What payments are due?

Both an employee who has reached a certain age and a working pensioner can resign. Upon dismissal, they are entitled to the same payments as all other employees.

Due to old age retirement

If an employee retires of his own free will, the following accruals must be made to him:

- wages for the current pay period;

- compensation for unused vacation.

A one-time payment upon dismissal due to old-age retirement is provided only to employees of those organizations, firms or enterprises in whose local documents this item is specified.

Expert opinion

Maria Lokshina

Family law expert since 2010

Those leaving due to retirement are not required to work for two weeks.

Upon dismissal of a working pensioner

A large number of people, having reached retirement age, continue to work.

If a pensioner decides to leave work of his own free will, he must receive the same payments as upon retirement:

- wages for the current reporting period;

- compensation for unused vacation.

For an employer: how to fire in 2021 according to the law

According to the law, dismissal is possible in case of his own desire to stop working, by agreement of the parties, in case of staff reduction, obvious violations on the part of the employee, due to appearing drunk.

At your own request

After 65 years of age, a person has the right not to work. You must prepare a statement and inform your employer of your intention to leave your position.

Rights of a pensioner upon dismissal of his own free will

After receiving the document, the manager is obliged to prepare an order containing all the detailed information about the employee: data, reason for termination of the employment contract, position held by him, date, signature, as well as the internal number of the contract under which he was listed in all company documents. You don't need to work for two weeks. It is necessary to have the worker’s signature confirming his familiarization with the order.

After the order comes into force, the employer is obliged to pay the employee and issue the necessary documents. The ex-employee signs the journal for recording the movement of internal documents, thereby recording the fact of their receipt.

What is the procedure for voluntary dismissal without work?

Termination of labor obligations due to retirement involves the dismissal of an employee without two weeks of work. In all other cases, the pensioner is obliged to notify the management team of his intentions to leave his position 14 calendar days in advance.

At the initiative of the employer

The employer has the right to say goodbye to the employee without his consent, and to do so in accordance with the law. Below are articles according to which it is possible to lay off an employee.

Is it possible to lay off at the initiative of the employer?

To fire a person without his consent, the employer must have reasons. In accordance with Article 81 of the Labor Code of the Russian Federation, these include:

- absenteeism;

- failure to comply with job descriptions;

- mismatch of qualifications;

- actions that led to administrative or criminal liability.

How to lay off a pensioner without his desire according to the law

If retraining is not completed or is not confirmed, the employee may be fired or laid off.

He is obliged to vacate his position. If he agrees to take another position, options are offered; if he refuses, the employer has the right to dismiss the working pensioner.

By agreement of the parties

Termination of contractual relations occurs by agreement of the two parties. The employee informs of his intention to stop working and asks for the employer's consent to dismissal.

In order to subsequently withdraw such a statement, permission from the other party is required.

Step-by-step instructions for downsizing

The employer is required to notify about the intention to reduce staff at least two months in advance. Moreover, open vacancies are offered to everyone who is likely to be deprived of work. Receive a written agreement to transfer to another position or refuse it and only after that draw up a dismissal order.

The calculation is made on the pensioner’s last working day.

By old age

An employer does not have the right to fire an employee simply because he has reached retirement age. Otherwise, he will face punishment for age discrimination against workers.

Who is entitled to bonuses and what kind?

A retiring pensioner must be accrued:

- salary increments and bonuses for fulfilling the monthly target, in proportion to the time worked. Usually they are accrued based on the results of work for the month. To receive full allowances and bonuses, you must work a full month;

- quarterly bonuses or compensation based on the results of the year, paid under the terms of the collective agreement, in accordance with the time worked. These payments are made after summing up the results of work for the quarter or year.

Before leaving for a well-deserved rest, you should carefully read the regulations on remuneration in force at the enterprise and the labor collective agreement.

Dear readers! To solve your problem right now, get a free consultation

— contact the on-duty lawyer in the online chat on the right or call:

+7

— Moscow and region.

+7

— St. Petersburg and region.

8

- Other regions of the Russian Federation

You will not need to waste your time and nerves

- an experienced lawyer will take care of solving all your problems!

Comments: 46

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Andrey

05/27/2021 at 09:02 am I entitled to a payment in 1966?

Reply ↓ Anna Popovich

05/27/2021 at 23:04Dear Andrey, funds are paid to citizens who were born before 1966.

Reply ↓

05/19/2021 at 11:43

Am I entitled to such a payment? - was born in 1958, in 2002-2004 and is still officially employed, I don’t know about the discrepancy of 5% and other conditions and I don’t know where to get the data

Reply ↓

- Anna Popovich

05/19/2021 at 17:12

Dear Svetlana, you can check with the Pension Fund about the discrepancy between the insurance and funded parts of your pension. Without compliance with this condition, payment is not assigned.

Reply ↓

05/17/2021 at 02:35

Good evening! I was born in 1966, from March 2001 to October 2003 I was on maternity leave. How much of a lump sum payment can I expect?

Reply ↓

- Anna Popovich

05/17/2021 at 16:14

Dear Elena, you need to contact the territorial division of the Pension Fund of the Russian Federation at the place of your registration.

Reply ↓

05/13/2021 at 02:36

Good evening! Mom, born 1944 She receives a pension from the Ministry of Defense for her husband, a group 3 disabled person, and has been working as a watchman since February 2021, with deductions for her. Is she entitled to payment? Thank you

Reply ↓

- Anna Popovich

05/13/2021 at 22:31

Dear Svetlana, payment is subject to a number of conditions. In particular, funds are paid to citizens who were born before 1966 with a minimum threshold for women - starting from 1957.

Reply ↓

05/07/2021 at 20:16

I, born in 1954, am I entitled to a lump sum payment?

Reply ↓

- Anna Popovich

05/07/2021 at 20:44

Dear Vladimir, the payment is due to women born between 1957 and 1966.

Reply ↓

05/07/2021 at 15:35

I was born in 1960. Whether payment is due or not7

Reply ↓

- Anna Popovich

05/07/2021 at 20:18

Dear Alexander, payments are due to persons who were born in the period from 1953 for men and 1957 for women until the end of 1966. In addition to the age limit, a number of additional conditions are taken into account - they are listed in the article.

Reply ↓

05/04/2021 at 15:02

I was born in 1957, am I entitled to compensation and how much?

Reply ↓

- Anna Popovich

05/04/2021 at 20:48

Dear Galina, the payment will be about five thousand rubles.

Reply ↓

05/03/2021 at 19:40

Born February 1957, is it supposed to?

Reply ↓

- Anna Popovich

05/04/2021 at 21:09

Dear Zoya, yes, you are entitled to a one-time pension payment. You can check the information at your Pension Fund branch.

Reply ↓

05/02/2021 at 00:50

I was born in October 1956. 34 years of experience. Group 3 disabled person. I receive a social pension. Am I entitled to a payment from May 1st?

Reply ↓

- Anna Popovich

05/03/2021 at 16:22

Dear Galina Pavlovna, to receive one-time payments, a minimum age threshold has been established: for women - from 1957, and for men - from 1953.

Reply ↓

04/29/2021 at 19:25

Good afternoon My mother is disabled (1956) and receives a survivor's pension. Please tell me if she is entitled to a lump sum payment, if so, what is the amount of the payment? Thank you.

Reply ↓

- Anna Popovich

04/29/2021 at 21:50

Dear Alla, those pensioners who are listed in Article 4 of Federal Law No. 360 can receive a one-time subsidy. The list of persons is given in the article.

Reply ↓

04/25/2021 at 20:25

I was born in 1955. What are the restrictions on payments for women? (The lump sum payment only affects men and women born between 1953 for men and 1957 for women through the end of 1966.) What is the difference between men and women, why are women only born in 1957?

Reply ↓

- Anna Popovich

04/26/2021 at 16:54

Dear Lyudmila, this age limit is established by Article 4 of Federal Law No. 360. The peculiarity of providing compensation is that citizens who were born before 1966 cannot independently determine the method of forming a pension. And people born since the beginning of 1967 have this opportunity. Receipt of state assistance is provided for pensioners born before 1966, since from 2002 to 2005, employers paid contributions to the funded part of the pension for all their employees.

Reply ↓

04/25/2021 at 03:02

I looked at the documents at the Pension Fund and it says from April 13 to April 30 payment of 34,000, but I already received my pension on the 23rd, how do I understand all this? Is it already written for the next month?

Reply ↓

- Anna Popovich

04/26/2021 at 13:32

Dear Tatyana, these are the deadlines for enrolling a pension in April, payments must fit within this framework, and April 23 is in the same range.

Reply ↓

04/17/2021 at 02:15

I was approved today for a one-time payment and wrote that as of April 16, the pension is set at 34,000 thousand and I receive 11,000. I understand that I will receive it along with the pension?

Reply ↓

- Anna Popovich

04/17/2021 at 19:00

Dear Tatyana, yes, that’s right.

Reply ↓

04/16/2021 at 14:33

Written by those born up to the end of 1966

Reply ↓

04/12/2021 at 22:53

I was born in 1966, am I entitled to a payment?

Reply ↓

- Anna Popovich

04/13/2021 at 00:39

Dear Natalya, no, one of the conditions for receiving payments is a year of birth before 1966.

Reply ↓

04/06/2021 at 03:08

For Crimea, this payment is acceptable because we are only in 2014. became Russians

Reply ↓

03/09/2021 at 15:39

I was born in 1964, are there lump sum payments?

Reply ↓

- Anna Popovich

03/09/2021 at 16:51

Dear Marcel, the grounds for receiving payments are listed in Article 4 of Federal Law No. 360 and the commented article. Not only the year of birth matters, but also additional conditions. Contact your regional Pension Fund office for detailed advice.

Reply ↓

02/17/2021 at 23:45

I was born in 1954. Am I entitled to a lump sum benefit?

Reply ↓

- Anna Popovich

02/18/2021 at 02:11

Dear Elena, lump sum payments are due to pensioners who were born before 1966. The reasons and procedure for obtaining them are described in the article.

Reply ↓

02/15/2021 at 19:58

Couldn’t you have written something simpler for old people? Why the bookish incomprehensible language? Then make at least different examples. If you want to do a good deed for the elderly, great. Just keep in mind that we are not lawyers.

Reply ↓

02/15/2021 at 19:20

I've been here since 1945. I have never used any benefits. Is it possible for me to receive compensation? I would like to know so as not to waste time and experience disappointment and resentment...

Reply ↓

- Anna Popovich

02/15/2021 at 21:51

Dear Olga, you can make a payment at the branches of the Pension Fund and Non-State Pension Fund, MFC or through the government services portal. Check the criteria for receiving payments given in the article and if you meet them, then apply for the transfer of funds.

Reply ↓

02/14/2021 at 23:09

If I was born in 1947, am I entitled to a payment and how to apply for it?

Reply ↓

- Anna Popovich

02/15/2021 at 15:16

Dear Natalya, in accordance with Article 4 of Federal Law No. 360, you can receive a payment. The grounds and procedure for obtaining are set out in the article.

Reply ↓

02/04/2021 at 19:47

Somehow everything is so complicated!!!

Reply ↓

- Alexander

02/15/2021 at 01:36

The main thing is to provide yourself with a large number of certificates: after all, we have a digital economy and a digital government. And in general, everything is provided using the “one window” method! Only all this, mostly on TV. And in life they will find thousands of reasons for refusal. After all, you need to save money

Reply ↓

02/03/2021 at 16:43

Why only 1953 and 1957? And those who have been women since 1952 are already wealthy?

Reply ↓

01/14/2021 at 18:07

And they sent me... Where did Makar send his calves... To the Pension Fund of the Russian Federation, however!

Reply ↓

03.12.2020 at 10:47

It’s not clear - in order to receive a payment, you need to meet all 7 conditions, or any of them?

Reply ↓

- Anna Popovich

03.12.2020 at 16:43

Dear Alexey, in order to qualify for one-time payments under Federal Law No. 360, you must meet all the conditions given.

Reply ↓

06/25/2020 at 12:44

2 months have passed since the electronic assignment of the lump sum benefit and nothing has been paid

Reply ↓

Compensation for unused vacation

When retiring, an employee must be paid compensation for unused vacation for the entire period of his work at the enterprise or organization.

Cash payment for unused vacation is made for all months of his work in the current year. To calculate the number of unused vacation days, you need to multiply the number of months worked in the reporting period by a factor of 2.33. The resulting number of vacation days that the employee did not use is multiplied by the average salary per day.

If an employee has used vacation in advance, then the amount of vacation pay paid to him in advance upon dismissal is deducted from his salary. An employee who is about to retire needs to think in advance whether to use his vacation in the year of dismissal or whether it is better to receive a cash payment for lack of demand.

Payments to an employee in connection with his retirement are subject to taxation at a rate of 13%.

How to quit in order to receive severance pay?

How can a working pensioner resign in order to receive benefits? This option may appear in the following situations:

- when staffing is reduced;

- upon liquidation of an enterprise, firm or organization.

Then severance pay, calculated from the average monthly income, is added to the accrued payments. If during the first month the laid-off pensioner has not found a new job, then severance pay must be paid for the second month. For the third month, benefits are not paid because the pensioner is not considered unemployed.

Only those who are retiring due to disability and are still able to work due to health reasons can count on redundancy benefits for the third month.

For people who have worked in the Far North or equivalent areas, severance pay is payable for up to six months if there is a problem with employment. They are entitled to early retirement and special “northern” allowances.

What do employees of the Ministry of Internal Affairs have to do?

A one-time benefit upon retirement from the army or internal affairs bodies, including the police, depends on length of service, distinction and health status:

- if the service life exceeds 20 years - 7 salaries of special monetary support;

- with a service life of less than 20 years - 2 salaries of special monetary support;

- in the presence of government awards of Russia or the Soviet Union - 1 salary of special monetary support;

- if a military serviceman or an employee of the Ministry of Internal Affairs is injured in service, then upon retirement he is entitled to an additional benefit of up to 2 million rubles;

- when disability is established, the funds due to the pensioner are indexed taking into account a coefficient established depending on the disability group and the cause of injury;

- compensation for personal property.

If at the time of dismissal the serviceman has not received clothing for the current year, then he is entitled to monetary compensation based on the submitted report and a certificate from the clothing service.

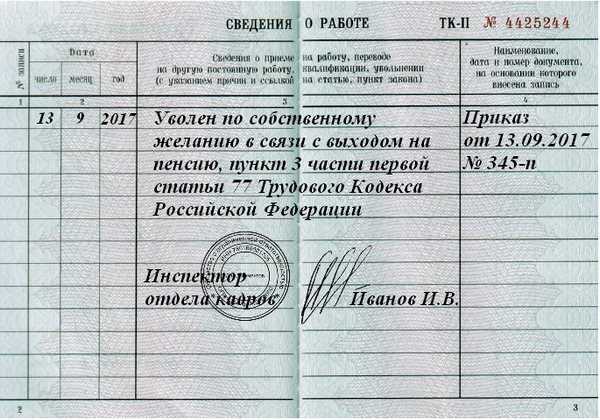

Registration of dismissal due to retirement

A citizen reaching retirement age cannot be a reason for dismissal. According to the law, this is the right to assign a state social benefit to a person. The Labor Code of the Russian Federation does not regulate the time period between an employee’s termination of an employment contract at his own request and his registration of pension benefits.

An employer does not have the right to refuse to terminate a pensioner’s employment contract or to set work periods. The step-by-step procedure for dismissal due to retirement looks like this:

- The employee writes a statement.

- The employer issues a corresponding order.

- Authorized persons of the enterprise organize the formation of payments upon retirement.

- The necessary entries are made in the work book of the dismissed employee.

To terminate an employment contract, a pensioner must, on his own initiative, draw up a corresponding application in writing and in accordance with the procedure established by the Labor Code of the Russian Federation. The document must contain:

- position and surname, first name, patronymic (hereinafter – full name) of the employer;

- directly a request for dismissal indicating the desired date of termination of the employment relationship;

- position and full name of the pensioner;

- the date on which this document is submitted, the signature of the applicant.

To avoid potential conflict situations, the pensioner should make a copy of the paper. The application must be submitted to an authorized employee, asking the latter to indicate the number and date of the incoming document on the copy. A sample of it might look like this:

| To the General Director of Dynasty LLC, Konstantin Evgenievich Nikolaev, from senior technologist Ekaterina Artemovna Taneyeva |

| Statement I ask you to dismiss me from my position from “___”___________ ______ to (day month Year) voluntarily due to retirement. |

| __________________________ ___________ __________________________ (date of application) (signature) (signature transcript) |

After an employee submits a letter of resignation, the employer, after reviewing it, draws up a corresponding order. The document must contain the following information: the serial number of the employment contract and the date of its termination. After the order is issued, a corresponding entry is made in the work book. It includes the date of dismissal and its reason. The data entered into the work book must completely coincide with the information contained in the order.

Working out a 2 week period

A citizen's retirement is a special type of voluntary dismissal. According to the law, a pensioner has the right not to notify the employer 2 weeks in advance of his decision to leave service. In a statement of desire to terminate the employment contract, the subordinate must indicate the appropriate reason. It will give an elderly person the opportunity to take advantage of the benefit guaranteed by the Labor Code of the Russian Federation - to quit without working in connection with retirement.