Home/Mortgage refinancing/How many times can you refinance your mortgage?

Mortgage refinancing is the re-issuance of a housing loan, its transfer to another banking organization in order to reduce the interest rate and monthly payments. When refinancing, funds from a newly opened loan cover the obligations on the old loan.

IMPORTANT

You can apply for a mortgage renewal to the same bank where you took out the loan. Typically, financial institutions are reluctant to refinance their own clients, but this option is also possible.

In order not to overpay, it is advisable to refinance a previously issued housing loan and work with the bank at current interest rates.

Attention! If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call Moscow; Saint Petersburg; Free call for all of Russia.

Mortgage Refinancing Law

Refinancing of a mortgage, like other loans, is carried out in accordance with Law 353-FZ “On Consumer Credit (Loan)”, which came into force on December 21, 2013.

Attention

Before contacting a bank to refinance a mortgage, it is advisable to consult a lawyer on the main provisions of the Law “On Mortgage” dated July 16, 1998 No. 102 FZ. Chapter eight is devoted to issues of assignment of rights under a mortgage (articles 47 to 49).

Mortgage refinancing reduces the debt burden: as a rule, the loan repayment period increases and the interest rate decreases. As a result, the monthly payment amount is reduced. In some cases, it is possible to refinance a home loan under the terms of the state program of preferential mortgages for young families, adopted on December 30, 2021. The interest rate will be 6%, the difference will be subsidized by the state.

How often can you refinance your apartment mortgage?

There is no formal (legal) restriction on re-issuing a housing loan. In other words, you can apply for a new loan in order to pay off the old one as often as the borrower wishes.

Attention

The internal regulations of a banking organization may limit a citizen - without fulfilling certain conditions, approval of an application for mortgage refinancing will not be possible.

A bad credit history, late payments - because of this, a financial institution will be wary of the borrower. In addition, banks are reluctant to refinance their own contracts. Therefore, it is advisable to contact another credit institution, preferably a large one with government participation.

Not all financial institutions refinance mortgages. Before submitting an application, check the current conditions and requirements of the credit institution for the borrower.

Which banks can refinance a mortgage?

In 2021, the following Russian banks offer on-lending services:

- Rosselkhozbank;

- VTB 24;

- Alfa Bank;

- Rosbank;

- Sberbank of Russia;

- Opening;

- Nordea Bank;

- Raiffeisenbank;

- UniCredit Bank;

- Home Credit.

You can familiarize yourself with the current conditions and find out how many times you can refinance a mortgage at Sberbank or another financial organization on the official websites.

How many times can you refinance your home mortgage?

The bank does not care which property the borrower chose to purchase. This could be an apartment, a single-family home within the city, a townhouse or a cottage. What is more important is the liquidity of real estate, its real market price and general condition.

A loan for a house, like an apartment, can be refinanced an unlimited number of times. The status of the property does not formally limit the borrower in any way. But for the bank, an apartment is more attractive; it is easier to sell in case of termination of payments. Therefore, in the case of a house, as with other non-standard types of housing, refusals to reissue a mortgage are possible.

How many times can you refinance your mortgage?

The legislation does not establish any strict prohibitions on the number of applications to the bank for refinancing. The borrower can refinance at least 10 times, however, it is worth considering that each time you will have to collect a new package of documents. As practice shows, the amount of refinancing also depends on the borrower himself and the characteristics of the credit policy of a particular institution.

Thus, only those clients who meet certain bank requirements can apply for refinancing:

- the client has an ideal credit history

- Several months have passed since the mortgage was issued (depending on the chosen bank)

- the client's income allows him to pay payments

- the client does not have, and has never had, any arrears on his existing mortgage

However, when applying for a second mortgage, that is, refinancing, you must remember that you will not be able to obtain a tax deduction again.

In what situations is it better to apply for refinancing again?

The decision to refinance your mortgage can be made impulsively. Most often this is due to changing conditions in the mortgage market. For example, interest rates have decreased. The borrower’s first thought is to apply under new conditions and save the family budget.

It is unwise to give in to your mood in financial matters. A mortgage loan is issued for many years, a significant amount must be paid, and in some cases a low interest rate does not automatically mean a reduction in the payment amount. Because of this, refinancing a mortgage may not be profitable even on conditions that are more attractive at first glance.

You should decide to refinance your mortgage in the following cases:

- The family’s financial situation has changed: income has decreased and unexpected expenses have appeared. In this case, re-issuing a housing loan for a long term is the only way out in order to continue payments and not lose property. It is wise to look for credit institutions with more favorable conditions to reduce monthly payments.

- The difference in interest rate should be at least 1-1.5%. For example, under a current loan agreement you pay 10.5% per annum. A new loan will be profitable if another bank offers a 9-9.5% rate.

- The new agreement does not require insurance or reinsurance of life and collateral. The new insurance will eat up the benefit from the low interest rate.

- The existing agreement does not provide for sanctions for switching to another bank or early payments on a housing loan.

- If you have several mortgage agreements in different banks, then it is more profitable to transfer them to one financial institution. Consolidated obligations are more convenient to pay, and the amount of payments is reduced.

- It is advisable to renew the mortgage if less than half of the payment period has passed. For example, the contract is concluded for 12 years. You can refinance the loan agreement again if you have at least 6-7 years left to pay. Otherwise, on new debt obligations you will have to pay not interest, but the principal amount of the debt, which is not so profitable.

- The conditions in another financial institution must really be much more favorable. It is better to consult about the pitfalls and hidden conditions when refinancing a mortgage that are not evident when you first read the contract before making a decision.

- In case of an unstable financial situation (significant exchange rate fluctuations), the mortgage is refinanced in order to change the currency of the debt.

In what situations is it better not to refinance again?

It is better not to apply for repeated mortgage refinancing if:

- Less than half of the loan term remains to be paid. The costs of re-examination and collection of documents will exceed the possible benefits.

- Interest rates differ slightly.

- Additional requirements (life insurance, real estate examination) significantly increase the cost of re-issuing a loan agreement.

- The current agreement provides for penalties for moving to another financial institution.

The above circumstances make recalculation unprofitable even taking into account more favorable interest rates.

What does refinancing do?

Mortgage loans are refinanced again in the hope of saving money and paying off debt obligations on favorable terms. In some cases, re-issuance of a mortgage loan is a necessary measure. It will lead to a worsening of the original situation, for example, the payment period will be extended. But in difficult life circumstances one has to make compromises in order not to lose property.

In other circumstances, refinancing your mortgage again will benefit:

- In exceptional cases, it is possible to receive an amount exceeding the loan payment. The surplus can be used for home renovations or set aside as an emergency reserve.

- By agreement with the lender, you can change the object of collateral if the borrower owns property that suits the credit institution.

- In the process of negotiations with the bank, you can choose the most favorable conditions, which will differ for the better from the standard ones prescribed in official documents. Financial institutions, as a rule, accommodate large borrowers.

Pros and cons of refinancing again

Repeated renewal of a housing loan, as a rule, has a beneficial effect on the family budget. The term and amount of payments are reduced. This is obvious, because of this, many people decide to refinance their mortgage.

Attention

The disadvantages of refinancing a mortgage are hidden, but we should not forget about them when starting the procedure of transferring debt obligations to another bank.

- Refinancing is essentially taking out a mortgage again. The borrower is forced to collect documents again, contact the bank, and wait for approval of the application. This is an extremely troublesome process that takes time.

- It is necessary to take into account additional costs: payment for a real estate examination, costs for registering a new contract with government agencies, life insurance of the borrower with another insurance company.

- The lending institution is reluctant to release borrowers. For switching to another bank when refinancing a mortgage, contracts usually provide for penalties.

- A low interest rate does not automatically mean more favorable terms under the mortgage agreement. If the loan is almost paid off, it is more profitable to stay with the old lender.

Pros and cons of refinancing

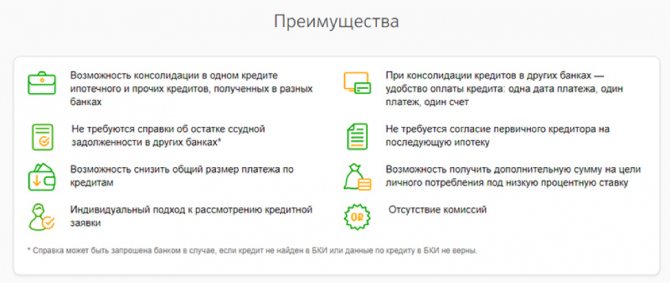

Essentially, refinancing is also a loan, so it has both positive and negative sides. The advantages of refinancing include:

- Lower interest rate means lower monthly payments.

- Combining several loans into one.

- Obtaining additional funds for urgent needs.

- Reducing the loan term, therefore, overpayments on the loan.

In addition to the positive aspects, one cannot help but mention the negative ones. The disadvantages of refinancing include:

- If the loan term is set to the same as for the original loan, the amount of interest paid as a result can be equal to what it would have been with the first loan.

- When applying for refinancing, monetary costs are inevitable, and quite significant ones. The client faces especially many expenses when changing lenders.

- If the client wants to shorten the loan term, he is required to make larger monthly payments.

- If the original loan was issued with a floating interest rate, there will always be a possibility of its reduction. Sometimes the rate on the first loan becomes lower than the fixed rate on the refinanced loan.

- If the borrower has already passed half of the mortgage term, then refinancing loses its meaning.

- If any bank refuses to refinance a client, this will not have the best effect on the quality of the credit history.

Which banks can refinance a mortgage?

Banking organizations are interested in attracting borrower clients, especially when it comes to large loans. Hence, there are large fines if the payer tries to change the bank before the end of the mortgage agreement.

The new client is also beneficial because the initial risk assessment was carried out by another credit institution. The client renewing the mortgage has a good financial reputation and there are no hidden dangers in such agreements.

Most major financial institutions offer mortgage refinancing (including refinancing). The borrower independently chooses the most suitable conditions.

Attention

It is wiser to contact large banks that carry out both initial and re-issuance of housing loans. Requirements for borrowers (package of documents, loan amount, client’s age) are standard and do not depend on how many times the mortgage is refinanced.

At Rosbank, mortgage refinancing is issued at a rate from 6.99% to 10.74%. The lowest percentage is provided if:

- the borrower uses the bank's salary products;

- life insurance and collateral real estate insurance was issued by Rosbank.

The requirements for the borrower's age are quite flexible: the bank works with clients from 21 to 70 years old.

Sberbank's conditions are no less attractive. The interest rate is from 9 to 11.5, the loan amount is from 300 thousand rubles, the borrower’s age is up to 75 years.

The refinancing rate at Rosselkhozbank ranges from 9.05% to 12% per year. Salary clients of the organization can count on a minimum interest rate on the loan. It is profitable to re-issue a mortgage for expensive apartments (costing from 3 million rubles). In this case, on-lending is carried out at a rate of 9.05% to 9.2% per annum. Refinancing of a home loan taken for the purchase of a residential building is carried out at a higher interest rate - from 11.45 to 12 per year. The bank works with borrowers aged 21 to 65 years.

Attention! Bank conditions are valid at the time of writing; to clarify current information, please contact consultants.

Which banks can I apply for?

Today, almost all major banks offer mortgage refinancing. The conditions for the product are approximately the same everywhere, as financial companies try to attract as many clients as possible by creating competitive offers. We have summarized the terms and conditions of the products into a general table that presents the offers of the most well-known banks.

| Bank | Interest rate | Loan terms | Loan amount |

| VTB | From 8.3% per annum | Up to 30 years old | Up to RUB 30,000,000 |

| Sberbank | From 9% per annum | Up to 30 years old | Up to RUB 30,000,000 |

| Opening | From 8.25% per annum | Up to 30 years old | Up to RUB 30,000,000 |

| Rosselkhozbank | From 9.05% per annum | Up to 30 years old | Up to 20,000,000 rub. |

| Gazprombank | From 8.4% per annum | Up to 30 years old | Up to 45,000,000 rub. |

As can be seen from the table, almost all banks provide mortgage loans for a period of 30 years. Firstly, a long loan term allows you to reduce your loan payment. Secondly, when the payment is reduced, the debt burden on the budget also decreases. As for interest rates, they are almost the same everywhere. However, the most favorable conditions are offered by VTB Bank and Gazprombank.

Conditions for refinancing

In order to successfully go through the procedure for refinancing a mortgage, it is necessary to comply with all the requirements that the new credit institution imposes on the citizen as a new borrower.

A particular bank may have its own subtleties when re-issuing a home loan. But in general the following conditions must be met:

- The loan that the new bank will approve must be equal to or greater than the previous loan amount.

- The application must be approved by the bank. If there were refusals before, you will not be able to refinance at this banking institution.

- Documents for mortgage refinancing must be completed correctly. If errors are found in them (in proper names, numbers, dates), the contract will not be concluded.

Conditions for refinancing a mortgage

Where is it profitable to refinance a loan if the procedure is not initiated for the first time? Here it is important not to fall for the tricks of banking institutions who want to attract a new client with a low rate, and then significantly increase the annual interest.

Attention: be sure to study the new mortgage agreement, which should not contain a clause on the lender’s ability to change the terms of the current document without additional approval from the borrower. Otherwise, the bank has the right to increase the rate several times without notifying you.

Let's look at the conditions under which Russian banks refinance mortgage loans using the following table:

| Name of credit institution | Interest rate (%) | Repayment period (months) | Maximum amount (RUB) |

| RosBank | 10,99 | 84 | 3 000 000 |

| RaiffeisenBank | 9,99 | 60 | 2 000 000 |

| UBRD | 13 | 84 | 1 000 000 |

| Alfa Bank | 11,99 | 60 | 3 000 000 |

| Home Credit | 9,9 | 60 | 1 000 000 |

Important! Payment terms in five out of six banks are reduced when collateral is changed. If the apartment provided is characterized by low liquidity, borrowers are given a reduced limit for the minimum repayment period.

In fact, there is no prohibition on refinancing a mortgage two, three or four times - the most serious consumers study the programs and navigate bank offers, periodically encountering current products with attractive conditions.

However, citizens with the following characteristics are more likely to be approved for a large loan for the second or third time:

- exceptionally positive credit history;

- high stable income (according to form 2-YLAK)$

- complete absence of delays in the payment of primary and secondary mortgage loans.

What costs might you incur when refinancing your mortgage?

Significant cost items for repeated refinancing are payment for an examination of the property and the conclusion of a life insurance agreement with an insurance company cooperating with the new lender. Due to the high cost of these procedures, many have to refuse to re-register debt obligations.

In addition, the borrower must pay:

- Notary services for certifying copies of documents.

- Fee for registering an agreement in Rosreestr.

- Housing lawyer services. With its help, you can analyze the conditions and make the right decision. This is an optional, but highly desirable stage when refinancing.

Documents for refinancing a mortgage

Refinancing again is similar to the process of applying for a home loan. The lender will require the borrower to:

- Identification document (passport).

- A notarized copy of the employment contract or work record book.

- SNILS.

- Tax return (if the citizen is registered as an entrepreneur).

- Certificate of income. This may be a standard form 2-NDFL or a document according to the internal regulations of a credit institution.

- A certificate of temporary registration, if the citizen does not have permanent registration.

The following are added to the standard package of documents when re-issuing a mortgage loan:

- a certificate of the amount of unpaid debt under the current agreement;

- all documents about the refinanced loan (terms, interest, date of conclusion and expiration of the agreement, amount of monthly payments);

- for married people - the consent of the spouse to re-loan.

All these documents must be prepared before submitting your application.

For your information

If refinancing is carried out at your own bank, then the financial institution does not need to create a new loan case. The package of necessary documents is already at the disposal of the organization’s specialists. Therefore, you will need a minimum set: passport, employment and income certificates, SNILS.

Step-by-step instructions for refinancing your mortgage

The process of transferring a mortgage from one bank to another is carried out in stages.

- Before contacting the bank, you must prepare the necessary documents. This is a standard set that is provided during the initial application for a home loan; additionally, documentation on the current agreement is required. The bank will ask you to fill out a form and submit an application for approval.

- The credit institution makes a decision on the application within several business days. If the answer comes earlier (2-3 hours), there is a high probability of errors in the documents.

- After a positive decision, the borrower contacts the bank where the current agreement is drawn up. There he informs about his intention to change the repayment terms of the housing loan and receives consent to transfer the debt. The creditor, in addition, issues a certificate of debt balances and provides details for final payment.

- At the request of the new credit institution, a real estate assessment is carried out. The appraiser conducts an examination and submits the conclusion to the bank.

If the insurance company that provided the borrower's previous life insurance is not accredited with the new bank, it is necessary to insure again, according to the terms of the new credit organization. Otherwise, monthly payments will increase by 1-1.5%.

- After this, a new agreement is signed. It must be carefully studied before all signatures and seals are placed: it may contain restrictions and conditions that are inconvenient for the borrower, sometimes even contrary to the law.

- A few days after signing the agreement, the new creditor pays the remaining debt to the account of the previous bank. After this, the borrower receives a certificate from the “old” bank about the absence of debt and the closure of the loan and receives a mortgage.

The mortgage must contain a record of transfer to the current mortgagor.

- At the final stage, the new agreement and the change in the mortgagor are registered with the government agency (Rosreestr).

Attention

If refinancing is carried out in the same bank where the mortgage was originally issued, then the debt is offset within the credit institution. The client only has to enter into a new contract.

How to refinance your mortgage

The procedure is similar to obtaining a mortgage loan for the first time:

- the bank approves you as a borrower;

- you collect documents (personal and collateral);

- If the new bank's decision is positive, you make a real estate appraisal. If you made a previous assessment within 6 months before the current review, then the bank may accept the old assessment;

- you approve the property - it is advisable to have a certificate of the balance of the debt by this time;

- carry out a mortgage transaction;

- the new bank repays the previous loan for you and removes its encumbrance or issues documents (mortgage note with a note of repayment and a certificate of no claims), and you yourself remove the encumbrance through the MFC;

- You submit documents for the new transaction to register the encumbrance on the new creditor. Sometimes this is done at the same time - you submit documents to Rosreestr on the repayment of the old encumbrance and on the registration of a new one.

The only difference: together with the new loan agreement, a mortgage agreement (or an agreement on pledge of rights of claim) is drawn up, which is registered in Rosreestr. It regulates your relationship with the new bank, to which you pledge the property as collateral to secure the loan. The apartment is already your property, or you have registered rights to it under an equity participation agreement, and you are mortgaging the apartment or rights to it to a new bank.

Mortgage refinancing terms

It is beneficial for the borrower to reissue loan obligations on new terms as early as possible: this way, payments can be reduced and savings can be made. At the final stage of the mortgage agreement (2-3 years before expiration), re-issuance of the loan loses its meaning - the interest has already been paid.

On the contrary, it is not profitable for a credit institution to lose a client at the initial stage of payments, so it will not be possible to refinance a housing loan earlier than a year after the conclusion of the contract. This condition is contained in most mortgage agreements.

How many times can you refinance?

It is worth noting that repeated refinancing is not officially prohibited - however, many banks pay special attention to such clients, carefully analyzing their personal credit history. The law does not limit the number of refinancing operations in various areas - everything depends directly on the requirements of the financial institution that issued the loan.

Many banks are trying to develop a refinancing program and create attractive conditions for clients. But in order to refinance a home loan several times, the borrower must meet the following criteria:

- The client must have an impeccable credit history - this is one of the most important conditions for many banks;

- All payments must be made without a single delay;

- The borrower's monthly income must be sufficient to cover the new mortgage payments.

The client must re-go through the procedure for checking standard documents, as well as re-sign the insurance contract. Only after all conditions are met can the refinancing program be re-approved. It is worth remembering that you cannot take advantage of this offer in the first year of paying off your mortgage loan debt.

It is worth noting that the repeated refinancing procedure does not allow you to receive a tax deduction a second time. Thus, it will not be possible to receive additional subsidies from the state.

Conditions for refinancing in banks

| Name of the bank | Interest rate | Additional terms | Insurance upon conclusion of a contract | Maximum loan amount |

| Rosselkhozbank | From 9.05% to 12%. Depends on payer status | The consent of the original creditor is not required | Collateral property must be insured. Health and life - at the request of the borrower | Up to 20 million rubles |

| Gazprombank | From 8.9% | Applications, according to customer reviews, are rarely rejected | Real estate insurance is required | Up to 45 million rubles |

| VTB | From 9% | It is possible to refinance without a certificate of income, but the loan rate increases | Insurance of collateral, life and health of the borrower is mandatory | Up to 30 million rubles |

| Sberbank | From 9% | The previous bank does not require consent to transfer the agreement | Insurance of collateral property is mandatory | Up to 7 million rubles |

| Alfa Bank | From 8.69% The smallest percentage is provided for salary clients of Alfa Bank | No refinancing applications rejected by other banks | The property must be insured against damage and against damage resulting from fraudulent activities | Up to 50 million rubles |

Attention! Bank conditions are valid at the time of writing; to clarify current information, please contact consultants.

The formal requirements that banks impose on applicants for mortgage renewal are similar.

- The borrower's age is from 21 (less often 20 years) to retirement age (65 years). The exception is Sberbank: they are ready to work with older clients (up to 75 years).

- Credit institutions prefer clients who have a constant source of income and extensive work experience. Trust will be generated by a citizen who worked at his last job for at least 3 months with a total work experience of at least a year over the last 5 years.

- Clients who use the bank’s salary products have a greater chance of having their application approved.

IMPORTANT

You should not rely on the minimum interest rate stated by the bank when refinancing a mortgage. To obtain it, you need to correspond to the portrait of the “ideal” borrower, receive a guaranteed salary above the regional average and not have problems repaying previous loans.

In what cases should you resort to refinancing?

Many experts believe that it is worth considering a refinancing program only in the following cases:

- The client is not satisfied with the terms of the agreement, as well as the bank’s technical services;

- The interest rate on the loan is too high compared to offers from other financial institutions;

- Quite a large monthly payment.

Before completing the procedure, you must carefully study the conditions of financial organizations and choose the most optimal option.

Possible reasons for bank refusals

Credit institutions are interested in new clients and try to attract them with attractive offers, but in some cases they refuse to reissue a housing loan. Before applying to reissue a mortgage loan, it is worth understanding the reasons why applications are rejected.

- It is not easy to sell a property that is pledged if the borrower stops making payments. The most profitable for the lender are economy class apartments in new buildings. They are liquid and highly valued in the market. There will be no problems with the approval of the application for re-registration of the mortgage for such housing.

The redevelopment carried out can reduce the price of housing and create problems in registering it through government agencies. Therefore, it is undesirable to carry out major alterations in an apartment that has not yet become the property.

- Bad credit history and low income of the borrower. If income has recently decreased or become unstable, it will be difficult to refinance debt obligations.

- Lack of insurance or refusal to insure the collateral property and the life of the borrower.

- The terms of the agreement do not meet the lender's requirements. For example, the borrower is not of suitable age, the mortgage amount is more or less than required, or the bank does not refinance at all.

- If during the payment period the co-borrowing spouses divorced and the property has not yet been divided according to law, the application for re-issuance of the housing loan will be rejected.

- They are reluctant to re-issue a mortgage on housing that was purchased using maternity capital.

Reasons for refusal

It is worth understanding in advance the reasons why most applications from clients are rejected. Then it will be easier to prepare for unforeseen situations:

- If payments are stopped, the property is almost impossible to sell. Economy-class apartments in new buildings are most profitable for banks, because they are liquid and easy to sell. The price of housing can be reduced due to redevelopment.

- Low income coupled with a bad credit history.

- Lack of insurance, refusal to draw up a contract for the real estate itself, or the life of the client.

- The application will most likely be rejected if the spouses have already filed for divorce, but the process of dividing property acquired during the marriage has not yet been completed.

- Mortgages are also reluctant to be issued for housing for which maternity capital was used.

How to increase the likelihood of a positive decision from the bank?

Even without explaining the reasons for the refusal, banks continue to act within the framework of current legislation. There is no way to challenge or appeal such decisions.

- It is better to get additional advice from a mortgage broker and look at other offers.

If the refusal is related to the presence of current debts, then it is worth paying them off at least partially. And only after that resubmit the application. - It is necessary to carefully prepare documents and eliminate problems that appeared for the first time.

- When a client repeatedly applies for a contract, it arouses increased interest. Therefore, you need to be prepared for the fact that the bank itself approaches inspections more carefully.

Preparation to increase the chances of a positive decision includes the following:

- Elimination of any inconsistencies in documents.

- Improve your credit history as much as possible.

- Presenting the property in a more favorable light.

Thanks to repeated refinancing, it becomes easier to secure and improve the family budget. Even if the difference in rates is 1%, it is not recommended to refuse agreements. The main thing is to carefully study the terms and choose the appropriate options for a particular borrower.

Refinancing itself is a rather complex procedure. It will take borrowers a lot of effort and time to obtain all the information and fulfill every requirement. It is not always advisable to use the service multiple times, although there are no legal prohibitions.

What to do if the bank refuses to refinance your mortgage?

Credit institutions do not explain the reasons for rejecting citizens’ applications, and in doing so, they act within the framework of the law.

A refusal to reissue a housing loan cannot be contested or appealed. The smartest thing to do is contact another credit institution or consult a mortgage broker.

For your information

If the refusal may be caused by an excessive credit load, then it is worth paying off part of the loans ahead of schedule and then only apply for mortgage refinancing.

It is necessary to eliminate the reasons for refusal to refinance, carefully prepare documents, and compare conditions in different banks. Then it is quite possible to reduce the burden on the family budget.