The essence of a mortgage for a young family

Young families can count on special, favorable conditions for obtaining a loan, such as a reduced interest rate and a minimum down payment. One of the main criteria for receiving benefits is registered marriage and the age threshold - from 18 to 35 years.

Main criteria for obtaining a “Young Family” mortgage:

| Age appropriate | Both spouses must be at least 18 and not over 35 years of age |

| Having a regular income | Preferably for every family member |

| Official employment | The borrower must work at a permanent place of employment for at least three months |

| Russian citizenship | You will also need to register in one place only for a certain period of time. |

| Availability of down payment | The amount of the contribution depends on the chosen bank |

If a banking organization requires additional confirmation of the client’s solvency, you need to be prepared to provide a work book (copy).

By the way, both families with children and still childless couples can count on special conditions for a mortgage loan.

As for the property, there are also certain conditions. Newlyweds can get approval to purchase:

- apartments in a multi-storey building, at the construction stage (the so-called primary market);

- apartments on the secondary market (a mandatory condition is that the house is less than 30 years old and in good condition);

- private residential building.

Also, a mortgage is issued for the construction of a private house and its improvement.

You can find general information about mortgage lending in the article: “What is a mortgage - in simple and accessible language”

State program “Young Family” to improve living conditions

In 2017, a state program called “Young Family” was adopted (Resolution of the Government of the Russian Federation dated December 17, 2010 No. 1050 (as amended on December 30, 2017)). The essence of this program is that the state provides subsidies in the form of a housing certificate to young families, and also limits mortgage interest for a certain group of people.

A young cell of society, having received government support, can add their own funds to purchase or purchase housing with a mortgage at reduced interest rates.

Step-by-step process for getting a mortgage

The path to your cherished home consists of several difficult steps, and it begins on the threshold of a banking institution. If your family meets the above parameters for preferential mortgage lending, then here is a list of your next steps.

- Study the mortgage offers of various banks and choose the most suitable option.

- Contact the branch of the selected bank and fill out an application (form).

- Request a list of required documents from a specialist and collect them (see below).

- Submit a set of papers to the credit institution and wait for the bank’s decision (usually no more than 7 business days). If the verification of the client’s identity and solvency was successful, it’s time to move on to the property - you’ve already got your eye on the apartment or house of your dreams?

- Collect a set of documents for the property by requesting a list from a loan specialist (see below).

- Submit the documents and wait again for the bank’s decision.

- Everything is fine? Then we sign a loan agreement. Important! Read the ENTIRE loan agreement very carefully to avoid surprises in the future.

- It may be necessary to additionally draw up security and insurance agreements for the collateral.

- Receive credit funds, pay the seller and move on to the most enjoyable step - registering ownership of the purchased home and celebrating your housewarming!

Important! If you have maternity capital, then it can be used for a down payment or for repaying the principal debt, thus reducing the loan burden.

You can also take advantage of the state program “Young Family” and receive a subsidy from the state for the purchase of housing. More information about the state program “Young Family” can be found here.

Basic conditions for issuing funds

The “Young Family” program is the availability of free subsidies from the state for partial repayment of debt obligations (depending on the individual characteristics of the couple). The federal benefits clearly state the amount of compensation: 30% for childless couples, 5% of the established thirty for each child.

The package of documents is submitted to the Housing Department at the registered address of one or both spouses. The terms of the mortgage presuppose the availability of status for citizens in need of improved living space. It is confirmed by a special certificate for preferential lending.

In the list of other basic requirements for borrowers:

- selection of primary housing with a loan repayment period of up to 30 years;

- a minimum PV is required (from 15%);

- execution of an agreement for collateral property (which is owned or new real estate);

- at least one year of work experience in the last place;

- 2-NDFL and other certificates about additional sources of financing for a young family;

- permanent registration of young spouses (or one of them) in the region of appeal.

A youth mortgage is available to one parent who is not officially married but is raising children. The main age requirement remains – no older than 35.

Important! The state benefit also applies to plots of land purchased for private development or the construction of a residential building on one’s own.

Required documents

To apply for a Young Family mortgage, you will need to collect a considerable set of documents. First, documents are prepared for the borrowers - the bank carefully checks the reliability and solvency of the future client.

| Application form | according to bank form |

| Borrowers' passports | + copies |

| Guarantor passports | + copies |

| Income certificates | according to form 2-NDFL or according to bank form |

| Marriage certificate | + copy |

| Birth certificates of children (if available) | + copies |

| Documents confirming relationship | If the parents of the young spouses act as co-borrowers |

| Additional documents upon request of the bank | Military ID, work book, SNILS, etc. |

As soon as the application is approved by the bank, we proceed to collecting documents for the property.

| Extract from the Unified State Register of Real Estate | |

| Seller's Certificate of Ownership of the Property | In the presence of |

| Technical certificate | cadastral |

| Contract of sale | preliminary |

| Property valuation report |

How to use the certificate

The validity period of the certificate after receipt by a citizen is 2 months. However, banks can carry out transactions using such a document for 9 months.

You can use the certificate in two ways:

- purchase of living space with additional payment of personal money;

- purchase housing through mortgage lending.

It is also possible to invest the funds received in a property that is under construction.

Mortgage calculator

The websites of banking organizations have such a convenient tool as a loan calculator. The program allows you to select the optimal loan and calculate monthly payments without visiting a bank office or calling a mortgage specialist.

What should be done? Enter the data in the special fields of the calculator:

- the total cost of the desired property;

- the amount of funds available to pay the down payment. The more funds have been accumulated, the correspondingly less amount will have to be paid;

- the requested mortgage amount;

- loan terms.

The interest rate depends on the selected type of loan and is entered into the calculator automatically. The preliminary amount of the monthly payment is also automatically calculated - and it becomes clear whether the amount of monthly contributions is feasible or not. Based on these calculations, you can reduce the size of the monthly payment (by increasing the loan term or reducing the requested amount), or you can increase it if the family has a stable income and plans to pay off the mortgage as soon as possible.

For example, here is the Sberbank loan calculator at the link.

Requirements

Not everyone can take advantage of this preferential program, because any social project is limited by certain conditions and requirements.

The program can be used by couples whose age does not exceed 35 years and whose income is not lower than the required one.

This amount is different for each type of family:

- for a family without a child – minimum 22 thousand rubles;

- for a family with one child – minimum 32.5 thousand rubles;

- for a family with two or more children – minimum 43.5 thousand rubles.

Help from the state, in turn, is also limited to certain numbers. The maximum young family can receive 30% of the value of future real estate.

However, the amount is limited:

- for a family without children 600 thousand rubles;

- for a family with one child 800 thousand rubles;

- for a large family 1 million rubles.

This amount is given by the state free of charge, but it must be taken into account that only those who are in line to improve their living conditions will receive assistance, while for two people the apartment area is limited to 48 square meters. If there are children in the family, then you can count on an additional 18 square meters for each.

It is worth considering: an important point is that despite participating in the social program, you can still return income tax, which is a definite plus.

The program makes housing affordable even for low-income families. The main thing is to take the time to prepare documents for the bank and participate in the program.

You may be interested in an article about mortgages for large families.

Read an informative article about the child mortgage deduction at the birth of a child here.

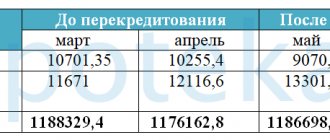

Refinancing

Recently, the term “loan refinancing” has become increasingly common. What is this?

Refinancing a mortgage at a lower interest rate, or in other words, taking out a new loan with more favorable conditions to repay the original loan.

This operation is carried out with the main goal of saving the family budget due to a more favorable loan rate. Refinancing old mortgage loans is especially important now - the interest rate on housing loans is steadily going down, and you can significantly reduce your monthly financial burden. The process of refinancing affects not only a reduction in the interest rate; you can also change the currency of the loan, for example, prefer a dollar loan to a ruble loan or vice versa. When refinancing, it is not necessary to change the bank - perhaps the credit institution that issued the mortgage offers the most favorable conditions for obtaining a new loan. Having decided to refinance, you need to study the mortgage offers of various banks and choose the best option. And of course, you need to be prepared for the second round of documents for a mortgage.

Is refinancing always profitable?

No not always. Below are the conditions under which refinancing will bring a positive financial result.

| The mortgage rate is at least 1% lower than the current one | More is better! |

| There are no additional payments or mortgage fees. | For example, there are no insurance premiums, or they are lower than current ones. |

| It is possible to transfer the mortgage to the borrower’s salary bank | Salary clients are most often provided with special conditions |

| The borrower will have enough free time to complete the refinancing procedure | Re-collection of documents! (see point 2) |

| Under the terms of the current agreement there should be no prohibition on early repayment of the loan | You can get fined |

| “Young” loan age | If you have been paying off your mortgage for many years, the interest that could have been saved has already been almost paid off. |

How to register with the housing department

To receive a mortgage at 6% per annum, you must be in need of improved housing conditions. To do this, you need to contact the housing department of the administration. It is necessary to clarify in advance what requirements apply in a particular region.

Table 3. Federal standards for living space per person

| Number of persons | Required area (sq.m.) |

| 1 | 33 |

| 2 | 48 |

| 3 or more | 18 per person |

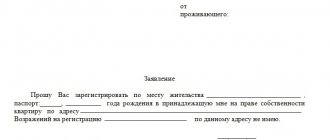

That is, when living in Khrushchev, it is quite easy to be recognized as needy. But this requires all family members to be registered together. The documents for registration are as follows:

- passports and birth certificates for persons under 14 years of age;

- a statement that must be written directly to a department employee;

- information about income;

- certificate of family composition;

- documents for existing housing.

The category of those in need in different regions includes residents of different types of apartments and houses

Some regions have established the possibility of requiring additional papers, and sometimes they need to be certified by a notary. Therefore, it is worth contacting the department staff in advance to ensure that everything you need is provided the first time.

Reviews of people who have already used this loan product

Eleanor from Khabarovsk shared her experience in mortgage lending:

“I have extensive experience in mortgage lending at Sberbank of Russia under the Young Family program. First, we built a one-room apartment with the money from this loan, then we sold it and took out a loan for a three-room apartment. Now we live in it, another 100 thousand, and it is ours.

The Young Family program does not provide huge advantages; the interest rate is the same, but the down payment can only be 10% (under general conditions 15%). You can take it without any money at all, but with a maternal certificate. The interest rate at Sberbank is not the lowest, but there are no hidden fees and expensive insurance, so it still ends up being cheaper.”

Alexander from the city of Ust-Ilimsk:

Among the advantages of a mortgage loan, “Young Family” notes quick processing and the ability to submit an application online, and among the disadvantages is mandatory life and health insurance.

And here is what Polina writes from Moscow:

“Having your own apartment is quite possible. A “Young Family” mortgage is not so scary if you objectively assess your capabilities. We took out a loan for 10 years, initially paid 15 thousand, but for the last six months we have been paying 5 thousand. I advise everyone who has taken out a mortgage to save up a hundred thousand and deposit it into the account, the amount of the monthly payment is significantly reduced.”

For a better understanding of the situation on mortgage products for a young family, we present to your attention a conversation with a mortgage consultant of one of the leading developers in the South of Russia, Alena Savilo:

How to buy an apartment as a young person

The most pressing problem for newlyweds is the housing issue. Many couples live with their parents in a small apartment, some spend money on rented living space. Mortgages for young people have become one of the main options for solving the housing problem. Not everyone can take out a regular mortgage, since it is quite expensive for the newlyweds’ budget, especially if there are children. In such a situation, a government program aimed at supporting young families will help.

There are two ways to buy a home with a mortgage:

- contact the bank on general terms;

- become a participant in a state project to support young families.

The difference between these options is significant: banks need to overpay a considerable amount for using a loan, while the state provides assistance free of charge. To receive a government subsidy, you must meet all the requirements and conditions of the program. The married couple must be recognized as in need of improved living conditions.

Read more about it in our previous post “Social Mortgage”.

There are several formats of social mortgage:

- subsidies in the form of partial coverage of the cost of an apartment purchased on credit;

- provision of affordable municipal housing at a discounted price, which can help you save significantly (subprogram “Affordable Housing for the Russian Family”);

- reduction of mortgage rates due to partial coverage by the state, including interest-free mortgages for young families.

In various regions there are special programs aimed at assisting young married couples in solving the housing problem. For more information, please contact your local government and housing authorities.

In order to attract customers, banks can also offer preferential terms for mortgage lending for young families:

- reduced interest rates;

- minimum down payment or no down payment;

- deferment of monthly payments without imposing penalties at the request of the client (if children were born);

Mortgages for young families in 2021 are available on preferential terms in large state banks.

As a result, preferential mortgages are available in two formats:

- With state support (social mortgage and affordable housing program for Russian families).

- With bank support (mortgage loan for a young family).

The first option involves a lot of red tape and the need to contact government agencies. The second option is much simpler, but most likely will bring slightly less benefits in material terms.

As a result, in order to become a participant in mortgage lending and take out a mortgage loan, a young family needs to complete several steps:

How to get a mortgage for a young family with the help of the state:

- gain the status of those in need of improved living conditions;

- participate in the “Young Family” program and become the owner of a certificate confirming your right to a preferential mortgage;

- Get a mortgage.

If a youth mortgage is issued directly through a bank, you need to select a suitable organization, familiarize yourself with its current lending conditions and conclude an agreement on a specific program.