Not every family can solve the housing problem on their own. It is no coincidence that such a banking service as lending does not lose its popularity. Documents for obtaining a mortgage for an individual require the closest attention of those who want to get their application approved. Their number is quite impressive, which is easily explained by the bank’s desire to maximally insure its risks when issuing such a large and long-term loan.

What documents are needed to get a mortgage in 2021?

When setting requirements regarding what documents are needed for a mortgage, the bank is guided by the following motives:

- the desire to obtain confirmation of the client’s solvency and the stability of his financial position in order to verify his ability to fulfill his obligations;

- assess whether the property selected for acquisition, which also serves as collateral, satisfies the bank’s requirements.

In this regard, the list of documents for all banks is extremely similar. Obviously there are differences. However, even if you have not yet decided which credit institution to contact, you can start by collecting standard documents that will be needed in any case. For many organizations, it is enough to provide only a passport. However, mortgage documents to private lenders may also include:

- SNILS or INN;

- certified copies of the work book;

- confirmation of income level - certificate in bank form, 2-NDFL;

- marriage certificates (for married couples) and birth certificates of children (when using maternity capital funds).

For employees receiving payment as part of a payroll project, proof of income is generally not required. For individual entrepreneurs there is a separate requirement: you need to submit 3-NDFL.

If we talk about personal documents of a potential bank client, these include the following:

- passport or other identity document;

- a second document to choose from the proposed list (most often a driver’s license is used in this role);

- military ID is mandatory for men under 27 years of age;

- for spouses - a marriage certificate and a marriage contract, if available;

- if there are children, a birth certificate for each of them;

- certificates of state pension insurance;

- for participants of special programs aimed at workers in certain fields of activity - documents confirming the availability of appropriate education.

Basic requirements for the borrower

- Nationality: does not matter;

- age: from 21 years old at the time of signing the agreement and no more than 65 years old by the time the loan is fully repaid;

- employment: the borrower can be an employee, an individual entrepreneur, a founder or co-founder of a company;

- military ID: not required;

- co-borrowers/guarantors: up to three people can act as co-borrowers - relatives or third parties.

The final decision on the borrower's compliance with the bank's requirements is made based on an analysis of the submitted documents. The loan application is reviewed within three working days from the date of submission.

For a young family

Programs for young families should not be confused with government subsidies. This mortgage offers a loyal interest rate and a long period of full repayment. Typically the following documents are required:

- passports of both spouses;

- marriage certificate;

- children's birth certificates.

The bank may require proof of income and official employment. You will need 2-NDFL, a bank account statement or a certificate similar to a financial institution.

List of documents for obtaining a mortgage

To apply for a mortgage loan, you must provide the bank with a passport, work record, certificate of employment and other papers. Often, a military ID, marriage certificate, birth certificates of minor children, even certificates from previous creditors are required. To obtain a mortgage at Rosbank Dom, the following documents are required:

- Passport. It is necessary to have permanent or temporary registration, but it is more likely to get approved for a mortgage with permanent registration. Photocopies of all pages are required.

- Income documents: a certificate in the bank form or in the 2-NDFL form, for business owners - tax returns established by law, depending on the taxation system, and management reporting. A certificate of income for individuals (2-NDFL) is issued by the employer.

- A copy of the work book with all completed pages, certified by the employer, a certificate in the prescribed form for military personnel.

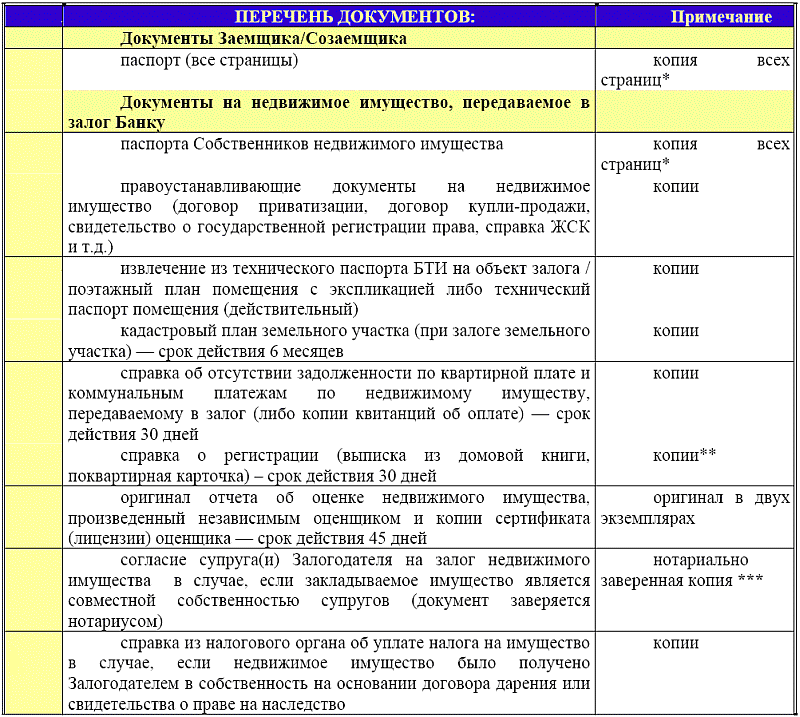

Package of documents for a mortgage on real estate pledged as collateral:

- Title and title documents for real estate: information from the Unified State Register of Real Estate, certificate of ownership (if available), supporting documents.

- A property valuation report from an appraisal company chosen by the borrower, drawn up in accordance with the legislation of the Russian Federation.

- Technical/cadastral documents for real estate for a mortgage loan. An application for the issuance of the necessary certificates is submitted to the Registration Chamber of Rosreestr. The application can also be submitted through an MFC employee.

- Copies of passports or birth certificates of real estate sellers.

Additional information that may be needed when applying for a mortgage

It should be borne in mind that sometimes the initially announced list of documents may not be enough. In the process of making a decision on a loan, the bank may need additional information. In this case, he will ask for the required information. For example, it may concern the financial situation, as a result of which it will be necessary to provide documentary evidence of the presence of real estate, expensive property, bank account statements, and so on.

The more documents confirming your income are provided to the bank, the higher the chances of receiving a mortgage loan.

Among the likely additional official mortgage documents, 2 documents are usually requested:

- SNILS;

- TIN;

- international passport;

- driver license;

- certificates confirming income.

What documents remain with the Buyer after purchasing an apartment?

The seller does not need the entire list of documents remaining after the purchase and sale transaction of the apartment. The only thing he should keep for himself (and even then not for long) is his copy of the Sale and Purchase Agreement, which was returned to him from Rosreestr after registering the transfer of rights under the transaction. For what?

This is interesting: Power in the Transition to Industrial Development

What is given to the Buyer after registering the transaction of purchasing an apartment with a mortgage? In addition to the documents listed above, he still has in his hands the original loan agreement with the bank (with the amount, term and conditions of the loan issued). A copy of this agreement is kept in the registration file.

What documents are needed to buy an apartment with a mortgage?

Almost all banks in Moscow are ready to offer you their services. But which bank should you choose? What loan program? Everyone chooses for themselves, the main thing is to purchase a quality product, because no one wants to stumble upon a “black” apartment, for which a trial could begin at any moment due to the dubiousness of the documents on the basis of which the transaction was made.

This is interesting: What is the Living Minimum in Moscow for Pensioners in 2021

Note:

The cadastral passport contains the item “Physical deterioration of the building.” It should not exceed 60%. If this value exceeds the permissible norm, then such a structure is recognized as unsafe and is subject to major repairs with the resettlement of residents or demolition.

Buying an apartment: what documents should be required from the seller

There is a mandatory package of documents required for verification so that in the future a person can live peacefully in his apartment. It is worth paying attention to the aspect that the responsibility for conducting a good faith inspection lies entirely with the potential buyer.

- The premises are not used as a rental property . The owner has the right to put the apartment up for sale at any time. If the premises are leased, the owner is obliged to terminate the contract or notify the other party of the intention to sell. In case of payment of the full amount for the use of the premises, the tenants have the right to use the apartment until the end of the contract.

- The apartment is not encumbered with collateral obligations . When drawing up a loan agreement to receive a large amount of cash, the borrower is required to provide collateral as a prerequisite for the loan. You can check the information on the Rosreestr website.

- Housing is not subject to seizure . The procedure is carried out by the judiciary if the owner has a large debt to pay utility bills or pay off loan obligations. An apartment or house that is under arrest cannot be sold to another owner. This becomes possible only after it is removed. Any transaction is considered invalid.

- Does not appear in the court hearing as a subject of dispute.

This is interesting: How much is the payment for travel on public transport for children from large families in Tatarstan?

Buying an apartment through a mortgage: a complete lending scheme

First you need to determine what kind of property you are going to purchase and find out the average market value of such an apartment. For example, it could be a two-room apartment, without renovation, 5-10 minutes from a transport stop. You should not immediately look for an apartment on the real estate market - this is one of the main mistakes of potential borrowers. At this stage, it is important to determine the approximate cost of this type of housing.

After submitting the application, the bank makes a preliminary decision on the loan within 2 to 7 days. A positive decision lasts for different periods of time - from 1.5 to 4 months. During this period, you need to find an apartment that you will buy with a mortgage.

12 Jun 2021 uristlaw 469

Share this post

- Related Posts

- Help for young families in 2021 in Dagestan

- How to Reflect the Saved Earnings for the Days of Blood Donation in 6 Personal Income Tax

- Kbk land tax for legal entities 2020

- How to View the Income of Civil Servants on the Federal Tax Service Website

What documents are needed when buying an apartment with a mortgage?

- about education;

- confirming the presence of real estate, deposits, and other assets;

- employment agreement (contract);

- Marriage (divorce) certificate;

- certificate of the amount of preferential pension for 1 month (from those who have not reached retirement age);

- tax return (if individual entrepreneur);

- contracts confirming income from the rental of real estate (rent)

- Certificates of state registration of property rights;

- The document according to which he purchased housing (see Certificate);

- reference data of the object from the BTI (accounting, inventory value;

- a copy of the apartment card, which will show whether everyone has been discharged, but there is no information about who has the right of lifelong residence;

- Certificate for sale (not required by Rosreestr), no debts for housing and communal services);

- certificate from the DEK (not required for a mortgage, no debts for electricity);

- extract from the Unified State Register;

- certificate from the pension fund on the use/non-use of maternal capital;

- certificate with PND and ND

Technical passport and technical plan - what is the difference

Owners often carry out reconstruction of real estate - redevelopment of premises, major repairs with replacement of building materials, changing the number of storeys of a residential building. Such work must be accompanied by obtaining permits from specialized organizations to carry out construction work and require the preparation of design estimates, an important part of which is the technical plan of the facility (requirements for the technical plan -).

Recommended article: Extract from the house register for a mortgage - how to get it?

It is performed by licensed design organizations; a plan is prepared based on the technical passport. After completing the reconstruction of the facility and putting it into operation, the owner orders a new registration certificate for the house or apartment. This is justified. In the case of mortgaging a reconstructed property, it is advisable to have a current technical passport for the bank's mortgage.