To provide housing for military personnel, the government has developed a special support program - a savings mortgage system. With its help, it became possible to obtain a mortgage, the fees for which are paid by the state. Borrowers who took advantage of the subsidy several years ago can now refinance their military mortgage at rates currently prevailing in the financial services market. The procedure will significantly reduce the financial burden, reduce risks and expenses in the event of dismissal from service.

How to improve the situation

Due to the protracted economic crisis, state assistance under the savings mortgage system (NIS) from the Ministry of Defense of the Russian Federation became insufficient to pay off monthly payments. The War Department carried out almost no indexation, so employees felt strong credit pressure.

The developed programs for refinancing military mortgages from banks offering a minimum interest rate helped change the situation for the better. Loyal loan repayment conditions facilitate timely repayment of debt.

The desire to refinance a loan must be justified with specific goals and reasons. For example, the family’s financial situation has changed, a child has been born, or someone has become seriously ill.

Important! Annual state support of NIS for military personnel last year amounted to 268,466.5 rubles. It is indexed at 7%, but does not cover inflation.

Monthly NIS contributions should ideally fully repay the loan payments. In practice, payments may exceed the amount of government assistance.

Most recently, due to the indignation of the Russian Ministry of Defense, the entire annual limit of payments from NIS was transferred to the personal accounts of military personnel at once. It can be deposited in a special account at 8%. At the same time, the state gets rid of the need to index payments.

The amount of the monthly payment on the military loan was 22,372.5 rubles. until the debt is paid in full. Now this figure will be adjusted annually. The entire annual limit set by the state will be distributed over 12 months of contributions.

But even these measures are not enough; as a result, employees have to pay extra from their own funds. If payments become burdensome, the military has to turn to another bank to refinance.

Promsvyazbank and military mortgage refinancing – why is it important

Due to the 2015 crisis, the state stopped indexing contributions to the NIS. At the same time, payments on the loan obligation were calculated taking into account indexation. As a result, mortgage debt began to accumulate.

The situation is such that the monthly payments are not enough to pay the loan in full. You either have to pay extra from personal funds, or watch the debts accumulate. If nothing changes, at the end of the payment period the debtor will have to repay the missing amount (from 100 to 300 thousand rubles) from his own pocket.

Advantages

Refinancing is the complete repayment of an existing mortgage with a new loan on more favorable terms. Applying for a new loan solves several issues at once:

- Combines all existing debt obligations into one.

- The interest rate on the loan is reduced by 1 - 2%.

- The monthly payment is reduced.

- Debt repayment terms change.

- The overpayment on the loan is reduced.

By investing additional funds, the borrower repays the loan faster, can sell his home and buy a more spacious one. Gradual repayment of the loan in comfortable conditions, with the help of the state, is a long but sure path to the financial well-being of the family.

Banks serving military personnel

Credit institutions that have joint capital with the state develop the most favorable conditions and rates for refinancing military mortgages. The largest of them work according to the system:

- Rosselkhozbank issues loans from 100 thousand to 2.23 million rubles. for a period of up to 30 years, at 9.05%;

- Svyaz-Bank offers from 0.5 to 2.2 million rubles. for a period from 1 to 20 years, with a rate of 10.9%;

- Sberbank - from 0.5 to 2.33 million rubles, for 20 years, at 9.5%;

- VTB-24 – issues loans in the amount of 0.6 to 2.29 million rubles, until the borrower reaches 45 years of age, with an interest rate of 9.5%;

- Gazprombank issues from 100 thousand to 2.24 million rubles, for 30 years, at 9% per share;

- “Opening” - amount up to 2.71 million rubles. for a period from 1 to 25 years, at 8.8% per annum.

Recommended article: Refinancing with Uralsib Bank at 8.39%

How to refinance a military mortgage at Otkritie Bank

The main condition of all credit institutions is that the loan should not exceed the established limits. If a large amount is needed for refinancing, the borrower will have to make an advance payment and apply for a loan for the balance.

To refinance military mortgages in 2021, banks are drawing up new loan agreements with a reduced interest rate.

Documents and conditions for refinancing a military mortgage at Promsvyazbank

conclusions

A military mortgage can be refinanced if it is beneficial to the borrower. But to carry out the procedure, you will need to select the appropriate bank and study its conditions.

- Related Posts

- How to refinance a mortgage again in 2021: conditions and procedure for refinancing

- The main pros and cons of refinancing a mortgage

- How to refinance a mortgage profitably and safely, TOP 7 offers from banks

- How does a bank loan refinance?

- Loan refinancing for pensioners: which bank is it profitable to refinance a loan in 2021?

- Insurance when refinancing a mortgage loan in 2021: features of mortgage insurance

Add a comment Cancel reply

Important nuances

Before you start collecting documents for on-lending, you need to find out the conditions of various financial organizations, loan rates and the cost of processing documents. In some cases, a down payment of 10 to 30% is required.

Important! Compare loan rates from different banks. Sometimes the difference is so small that it does not cover the cost of re-registration.

Experts advise those whose mortgage was issued with a “floating” interest rate to refinance. After all the documents are completed, it will become fixed.

Military personnel who have been transferred to the reserve at their own request may need to refinance their loans. They are not covered by NIS laws, and timely repayment of debt becomes an almost impossible task.

How to calculate the benefits of refinancing

The monthly mortgage interest amount is calculated using the formula:

Let's look at calculating the benefits of re-issuing a loan using a specific example. Initial loan terms:

- debt balance – 1.2 million rubles;

- Interest rate – 10.5% per annum;

- monthly payment – 22372.5 rub.

After refinancing, the rate decreased to 8.9%, but the monthly payment remained the same. The data obtained is entered into the table:

Important! The period until full repayment of the mortgage may increase if the state does not timely index payments from the NIS.

In addition, you need to take into account the costs of processing additional documents:

- assessment of the value of the purchased property;

- new insurance policy;

- technical passport (if it does not exist).

Getting them will take some time and up to 10,000 rubles, which will quickly pay off.

How to apply

If a serviceman has concluded that it is necessary to use the services of a financial institution for refinancing, in order to reduce the interest rate or monthly payments, he can submit an application to his or any other bank.

You can do this in two ways:

- When visiting a branch of a credit institution in person.

- Online, via the Internet.

Bank employees give the borrower a complete list of documents necessary to refinance a military mortgage, which he must provide in the near future to conclude a new agreement. This includes:

- passport of a citizen of the Russian Federation;

- completed application;

- certificate of NIS participant more than three years old;

- documents for the purchased property - technical passport, house register, extract from the Unified State Register of Real Estate;

- SNILS certificate;

- certificate of monthly income in the prescribed form.

You can submit your application online from the comfort of your home. On the corresponding page of the bank’s official website, you need to fill out a special window to create a personal account where you enter the data:

- last name, first name, patronymic of the borrower;

- the year of his birth;

- phone number;

- E-mail address.

In another form it is specified:

- purpose of the loan;

- real estate price;

- initial fee;

- debt repayment period.

If you have any questions, contact an online consultant via chat, who will explain what documents are needed to refinance a military mortgage and give advice on further actions. The answer comes immediately.

Recommended article: Is it worth getting a mortgage through realtors - pros and cons

A package of prepared documents is brought to the office of the bank chosen for refinancing, whose employee may require a copy of the marriage certificate and the spouse’s consent to conduct a financial transaction certified by a notary. Review lasts from 3 to 15 days.

Documents for refinancing a military mortgage at Promsvyazbank

The complete list of papers depends on whether the housing was purchased on the primary or secondary market, as well as on the condition of the apartment at the moment. To sign a preliminary agreement (PKD) you will need:

- application form;

- passports of the borrower and all co-borrowers;

- current loan agreement (LCL);

- marriage certificate (unmarried borrowers write a statement stating that they were not married at the time of purchasing the home);

- current payment schedule (issued by the previous creditor).

After a positive decision from RVI, the list will expand. You will have to re-evaluate and pay for it yourself (the result is valid for 6 months). In some cases, you may need a certificate stating that the house is not in disrepair. But this is only relevant for old apartments in Moscow and St. Petersburg.

You must also bring:

- details for transferring funds to repay the refinanced loan (the corresponding certificate is taken from the previous bank);

- a certificate of current debt and the absence of arrears (or another similar document);

- certificate of ownership and/or extract from the Unified State Register of Real Estate (valid for 1 month);

- certificates in form No. 7 (technical characteristics of the residential premises) and No. 9 (information about persons registered in the apartment);

- notarized consent of the spouse to pledge the apartment (for those who are married);

- registration certificate

Attention! The bank may request any other documents at its discretion.

Practice shows that it takes about 3 weeks to collect and approve all the papers. However, many certificates are valid only for a given month.

How to refinance a military mortgage at Otkritie Bank

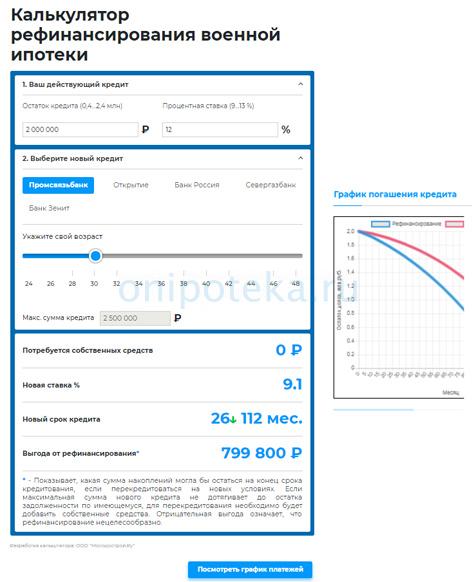

How the calculator works

The feasibility of all actions can be checked using the military mortgage refinancing calculator on the website of any bank serving NIS participants.

One of the main conditions is that before the debt is fully repaid, the employee must be no older than 50 years. The algorithm of the calculator depends on the accuracy of filling in all fields:

- Enter the loan balance. You can find it out at a branch of a credit institution or through online banking.

- Select any bank from the proposed list and see the terms and conditions for refinancing.

- Indicate your age; the amount of the loan that the financial institution can approve depends on this.

- If the proposed limit is less than your debt, then you must pay the remaining amount.

- The calculator will show how much the debt repayment period will change after refinancing, and what amount will remain in the savings account.

The online military mortgage refinancing calculator compares two different loans and clearly shows payment schedules and full repayment of the loan. An NIS participant sees what he is left with at the end of his military service:

- fully repaid mortgage loan;

- the amount of remaining debt;

- the amount that will accumulate in your personal account after closing the loan.

Evaluate all the pros and cons in order to competently refinance your current obligations.

Possible options

The main provisions under which it is possible to refinance a military mortgage at a lower interest rate are either the fact that the loan was issued before the funds were transferred, or if the contractor pays part of the amount himself. So, the reason will also be dismissal from service.

The simplest option is to contact the same bank where the mortgage was issued. You will need to write an application requesting to transfer the loan to conditions that are more favorable in connection with the bank’s current offers. Refinancing of a mortgage at a lower interest rate will be formalized in an additional agreement, which will change the current conditions, otherwise everything will remain as before.

If you want to change the bank, you should clarify whether it is a participant in the cooperation program with Rosvoenipoteka, otherwise the whole process may be interrupted for this reason alone.

Stages of on-lending

Refinancing a military mortgage takes place in several stages:

- Obtain approval from the selected bank.

- Agree on a new loan with Rosvoenipoteka, which controls the expenditure of public funds.

- Establish a grace period when the borrower does not pay interest on the loan.

- Calculate the amount of money spent from the NIS.

- Determine the amount of debt repayment from the serviceman’s personal funds.

- Obtain written approval from Rosvoenipoteka and provide it to the new bank.

- Conclude a new mortgage agreement.

After this, you should contact the primary financial institution to obtain a certificate of full repayment of the loan. It is important to remove the mortgaged apartment from this bank and register a mortgage for it with a new lender.

The credit institution makes a decision, which may result in:

- lowering the annual interest rate while maintaining payment terms;

- an increase in the repayment period of the debt with a decrease in the amount of regular payments;

- deferment of debt repayment;

- full repayment of debt.

When applying to Rosvoenipoteka you will need the following documents:

- military ID or civil passport of an employee;

- certified copies of the previous and new loan agreement;

- the loan repayment plan drawn up by the borrower;

- certificate of opening and details of the account to which the funds will be transferred;

- certificate of income for the last three months.

Certain requirements are also imposed on the property on which a mortgage has been taken out. This must be a primary property from a trusted developer.

Benefit calculation

To calculate savings, it is recommended to use a regular refinancing calculator available on the Internet. The debtor enters in the appropriate fields the parameters of the current loan, the conditions offered by the new bank and notes his wish to maintain the amount of the regular payment or reduce the repayment period. The result is expressed in terms of a reduction in overpayments, acceleration of settlements and a negative difference in the payment burden.

Unfortunately, the functionality of the calculator does not include accounting for the costs associated with the procedure. They depend on the amount of the remaining debt, the value of the property and other features of the specific mortgage agreement.

Why do banks refuse?

An inevitable refusal will follow if the borrower falls into one of the following categories:

- recently retired from the Russian army of his own free will;

- the debt balance is less than 400,000 or more than 2.4 million rubles;

- provided incomplete or unreliable information about his solvency;

- the employee has been a member of the NIS for less than three years;

- has a problematic credit history.

Banks minimize their risks, so they carefully check the data of borrowers. If there is at least one of the problems mentioned, the result will most likely be negative.

Requirements for an existing mortgage

The financial organization in which the new loan is issued puts forward its requirements for a military loan:

- there should be no delays in payments;

- the previous creditor does not request full repayment of the debt;

- This loan has not previously been refinanced or restructured by other financial institutions.

Important! The bank may require early repayment of the debt if payments have not been made within the last 200 days.

Problems with registration

One of the most frequently encountered problems is registration of an NIS participant, which can take up to 9 months. During this time, the deadline for submitting documents to refinance a military mortgage expires. Only a small number of credit institutions are ready to accept the electronic version of the document.

Recommended article: Family military mortgage in 2021 – conditions and banks

Late payments become an equally important problem if payment is not received for more than 30 days. Banks do not want to work with clients who have financial problems and therefore often refuse to provide services.

A borrower aged about 50 has virtually no chance of refinancing a military loan. After retirement, his mortgage is transformed into a civil one, on a general basis.

Incorrectly completed documents become a significant obstacle, which can be overcome if they are prepared again.

Refinancing conditions change frequently, and the borrower has to wait for new rules to come into force in order to carry out the operation at the most favorable moment.

It turns out that the amount of the remaining debt does not coincide with the payment schedule due to the lack of indexation of NIS contributions.

Registration of documents for refinancing a military mortgage at Rosvoenipoteka can take several months, and during this time the borrower is required to repay the loan from personal funds.

How to pay for a refinanced loan

Military mortgages are paid for using savings account funds. While the borrower is in service, he does not contribute personal funds and is not responsible for arrears. But upon dismissal, you will have to take on the loan repayment yourself.

If desired, the borrower has the right to repay part of the funds with personal savings. In this case, the balance of funds in NIS accounts can be used for other purposes. Even get a new loan for a second home.

Important! In 2021, the provision on refinancing only came into force. Sometimes there were delays in processing documents and transferring money by Rosvoenipoteka. However, there is no need to worry about loan arrears. Even if it’s late, the state will compensate for payments.

On-lending results

Banks handle military mortgage refinancing with great caution. This is normal, because they are losing their own income. Some 2 - 3% of an amount of several million adds up to tens of thousands of lost rubles.

The borrower wins:

- under the new agreement, he is given a fixed rate instead of a floating one, which significantly saves money;

- the payment schedule consists of equal installments until the debt is fully repaid;

- You can reduce your monthly installment by increasing the loan term.

As a result, the financial burden on the serviceman’s family budget is eased, the loan is repaid without delays or unforeseen problems.

Promsvyazbank: refinancing a military mortgage in 2021 and additional costs

When refinancing, PSB does not require the borrower to deposit personal funds. However, you will still have to spend money. We list the expenses that await the debtor in the process of changing creditors:

- re-valuation of property (3-5 thousand rubles);

- notarial consent of the spouse (1.5-2 thousand rubles);

- insurance (2-3 thousand rubles);

- extract from the Unified State Register (USRN) (800 rubles);

- state duty for re-registration of the subject of pledge.

Thus, you will have to spend at least 10 thousand rubles. However, the benefits of refinancing are more significant!

Important! When re-issuing a loan, there is a time gap. If, according to the old schedule, payments were written off on the 31st, and the new agreement is valid from the 20th, then the borrower will have to pay interest for 11 days on his own. This amount can range from 2 to 10 thousand rubles. The greater the interval between the old and new date, the greater the difference will be.

Registration of insurance

If for ordinary citizens, insurance of purchased real estate is carried out at will, then a military mortgage provides for mandatory insurance not only of the purchased apartment, but of the life and health of the borrower. The terms of such insurance are regulated by the state.

The bank does this in order to reduce its risks. The insurance company, in turn, closely monitors regular payments. If they cease, the insurance company has the right to terminate the contract unilaterally.

In this case, the lender will refuse to provide the loan and demand the return of the spent funds.

Customer Reviews

Having calculated the actual changes in monthly payments after refinancing, military personnel believe that this only makes sense if the difference in the interest rate is more than 2%.

Key points of negative reviews:

- Lengthy processing and endless nagging from bank employees require a lot of patience and time.

- The program is valid only in the Krasnodar region, St. Petersburg, Moscow and the Moscow region.

- There is no guarantee that the borrower will be approved for this operation.

- Registration of some documents requires material costs.

Positive reviews about military mortgage refinancing:

- The credit burden on the family budget is reduced.

- Paying in equal payments allows you to plan your monthly expenses.

- The amount of overpayment is significantly reduced.

- If the debt is repaid early, the serviceman has the right to spend NIS contributions at his own discretion, including for the purchase of new real estate.

Refinancing a military mortgage is a big decision that requires a lot of effort and a lot of attention. But if the result allows you to improve the quality of life of the family, then why not try?

Rate the author

(

1 ratings, average: 5.00 out of 5)

Share on social networks

Author:

Mortgage specialist Maria Yurievna Sokhan

Date of publication May 7, 2019 July 16, 2019