Find out on our website about the features of exchanging privatized and municipal apartments, how to exchange old apartments for a new building, and also whether it is possible to exchange a mortgaged apartment.

Concept

By agreement, a person exchanges the housing he owns for another housing or other things (garage, land, car).

If the exchange is unequal, one of the participants pays the difference in value in money .

In the text of the contract, the cost of the apartments is indicated only in rubles, even if one party actually transfers currency to the other.

Such an agreement is concluded only in relation to an apartment owned . When exchanging non-privatized housing, when it comes to exchanging the rights to conclude a rental agreement, the transaction is governed by other legal norms.

The rules governing exchange relations are contained in Chapter 31 of the Civil Code of the Russian Federation. According to Article 567 of the Civil Code of the Russian Federation, the rules of Chapter 30 are applied to this agreement, which do not contradict Chapter 31 and the essence of the exchange action. In this case, it is considered that the parties to the agreement are both the seller and the buyer.

An overview of judicial practice in this area is given in the letter of the Presidium of the Supreme Arbitration Court of the Russian Federation No. 69 dated September 24, 2002.

You can learn about how to exchange a three-room or two-room apartment, how to change a room in a communal apartment or dormitory, as well as in what cases a forced exchange is carried out through the court from our articles.

What is it needed for?

Why is it necessary to conclude an apartment exchange contract with an additional payment?

One party enters into an agreement to improve living conditions with minimal costs and inconvenience.

The second side sees the benefit from it in the opportunity to receive a significant amount of money at a time and reduce utility bills when living in a smaller apartment.

There are pros and cons to the acquisition/sale of housing by concluding such a contract, instead of a purchase and sale transaction.

Find out what documents are required to exchange an apartment, as well as whether it is possible to exchange a room for a house and land, from our articles.

pros

Reducing the risk of fraud on both sides. Under such an agreement, the participants immediately receive what they want with a guarantee; whereas in case of counter purchase and sale, the terms of registration of transactions do not coincide, which is successfully used by swindlers.

There are a number of fraudulent schemes, as a result of which a person is left without an apartment and without money. This happens especially often when citizens, in order to save money, ignore the services of realtors and try to make transactions on their own.

When a person sells an apartment to another person and intends to buy from a third person, this is also associated with risk . Money is subject to inflation, and in recent decades we have encountered cases where it was sudden and rapid.

In the nineties, in 2008, 2014, we had situations where, shortly after the sale, it was impossible to buy housing of the required quality with the proceeds from a previously sold apartment.

On the other hand, apartments during a crisis are difficult to sell for an acceptable amount, since buyers do not have enough cash for this.

When moving, a person is faced with the problem of adequately assessing the purchased housing : he does not know enough about the features of life in another city. If you rely on prices published in newspapers, you may get a different situation on the spot.

Creditors with the help of bailiffs and debt collectors can claim the money received from a purchase and sale transaction: tracking such a transaction is not difficult, while the only home a person cannot legally take away .

Finally, there is a category of citizens for whom it is simply impossible to resist spending cash when it is already in their hands. An exchange agreement with an additional payment allows you to “settle” the listed problems.

Tax benefit . If a party sells housing purchased less than three years ago, he is obliged to include income from the sale in the year-end declaration and pay income tax on the declared amount.

In an exchange transaction, tax is paid only on the additional payment, which, by agreement of the participants, can not be indicated in the document or written down in the text in a symbolic amount, but the real amount can be transferred from hand to hand.

Such an agreement is an ideal solution to housing problems between relatives . With age, the parental family has shrunk to two people; she no longer needs a large apartment, for which she also has to pay ever-increasing utility costs. Children got married, grandchildren appeared, but for now young families live in a modest two-room apartment or studio.

The difficulties of relocation and temporary residence are eliminated. For citizens with a family or valuable property, the sale of apartments threatens the prospect of temporary rental housing while they search for a suitable purchase option. If the search drags on, this will lead to a long-term deterioration in the standard of living. The barter agreement eliminates this problem.

Minuses

The exchange option takes much longer to search for than the purchase and sale option. This is especially true for non-resident exchanges: the probability that a resident of the locality you need needs to move to your city is in some cases close to zero.

to agree on the amount of additional payment for participants.

In some cases, it is influenced by non-market factors, for example, the need for an urgent move.

It is difficult to establish an adequate market value of the exchanged apartments: published advertisements for the sale of similar housing express only the desires of sellers and buyers. The prices of real transactions remain behind the scenes.

Exchange, compared to buying and selling, narrows the choice . The parties have to move not to the optimal area of the city from their point of view, but to the one where the exchange is offered.

If a participant purchases housing for the first time, the purchase allows her to make a tax deduction of the personal income tax base in the amount of the transaction amount. In the option under consideration, she will receive such a deduction only from the amount of the additional payment.

An exchange agreement gives both participants additional rights compared to the sale and purchase. Within three years after its conclusion, any of the parties can change their mind and make claims against the counterparty, seeking not only its cancellation, but also reimbursement of their expenses.

After weighing all the pros and cons, make a decision.

Exchange agreement with additional payment

In the absence of an indication of the need for additional payment, both real estate objects are considered equal by default. If the property is not equal in value, then the contract must contain data on the amount of additional payment if it will be made in cash or data on other property.

In the first case, the exact amount reached through negotiations between the parties is indicated. It is indicated in digital form with a mandatory written decoding and indication of the monetary unit.

If the additional payment is made by transferring rights to other property, then the data on it must be reflected in the contract, including the following information:

- Full name.

- Exact amount.

- Documents confirming the right to own this property.

- Location address if the additional payment is another property, including non-residential premises.

- Other data confirming the quality, quantity and value of this property.

Exchange agreements with additional payment can be found here.

Form requirements

The housing exchange agreement is drawn up in writing. Notarization is carried out at the request of the participants.

Contents : what is included in the contract? Participants indicate the individual characteristics of the exchanged apartments, things, the amount of additional payment, the procedure for making it, the timing of relocation, and other details important for the parties.

Essential conditions:

- subject: which particular apartment (indicating the address, technical characteristics) is changed to another (also indicating individual characteristics) or things (with individualization);

- amount of surcharge.

Without specifying these conditions, the agreement is considered not concluded.

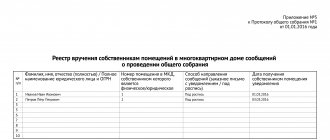

The exchange agreement itself and the transfer of ownership of the participants are subject to mandatory state registration

Law Club Conference

2.2. The Party that has received from the other Party a requirement to conclude the Main Agreement is obliged, within 14 working days, to provide the other Party with the documents necessary on its part to sign the Main Agreement, as well as state registration of the transfer of ownership of the Apartments, and sign the Main Agreement, including the following documents:

And maybe someone else has come across that now the consent of the guardianship and trusteeship authorities is not required if an apartment in which a minor is registered is alienated. In our country, the conditions of the minor are worsening, which could threaten later, but now we are not violating anything.

Rights and obligations of the parties

In this case, each participant is the seller of the apartment and is obliged to transfer it, and the buyer of the apartment is obliged to accept it. Each participant is obliged :

- Transfer the apartment(s): free from the rights of other persons; with all equipment, documents; in the quantity specified in the agreement; exactly the one specified in the agreement; acceptable quality; with door, glazed windows and keys; in the agreed configuration.

- Report any violation of the terms of the agreement within a reasonable time.

- Accept the transferred housing.

Responsibility of the parties

The contract must stipulate what liability the parties bear in case of non-fulfillment or improper fulfillment of the agreement. But the clauses of the contract should not contradict civil law.

If one party does not transfer the property within the prescribed period, then the second party to the transaction has the right:

- refuse to fulfill your obligation;

- demand the return of the transferred object;

- demand compensation for losses incurred as a result of the transaction.

The parties to the agreement have the right to establish financial liability for the transfer of goods later than the period specified in the agreement.

If the owner has transferred goods that are not free from the rights of other persons, then the second party may:

- ask to reduce the cost of the subject of the contract;

- demand termination of the agreement and compensation for losses caused by the transaction.

When one party transfers property of poor quality, the other has the right:

- demand a reduction in the price of the object;

- ask for deficiencies to be corrected;

- demand reimbursement of expenses if you had to fix the defects yourself;

- ask to replace the subject of the contract;

- demand termination of the contract.

Thus, an exchange agreement is a transaction during which the parties exchange property with the subsequent transfer of ownership. It is similar to purchase and sale, but only one party in return transfers not money, but an equivalent object.

Features and nuances

The ownership right passes after both participants fulfill their obligations for the mutual transfer of apartments (things), unless otherwise stated in the agreement or law.

When the party to the contract is married, and the apartments and other items of the agreement are, by law, the common property of the spouses (acquired by one of them during marriage for compensation), the consent of the other spouse, certified by a notary, is required to conclude the contract.

The conclusion of the agreement is carried out in the following sequence: The parties inspect the exchanged apartments and things, making sure of their suitability for use. Participants, with the help of a lawyer, draw up the text of the contract.

Participants register the agreement in Rosreestr.

Participants pay/accept additional payment and move. Each party registers its ownership of the housing purchased under the contract with Rosreestr.

If a party does not take steps to re-register property rights as specified in the registered exchange agreement, the injured participant has the right to demand re-registration through the court .

Main features of a barter agreement

- The principle of the transaction is the transfer of property in exchange for another object.

- After the transaction is concluded, ownership passes to the new owner.

- Counter representation: the owner, selling his property, receives income in the form of a new property.

- Additional income in monetary terms may arise.

- The change of owners occurs simultaneously after all the terms of the agreement have been fulfilled (or in a special manner agreed upon in advance).

- If the transaction is unequal, when the assessed value of the objects is different, an exchange agreement is concluded with the terms of additional payment.