the required amount, by mutual agreement between the winner and the organizers, the car can be sold.

Foreign draws

In most cases, tax on lottery winnings is paid in the country where the lottery was held. This is done within the framework of international agreements to eliminate cases of double taxation.

As an example, consider the tax rates on winnings in different countries:

- Italy - 6%;

- Czech Republic - 20%;

- Bulgaria - 5%;

- USA - on average 25%, but different states may have their own rates.

Promotions

These are incentive lotteries that are conducted by various companies to promote their products and services in the market. It was mentioned above that for such winnings the rate is set at 35%.

Read also: Registration of a vehicle with the traffic police

Cash prizes

Such winnings can be in incentive and regular lotteries. Therefore, the tax rate is 13 and 35% respectively. If the winner is a non-resident of the country, he pays 30% of the winnings.

Tax evasion in Russia

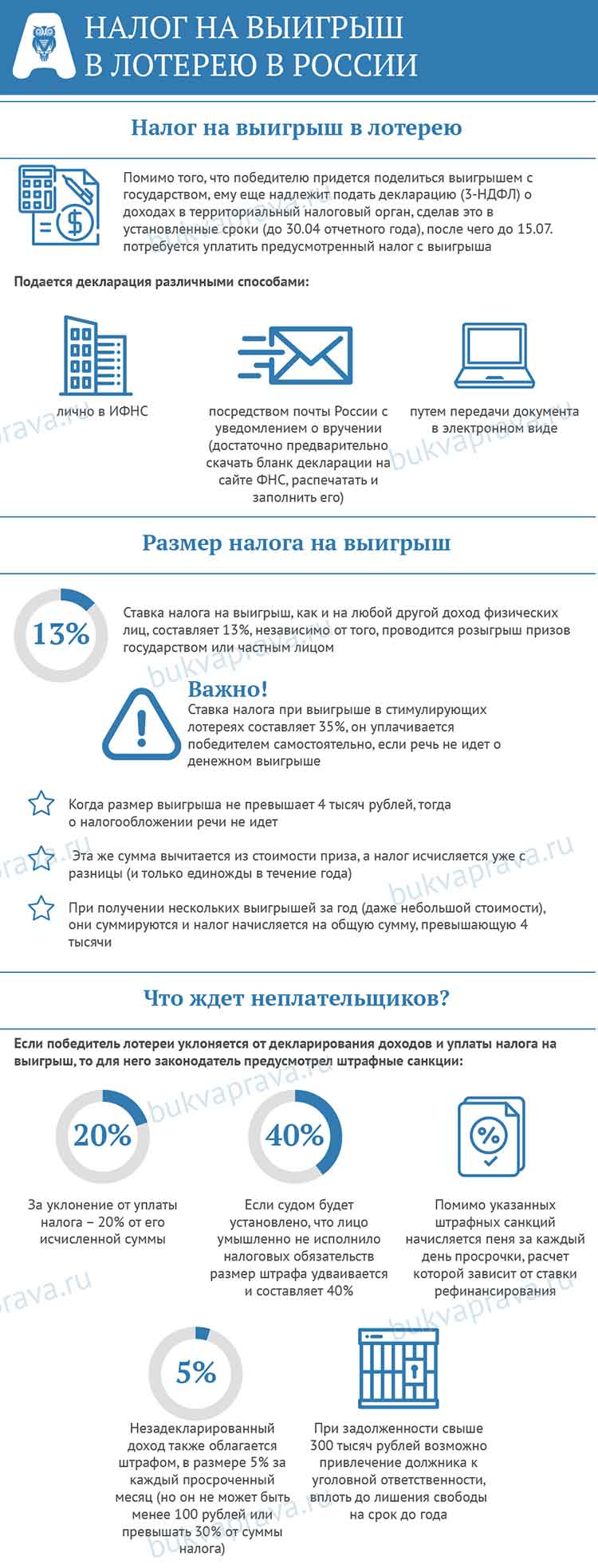

Winning a jackpot is always a pleasure, and you especially don’t want to share with him when your lucky ticket shows a sum of six zeros, and you also want to keep the small prize in its entirety. But, if a lottery winner evades declaring income and paying tax on winnings, then the legislator has provided penalties for him:

- For tax evasion - 20% of the calculated amount.

- If the court finds that a person intentionally failed to fulfill tax obligations, the fine is doubled and amounts to 40%.

- In addition to the specified penalties, a penalty is charged for each day of delay, the calculation of which depends on the refinancing rate.

- Undeclared income is also subject to a fine of 5% for each overdue month (but it cannot be less than 100 rubles or exceed 30% of the tax amount).

Tax authorities have the right to collect tax on lottery winnings forcibly by court decision, for example, by sending a writ of execution to the accounting department of an enterprise, according to which deductions will be made from the citizen’s salary.

The amount of punishment directly depends on the amount of winnings. The defaulter will face administrative penalties up to 100,000 rubles. If a citizen of the Russian Federation has not reported winnings from 100 thousand to 1 million rubles, then his case will be considered criminal and will entail punishment in the form of a fine or seizure of property. If the hidden winnings exceed a million rubles, the “lucky one” will face imprisonment for up to 1 year.

In order to avoid unpleasant consequences, when receiving winnings, one should not forget about the existence of obligations to the state to pay tax.

Is it possible not to pay tax or at least reduce it?

Paying income tax is the direct responsibility of a citizen of the country. Otherwise, you voluntarily break the law and will be held accountable for this offense. The tax can be changed downward, but of course not by much. Clause 28 of Article 217 of the Tax Code of the Russian Federation states that prizes not exceeding 4,000 rubles received in total during the year are exempt from taxation.

What happens if you don't pay for winnings?

Such an act falls under the definition of “tax evasion.” The following sanctions may be applied to violators:

- The penalty for non-payment of taxes is punishable by a fine of 20% of the total amount owed. If during the trial it is revealed that a citizen deliberately evaded tax payments, the amount of the fine will double and amount to 40%.

- For each day of delay, a penalty is charged in the amount of 1/300 of the refinancing rate established by the Central Bank of Russia;

- Failure to file a tax return on time will also result in a 5% penalty for each month late. It should be clarified that the amount of such penalties cannot exceed 30% of the amount of unpaid taxes, but not less than 1,000 rubles.

Regarding large winnings, punitive measures are becoming more stringent. For example, if the tax debt exceeds 900,000 rubles, the defaulter may be arrested for up to 12 months or fined in the amount of 100,000-300,000 rubles.

Please note that based on a court decision, tax debt can be collected by force. For example, certain amounts will be withheld from the debtor’s salary until the entire debt is repaid. Previously, the accounting department of the enterprise receives a writ of execution.

Read also: Warranty card

In addition, citizens who do not pay taxes to the state end up on a kind of black list and will not be able to travel abroad.

When and how to pay tax

Of course, no one wants to share the jackpot, especially if it is an amount of tens or hundreds of thousands of rubles. But the law is the law. Winnings are nothing more than the income of an individual, and as all income is subject to taxation in accordance with the Tax Code of the Russian Federation, the responsibility for its concealment is very strict. If this obligation is violated, the required amount will be forcibly written off from the debtor. If we are talking about a material prize, then the bailiffs can seize it.

This is also important to know:

Property deduction when selling an apartment, features of receipt in 2019

Free legal consultation We will answer your question in 5 minutes!

Free legal consultation

We will answer your question in 5 minutes!

Ask a Question

Call: 8 800 511-39-66

If fortune was on your side and you won a car, an apartment or a certain amount of money, in order not to become a lawbreaker, you will need to take the following steps. Contact the organizer of the draw and issue a certificate from him in form 2-NDFL, it should indicate the amount of income you received. Later, you will record this amount in the decoration form 3-NDFL, along with all other income for the year. You must submit your tax return by April 30 of the year following the year in which you received the income. If you do not pay your taxes by July 15, penalties will begin to accrue.

We also advise you to check the tax on winnings, which must be paid for you by the organizers of the lottery or prize draw. There are often cases when payment was not made and a person became a lawbreaker without knowing it.

Remember, you always have the right to request from the organizers of the draw documents on the basis of which you will need to submit a declaration or official basis for tax exemption.

In addition, we recommend that you always read the documentation indicating the prize amount. Especially if we are talking about material gains: a car, household appliances, etc.

How to properly submit a declaration and pay the fee

So, if a citizen who wins the lottery, in accordance with the above conditions, is obliged to pay and transfer money to the budget independently, he must:

- Fill out and submit a tax return in Form 3-NDFL at your place of residence - you need to report for income received in the previous tax period (if the money was received in 2021, the reporting deadline will be 05/03/2019).

- Calculate the payment amount yourself and transfer it no later than July 15 of the year following the reporting year (in our example, July 15, 2019).

It should be calculated like this:

((Win-2018 + win-2018 + win-2018...) – 4000) × 13% = tax amount.

Tax on winnings in other countries

USA (United States of America)

In terms of the number of different lotteries and prize draws, the United States of America is ahead of the rest. The country has a huge number of lotteries and casinos, both public and private. All these entertainments are not prohibited by law; in addition, compliance with the rules is strictly monitored and absolutely every citizen has a chance to hit the Jackpot of tens of millions of dollars.

The United States is known for its unique taxation system; each state has its own bet size on everything, including lottery winnings. There is a basic tax that applies throughout the country - this is 25% of the amount won, and an additional tax for each state. This could be 5, 10 or 15%. But there is a limitation here; the total taxes cannot be more than 40%. And in California, Texas and Nevada there is no additional tax at all.

This is also important to know:

Property deduction when selling an apartment, features of receipt in 2019

The tax in the USA begins to apply if the winnings exceed $600. If the lucky winner does not want to share his winnings with the state, then after the tax office finds out about the fact of evasion, the entire amount won will be confiscated. If the winner was a non-resident of the country, he may face deportation.

Las Vegas casino tax

Las Vegas, it has always attracted the most desperate and gambling players with its lights. Thousands of roulettes, gaming tables and slot machines, bets worth millions of dollars, all this is like footage from expensive Hollywood movies. But what really happens there and is it possible to arrive there with ten dollars in your pocket and hit a huge jackpot?

Despite all the popularity of Las Vegas, in fact it is just a created image of a paradise for adventurers, because playing in casinos in the United States is not profitable. Tax rate on winnings is 35%. 25% will be withheld immediately, while still within the casino, but this is only if your winnings exceed 5 thousand dollars. By the way, there is one more feature - 25% is deducted if the player gives his details. If he decides to take the winnings incognito, then he will have to pay 28% to the treasury.

There is also a small concession for residents: they can create a “gamer’s diary”, where all victories and losses are recorded. The tax will be charged at the end of the tax period, and only if the sum of all winnings is greater than losses. But Vegas casinos are often filled with foreigners, and they cannot afford such a bonus.

In this context, the capital of casinos can be called, oddly enough, Belarus. There is no taxation on this type of income. And you will receive the entire amount you won.

Countries that do not tax winnings

But in Canada, neighboring the United States, there is no such tax at all. This also applies to a number of other countries: Australia, Great Britain, France, Austria, Finland, Germany, Belarus, Japan, Turkey and Ireland.

Biggest winnings

The largest winnings recorded in our country amounted to half a billion, or, to be more precise, 506 million rubles. The winner of the lucky ticket lives in the Voronezh region.

In the US state of Massachusetts, a hit of $758.7 million was recorded. In Europe, the leading place in this ranking is occupied by a winning of 168 million euros; the ticket was purchased in Brussels.