A personal account for an apartment is opened for all residential premises (house, apartment), regardless of the form of ownership. That is, housing can be either privately or municipally owned.

Using your personal account, you can track information about payment of payments for the use of residential premises, whether it is the owner or the tenant. It must also be said that it is not opened to the owner of one or another right of ownership of housing, but directly to the apartment (house, dorm room, etc.). If several people live in the premises, then the personal account will contain information about this.

This document contains information about the apartment, the responsible tenant and the persons living with him, etc.

In this connection, an extract from a personal account is a very necessary document, especially when making transactions with housing, such as purchase and sale, privatization, entry into inheritance rights, etc., after the conclusion of which its re-registration .

The financial and personal account can be divided in cases provided for by law (for example, during the privatization of housing). The exception is the section of the municipal apartment account.

To receive an extract, the responsible tenant must submit a corresponding application to the management company. The production time for such a document is no more than three days . You can also contact the multifunctional center and use this public service.

How to find out the personal account of an apartment

In order to find out information about the personal account of an apartment, the person registered in it must contact the management company that manages the apartment building or the homeowners' association (HOA), if the owners have chosen direct management. You can also order such information through the multifunctional center.

In order to receive an extract from your personal account, you must submit the following documents:

- identification document of the person applying for the extract. As a rule, this is a passport;

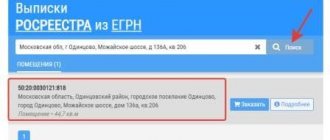

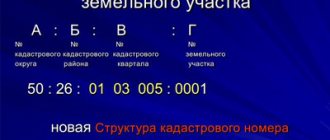

- legal documents, namely a certificate of state registration of rights (extract from the Unified State Register), a social tenancy agreement for residential premises, etc.

Where to look for information about your personal account number

Only the account owner or an authorized representative can obtain information about a personal account. This data is not shared with outsiders.

All individuals who are issued cards at a bank are required to open an account. It is impossible for a client to have a card but not have a card account. It doesn’t matter whether it’s a credit card or a debit card, it works within the international payment systems Visa/MasterCard or the national one - Mir.

There are several ways to find balance account information:

- in a universal banking service agreement;

- in online banking or mobile application;

- via hotline;

- when visiting the office in person;

- at a terminal or ATM.

Online options are the most convenient, but some clients still prefer personal contact with bank employees.

Agreement

Sberbank concludes an individual banking service agreement with each client. Even if the client does not receive wages, pensions or other types of payments on a debit card, but has issued an installment plan or a credit card, then a current account is opened for him. Universal service agreements contain information about the conditions, rules, responsibilities of the bank and the client, as well as details of the parties. In this document you can find the personal account number of an individual, which consists of 20 digits.

Each client is assigned a unique current account at the bank. Neither Sberbank nor any other bank in the Russian Federation has two clients who have the same personal accounts.

If you don’t have a service agreement with Sber at hand, you can look for the envelope that contained the bank card. On the same form where your full name, address and PIN code are indicated, there is information with the account number, which is attached to the received card.

Online services

Information about the account number is available in the Personal Account of Sberbank.Online. Registered users can open an account through the website or mobile application. When working from the site, the search scheme looks like this:

- After authorization, open the “Maps” tab.

- Activate the cards for which you need data, click “Card Information”.

- In the “General Information” section, information about the cardholder and card account number is available.

In the mobile application, select the desired card. Activate the “Show details” option. The list of data will indicate the card account number. You can save this data or send it directly from the application.

Hotline

You can get accurate information about your personal account number in Sberbank through the hotline. Calls to a single number 900 are free for all Russians from mobile phones. The client will need to prepare a card, general passport, paper and pen in advance. The contact center employee will request information to identify the client:

- FULL NAME;

- the code word that was assigned when activating the card or opening an account;

- series, passport number, residential address.

Remember! Call center specialists never ask for CVV, CVC, card PIN or Internet banking access code. This information is confidential and therefore cannot be disclosed even to representatives of Sberbank.

The operator will dictate the personal account number of the identified client. You will need to write it down and recheck it again. It is important to note that the numbers should be no more and no less than 20.

Office

The traditional way to resolve issues related to banking services is to visit the office. In this case, the client will need a passport or another document replacing it, which was entered into the Sberbank database during identification.

A bank employee will issue a form containing data for all accounts or for one specific card account. In addition, the document states:

- name of the receiving bank;

- correspondent account;

- BIC;

- checkpoint;

- TIN.

If the sender transfers funds in a foreign currency, then the data in the foreign currency and the SWIFT code must be provided. If the recipient does not have a foreign currency account, an automatic conversion will be made at the currency rate on the day the funds are credited.

The personal account number is also contained on all statements. If they come by email, you can find the card account number there or ask for a printout in the office.

ATM

To find out information about your personal account number through an ATM or terminal, you will need a card. The instructions for finding a 20-digit card account consist of the following steps:

- Place the card in the special slot with the chip facing up and forward.

- Enter your PIN code.

- Go to the “My Accounts” tab.

- Select the account or deposit you need.

- Click the “Details” button.

The printed receipt contains all the cardholder details. They can be photographed and sent to the sender so that when sending funds no errors are made either in the personal account number or in other data.

Extract from the personal account

An extract from a personal account is a document containing data on the area of the premises. Based on this data on the area, utility bills are calculated.

The extract is confirmation that the citizen is registered and lives at a specific address.

Using your personal account, you can see the debt or lack of debt for payments for the maintenance of the residential premises.

A document of this kind is issued by the management company or HOA. To obtain it, you must contact the company or HOA. As a rule, the finished document can be received in two to three days . The statement can be used within one month . After this period it becomes invalid.

The personal account statement must contain the following data:

- personal data about the responsible tenant, allowing him to be identified;

- information about the apartment (apartment number, floor on which it is located, number of rooms in the room, etc.);

- about what amenities the apartment residents use (heating, running water, electricity, natural gas, elevator, availability of a bathroom, etc.);

- about the total area (residential and non-residential area must be indicated) of the apartment;

- information about persons registered in the premises (last name, first name, patronymic, date of birth, passport details or details of the child’s birth certificate, etc.).

How to open a personal account for an apartment

A personal account is opened for a specific apartment in which several residents can live. In connection with which it opens to the responsible tenant.

In order to become responsible tenant, you must meet the following criteria:

- The citizen must be an adult.

- Capacity, that is, a person must be aware and account for his actions.

- The person must be registered in this residential premises.

To open a personal account for an apartment, you must present the following documents :

- certificate of state registration or, in the case where the apartment is municipal, a social tenancy agreement;

- the basis document, namely a purchase and sale agreement, a gift agreement, etc.;

- act of acceptance and transfer of the apartment;

- passport;

- if the interests of the tenant are represented by a trusted person, then a power of attorney.

It must be borne in mind that documents must be submitted in copies and originals. Originals are required for verification with copies.

Opening upon change of owner

Re-registration of a financial and personal account is required when ownership is transferred to another person. To do this, you need to contact the management organization. Next, you should contact the unified information and settlement center to renew contracts for the new owner with energy companies, water supply organizations, and gas supply organizations for the supply of resources.

You must have the following documents with you :

- passport;

- certificate of registration of rights, social tenancy agreement for the new owner, tenant;

- a certificate about the number of registered persons in the apartment.

Splitting a personal account

The division of a personal account becomes necessary when a situation occurs that more than one family living in an apartment runs a separate household, and the responsible tenant must pay. This happens, for example, when spouses divorce and are forced to live together in the same place of residence, but in different rooms, and also when children start their own families.

The division of personal accounts is only the distribution of responsibilities of people living together to pay utility bills.

It must be borne in mind that this does not entail a change in the terms of the social tenancy agreement for each resident.

The use of such measures allows two separate families running a separate household to pay only according to their personal account, which makes it possible to resolve disputes about who consumes more.

How to divide bills in a municipal apartment

It is possible to split a personal account if the apartment is municipally owned and used by the tenant under a social tenancy agreement, but as judicial practice shows, not in all cases. The Housing Code of the Russian Federation (hereinafter referred to as the Housing Code of the Russian Federation) does not provide for the division of a personal account into a municipal apartment.

But, nevertheless, in accordance with paragraph 4 of Art. 69 of the Housing Code of the Russian Federation, if a citizen ceases to be a member of the tenant’s family, then he does not lose his rights in relation to housing. At the same time, he is independently responsible , including for non-payment of utility bills.

From the systemic interpretation of the norms of the Housing Code of the Russian Federation, it follows that the parties, if it is necessary to divide the personal account, can enter into an agreement among themselves on the payment of payments for the maintenance of the apartment. However, there are cases when it is not possible to reach an agreement and the parties to the conflict go to court.

But the court will take into account whether the procedure for pre-trial settlement of the dispute . The parties should try to come to an agreement by drawing up a notarial agreement, and also contact the unified information and settlement center with an application for splitting the account . If a refusal follows, it must be written and justified. It will also need to be presented to the court.

The responsible tenant must file a claim with the court demanding that the shares of each person living in the apartment be determined. In this case, the court will determine the shares of each user and indicate who will have to pay what share of utility bills.

But in this case, the conclusion of a separate social rental agreement will not follow, since the current Housing Code of the Russian Federation does not provide for such a procedure. A similar position is set out in the Resolution of the Plenum of the Supreme Court of the Russian Federation dated July 2, 2009 No. 14 “On some issues that arose in judicial practice when applying the Housing Code of the Russian Federation.”

Example

The citizen appealed to the court with a demand to divide her personal account into a municipal apartment. This apartment was previously provided under a social rental agreement as official housing to her husband. She and her husband divorced, and the husband has not paid utility bills for a year.

The court refused to satisfy the claims, since it is impossible to divide the personal account into official housing.

Is it possible to split bills in a privatized apartment?

It is possible to divide a personal account if the apartment is registered in shares. If the privatization of the apartment was carried out for one owner, then splitting the account does not make sense.

If the apartment is in shared ownership without indicating the square meters belonging to each of the owners, then the allocation of the share in kind and the subsequent division of the personal account are possible only in court.

The court will refuse to satisfy the claims if:

- the apartment is privately owned by a citizen;

- the apartment is under arrest or other encumbrance;

- housing is for service purposes.

It is possible to open a separate personal account only if it is for a separate room in the apartment, not adjacent to other rooms. In addition, it must comply with sanitary and technical standards.

Example

Citizen Popova went to court with a demand to divide utility bills. After a divorce from my husband, the apartment was registered as shared ownership of ½ each. The husband has not paid utility bills for two years now and she bears the entire burden of expenses for the apartment. She also asked to recover from her ex-husband half of the payments paid for two years.

The husband filed a counterclaim, saying that he was paying the payments regularly. Citizen Popova made payments using her personal card and submitted a bank statement to the court. The court satisfied the requirements in full.

Current and personal accounts of HOAs - what are they and what is the difference?

A current account in an HOA is a bank deposit registered in the name of a specific association of owners for storing financial resources; a housing organization may have one such account, while there may be many personal accounts.

Personal accounts in housing associations are not bank accounts , unlike settlement accounts; they are necessary for internal identification of subjects of financial transactions carried out by the HOA.

REFERENCE! A current account is opened in a bank in the name of the HOA for storing and transferring funds, and personal accounts are assigned by the accounting department to residents who pay receipts, as well as to suppliers of resources and services in the housing association’s payment system.