What does seizure and collection of funds on a card mean?

Information about the seizure of a card or account does not appear just like that. Most likely, the day before the client received warnings about the presence of financial claims from dissatisfied collectors, and then the bank sent by mail an order to force the claim to be satisfied at the expense of the money in the accounts, cards and property of the debtor.

If you have access to Sberbank Online, it is not difficult to view information about the changed status of the plastic. It is important to understand what consequences this or that restriction will lead to. The Sberbank website contains a lot of explanatory information on how to resolve the problem and how to act in relations with the bank in the future:

- collection – involves reducing or resetting the balance of the debtor’s account on the basis of an existing resolution and enforcement proceedings;

- arrest - restriction of the rights to use the debtor’s funds placed in the bank, but does not provide for write-offs.

Sberbank is the first bank that the bailiff will contact, identifying the accounts and cards of the person against whom a court decision on forced collection has been made. After information about the presence of Sberbank accounts appears in the bailiff’s database, the financial institution will be sent a resolution according to which the bank will write off all or part of the debt and prohibit the client from spending the funds. Sometimes they do without going to court if the claimant directly contacts Sberbank and presents a writ of execution.

The tax authority can impose an arrest if there are claims against the taxpayer, but to write off funds, the order of the Federal Tax Service is not enough - you will need to obtain, at a minimum, a court order.

Sometimes the debtor does not agree with the arrest for a variety of reasons. To cancel a seizure or foreclosure, it is necessary to find out who initiated the restrictive process. If the initiator of the restriction has no more claims, the bank will lift the ban on expense transactions only if it receives confirmation from the bailiff, court, or the creditor himself simply cancels the sanctions. Law No. 229-FZ establishes the boundaries of the bank’s powers, and canceling the arrest is not one of them.

Sberbank has a practice of filing writs of execution bypassing bailiffs. Collection is carried out by the person who has filed a claim against the debtor:

- If it is an organization or individual entrepreneur, the bank’s system offers to track the status on the website, or use a single toll-free number. You can also set up a notification based on the cell phone number specified by the collector.

- If the debtor is an individual, the collection is monitored through the website, or the collector asks to send information by mail.

When submitting a writ of execution through the bailiff service, information is received via a toll-free telephone number or by number when calling from Moscow.

General characteristics of collecting money under a writ of execution

Employees of the judicial system can withdraw money from the user’s account based on an application to the bank for the collection of funds under a writ of execution. The internal regulations approved the rules for preparing the necessary documentation for withdrawing funds from a Sberbank client from the debtor’s account.

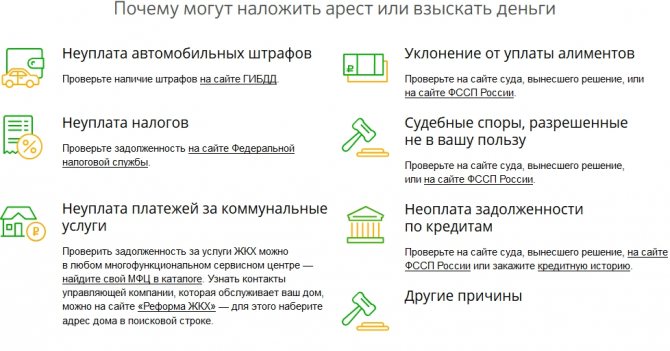

Reasons for collecting funds from the card

Users whose obligations are fulfilled on time have nothing to worry about. But it happens that they are unaware of the existence of a debt and the need to pay it.

Common causes of debt:

- outstanding fines from the traffic police;

- tax avoidance;

- alimony debt;

- debts for utility bills;

- late loan repayment;

- court decisions in various cases (for example, payment for moral damages or compensation).

If a writ of execution exists, the bailiffs have the right to seize the account. The write-off is carried out strictly according to a specific procedure with the execution of the relevant papers. Without a court decision, Sberbank does not have the right to withdraw money from the client’s account.

The user will be notified via text message that the money has been seized based on a court order. If you do not understand the reason for the arrest, it is recommended to go to the official page of the court and find your case. The number is indicated in the SMS. Study the details and details: who is the plaintiff, what is the total amount of the claim.

The measures applied to funds in the account are as follows:

- Arrest. Bailiffs can block the entire amount of finance or part of it to pay the debt. The rest of the money can be spent as you wish.

- Collection. Write-off of financial assets in favor of an organization or citizen upon presentation of a document confirming the legality of the action. If there is not enough money on the card to repay, subsequent charges will be sent to the creditor until the debt is paid in full.

Is it possible to make transfers from a card during arrest or foreclosure?

The main task when setting restrictions is to prohibit expenditure transactions, including transfers, and to receive an amount within the financial requirements of the creditor. The debtor has many questions about how to bear mandatory expenses when the main accounts are frozen and it is necessary to make mandatory payments to banks (for loans), and what to do for men who are forced to pay monthly alimony.

Writing off debts can drag on for months and even years, which means that the debtor’s life becomes much more complicated, because no one excludes other payments in addition to collection. Moreover, new delays and forced collections may arise.

Anyone who was unable to cope with debt closure in the first month will probably encounter:

- With complete zeroing of the account if the bank seizes and organizes collection.

- With a write-off of no more than 50% of the salary for payments for enforcement proceedings.

- Distribution of the load and the order of debt write-offs in a strictly defined order. First, debts related to compensation for harm to the health of other citizens and payment of alimony must be repaid. Claims for wages, severance pay and executive benefits are then settled. The remainder will be used to pay off wages and budgetary contributions. Repayment of loans, execution of current accounts and payments is carried out, but only after repayment of obligations for salaries, taxes, and compensation payments.

If, instead of collection, a seizure is placed on the card with the impossibility of expense transactions at the initiative of the tax service, the new accrued amounts through the Federal Tax Service are subject to write-off without restrictions.

How to find out about arrests and collections of your card

The most detailed information about collection, of course, will be contained in the FSSP of Russia database, but the Sberbank resource is no less convenient, since it reflects the current situation with access to one’s own accounts and cards. The status of each card is explained by the bank in the personal user account - the description is located next to the link to the card number or account.

The algorithm for checking the status of a card via online banking includes 4 steps:

- After authorization in your personal account, go to the tab with a description of client accounts and cards.

- They find the card of interest, next to which an inscription about the collection action appears.

- They follow the link to the enforcement documents, which do not allow the arrest to be lifted from the client’s details.

- Study the content. It should be taken into account that there may be several sheets of enforcement proceedings for compulsory collection. Information is revealed sequentially.

From the information on the Sber website, clients will learn which sanctions apply to a person - arrest or penalty, and can also check the basis for the ban (court decision or fine for violating traffic rules). The bank will familiarize you with the details of collection - the authorized body that issued the document for execution and the amounts (seized and already paid), as well as the balance of the debt.

In addition to the Sberbank website, information about overdue debt can be checked on the State Services website or in the database of enforcement proceedings of the Bailiff Service.

Can bailiffs withdraw money from a card?

One of the powers of FSSP employees is to search for a defaulter, search for property that he has and money in the accounts of financial institutions (settlement, deposit, debit, salary), warning about the need to repay the debt amount.

Bailiffs have the right to inquire from all financial and credit institutions about the existence of accounts and their balance. The bank is obliged to provide all the necessary information. Upon presentation of the writ of execution, he withdraws the required amount from the user’s card.

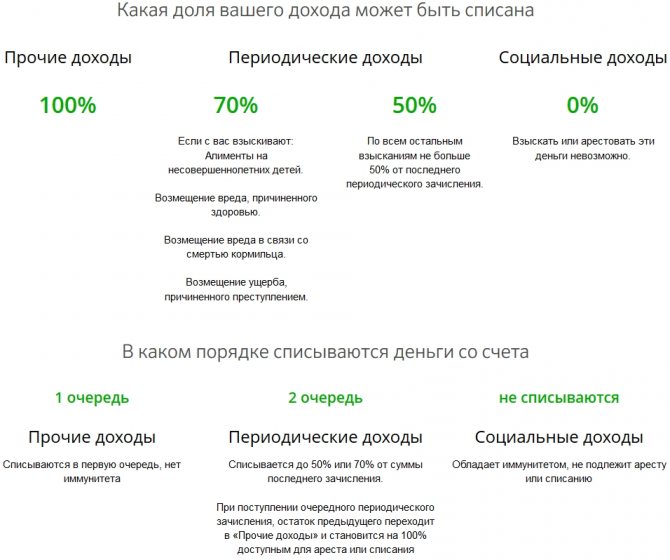

The table shows what share of your income can be debited from the card. As you can see, social income is not subject to arrest and collection, as it is immune to write-off and blocking.

Reasons for seizure

Information on the introduction of restrictive measures can be found directly in your personal account, or you can find a link to executive documents and court decisions in the State Services account or through the general database of the bailiff service. Generally speaking, the reason why the bank seized the account can be formulated as taking measures to ensure the fulfillment of financial obligations.

This could include missed payments of fines, alimony, credit debts, or refusal to pay compensation in court.

In order for a seizure to be imposed, the bank does not need the claimant’s unfounded allegations. Only a document prescribing enforcement and the participation of a judicial authority will allow the bank to prohibit the client from spending his own money, which he entrusted for safekeeping.

In the vast majority of cases, savings bank accounts and deposits are seized on the basis of a FSSP resolution submitted to the bank or a court order. This is caused by an increase in the number of overdue current payments and obligations.

Resolution of the issue in court

lawsuit in court for free in word format

Currently, collection services do not resort to illegal methods of debt collection.

If after the work of the agents the debtor still does not decide to pay, he is sent a notice of intention to file a lawsuit.

If the client does not respond to the letter within ten days, preparations for the trial begin.

Documents are collected, an application is drawn up, and then the package is submitted to the territorial division of the court at the place of registration of the borrower.

The agency will notify the defaulter in writing of the fact that a claim has been filed in court. Often the court sides with the collectors.

However, the fact that the case is dealt with with the involvement of the judiciary has its advantages:

- the court will fix the final amount, it will no longer change upward,

- Based on current legislation, the defaulter is exempt from paying fines and penalties on the loan.

After making a decision, the court sends copies to both the plaintiff and the defendant. After the verdict comes into force, the defaulter is given five days to voluntarily fulfill his obligations under the contract. If the defendant does not want to contribute funds, the case is transferred to the bailiffs.

Do I need to pay debt collectors for an overdue loan?

How to remove arrests and collections of funds from a card

If there is a collection or arrest in Sberbank, there are only 2 ways to remove the restriction:

- By protesting the actions of the bailiff, the initiator of the arrest in a higher organization or court (you will need to prove your innocence or the fact of distortion of information that guided the initiator of the collection).

- Through full and final repayment of the debt (immediately or in parts). If there is no doubt about his own guilt, the debtor begins to pay off the resulting debt as quickly as possible. When the last payment has been made, together with a confirming receipt, contact the FSSP employee who opened the proceedings and present documents confirming the full fulfillment of obligations.

The last scheme for lifting the arrest is a classic option when the debtor seeks to fulfill non-important obligations and is interested in quickly resuming access to a debit account or card.

You can ask for a certificate of lifting restrictions and submit it to the bank yourself, making sure that it is drawn up correctly. It takes several hours within 1 business day to clear the account. If there is no need to urgently remove the seizure of funds on the card, it is enough to pay the last payment and wait until the bailiff prepares a resolution and submits it to the bank for execution. When the amount appears in the account and is written off to satisfy the collection, the bailiff will contact the bank and report that there is no reason to extend the restrictions. Typically, the time to top up your account and record the end of production takes no more than 3 days.

If only one debt is written off, the Sberbank client remains to repay the amount specified in the writ of execution. Unfortunately, financial difficulties often lead to the formation of a whole complex of debts, and a lot of effort will have to be made to remove the accumulative arrest. One of the options for getting rid of problems with frozen accounts would be to try to come to an agreement with the creditor, convincing him to withdraw the sheet from execution. As soon as the document is withdrawn from execution, the bailiff closes the proceedings.

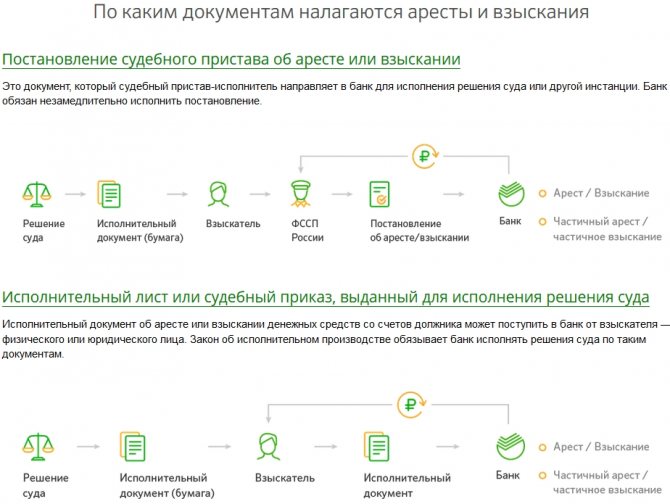

Procedure for seizing an account in Sberbank by bailiffs without notice

Documents according to which accounts are seized or funds are collected from the card are sent by executive authorities directly to Sberbank. Submitted papers may be in carved formats. Let us list and describe the design algorithm:

- Resolution from the bailiff service

The document appears only by court decision. The bank, upon receipt, immediately blocks the debtor's account.

If you have recently resolved conflict situations with legal entities or individuals, and the dispute was not resolved in your favor, it is better to pay the fine immediately. Otherwise, Sberbank will receive a writ of execution, and the money will still be written off.

- Resolutions from other structures (during the investigation, etc.)

First of all, you need to find the reason. This can be done on the official website of the FSSP of Russia or on the State Services portal.

When a Sberbank card is seized, the owner receives an SMS message on his mobile phone. Sometimes a person finds out about this when trying to withdraw money from the card. If an arrest has already been made, proceed as follows:

- Get information about the reason for the card seizure:

- call the Sberbank service and clarify the reason for the blocking. The hotline number is printed on the back of the card. Seizure of a bank card occurs by court order

- view account details through your online banking personal account or by visiting the nearest bank office. At the bank branch you can be provided with information on enforcement proceedings indicating the full name of the bailiff

- You can check whether there is a debt on the State Services website. Perhaps some fine or large payment has not been paid

- contact the bailiff service to obtain information about what caused the arrest

- Eliminate the reason for blocking funds:

- pay off the resulting debt. After this, apply to the FSSP to lift the arrest.

- if it is not financially possible to pay the entire amount of the debt, then you need to contact the bailiffs and resolve with them the issue of repaying the debt in ways acceptable to you. For example, partial repayment of debt from wages

- when the debt is repaid, the bailiff will send a request to the bank to unblock the account

- If you consider the arrest to be unlawful or erroneous, you should contact the authorized bailiffs:

- if a salary card is blocked or the amount of social benefits is written off, then you need to submit an application to the bailiff service with information about the card account number. It is better to draw up such an application in two copies and put a mark on delivery

- Attach to the application a supporting document on transfers (certificate from the place of work or social security authority) to the Sberbank card

- Having received an application with information about the nature of payments to the account, the bailiff must lift the arrest on the day of the application

- In order to appeal illegal actions committed by employees to suspend debit transactions from the card, you need to collect a package of documents proving your case:

- write a complaint to the court and ask to cancel the arrest order

- attach a copy of the resolution on enforcement proceedings and account blocking

- prepare a bank statement about debiting funds from the card

- This must be done within ten days from the date of arrest. But this method takes a long time, since the card will remain blocked throughout the entire process.

Today, it is quite common for a citizen to have funds withdrawn from their bank accounts or have them seized.

How and why the owner’s funds are collected from a Sberbank card will be discussed in the article.

Citizens who fulfill their obligations in various areas in a timely manner and do not violate laws and order should not worry about penalties.

Attention! Although there may be situations where they are not even aware of the existence of a debt or a decision on the need for payment.

The most common reasons for collection from a Sberbank card are:

- unpaid traffic fines;

- non-payment of taxes;

- debt on utility bills;

- loan debt;

- evasion of payment of alimony;

- litigation for various reasons (the decision may be the need to pay compensation, moral damage, etc.).

Finding out about collection of funds from a card is quite simple.

Sberbank sends a notification to the client with complete information:

- name and card number;

- the amount of funds to be recovered;

- basis: number, date of the decision, who issued it;

- data to obtain detailed information about the situation.

If the client has no idea what is at stake, he is recommended to visit the website of the specified court, find his case using the number recorded in the SMS and study the details (the essence of the issue, who is the plaintiff, the total amount of the penalty).

Advice! If bailiffs are collecting money from a Sberbank card, you can get information on the FSSP website using the decree number.

Here you can see the contacts and name of the bailiff, and make an appointment with him if you have any complaints about the case.

Also, according to available data, you can find information on the State Services portal in your Personal Account by clicking on Judicial debt.

For any of the reasons described, one of the following measures is taken:

- Seizure – bank accounts are blocked in full or only in the amount of liabilities. If there is more money on the card, you can manage the rest at your own discretion.

- Collection - writing off money in favor of a person or body, according to enforcement documents. If there is insufficient funds, subsequent proceeds are also sent to the creditor.

Collection from a Sberbank card is carried out only on the basis of a decree issued by a court or bailiffs.

The procedure for interaction when collecting funds from a citizen’s card is as follows:

- The court, bailiffs and other private or legal entities (collectors) submit the writ of execution to Sberbank.

- Sberbank makes a decision on partial or full recovery. The first is carried out in the absence of sufficient funds on the card.

- In case of partial collection, the missing amount is withdrawn from subsequent receipts.

- Once the obligations have been repaid, collection ceases. If this does not happen, you need to contact the relevant authority, request permission to cancel the collection and transfer it to Sberbank.

- If there is a large debt, collection may take a long time.

In this case, funds are withdrawn from the card in the following amounts, taking into account the type of receipt:

- Salary, pension: 50-70%. The largest amount is levied for payment of alimony for minors, for compensation for health, compensation for the loss of a breadwinner and for damage caused during the commission of a crime.

- Social payments: 0%. Collections are not made from benefits, subsidies, and deductions for children.

- Other: 100%.

Collection is carried out from other income, and if there are not enough of them, from salary (pension) income.

Having received a message about the collection of funds from a Sberbank card in the absence of debts, you should study the situation in detail.

An error can occur if the personal data of the client and the debtor completely coincide.

Expert opinion

Evgeniy Belyaev

Legal consultant, financial expert

Ask

In this case, you should personally visit the bailiffs or the judicial authority and file a statement about the error that occurred, explaining that you are the debtor’s namesake.

You should have all proof of identity with you: passport, INN, SNILS.

If the FSSP does not contain an executive document or resolution in your name, you should contact Sberbank for clarification.

We suggest you read: Arrest for registry actions

Conclusion

Collection of funds from a Sberbank card is carried out on the basis of writs of execution issued by judicial authorities or bailiffs.

Money is withdrawn from almost all receipts until the required amount is reached.

In order not to be subject to arrests and penalties, you should take your obligations responsibly: pay loans, fines, taxes, pay utility bills on time, do not evade alimony, etc.

Recently, more and more often, bailiffs are writing off the debts of persistent defaulters of housing and communal services and alimony directly from their bank accounts - salary and personal.

The procedure for seizing an account at Sberbank is completely legal. But before the account is seized and the bank card is blocked, the bailiff is obliged to notify the citizen about this procedure.

It is not Sberbank’s responsibility to notify its clients about this.

Federal Law No. 229 “On Enforcement Proceedings” states that if there are not enough funds in an account in Sberbank or another banking institution of a citizen to repay the debt, then subsequent proceeds will be seized - until the amount of debt is accumulated in full.

Article 115 of the Criminal Procedure Code of the Russian Federation defines the procedure for seizing bank funds for payments in execution of a court verdict in civil and other claims, which also provides for confiscation of property.

Warning! The procedure for seizing bank accounts by bailiffs is stated in Federal Law No. 118, 395-1 - “On Bailiffs”, “On Banks and Banking Activities”.

To enforce a claim, funds may be seized at any stage of the arbitration process. This is stated in Article 91 of the Arbitration Procedure Code of the Russian Federation.

In order to ensure the legality of the actions of the performers and prevent various insinuations with the law, amendments have been made to the law on bailiffs in Russian legislation.

Before depositing them, banks “froze” only those funds that were already in the accounts at the time of the request from the bailiff.

Now banks are given the right to write off money from an account within one day and “freeze” the account until the entire debt is repaid.

Both salary and credit bank cards are subject to seizure. You can write off funds not exceeding 50 percent of the amount from salary receipts.

Procedural actions to “freeze” accounts can only be started after receiving a judicial enforcement act or an order to collect debts from a specific person.

The first thing to do is to immediately send, for example, to Sberbank or other financial institutions, requests to identify all accounts opened in the name of this citizen and establish the funds that are available on them.

- First of all, the plaintiff tries to collect the debt from the debtor on his own, sending him the appropriate notices and messages; if such requests are ignored, then the plaintiff files an application for debt collection in court. Usually, if there is a good evidence base, a positive decision is made in favor of the plaintiff and the bailiffs will request information from all banks about the availability of accounts and what kind of deposits the debtor has. After this, the account data is frozen. Overdue debt is collected forcibly in favor of the plaintiff.