VTB is a universal commercial bank in Russia. The company is always happy to offer its clients a wide range of services. VTB's mortgage lending program is of particular interest to clients. For most families, the issue of improving living conditions is a priority. However, not every family has the opportunity to purchase a home with their own funds. There is a need to find a reliable lender. Today, the VTB financial organization is distinguished by its honest internal policy. Employees avoid the practice of charging hidden commissions. The terms of each transaction are as transparent as possible. This is why mortgages from VTB Bank attract a large number of borrowers.

The essence of mortgage lending from VTB

This banking product has many advantages, thanks to which the customer base is constantly expanding:

- The mortgage is issued as quickly as possible. There is no additional fee for speed.

- It is possible to obtain a mortgage without providing a certificate of income.

- Special lending conditions apply to employees of municipal organizations and government agencies.

- When purchasing housing in a new building and on the secondary market, interest rates are set at the same level.

- Mortgages are issued for various types of residential real estate

- An approved application is valid for four months.

- Registration is not required in the region where the mortgage is issued at the VTB Bank branch.

If we compare other participants in the financial market, the interest rate at VTB is set at an average level. When repaying a debt, payments may be made in equal installments.

Features of mortgages at VTB

Mortgage lending programs at VTB have a number of advantages, thanks to which the bank chooses a large number of clients:

- quick mortgage processing without increasing the rate;

- the ability to get a mortgage without proof of income;

- there are special offers for workers in socially oriented areas, state and municipal employees;

- rates for primary and secondary real estate are the same;

- wide choice of real estate: apartment, apartment, townhouse, private residential building;

- you can use maternity capital;

- cashback available up to 5,000 per year and savings of up to 0.3% interest rate using a Multicard;

- long term of approval – 4 months;

- There are no requirements for registration in the region where VTB mortgages are issued.

At VTB, rates are kept at an average level compared to other participants in the domestic banking sector, and do not change by region. Unfortunately, you cannot choose between annuity and differentiated payments; the borrower will automatically have the repayment calculated in equal (annuity) payments.

Interest rate for VTB mortgage lending

This financial institution offers a large number of mortgage programs. The minimum rate starts from 2%, this value is used in the Far Eastern Program. The maximum value will be when purchasing a private house - 8.5%.

However, these indicators may change given the dynamics in the financial and housing markets. Therefore, current information about VTB loans can be found on the company’s official website.

When the interest rate can be changed

The interest rate can be changed either up or down for the following reasons:

- If the down payment is less than 20%, then the interest rate increases by 1% of the base value.

- When the borrower refuses to purchase comprehensive insurance, the rate increases by 1%.

- VTB offers a mortgage at 7.9% when purchasing a new or secondary home. However, you must make a down payment of 50% of the total cost.

- Favorable terms of cooperation are offered to public sector employees and government agencies.

- VTB salary card holders have preferential conditions when applying for a mortgage.

A certificate of income will not affect the interest rate.

What benefits do VTB Multicard owners receive when applying for a mortgage?

This card provides an opportunity to save when signing a mortgage agreement from VTB. Not only can you make your monthly mortgage payment, but you can also make day-to-day payments at various points of sale.

To save money on your mortgage payment, you need to do the following:

- Submit an application for a VTB Multicard.

- Activate the “Borrower” function.

- All payments under the mortgage agreement must be made using the card received.

Important! When paying off a mortgage loan, up to 5,000 rubles per year is returned to the borrower’s account.

How to get a mortgage at VTB24

If you decide to become a VTB24 borrower, then you need to know how to get a mortgage, where to apply and what documents you need to bring.

It will be useful to view:

Borrower actions

The borrower will have to do the following:

- Select a suitable program and check your compliance with the specified requirements;

- Contact the mortgage lending center (contact the mortgage loan support department) or submit an application on the VTB24 website;

- Wait for it to be reviewed . You will receive the answer in the form of SMS (you indicate your phone number in the application). If the message does not arrive for more than 5 business days, you should call the bank and clarify information about the loan. The hotline telephone number is listed on the bank's website;

- Collect all the necessary documents and contact the nearest bank branch;

- Apply for a mortgage by signing a loan agreement ;

- Make a down payment if required by the terms of the program;

- Register your right to a property in Rosreestr.

Required documents

If your application has been approved, then it is worth collecting a certain package of documents. These papers must confirm your financial condition and compliance with all bank requirements.

Of course, this list does not apply to the two-document mortgage program. In other cases, a standard list will still be needed.

Namely:

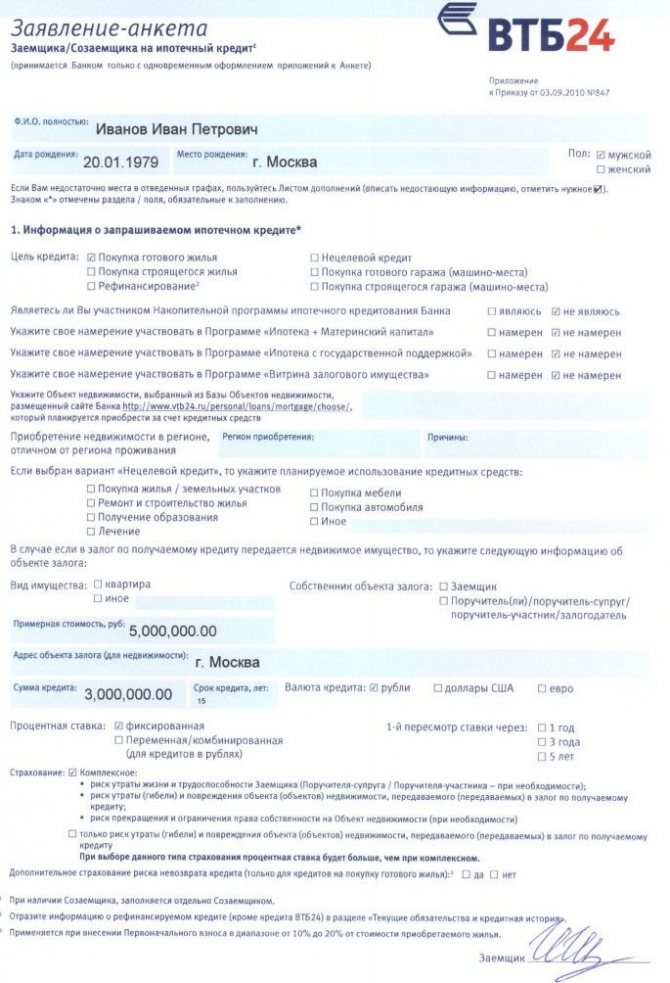

- A completed application form;

- Identification;

- Individual account insurance number;

- Certificate on 2-NDFL, with information for the last year (only for legal entities and individual entrepreneurs);

- Military ID (for men under 27 years old).

Photo gallery:

Application form Passport

Insurance certificate

Certificates 2-NDFL

Military ID

Note! Along with this, you should be prepared for the fact that the lender may ask you to provide additional documents. This is a standard practice of any bank, which is used if it is necessary to clarify additional information about the income, social status or marital status of the borrower.

Down payment amount for mortgage lending from VTB

It is important for the borrower to know the basic conditions for making a down payment:

- The down payment must be at least 10% of the total value of the property.

- When making a down payment of less than 20%, the interest rate increases by 1%.

- Owners of maternity capital must contribute at least 10% of the total cost of housing.

- If the borrower is ready to contribute more than 30% of the total amount, then the agreement can be signed without a certificate of income level.

- An express loan service is available to borrowers. This procedure is performed within 24 hours. However, a down payment of at least 30% must be made.

- When making a down payment of 50%, a minimum interest rate may be set.

- When the borrower participates in the government program, the size of the down payment does not affect the interest rate in any way.

All the necessary information about mortgage programs

The bank's conditions are extremely simple for anyone who wants to borrow a certain amount of money from VTB.

The bank provides several mortgage programs to individuals:

- Classic program. Purchasing living space (in a new building or a finished house). This VTB mortgage is issued under an agreement for purchased premises in the primary or secondary market. The maximum amount issued by the organization is 30 million rubles. But only on the condition that the borrower can pay such a large amount of money monthly.

When obtaining a mortgage to purchase real estate in a new building that was previously accredited, the procedure is simplified significantly. For accreditation, managers of selling companies invite the client to a transaction in order to sign an agreement and make a down payment. When purchasing a secondary home, registration takes a little longer. After all, for this you need to evaluate the property from a specialist and collect all the necessary documents about the owner’s rights to sell it.

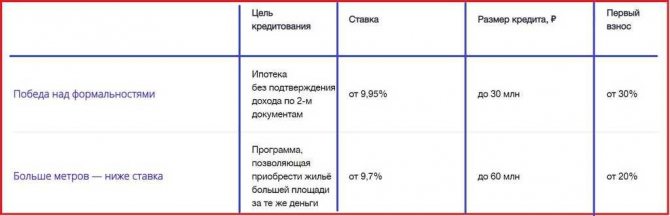

- The higher the meters, the lower the rate. These VTB mortgage conditions have been created for borrowers purchasing real estate with an area of 65 m2 or more. For borrowers, the bank provides a tariff at a low rate, which ranges from 10% per year. In addition to the difference in tariffs and a down payment of 20%, the terms of the program are similar to the classic mortgage option.

About when it is still possible to reduce the VTB mortgage rate - in detail in another article.

- Mortgage with a minimum set of documents. This program allows you to draw up a loan agreement without any particular difficulties for the client. When submitting an application, the conditions for a VTB mortgage based on two documents (RF passport, SNILS) are quite flexible, because every adult citizen of the Russian Federation can fulfill them.

But this program has a drawback - a high initial payment of 40%, and you will also have to pay an additional 0.5% to the annual rate.

- Housing on bail. Applying for mortgage lending is easy, since VTB previously checked all the documents, having also assessed the property. Typically, this mortgage is popular with clients whose property is pledged for sale. Such housing is collateral for problem lenders whose borrowers did not have time to pay the monthly installment and became in arrears.

Recommended article: Escrow account, what is it in simple words and how will the mortgage transaction proceed?

- Mortgage with state support from VTB for military personnel. Mortgage lending is provided for a period of up to 14 years. And in 2021 there was a reduction in rates at 10.9% per annum. Therefore, the design of the program has become extremely profitable and widespread among citizens of the Russian Federation.

- Mortgage refinancing program. Transferring a loan taken to another bank with the most suitable conditions for the client is a unique opportunity at VTB Bank. The annual rate starts from 10.7% for those who are participants in the salary project and for those who have taken out comprehensive insurance.

- Mortgage young family VTB. The terms of the VTB mortgage with maternity capital are used when applying for any mortgage program the client likes for the purchase of real estate. For a down payment, when repaying a new or existing loan, VTB allows the use of certificates.

What mortgage programs with state support does VTB offer?

This financial institution has developed a number of mortgage programs with state support. It is worth considering that in this case the conditions and interest rate will be more favorable compared to other bank programs.

This year the following mortgage lending programs are presented:

- Mortgage with government support at 6.5% per annum. This offer is valid for all borrowers. However, provision is made for the purchase of housing from a legal entity that acts as a seller.

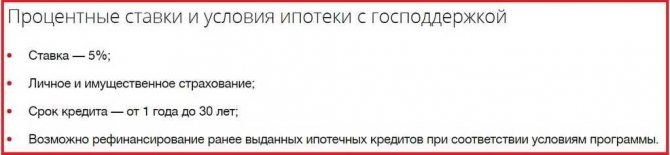

- Mortgage with an interest rate of 5% for those families where the birth of a second or subsequent child took place between 2018 and 2021.

- Mortgage under the Far Eastern program at a minimum rate of 2%. Provided for those citizens who plan to purchase housing in the Far Eastern Federal District.

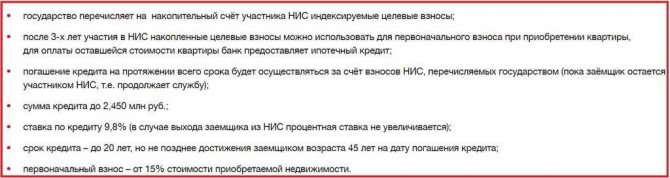

- Mortgage for military personnel participating in NIS at 8.5%.

VTB offers quite a few mortgage programs.

Mortgage programs

VTB 24 offers its clients two standard mortgage lending programs: Mortgage for a new building and Mortgage for a secondary home. In addition, two special programs are available to all categories of citizens:

As for preferential categories of citizens, VTB 24 operates a mortgage lending program for military personnel. It can be issued under the following conditions:

For persons with two or more children, at least one of whom was born between 2021 and 2022, VTB 24 has a mortgage program with state support. You can receive it under the following conditions:

In addition to the programs listed above, borrowers have the right to apply for a consumer loan secured by real estate from VTB 24.

What are the requirements for the borrower?

VTB sets fairly standard requirements for future borrowers:

- The bank is ready to sign a mortgage agreement only with a citizen of the Russian Federation.

- Availability of Russian registration.

- The minimum age of the borrower is 21 years.

- The upper age limit is set at 75 years. But this does not mean that an agreement will be concluded with citizens of this age. The borrower must close the mortgage agreement before he turns 75 years old.

The spouse will act as a mandatory guarantor. This does not even require Russian citizenship. Also, the bank is ready not to take into account the minimum income of such a co-borrower.

What are the requirements for the property?

The bank sets requirements not only for the borrower, but also for the purchased property. VTB is ready to approve a mortgage if the property is purchased from accredited developers.

If the property you like is not included in the bank list of developers, then you need to start collecting all the required documentation. The list of documents can be obtained from a bank employee. The prepared package of documents must be sent to the bank for accreditation.

If we are talking about purchasing secondary real estate, then it must be free of encumbrances. All legal issues regarding the purchased apartment will be examined by the bank. To do this, you need to transfer a complete list of documents to the facility. In this case, the selected property must be suitable for living. The building itself must strictly meet the requirements for accident-free housing.

Valuation of real estate

A prerequisite for obtaining a loan is to carry out appraisal activities. This procedure is performed only by accredited specialists who have the appropriate education and permission to conduct such activities.

As a rule, the bank offers a whole list of appraisers who can evaluate a mortgaged apartment. If the borrower decides to use the services of an appraiser who is not listed on the bank list, then there are several rules to remember. It is recommended to consult with a bank employee in advance regarding the selected specialist. Perhaps the bank already has positive or negative experience with this appraiser.

Important! An incorrectly conducted examination will not be accepted. The assessment will have to be re-ordered. The borrower must pay for each procedure.

How to apply for a mortgage at VTB Bank

To apply for a mortgage you will need to complete the following steps:

- Go to the company’s official website and fill out an online application for a loan.

- Submit the completed form for initial approval.

- Next, you should wait for a call from a bank employee.

- If the decision is positive, the client will be assigned a date and time to visit a VTB Bank branch.

- When visiting a financial institution, you must have a complete package of documents with you to complete the transaction.

- After the meeting with the borrower, the bank will consider the application within 5 business days. If the client receives preliminary approval, then he has 4 months to search for real estate. Once this time has expired, the application will no longer be relevant. In this case, you will have to repeat all the steps to complete a new application.

- If the property has been found, you can begin collecting documents.

- On the designated day, you must appear at the VTB Mortgage Center to complete the transaction. Participants will have to sign a contract for the purchase of housing, as well as a mortgage agreement.

- Next, the signed documents must be submitted for registration to the MFC.

- In just a week, the buyer will become the full owner of the apartment. However, the purchased property acts as an encumbrance when applying for a mortgage. If the terms of the agreement are violated by the borrower, ownership of the apartment is transferred to the financial institution.

- As a final stage, settlement is made with the seller of the apartment.

After obtaining a mortgage, the borrower should not forget about the timely fulfillment of debt obligations under the contract.

Registration of a mortgage

To take out a mortgage at VTB you must:

- Fill out the online application (link to the official website). After the initial processing, your personal manager will call and make an appointment at the mortgage center.

- You need to bring the documents listed above to the office.

- After 1-5 business days, the bank will send a preliminary approval, which is valid for 4 months.

- Within 4 months, you need to decide on the property and collect documents for it, which the VTB manager will request.

- On the day of the transaction, you need to sign a real estate purchase agreement, a mortgage agreement and submit documents for registration to the MFC.

- After 7-9 days, the ownership will be registered in the name of the buyer, and the encumbrance will be registered with VTB, after which settlement with the seller will take place.

After completing all formalities, you can begin repaying the mortgage according to the established schedule.